ON DECK FOR TUESDAY, JANUARY 14

KEY POINTS:

- Equities rally on two fragile theories

- A temporary Israel-Hamas cease fire may be in the works

- What does Trump think of his advisers’ tariff proposal that would lose face?

- US producer prices to inform PCE expectations amid bigger issues

- Light Fed-speak on tap

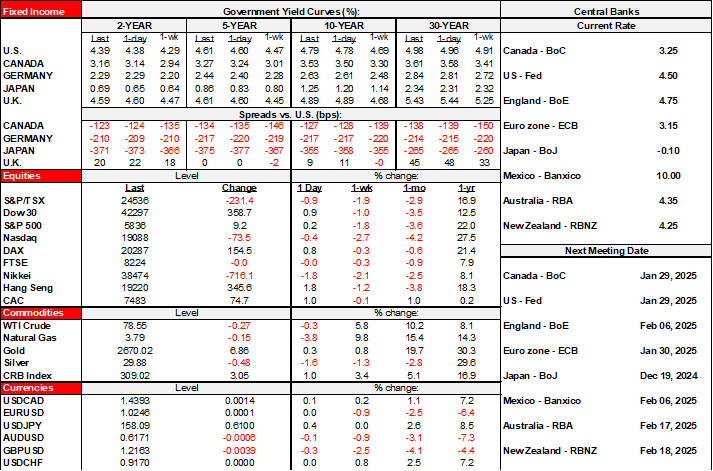

- Carney might have sounded supportive of ‘axe the tax’ but with a catch

A very light set of calendar-based developments is on tap out of the US after a quiet overnight session and ahead of tomorrow’s US CPI and US bank earnings. Sovereign yields are little changed so far this morning across most major benchmarks but with a very slight cheapening bias across US and Canadian curves. Equities are up by between a little in TSX futures to 1% in some European exchanges after a mixed Asian session with Tokyo back from holiday and pushing lower against gains elsewhere. The USD depreciated late yesterday afternoon when a story plant by some of Trump’s advisers hit (see below) but has since treaded water and is mixed this morning with gains being registered against CAD, sterling and the yen.

A Temporary Cease Fire?

What’s partly driving these moves is some combination of reports of a cease-fire deal between Israel and Hamas involving the release of some hostages that may at least temporarily deescalate some geopolitical tensions, plus potential tariff developments in the US.

What Does Trump Think of a Tariff Proposal That Would Lose Face?

I wouldn’t put much stock in the piece from late yesterday afternoon about how the Trump camp is considering gradually raising tariffs in increments of 2–5% a month.

First, it’s his advisers saying this, and we know full well that Trump often doesn’t listen to his advisers that can have a tendency to go rogue, and so just wait for the possible counter from Trump.

Second, it’s hard to see how Trump would stand down from his constant threat of imposing large tariffs without seriously losing face as some of his advisers apparently seek to rein in the craziness.

Third, they haven’t presented it to him, except, well, now through the media which is a tactic that I’m sure he’ll love...

Fourth, it may be a sign of de-escalation of the threat, but with the same likely retaliatory response from US trade partners.

Fifth, the whole rationale for US tariffs in the first place is unwise and marked by constantly shifting motives and goals.

Finally, the theory being offered that it would mean less inflationary pressure is bonkers; it would just mean putting higher inflation on a slower fuse, like a water torture approach to prices paid by Americans but with the same end result.

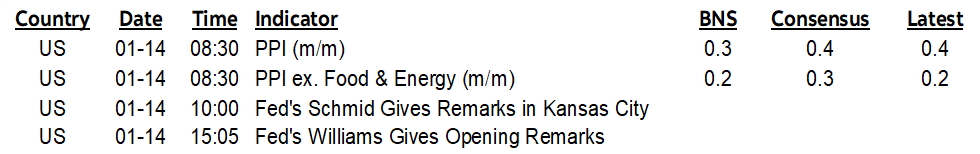

US PPI To Inform PCE, Light Fed-Speak

US producer prices will be updated with the December reading this morning (8:30amET). The report is likely to be of little use given bigger considerations at hand and pushed out Fed pricing.

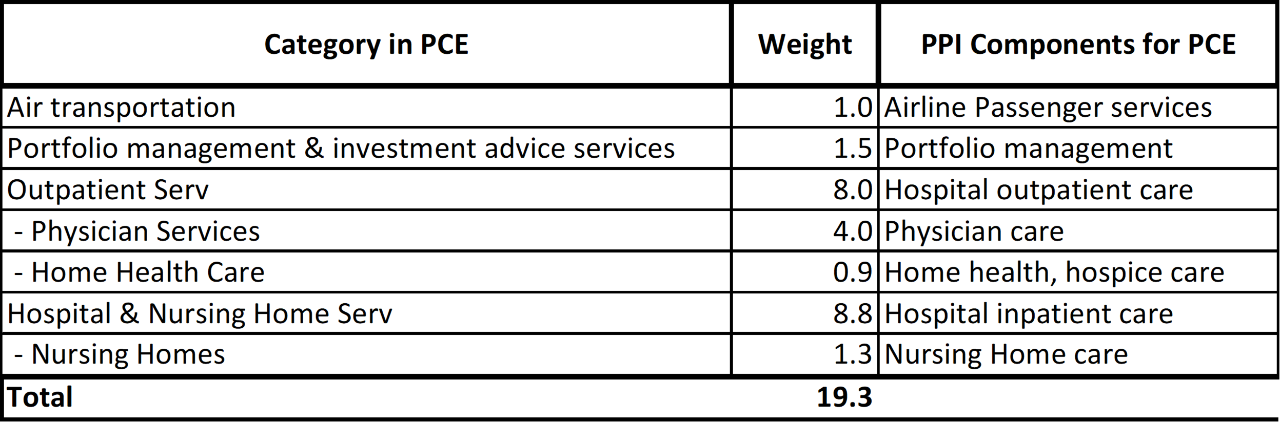

But US producer prices for December will be used to inform expectations for PCE at month-end. Watch the PPI components that feed into PCE (chart 1) that, when combined with the next day’s CPI figures, will be used to firm up PCE and core PCE estimates. They include items like air transportation, portfolio management, outpatient services and hospital/nursing home services that have a cumulative weight of 19.3% in PCE.

There will also be light Fed-speak before Saturday’s rather fortuitous blackout kicks in ahead of Trump week. I bet Powell & Co are thankful they get to sit out some of the crazy stuff for a week and a half.

Carney May Have Hinted At Part of a Platform

This interview with Mark Carney could be interpreted to mean that he’s leaning toward an ‘axe the tax’ policy stance in reference to the carbon tax in that he says the flaw is making everyday Canadians pay for emissions mostly generated by the oil industry that needs to be cleaned up. One can't much argue with that, except for the politics in energy-sensitive parts of the country. So, 'axe the tax' but replace it with something more directed at the oil and gas sector?

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.