ON DECK FOR WEDNESDAY, SEPTEMBER 4

KEY POINTS:

- Risk-off sentiment continues

- BoC expected to cut 25bps, leave QT intact in a cut and dried affair

- Why upsizing would be a mistake

- Canadian consumers have amassed a massive spending war chest

- Why warnings on Canadian per capita measures are far too sensational

- Minor US, Canadian data on tap

Risk off sentiment is again sweeping through markets ahead of the Bank of Canada which is the day’s main focus. Stocks are broadly lower particularly in overnight Asian and European markets as they catch up to yesterday’s N.A. sell off. Sovereign bonds are gently richer with yields down by single digit basis points across global benchmarks. Oil is down again by about -½%.

UNCERTAIN MARKET CATALYSTS

The catalysts are more uncertain than the headlines suggest. For instance, it wasn’t US data that started it, as US stocks were dropping before the ISM-manufacturing print yesterday morning that itself was a bland affair for a small part of the US economy in my view. Tumbling tech stocks led by Nvidia’s post-earnings challenges compounded by a US antitrust probe are a more plausible driver of broader weakness as the IT subsector of the S&P500 fell by 10% yesterday. September can often bring fresh retakes on risk appetite, and markets may be looking at a less friendly tax and regulatory regime in the US as Harris widens her polling lead over Trump who frankly is sounding more unglued by the day even relative to his usual cognitive challenges.

BANK OF CANADA SHOULD BE A CUT AND DRIED AFFAIR

But the Bank of Canada will be the main focus for many of us. Relatively minor data is on the docket. Chile’s central bank resumed cutting last evening with a 25bps reduction to 5.5% after the surprise hold at its last meeting.

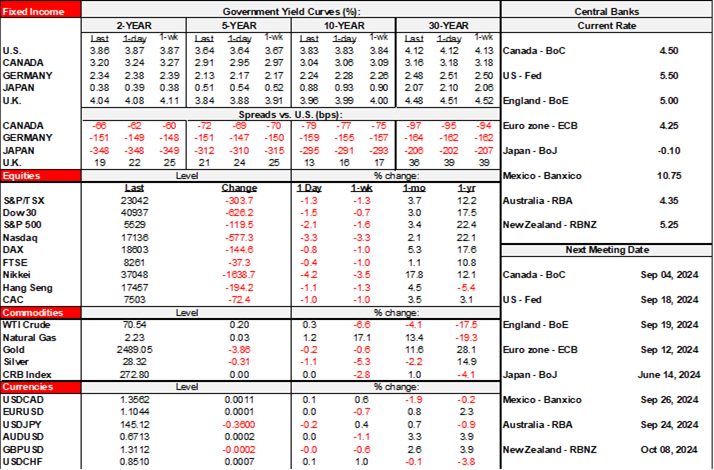

The BoC is universally expected to cut 25bps in a statement-only affair (9:45amET) followed by the usual tedious press conference (10:30amET) but sans MPR as the next round of forecasts will arrive at the October 23rd decision.

I expect a dovish bias that updates sentiment at the July 24th decision with what has happened to data and developments since then. Q2 GDP growth was 80% driven by government and momentum at the quarter-end and start of Q3 was poor. Jobs have flatlined over the past couple of months, but that’s primarily a youths versus temps story in my view. Core inflation has continued its soft patch.

The tail risks are a pause which seems highly unlikely and indefensible relative to data and BoC rhetoric to date, or either a larger cut or expressed openness toward upsizing in the presser.

I don’t see the conditions for a 50bps cut and think it would be policy error if they upsized. It’s also unlikely that Macklem would express openness to upsizing in any useful way while sounding data dependent and repeating that the way down won’t be like the big moves on the way up as the BoC caught up to soaring inflation.

Some of the arguments against up-sizing include:

- It could have a negative signalling effect.

- The BoC is probably content with where market rates sit and not feeling the need to jolt them. Canada 2s are priced at 3.2% and hence offering little term premia above a potential move toward a more neutral setting. That’s even truer for the Canada 5-year yield at about 2.95% which is a key measure as input into the most popular mortgage rate.

- Markets would likely move to price another outsized moved and push the BoC which may not be comfortable doing so and could risk disappointing markets later.

- It would violate guidance that the path down would not have discrete drops and would not be symmetrical to the path upward. The BoC should be focused upon repairing the damage done to its forward guidance in the pandemic when they promised Canadians rates wouldn’t go up for years because inflation would remain low only to hike much earlier when inflation ripped. That reeled in excessive numbers of debtors who subsequently got boomeranged on rates.

- They should keep their powder dry for potentially more exigent circumstances, like market dysfunction (not just price discovery) or a more alarming turn lower in the data.

- Up-sizing could provide cause to raise future inflation forecasts and risk more erratic policy in future.

- Further, we get the jobs and wages report two days from now. Imagine upsizing into the random number generator that could either validate the move, or make them look rather silly if jobs and wages rip.

But my main argument in favour of slow, gradual cuts and risk of a pause into 2025 is that inflation risk remains material for several reasons.

- I don’t subscribe to the BoC’s output gap and excess supply estimates as they are based on potential growth assumptions to date that I don’t agree with. PGDP is the ultimate fudge factor in a forecast. The BoC contentiously raised its estimate of PGDP this year and lowered it in future, showing far too much sensitivity to the surge in non permanent residents and the expected tightening of immigration policy affecting that category. International students, temporary foreign workers and asylum seekers do not add to potential growth in the short-term in the way in which the BoC has estimated by basically treating their contributions as equivalent to immigration through permanent residents and the born in Canada population.

- Output gaps explain at best only a fraction of inflation risk imo, just as they did during the pandemic.

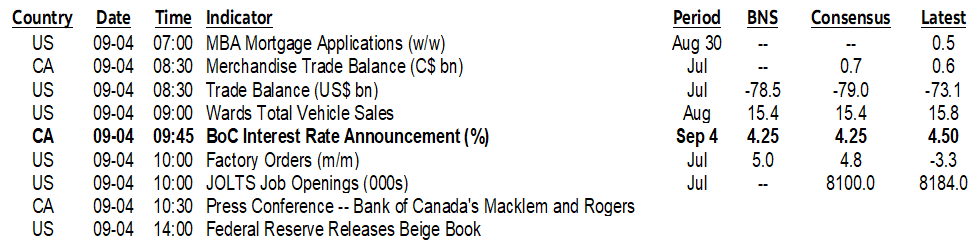

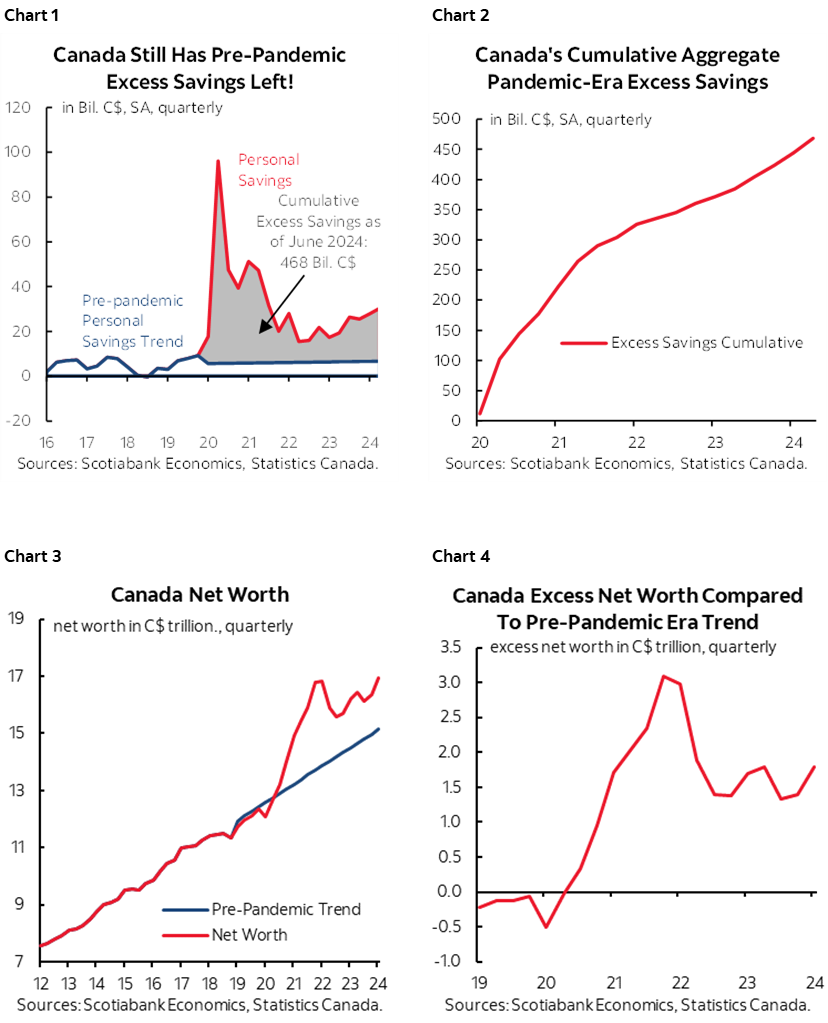

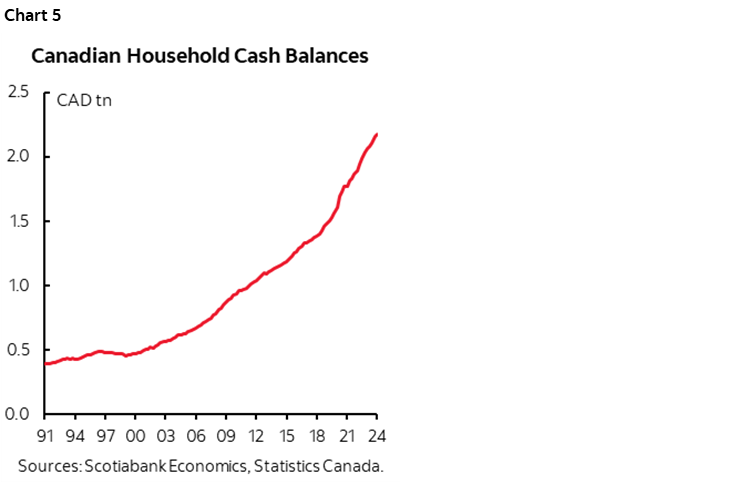

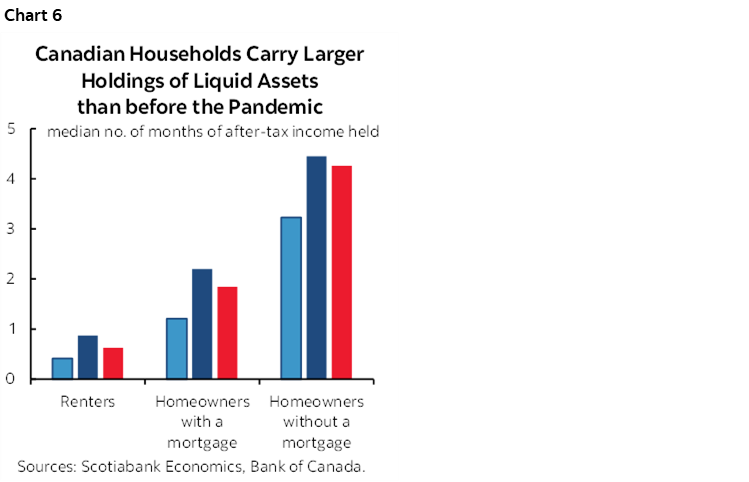

- Cutting too aggressively could unleash a tsunami of consumer and housing demand given how high excess savings and pent-up demand are becoming. I wrote about this and explained the calculations back in May (here) and updated the calcs in Friday’s GDP note. As rates fall, the opportunity cost to spending a half-trillion in excess savings declines and could be supported by even bigger cumulative gains in household net worth not included in the calcs. This is very unlike the US; Canada’s household saving rate at 7¼% has surged and vastly eclipses the US at 2.9%. The US has depleted excess savings on a narrowly defined basis whereas Canadian households have amassed a vastly bigger amount of excess narrowly defined saving and that does not include balance sheet developments. Narrowly defined excess saving to a pre-pandemic trend line sit at about C$470 billion now (charts 1, 2). Household net worth in Canada is almost C$2 trillion above a trend line fitted to pre-pandemic levels (charts 3, 4). Households have squirrelled away their gains in an arsenal that is likely to prove tempting to spend by the 60% of households that don’t have a mortgage and much of the remaining 40% that is managing resets just fine particularly as reset risk falls with bond market developments. Further, household cash balances have soared to about C$2¼ trillion (chart 5). Bank of Canada data shows that it is homeowners without a mortgage who have increased their cash holdings the most (chart 6).

- Supply chains remain fragile. Whether its global shipping costs related to Red Sea tensions, geopolitical risk, or labour tensions, we’re still in an environment of serial supply shocks.

- Real wage growth is accelerating, productivity is tanking

- Fiscal policy continues to add to economic growth and may become more stimulative into an election year

- Mortgage resets remain a wildly exaggerated risk. 90+ days arrears remain very low. Ditto for consumer bankruptcies. Mortgage provisions for loan losses as a share of mortgages outstanding have gone from nothing when mortgages were basically free to around historical average.

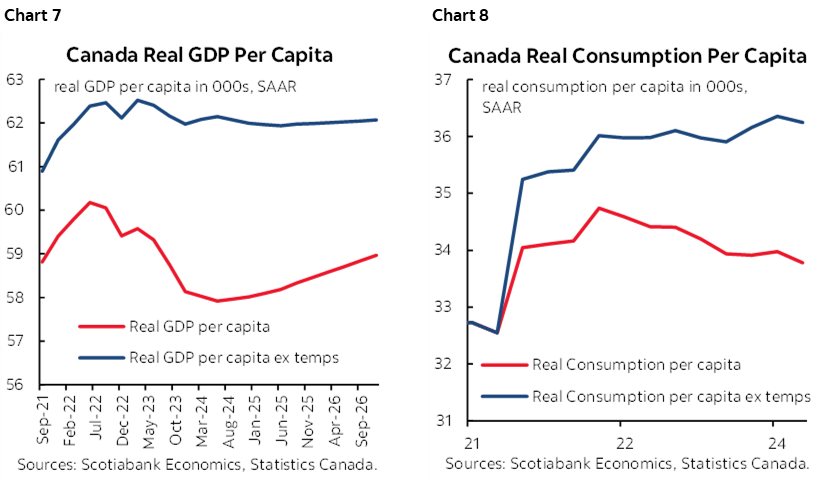

- I think the fuss over real per capita GDP and real per capita consumption is wildly exaggerated. Some of it is driven by weak labour productivity which has long been a problem and with governments, businesses and workers sharing accountability rather than the bias across much of the business community that it’s all the fault of governments. Some of the softness in per capita measures, however, is driven by excessive population growth over the past couple of years that a) is targeted for decline by reining in the non permanent resident category and perhaps more in a full immigration review this fall, and b) makes the untenable assumption that we should expect one-for-one contributions to the economy from international students, temporary foreign workers and asylum seekers—many of whom may be here only temporarily—on par with the contributions from permanent resident immigration and the born-in-Canada population. As the non permanent resident population is curtailed, GDP per capita should rise as long as trend GDP growth is above the projected <1% population growth. To see what kind of an impact including or excluding temps has on the calculations see charts 7 and 8. Real consumption per capita, for example, is not falling if we exclude temps.

OTHER STUFF

There will also be minor data updates this morning but I view them as distractions to the main focus upon the BoC and twin US and Canadian jobs reports on Friday. Canada updates trade figures for July (8:30amET). So does the US at the same time, but we already know that the merchandise deficit widened and just requires a usually stable services surplus to be tacked on. US JOLTS job vacancies are due at 10amET and can attract market attention. US factory orders should rise strongly given what we knwo about durables (10amET). The Fed’s Beige Book arrives at 2pmET and used to matter in a previous era before FOMC officials began talking so much.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.