ON DECK FOR MONDAY, JANUARY 13

KEY POINTS:

- Global markets continue to react to US payrolls, tariff developments, week ahead

- Markets are pricing only one Fed cut this year, another one next year

- US 10s cheapening may be interrupted by the debt ceiling before new peaks emerge

- Reduced BoC pricing points to 50bps of cuts this year and then holding

- Canada throws everything on the table in response to US tariffs

- Canada’s Liberal leadership race has been winnowed down to 2–3 candidates…

- …and next up is the harder part—outlining and selling their platforms

- Chinese exporters are clearing the decks ahead of Trump

- Nothing material on tap into the N.A. session

- Global Week Ahead — Play the Long Game on Tariffs (here)

This morning is mostly a continuation of Friday’s reaction to US payrolls in the markets alongside weekend developments concerning tariffs. There is very little truly new information to assess. Markets also have an eye on the week’s main expected developments especially on Wednesday when US CPI and US bank earnings tag team with one another.

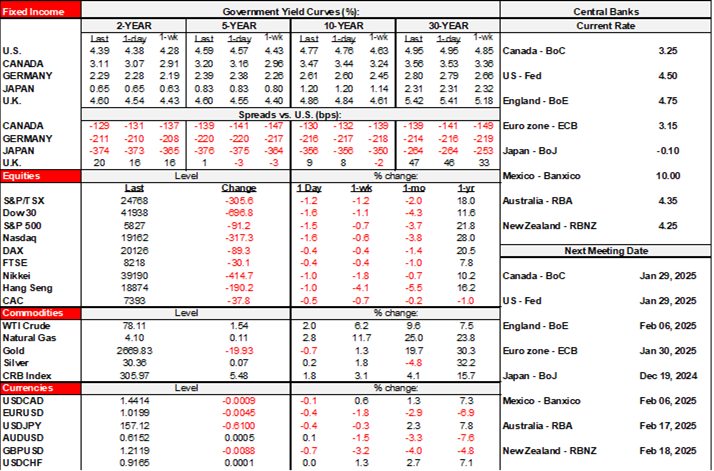

Global sovereign bond yields are rising with Asia-Pacific markets leading the way in lagging reaction to payrolls except for Japan that is shut for ‘Coming of Age Day’ and will react tomorrow. Australia’s curve bear flattened as an 11–12bps rise in shorter-term yields led the reaction. US Treasuries, Canadas, gilts and EGBs are also mildly cheapening. Stocks are broadly lower everywhere including N.A. futures that are down by between ½% (TSX) and over 1% (Nasdaq) while European cash markets are down by between ¼% and 1%. Asia-Pacific markets are down by more on bigger catchups in Seoul, HK, India and with Japanese futures pointed to a negative cash open tomorrow. The USD is broadly stronger along with the yen and CHF as safe havens, while CAD is holding its own and outperforming most other majors after Canada’s strong job readings and repriced BoC expectations on jobs and tariffs.

Fed and BoC Pricing

As part of the extended reaction in bond markets, pricing for the Federal Reserve’s and Bank of Canada’s actions this year continues to be scaled back. Cumulative Fed easing this year has been pared by another few basis points to an even single 25bps cut for the year as a whole and with only another 25bps cut priced for all of next year. Cumulative BoC easing this year has been shaved by another 8bps this morning to less than 50bps of additional cuts.

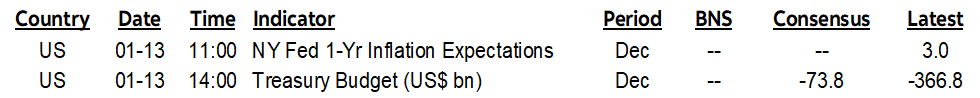

5% US 10s Face Debt Ceiling Scarcity in the Short-term Before Renewing Upward Path

And in bonds, the issue isn’t whether the US 10s can hit 5%. That seems likely in the short-term. The issue is how long can they stay there in the short-term and the path beyond. 5%+ is a view I’ve previously expressed and it now seems likely as they’re already at 4.77%. The issue is what’s the cap above that in the near-term and beyond. As written ever since last summer, Trumponomics 2.0 risks even higher yields than that. As written since late last year, there is the possible interrupting influence of the US debt ceiling that becomes binding at tens of trillions of US debt this week (chart 1), thus triggering relative scarcity by stopping net issuance and prompting emergency measures by the US Treasury. Among those emergency measures—barring heroics in Congress—will be potentially flooding the system with liquidity as Treasury draws down its general account at the Fed and the flows wind up in bank reserves. That could depress yields for a time, only to see them rise again when the ceiling is eventually addressed and Treasury begins issuing to replenish its cash holdings—just like what happened in 2023. The situation is obviously fluid with many policy variables in play amid high uncertainty around the global economic outlook.

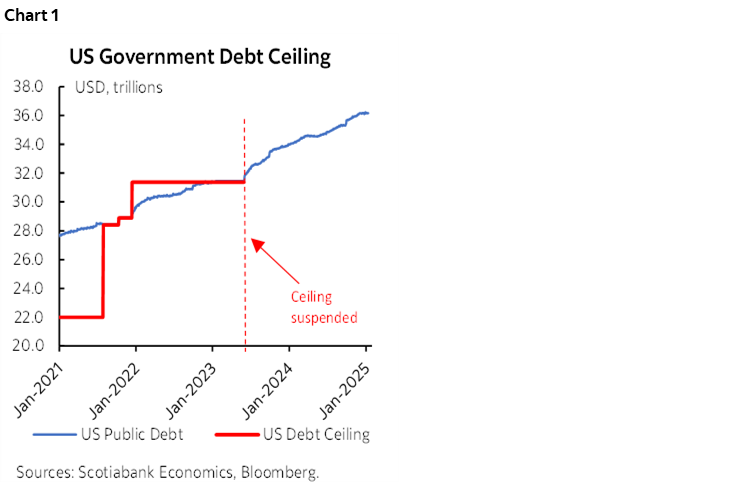

Chinese Exports are Front-Loading Economic Growth

Chinese exports were strong in December in USD terms (10.7% y/y, 7.5% consensus) and in yuan terms (10.9% y/y) while imports only grew by about 1% y/y in currency terms. Chart 2 shows the surging exports. This may reflect a rush to get exports out before tariffs, in which case the GDP jump that is expected on Thursday when Q4 numbers arrive (1.6% q/q SA nonannualized, 0.9% prior) may be transitory on pull-forward momentum.

Canada Emphasizes a Broad Based Tariff Response

Canada’s foreign minister reaffirmed yesterday that ‘everything is on the table’ by way of a response to potential US tariffs including broadly applied counter tariffs and energy export restrictions. PM Trudeau reaffirmed that “we are ready to respond with tariffs as necessary” while emphasizing that Canada is the number one export partner of 35 US states.

The Easy Part in Canada’s Liberal Leadership Race is Coming to a Head

The field is being winnowed down to 2–3 candidates. Canada’s Liberal party leadership contest is expected to see Mark Carney formally announce he is entering the race by late this week. Freeland is also expected to do so soon. Former BC Premier Christy Clark is still contemplating entry. The deadline to declare is January 23rd. So far, Dominic Leblanc, Melanie Joly, Anita Anand (who also said she will not run again) and Steven MacKinnon have all rejected entering the race. The only ones who have formally announced their candidacy are two extreme long shots (Frank Baylis, Chandra Arya).

That’s the easy part of the Liberal leadership race—declaring candidacy. Next up will be the pressure on each of them to outline their platforms. I’m pretty sure Freeland would strike an aggressive tone in response to the US threat, for instance, but we haven’t heard much from the other two possible leading candidates (Carney, Clark). At least in the short- to medium-term, plans for debt and deficits, spending, taxes climate and defence policies etc will all be informed by the impact of how trade tensions evolve from here. A candidate that indicates a passive approach to the US tariff threat is probably D.O.A.

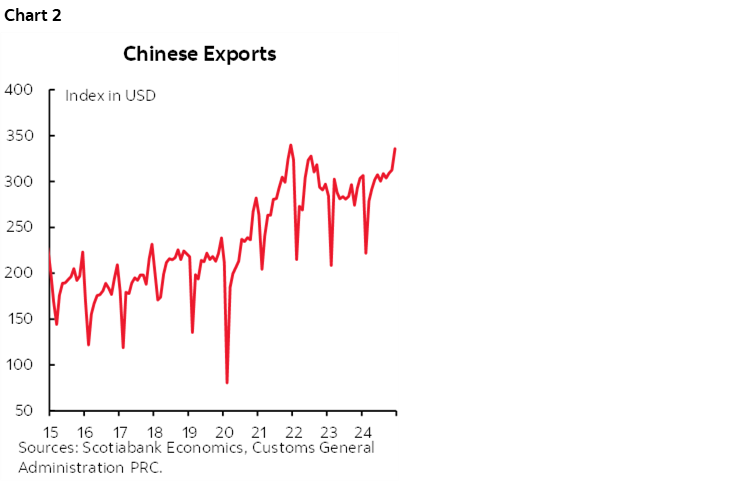

Light US Releases, Nothing from Canada

There are no data material releases to consider either through the overnight session or into the N.A. session. Only the NY Fed’s 1-year measure of inflation expectations for December (11amET) and the monthly US Treasury budget balance for December (2pmET) are on tap.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.