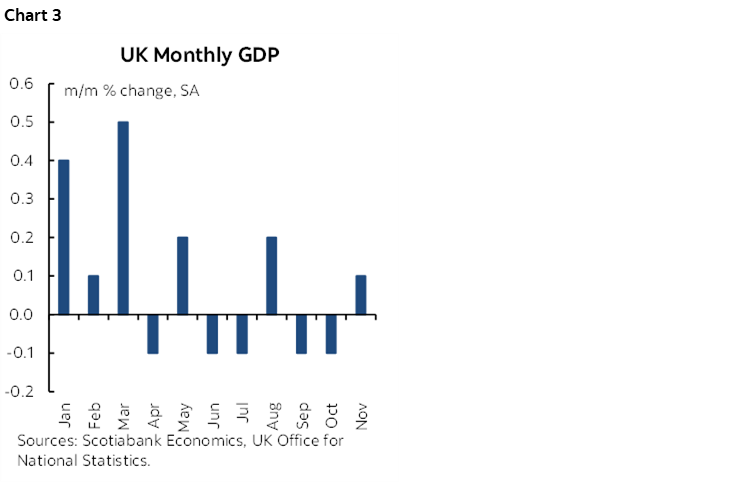

ON DECK FOR THURSDAY, JANUARY 16

KEY POINTS:

- Regional drivers replace global market effects of yesterday’s US CPI

- Are Americans front-loading retail sales ahead of potential tariff insanity?

- The BoJ rumour mill firmed up BoJ hike pricing

- Australian yields shook off a mixed jobs report

- UK readings reinforce BoE cut expectations

- Today’s curiously timed BoC speech on balance sheet plans

- Canada’s impressive unity against US trade aggression

- Strong US bank earnings into US policy uncertainty

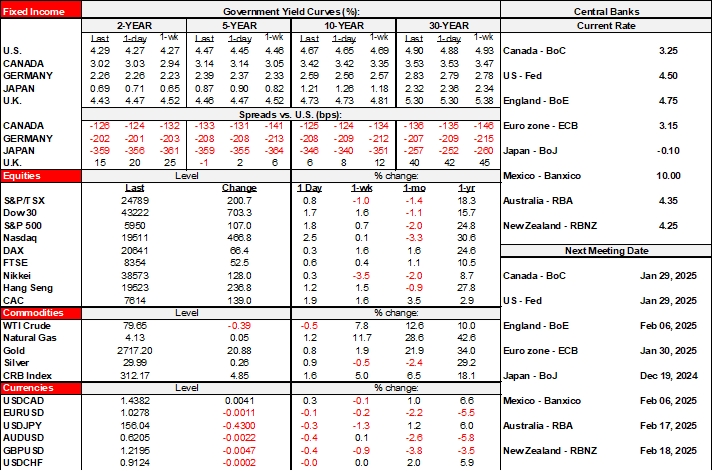

Markets are diverging from one another in some respects this morning, but with the general tone being mildly supportive of risk appetite. More US banks beat expectations. US retail sales were constructive in the details despite a slight headline miss. There will be a BoC speech on balance sheet plans etc. Equities are broadly higher. US Treasury yields are little changed with only a mild reversal of the post-CPI rally at the front-end. Gilts are outperforming on soft data. Asia-Pacific yields rallied as they caught up to the spillover effects of US CPI, except in Japan where further talk of a coming rate hike contributed to a bull flattener. EGBs are mostly just treading water. The yen is the star pupil after the BoJ news, but most other currencies are flat to weaker to the dollar.

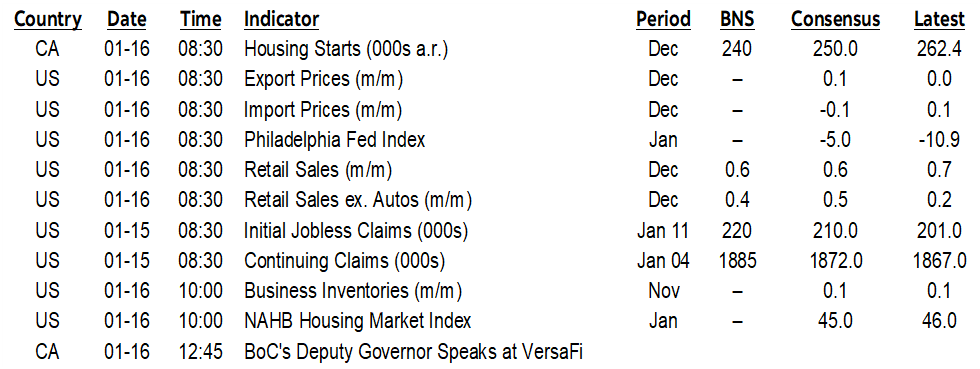

An Impressive Round of US Bank Earnings

US bank earnings continue to solidly beat expectations including BofA and Morgan Stanley this morning. Yesterday’s and today’s beats are shown in chart 1. They did very well without easier regs while they and their clients face forward-looking uncertainties over trade, immigration and fiscal policy.

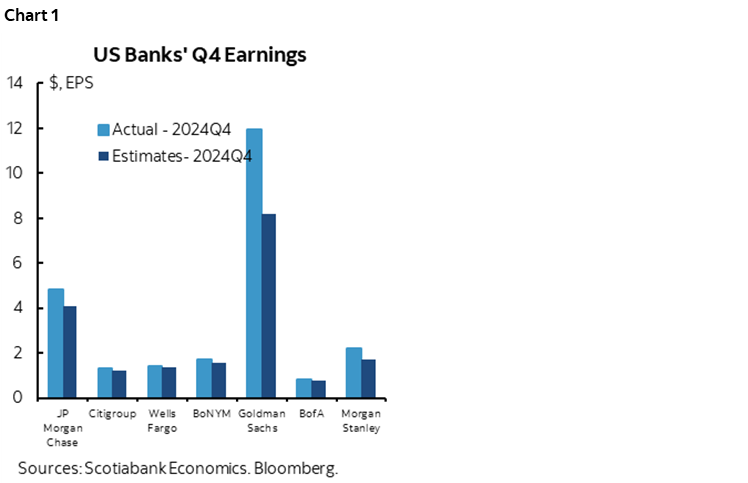

BoJ Rumour Mill Drove Rate Hike Pricing

Those ‘people familiar with the matter’ were at it again overnight, this time in the case of what the Bank of Japan may do next week. They indicated to journalists in clandestine fashion that there is a likelihood that the BoJ hikes by 25bps next Friday barring any disruptive effects around whatever Trump may do. The latter seems likely, so perhaps take it with a grain of salt. While the rumour mill isn’t always accurate, there was already a decent chance price as only another couple of points were added to pricing that now stands at about 20bps. Pricing is double where it was at the start of this week in the wake of comments by Governor Ueda and DepGov Himino that formally declared this one to be a live meeting at which they would decide whether to hike or not (chart 2). That’s Japanese for ‘we’re gonna hike’ barring something really big happening.

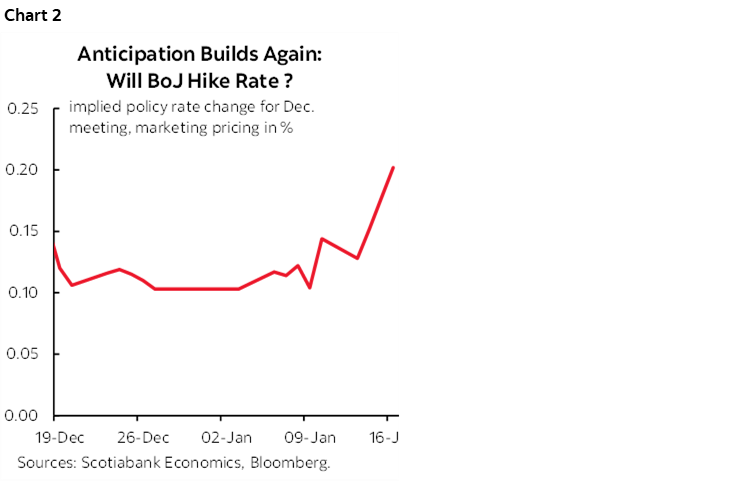

UK Activity Readings Reinforce BoE Cut Pricing

Soft UK activity readings for November reinforced expectations for a BoE cut on February 6th and drove lower yields in bull steepener fashion. GDP was soft (0.1% m/m, 0.2% consensus). At least it wasn’t negative though (chart 3). Industrial output fell -0.4% (+0.1% consensus). Services were on consensus at 0.1% m/m but revised a tick lower to -0.1% the prior month. The trade deficit widened including through revisions and a bigger than expected deficit for November, but much of the reason was a prior month surge in imports.

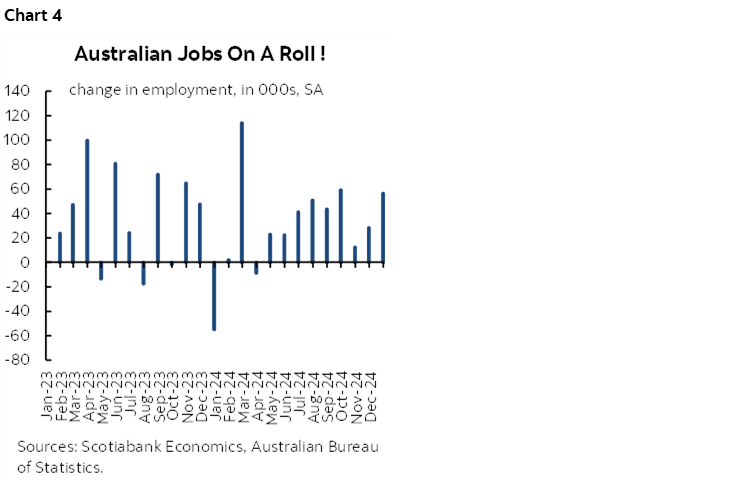

Australian Markets Shake Off Jobs

Australia’s job gain had little influence upon yields that were already falling before the release in sympathy with the post-CPI US rally. The composition dented the headline gain of 56k jobs in December (chart 4) along with a mild negative revision to the prior month’s gain (28k instead of 36k). Of the 56k created in December, all of it was driven by an 80k gain in part-time jobs while full-time employment fell by 24k. The unemployment rate ticked higher to 4% as the labour force participation rate ticked up.

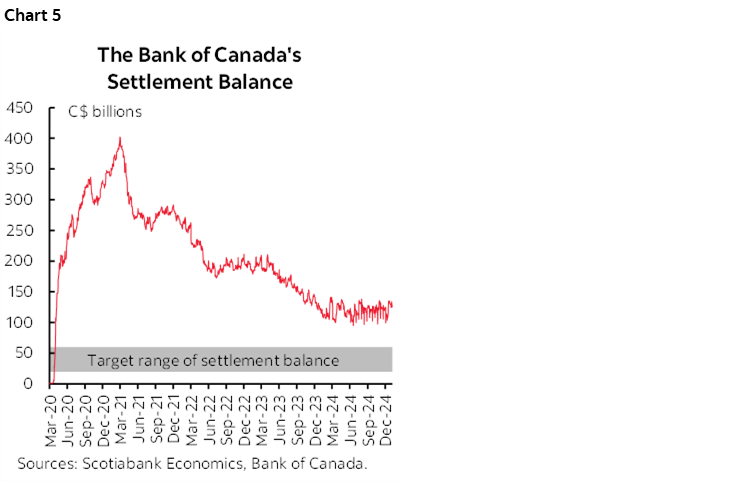

BoC Speech on Balance Sheets

There will be a BoC speech on balance sheet plans with the embargo lifting at 12:30pm, along with audience Q&A after DepGov Gravelle finishes reading but no presser. See my global week ahead for expectations and possibilities. The speech timing is odd as an annual update since the topic of balance sheet, BoC market supports and programs is usually addressed by him in March. Plus, the BoC is nowhere close to its stated goals (chart 5). I attempted to discuss the full range of possible topics and issues he may address in my article for an audience that closely follows the BoC. Be as open minded to what the BoC may do with its policy rate and balance sheet plans as you need to be in terms of what’s coming ahead by way of tariffs and Canada’s possible response and the potential impact upon the economy, markets, deficits and issuance.

US Retail Sales to Provide a Holiday Recap

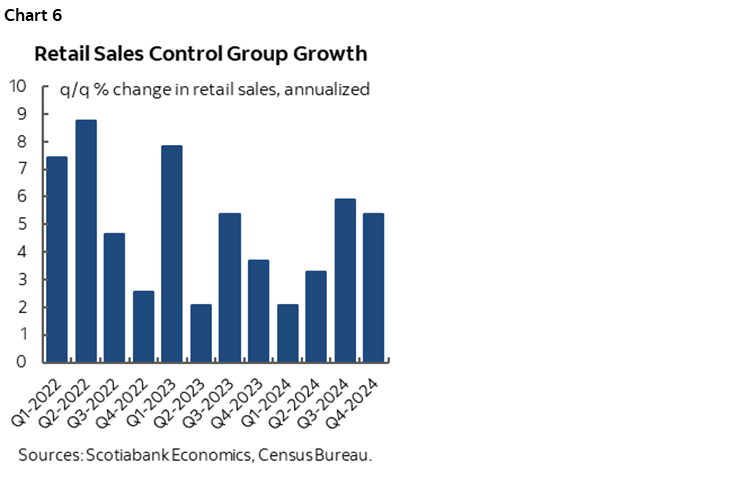

A strong US retail sales report continued to generate debate over how much of it reflects momentum and sound consumer fundamentals, versus front-loading to get ahead of potentially insane trade policies.

Key is that the retail sales control group—that excludes autos, building materials and gas—was up by 0.7% m/m SA. It’s a more stable measure of underlying spending momentum and is how retail more directly feeds into consumption within GDP accounts. Total retail sales were up 0.4% m/m and sales ex-autos were up 0.4%.

Total sales were up 7.3% q/q SAAR (seasonally adjusted at an annualized rate), core sales were up 5.0% q/q SAAR and the control group was up by 5.4% (chart 6). All quite strong. In fact, the overall q4/q3 jump in total retail sales was the strongest nominal gain since 2023Q1.

So is it front-loading to get ahead of tariffs? Maybe some of it, and the soaring Philly Fed manufacturing measure could support that narrative alongside other PMIs, auto sales etc. And yet there was momentum before as well including in Q3 when the election outcome was more uncertain. But if it is front-loading, then Trump will be greeted by a retrenchment into Spring and one that would be magnified by insane trade policies.

There is, however, momentum built into the Q1 math for retail sales. 2.2% q/q SAAR growth in nominal sales is baked into the math given the way Q4 ended and the overall Q4 average as the known factors to date and obviously before we get any Q1 data. Also as a caution is that US retail sales can be one of the most heavily revised US data series going, but in either direction. It’s the same thing in Canada regarding revision risk where the retailers' survey response rate has fallen off a cliff.

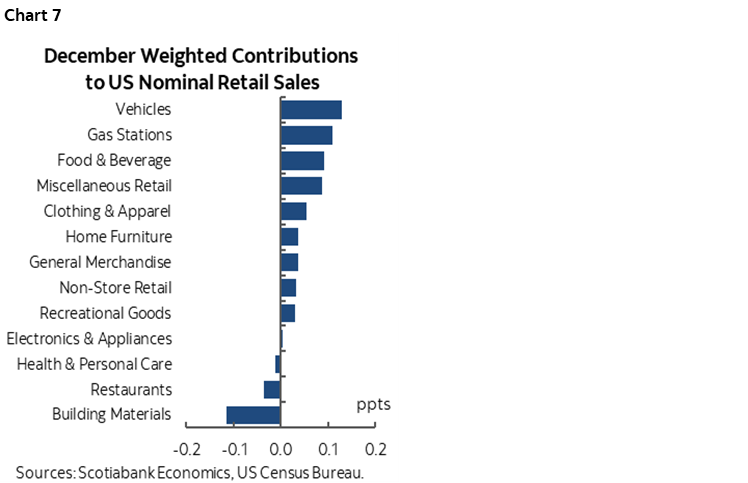

Chart 7 shows what drove the monthly gain in total retail sales in terms of weighted contributions to the percentage change of 0.4% m/m SA.

Canada’s Remarkable Unity Against US Trade Aggression

Wow. Thirteen out of fourteen of Canada’s first ministers reached some form of agreement yesterday in terms of keeping all options on the table while determining how to respond to Trump’s potential tariffs including potential counter-tariffs on C$150B of US imports. All options as in tariffs, negotiations, restrictions on sensitive resource exports and pricing, and requisite support packages for the economy during the shock. Even Quebec’s Premier Legault, when asked whether he would support restricting hydro, somewhat ducked the question but this time he at least publicly repeated the party line that all options are on the table. And Saskatchewan’s Scott Moe—despite his own reservations—was an adult who stayed at the table throughout including for the presser.

Of course, some of the brave face that was put on by the group no doubt masked individual reservations across the range of policy responses they deliberately didn’t get into by way of details either because they were still debating and/or didn’t want to show their hand at this point. And yet at least it was a pretty convincing attempt at showcasing unity across all but one single province—one out of 14 first ministers (PM, 10 Premiers, 3 Territories)—as the one opted to phone it in and photobomb the press conference with a tantrum on Twitter. If you know anything at all about Canada, then to get such high support up and down the table is a rarity. For Americans reading this note, you know full well that harmonious agreement is tough to achieve across your own polarized country on just about any topic.

It's natural to understand the concern over using energy—or any other tool or commodity—as a point of leverage. They have legitimate concern about the impact upon their economy and provincial finances especially if Canada’s response relies disproportionately on curtailing energy exports, which doesn’t seem to be the case.

But frankly, the one that opted out shouldn’t surprise many. It’s the province’s overall way of doing things on multiple issues. The rest of the country is getting used to Alberta’s serial pattern of opting out of pressing national matters over recent years. That’s true whether it’s on pandemic policies and anti-vax beliefs that vilified folks who chose to get vaccinated, or demands to withdraw from the CPP national pension, or opposition to environmental policies, and now what to do about US trade aggression. You can debate the merits to Alberta’s stances, but the point here is that opting out isn’t unprecedented or unusual for this provincial administration. As far as I can tell from Premier Smith’s Twitter bomb in the middle of the First Ministers’ press conference, the answer to what Canada should do is basically nothing. Meet with US officials, which is an approach that has been a bust to date. Try logic when Trump’s logic on trade matters is so seriously uninformed. Gush over him and his disciples including former Canadians. Do nothing other than to say wouldn’t it be grand if Canada could go back in the past and develop resources more fully or if Canada could spend more on developing resources now in a process that would take years, more like decades, and which, of course, would mean a bigger Canadian trade surplus with the US today and no doubt much to Trump’s delight! And with uncertain effects on non-resource sectors.

Trudeau’s veiled response was that no part of the country should disproportionately bear the burden of Canada’s response to trade aggression—which is the correct approach—and to note that it is Ontario’s auto sector—not energy—that is the prime target for the incoming US administration. That’s rich, in that US bail-outs and subsidies—especially in southern states—have damaged Ontario’s auto industry for a long time. Nevertheless, the signal is that there won’t be one tool used versus a broad toolkit.

Now I’m not asking folks with varying views to agree with everything he has done during his tenure in office, but in my opinion, Ontario Premier Ford is the most Prime Ministerial leader standing up for Canada that we’ve got. Loved the hat. He’s no leftie attacking the GOP, so he has the credibility of being on the same wide end of the spectrum as the tariff mongers south of the border, thus making it impossible for them to reject him on such terms. Impossible to label him as ‘oh, just another Canadian socialist.’ He’s not off cavorting with the folks at Mar-a-Lago who wish to destroy his country. He’s at the table, as a leader should be, putting on a brave face and making it clear that Canada won’t be a pushover. Speaking up while other Conservatives promote disharmony or hide. Ford’s approach is critical in dealing with Trump in trading off potentially greater short-term pain for the sake of defending the economy for the longer term. See my week ahead article as the latest explanation of my thoughts on Canada’s response for more.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.