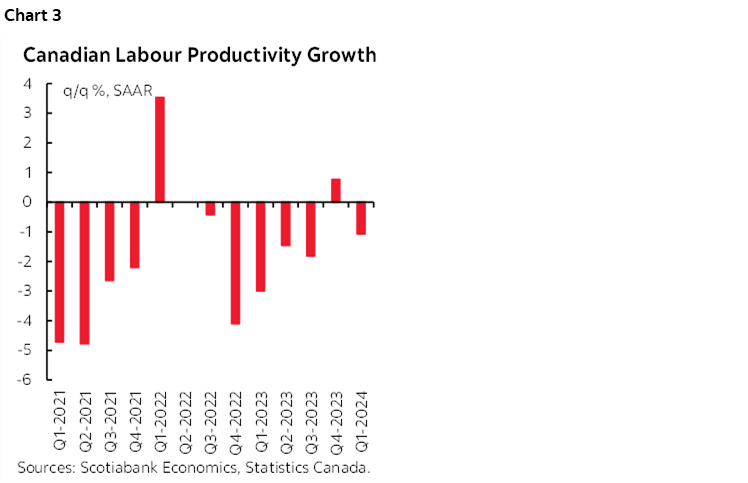

ON DECK FOR THURSDAY, SEPTEMBER 5

KEY POINTS:

- Subdued markets await tomorrow’s US payrolls, Canadian jobs

- US ISM likely to show modest service sector growth

- US layoffs surge, but could be a temporary seasonal repeat of 2022–23

- US to also update ADP, weekly claims

- Canada’s political developments mean nothing to markets—yet

- Canadian labour productivity probably remains weak

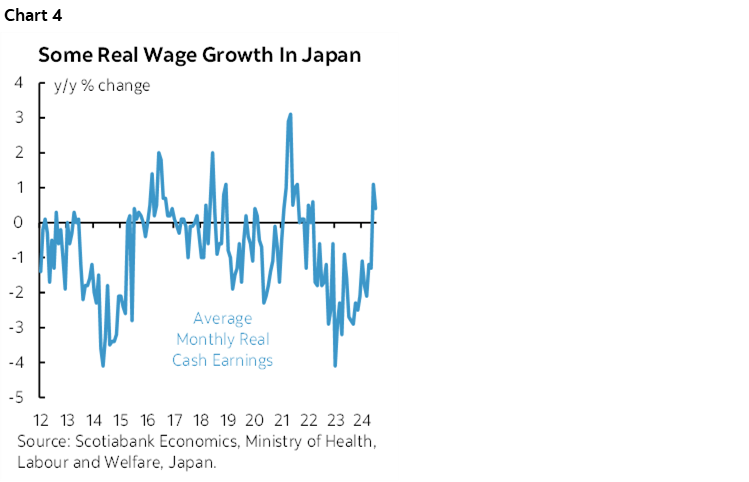

- Japanese real wage growth beats expectations

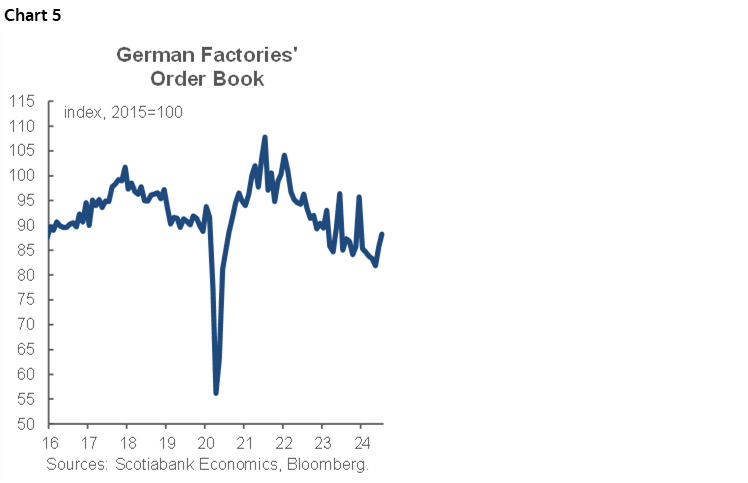

- So did German factory orders

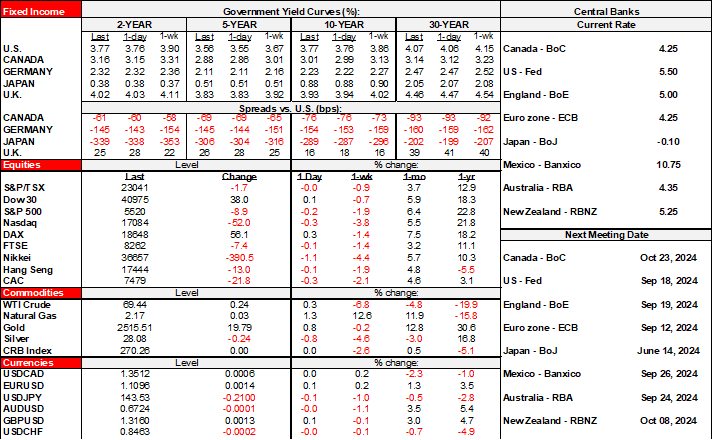

It's the calm before tomorrow’s nonfarm payrolls (and Canadian jobs) that is driving muted changes across asset classes amid light developments so far this morning. The main focal points will be more data releases covering the status of the US job market and service sector.

Pre-Nonfarm US Macro Readings

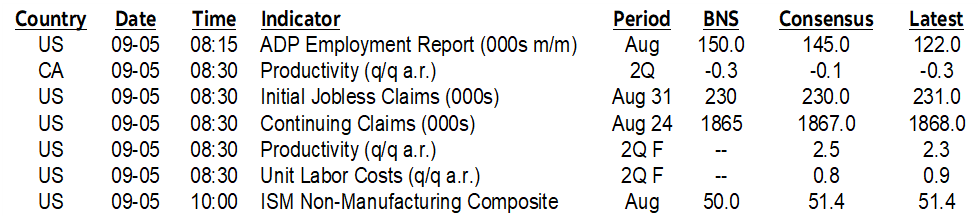

- What happens to ISM-services for the month of August (10amET) deserves much greater attention than Tuesday's ISM-manufacturing report given the much higher weight on services in the US economy. Services have been performing somewhat better than manufacturing but have still witnessed cooling growth (chart 1).

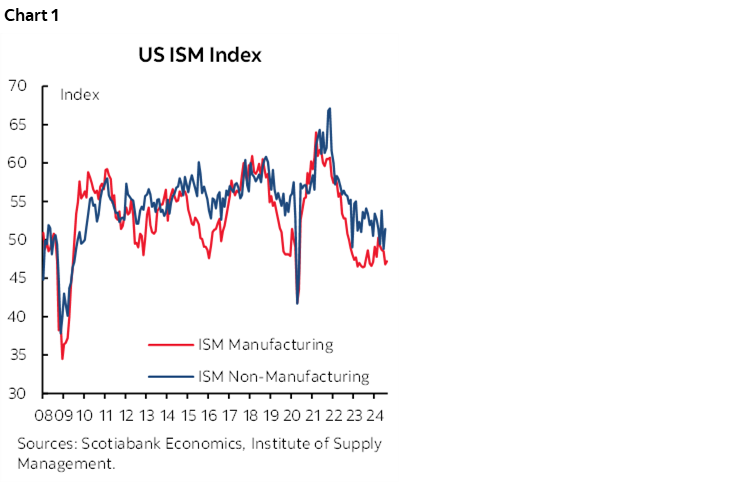

- Mass layoffs surged in August as Challenger job cuts increased to 75,891 from 25,885 in July which is the highest tally since March. One caution is that the numbers are not seasonally adjusted and we saw the same thing happen when July transitioned to August in each of the past two years (chart 2). That offers further reason to be skeptical toward US labour market readings. Pretty much all of the surge in August over July was in tech that went from about 6k layoffs in July to about 40k in August.

- ADP private payrolls for August (8:15amET) often trigger a market reaction, yet they typically offer very poor tracking of private nonfarm payrolls.

- Weekly unemployment insurance claims (8:30amET) will be warm-ups to tomorrow's nonfarm payrolls. This will give us a little better handle on nonfarm risks.

Canada’s Smoke and Mirrors Political Moves

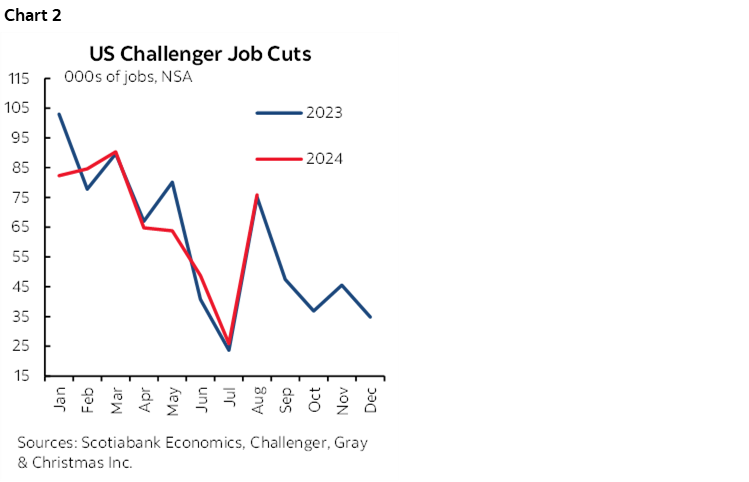

Canada will refresh its composite PMI (9:30amET) and probably post weak labour productivity again (8:30amET) which extends the moribund performance to date (chart 3).

In Canada, the left wing NDP’s withdrawal from the Supply and Confidence agreement with the also left Libs smells like a smoke and mirrors operation to me. I fielded a bunch of instant questions from investors yesterday and here’s what I argued.

- It has no meaningful consequences for Canadian markets whether we’re talking USDCAD, bond yields, or stocks—at least not yet. NDP leader Singh was taunted or goaded into withdrawing from the agreement by Conservative leader Poilievre. Nevertheless, it would be political suicide for the NDP to go against Trudeau’s Liberals by forcing a confidence vote and voting down the government, thereby triggering an election.

- That’s because of polling, because of party finances, and because of all the MPs who could lose their seats and thus eligibility for pensions for those who have not qualified as yet—including the NDP leader himself.

- This site attempts to convert polling into seat projections and shows a landslide victory by the Conservatives who would win 210 out of 338 seats in Parliament if an election were held today, while the Libs would be cut almost in half to 81 seats and the NDP would lose about a third of its seats down to 16 and the regional Quebec-based BQ party would be little changed at 34 seats.

- What the NDP’s withdrawal may achieve is to intensify pressure at the margin on the Libs to give the left wing NDP party even more of what it seeks in the Fall fiscal and economic update and the Winter budget which would play to my thesis that monetary policy easing and fiscal policy easing risk intensifying into an election year.

Overnight Macro

Japanese real wage growth remained slightly positive against expectations (chart 4). It was up 0.4% y/y (-0.6% consensus) for the second straight monthly gain. Nominal wages were stronger than expected at 3.6% y/y. The data may reaffirm expectations for another BoJ hike next month but it had no material effect on JGBs or the yen overnight.

German factory orders surprised higher with a 2.9% m/m SA gain in July (-1.7% consensus) with an upward revision to June (4.6% from 3.9%). These gains are at least welcome temporary relief relative to the longer-term trend since the initial recover in global goods production began to abate (chart 5).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.