ON DECK FOR MONDAY, APRIL 14

KEY POINTS:

- Markets put a positive spin on weekend tariff chaos

- Trump administration sloppily handles tariffs on consumer electronics

- Chinese financing and exports surpass expectations…

- …likely on temporary tariff front-running

- US bank earnings, Fed-speak on tap

- Global Week Ahead — The End of Dollar Dominance? (here)

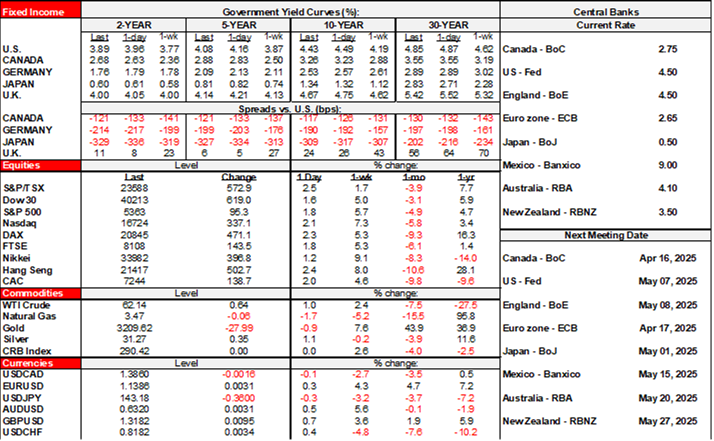

What’s a day without more turmoil in the Trump administration! Markets are clearly taking the wildly contradictory developments over the weekend as a positive sign on net, perhaps believing that the Trump administration continues to moderate its tariff overshoot. We also have strong overnight data from China to consider plus more US bank earnings on tap shortly after this note goes out. US equity futures are up by over 1%, European cash markets are up by around 2%, and Asian equity benchmarks also rallied. US Treasury yields are rallying by about 6–7bps across most maturities with Europe performing similarly. The dollar is broadly softer. Oil prices are up by about 1%.

TRUMP ADMINISTRATION ONCE AGAIN MAKING UP POLICY ON THE FLY

Head spinning headlines since Friday evening point to policy being made up on the fly as it applies to imports of consumer electronics. On Friday evening, the US Commerce Department issued a list of exemptions to tariffs (here) that made it sound like about 23% of imports from China and about 10% of total US imports were being exempt including smartphones, some computers, and chipmaking equipment. Then yesterday morning, Commerce Secretary Lutnick downplayed this by saying the items were only exempt from the (crazy) formula that determines reciprocal tariffs and semiconductor tariffs coming in “a month or two” would apply new tariffs to the affected items including iPhones. Then Trump weighed in and suggested nothing would be exempt by saying they will be “taking a look at semiconductors and the WHOLE SUPPLY CHAIN” with his emphasis added.

STRONG CHINESE FINANCING, EXPORTS REFLECT TARIFF FRONT-RUNNING

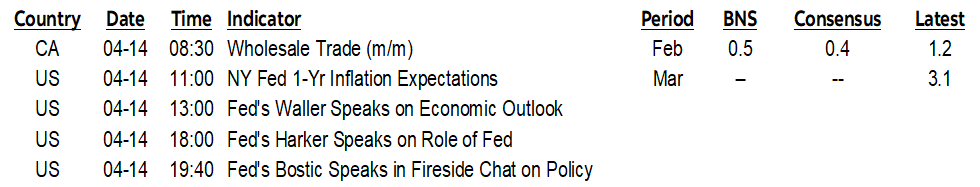

Chinese financing figures came in a bit stronger than expected for March. That may be tied to tariff front-running. Year-to-date financing is running at the hottest on record in terms of originations with local currency loans running at the second fastest pace of originations on record (charts 1, 2). Growth in outstandings of all financing products combined has been accelerating since November but remains low by historical standards (charts 3, 4). Growth in local currency loans outstanding continues to decelerate.

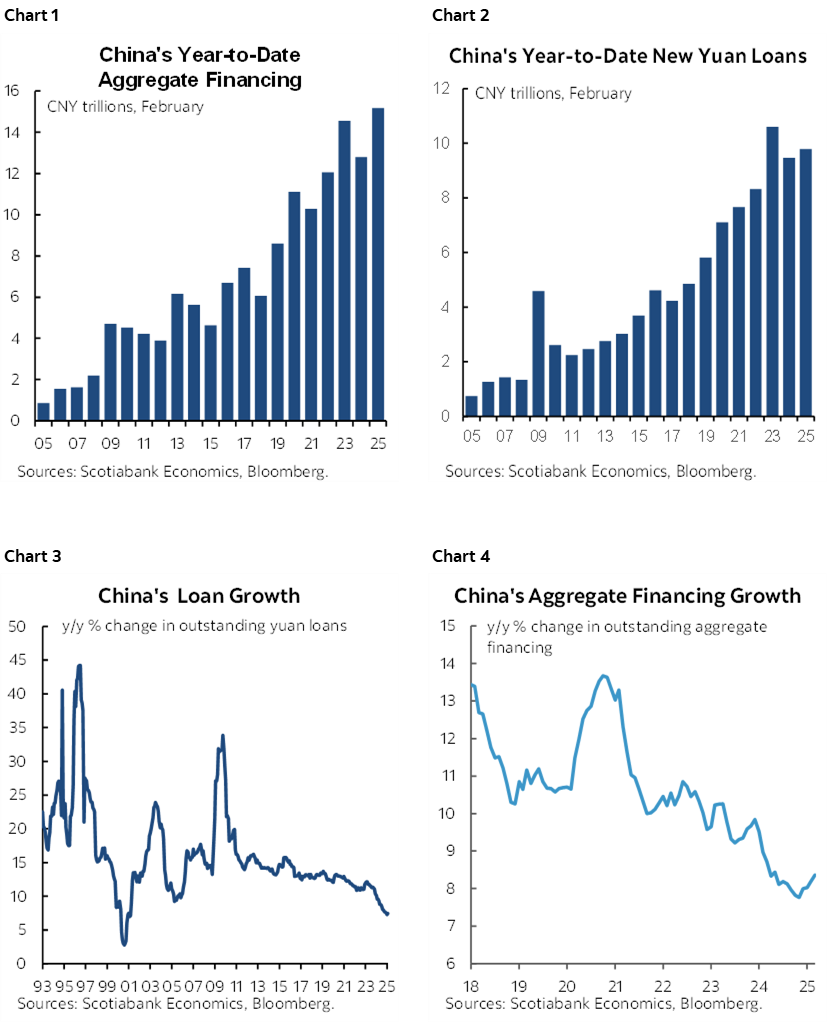

Chinese exports smashed expectations for March but probably because of greater than estimated tariff front-running (chart 5). In USD terms, exports were up 12.4% y/y but imports fell 4.3% y/y. Some of that was a currency effect, but yuan-denominated exports were up 13.5% y/y and imports fell 3.5%. China’s overall trade surplus rebounded from the prior month’s drop but is still shy of readings in December and January.

US BANK EARNINGS AND FED-SPEAK ON TAP

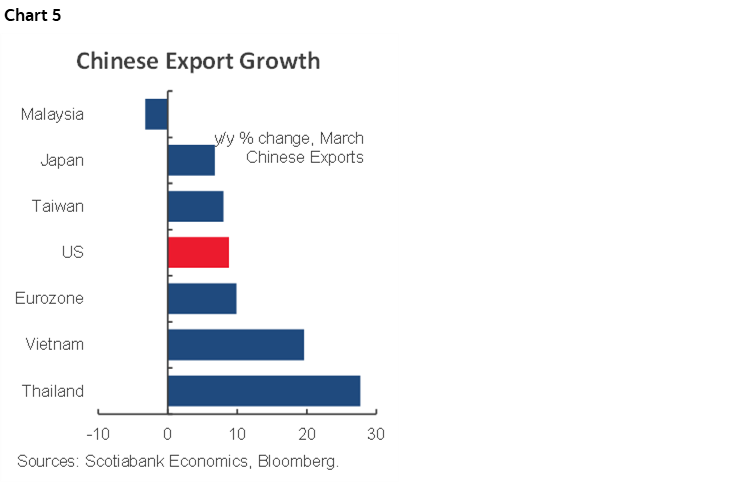

On tap will be more US bank earnings (GS, 7:30amET) and Fed-speak with a particular focus on Governor Waller’s economic outlook (1pmET).

Light data will include an expected small gain in Canadian wholesale trade for February (8:30amET) and the NY Fed’s 1-year inflation expectations reading for March (11amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.