ON DECK FOR TUESDAY, APRIL 8

KEY POINTS:

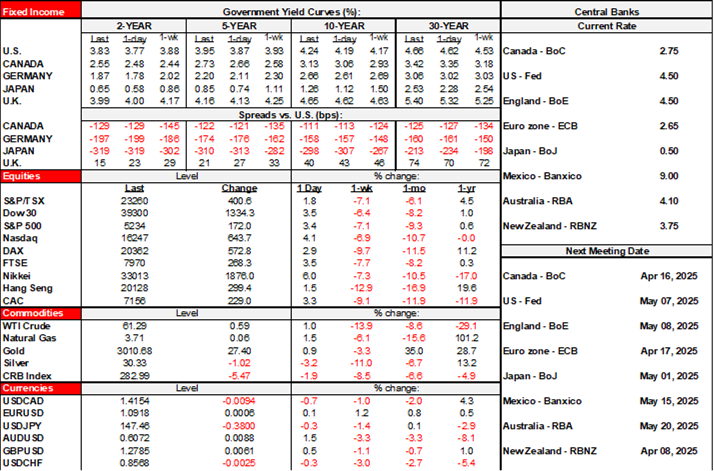

- Equities rally, bonds continue to sell off as markets await next steps in trade war

- The holes in Navarro’s thesis

- Fed’s Daly to speak on the outlook

Markets are somewhat calmer this morning as they await next steps in the trade war and absent fresh, material developments. Stocks are firmer with the US S&P up 3½% and European cash markets gaining by roughly 3% across benchmarks. This follows an overnight rally that lifted equities in Tokyo by 6%, HK by 1 ½% and mainland China by ¾% to 1½%.

Sovereign bonds are cheapening across N.A. and Europe. US Treasury yields are up by 6–8bps across maturities and Canadian yields are performing similarly. Gilts are bear steepening. EGBs are mostly bear flattening with two-year yields leading the rise at +4–8bps. Asia-Pacific bond yields also moved higher as they caught up to yesterday’s western moves. The dollar is retreating in broad fashion against most major crosses, although the euro is little changed. Oil and gold are slightly higher.

There is nothing material by way of overnight calendar-based developments or developments on tap for today. I think some of the headlines from the US administration on trade talks with countries like Japan and South Korea are playing a role in the equity tone, but Japan has said its willingness to talk is limited by its sense it does nothing unfair (more on that below) and South Korea is headed for election in June.

Next moves in the trade war are focused upon tomorrow. By tomorrow, the US will impose a 104% tariff including the pre-existing 20% plus last week’s 34% plus an additional 50% and call off any further trade talks if China doesn’t reverse its retaliatory measures. China responded to this latest aggression by saying “The US threat to escalate tariffs on China is a mistake on top of a mistake. If the US insists on its own way, China will fight to the end.” And so if the US goes ahead tomorrow, China will probably retaliate again.

The EU attempted to offer to eliminate bilateral tariffs on industrial goods if the US did the same and the US rejected the offer as insufficient perhaps because of alleged non-tariff barriers and crazy demands such as dropping VAT taxes that are obvious non-starters. Don’t waste your time EU, as Canada learned from seeking to constantly negotiate only to get hit by tariffs on steel, aluminum, autos, lumber, non-CUSMA compliant trade, and probably dairy and copper soon. By yesterday afternoon, EU trade ministers were reportedly preparing to retaliate after giving limited time for the US to reconsider which could be measured in days to weeks.

The only thing on tap today will be San Fran Fed President Daly’s remarks on the outlook (2pmET).

ADDRESSING NAVARRO’S CLAIMS

Peter Navarro, trade adviser to the Trump administration, published this op-ed in the Financial Times yesterday. Navarro and Stephen Miran, the Chair of the White House Council of Economic Advisers, have the most influence over Trump in terms of protectionist trade policy and so it’s important to address the claims as reflected in Navarro’s attempt at explaining them before a business and markets audience.

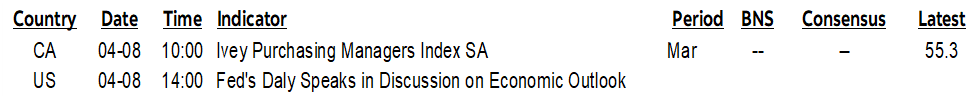

Claims About Tariff and Non-Tariff Barriers

Navarro says that foreign countries are unfair with higher tariffs and non-tariff barriers than the US imposes. That can be true in some cases, but not in many others. Chart 1 shows the ranking by weighted average tariff barriers and that Canada and the US are identical despite US trade aggression, Japan isn’t materially higher at all and ditto for much of Europe. Where the tariff barriers are higher tend to be across other Asian and LatAm countries. Chart 2 shows the ranking by average non-tariff barrier and here too the US and Canada are identical, Japan has fewer, and Europe tends to have more. Some NTBs are indeed arbitrary and protectionist, while others can reflect choice over food safety standards or environmental policies that countries like Europe and Canada treat more seriously than the US.

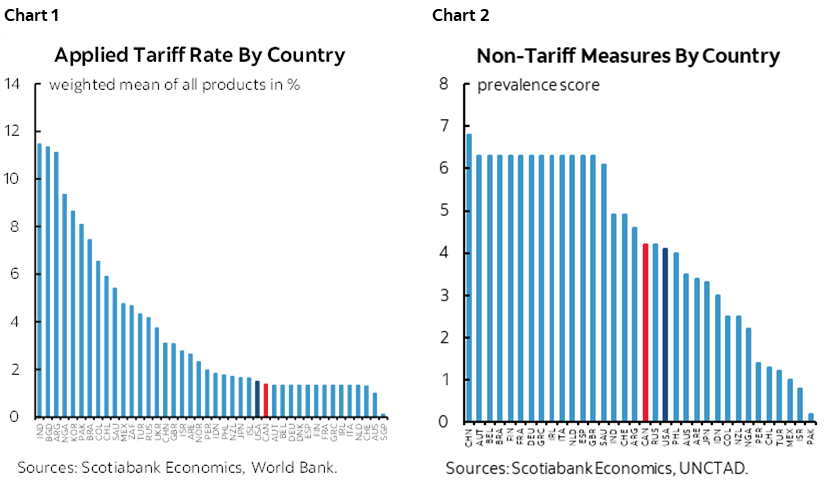

No Mention of Subsidies

What’s missing from Navarro’s claims is any reference to subsidies. That’s likely intentional because here’s where the US halo becomes rather tilted. The World Bank, IMF , OECD and WTO collaborate on tracking subsidy programs around the world (here, here and here). Chart 3 summarizes the outcome. The US accounts for 27% of all global subsidy programs, more than China at 18.5%, and similar to the EU. Countries like Canada get dragged along the subsidy path because of the dominance of such programs elsewhere.

You see, it’s long been understood that the rich(er) world uses subsidies, the poor(er) world uses tariffs and NTBs because many of those poorer countries can’t afford to play the subsidy game. The US administration is cherry-picking the totality of protectionist measures by choosing to only focus upon tariffs and NTBs and even at that in highly distorting fashion.

The definition of subsidies used by these agencies is as follows:

"Subsidies take many forms. These include direct government expenditures, tax incentives (such as tax credits or reduced tax rates), equity infusions, soft loans, government provision of goods and services and procurement on favorable terms, and price supports.2 The actions may be taken at the supranational, national, regional, or local levels, either directly by government or by another entity under government influence (such as through a state-owned enterprise)."

Some assert that the US uses subsidies in response to tariffs and NTBs used by others. This is a totally false claim and one that gets the order of operations wrong. For instance, the US Farm Bill and its hundreds of billions spent each year on subsidies was enacted in the 1930s, many decades before current US concerns about tariffs and NTBs and many decades before Europe’s CAP. Back then the Farm Bill helped poorer owner-proprietor farmers. Today it's a corporate hand-out. Further, US auto subsidies have been around for decades. The US 'chicken tax' on imported trucks started in 1964. The US allowed mortgage interest deductibility as a subsidy to lenders starting in 1894 (not a typo). The US military-industrial complex and its array of favourable subsidies and procurement programs has been around for many decades. Ditto for strong dollar policies. Ditto for soaring fiscal deficits that routinely seek to prime the pump of the US economy to its advantage. Ditto for frequent crisis bail-outs like during the GFC. Ditto for the Federal Reserve’s distorting QE policies since the GFC.

Why US Companies Can’t Sell More Abroad

Navarro and other members of the US administration claim that the reason US companies cannot sell products into foreign markets is strictly because of non-market barriers to entry. They often neglect to address the serial marketing woes of US companies. For instance, this piece for Bloomberg subscribers is an excellent reminder of why US auto firms don’t sell much in Japan. Japan actually imposes no tariff on vehicle imports from the US versus the 2.5% tariff the US imposed before sending that through the roof last week. Simply put, Europe and Japan have fundamentally different tastes and don’t want big, clunky, less fuel efficient and costly US made vehicles subject to different safety and reliability standards. Show cultural and market sensitivities by making better products and maybe you’ll sell more in those markets. They don’t want big clunky F-150s and Dodge Rams or SUVs that dominate so much of US vehicle production!

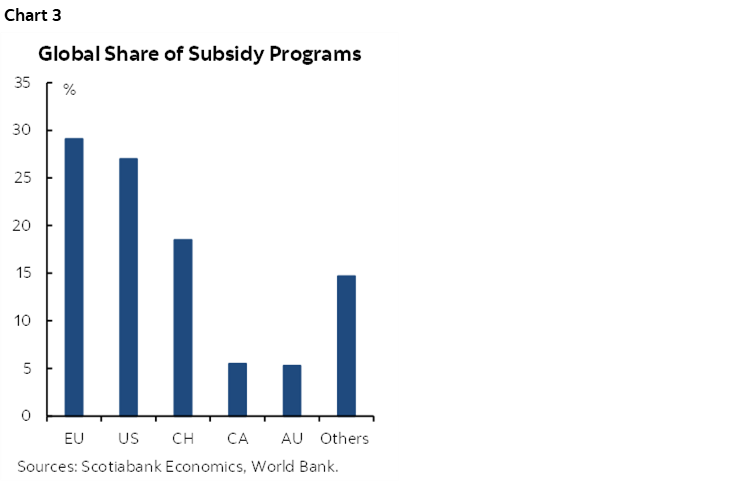

No, the Theory is Not Incorrect

Navarro says that the theory that trade imbalances should always be eliminated through price and exchange rate moves is fundamentally wrong because of foreign protectionist barriers against the US that prevent rebalancing. The error Navarro is making is holding all other US policies constant throughout the period of persistent US trade and current account deficits. That’s unfair because the US keeps encouraging irresponsible fiscal policy and excess consumption while not saving enough as a country and therefore it pulls in excess imports while driving a strong dollar that harms exports. US policy serves as offsets to equilibrating market mechanisms. Expensive military incursions abroad including the WMD hoax and constantly giving away unfunded tax cuts explain much of the rise of US public debt (chart 4) and four of the biggest run-ups in US public debt have come under Republican Presidents including Trump 1.0 (chart 5). Trump 2.0 is only just beginning.

What About that US Services Surplus??

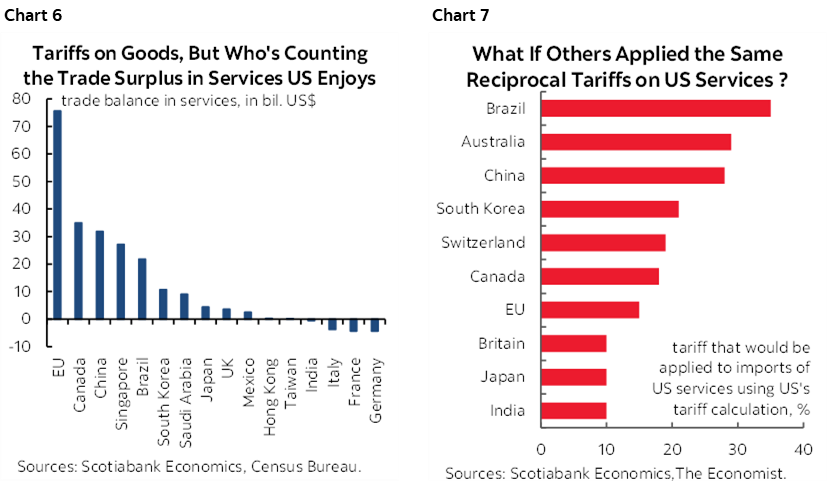

Navarro ignores that the US is better at services than most, hence its persistent services trade surplus, and including some of the best enterprises in fields like tech and finance. Mr. Navarro doesn’t address why market mechanisms like prices and exchange rate movements have been unable to close the US services surplus over time like he alleges toward the goods deficit. It’s probably because the US is better at many of these services but I guess when it’s a surplus he ignores it! Chart 6 shows a break down of the US services surplus by country and how vulnerable the US balance with Europe may become if Europe retaliates. Chart 7 is replicated from The Economist and shows what would happen if other countries applied the same formula the US did against US services exports. China and the EU, UK, Canada and Japan could utterly crush US services exports but to the detriment of all.

The Flip Side to the Current Account Deficit

Navarro takes a one-sided approach to the current account deficit when he says it transfers wealth. That’s not quite how the balance of payments works. The flip side is that it's funded by massive capital account surpluses that inject foreign savings into funding attractive investment opportunities and excess US spending. The US has—until trade wars—benefited from buoyant financial asset prices and relatively cheap debt funding because much of the world beats a path to its door to finance the current account deficit on favourable terms.

Foreign Ownership

Navarro laments that "foreign interests" have taken over US assets. In my opinion, foreign capital inflows reflect a) good investment opportunities in the US that the US should welcome, and b) chronic mismanagement of the US twin deficits that have a very large domestic policy component to them. Want lower foreign ownership of US assets? Fix chronic fiscal deficits and shift toward policies that encourage more domestic saving.

Reciprocal Tariffs Overshoot

Navarro says that reciprocal tariffs will fix the problem as he lays it out and that they are just matching higher tariffs elsewhere. No, not even close, the US is massively overshooting other countries’ tariffs with its tariffs. No, they risk crushing America's export markets and sending world trade into a downward spiral that costs everyone including the US.

Turning Back the Clock on Development

Navarro laments the long-term loss of manufacturing jobs. That's not just the US. Many developed economies have gone through this. It's not necessarily a bad thing! Many manufacturing jobs are good, high paying jobs. Many are not. But the trend reflects the rise of the services economy as the next natural progression of economic development from agriculture to manufacturing and heavy industry to services. The US has done well at this, with better income per capita performance than many other countries and higher quality jobs. Seeking to wind back the clock on economic development could carry negative consequences for overall economic progress and come at the expense of services through competition for labour, capital and resources.

The US Also Ignores Trade Rulings

Navarro notes the WTO dispute resolution system is broken and the US often wins but its victories "did not matter." He exaggerates. Canadians know that. Look at the lumber dispute that the US has lost a countless number of times at NAFTA and WTO panels yet the US keeps taking a run at Canadian lumber companies.

Conflicting Aims

He concludes that all America wants is fairness and to ‘charge you what you are charging us.’ That's not Trump's narrative. Trump’s narrative is about bringing it manufacturing home and not stopping until he sees that happening.

Be Careful What You Ask for on Currencies

On his allegations about currency manipulation, it's more complicated than that. Some do manipulate. Some are alleged to do so but evidence is wanting. Be careful toward others. For instance, if China were to instantly float its yuan, then you’d probably have a Chinese and global financial crisis on your hands as a much bigger version of the mess that unfolded about a decade ago. And on FX manipulation, the US constantly pursues strong dollar policies while curiously lamenting the strong dollar.

Root Drivers of Inequality

I hear his concerns about unequal outcomes in the US. It's a serious issue in many countries but particularly the US. Yet the administration's policies would worsen inequality. Where the US failed on free trade was on education and training and broader social policies. It got the free(r) trade part right but failed on a lot of other policies that were needed to go along with that. The US can't go on blaming the rest of the world for that. Its top tier universities are (soon were?) among the best anywhere if not the best. Great if you go to university and can afford America’s higher education bills. Much of the rest of the system underperforms across standardized testing and access. Ditto for unequal access to healthcare and the devastation faced by many families if someone has the audacity to get sick.

Pollution and Sweatshops

Navarro’s op-ed noted “many foreign competitors operate from sweatshops and pollution havens that morally and environmentally stain the global landscape from Asia and Africa to Latin America.” He’s right. So did the US at a far earlier stage of its development. Same with Europe. And you want to bring all of that back home to America?? While withdrawing from the Paris Agreement???

What is the US Offering?

And maybe, just maybe, the US administration could offer a thing or two. What's the #1 complaint of developing countries? Rich country agricultural policy that keeps them poor through barriers, subsidies and dumping. The US Farm Bill and Europe's CAP are the worst among them. I'm surprised we haven't heard those countries raise this so far. You could reason that some of them are forced to have high tariffs because they have no other route. They can't develop their ag sectors given rich country policies and as the first step toward development. They don't have the economies of scale and scope to compete with US manufacturers. That leaves few options.

Eliminate the longstanding 'chicken tax' on imported trucks? Stop subsidizing tech firms so much? How about that military-industrial quagmire of subsidies? Interest deductibility as a mortgage industry subsidy? Stop subsidizing your auto firms to locate plants in the midwest and southern states that siphoned off investment from Canada? Chips subsidies? Aerospace industry subsidies? Serial bail outs every ten years? Distorting Fed QE policies that distort the playing field in favour of US financial markets relative to others and with spillover effects for the US economy? And on and on. The point is, everyone's hands are dirty in world commerce but it seems to me that somehow the US still manages to be one of the strongest and richest economies on the planet!!

VAT Taxes Are Not a Barrier

This is where things get really silly—the US dictating tax policy to other countries. Navarro demands that Europe drop VAT taxes. Canada also has one. Don't hold your breath. A VAT is a more efficient value-added way of taxation than US state and local government sales taxes. It is applied against domestic and foreign goods and services sold in their markets and does not discriminate but the US has a problem with it because it seeks to restrain overall consumption and that’s an area where US companies excel given the nature of the US economy. The US could save and invest more and address its chronic current account deficits that are heavily the product of its own creation if it had a VAT of its own. Instead, it keeps overly encouraging consumption and huge and mounting fiscal deficits.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.