ON DECK FOR WEDNESDAY, MARCH 12

KEY POINTS:

- Reduced tariff jitters lift risk appetite with US inflation, BoC pending

- The BoC is expected to cut with a neutral/hawkish bias…

- …as data to date doesn’t support easing…

- …while crazy US trade policy carries competing effects on demand and supply…

- …with fiscal and regulatory supports ahead

- US core CPI will only incrementally inform the Fed’s ‘patience’

- Will the post-pandemic Q1 effect again dominate upside risks to core CPI?

- Trump is dead wrong on Canadian dairy tariffs

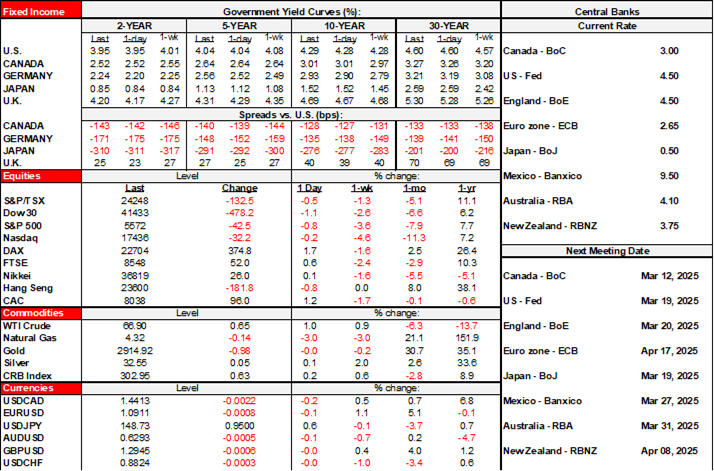

Yesterday’s nuttiness on US trade policy is being unwound across markets. What happens today will be driven more by US CPI and perhaps the Bank of Canada’s management of tariff-induced uncertainties. The BoC will be the proverbial canary-in the-coalmine across global central banks before next week’s deluge of decisions, and by way of the signals it sends on how to manage tariff effects on inflation from both the demand and supply sides. We’ve seen moments when BoC actions can spill over into market implications abroad and this could be one of them as a central bank in a trade-dependent economy weighs in on how to manage tariffs.

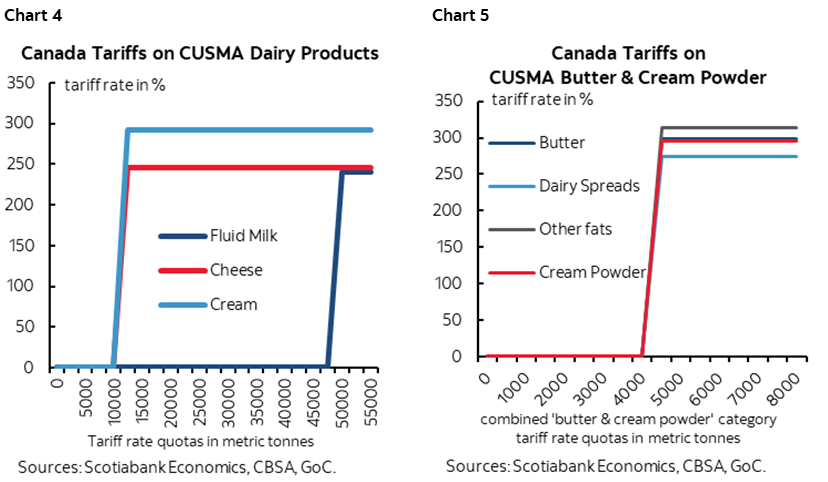

US CPI—INCREMENTALLY INFORMING THE FED’S PATIENCE

CPI arrives at 8:30amET. Most forecasters expected 0.3% m/m SA for core CPI. This time I’m on consensus as Scotia’s house call in consensus surveys is 0.3% m/m. All core CPI estimates are between 0.2–0.4% m/m with very thin tails in the 0.2 (including a few credible shops), and 0.4 (not very widely watched shops) camps. The Cleveland Fed’s ‘nowcast’ for core CPI rounds up to 0.3%. Outside of that range isn’t impossible but is playing random noise given high data deficiencies.

Downside risk is partly informed by the high base effect stemming from the strong 0.4% core CPI rise in January that may have had some distortions with considerations including weather and LA fires. Some mean reversion from the large spike in core services ex-housing in January is possible. Shelter inflation has been range bound over recent months and that is expected to continue. There were also big gains in categories like home and auto insurance premiums, used vehicle prices, recreation services, and drug prices during January that could soften.

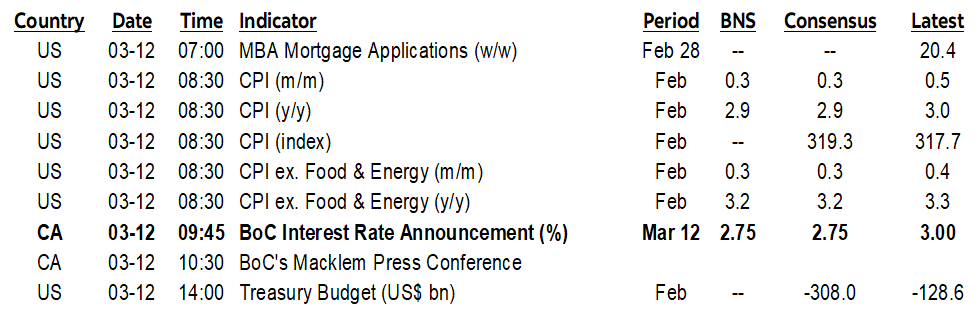

Upside risk is partly informed by the pattern over recent years whereby seasonally unadjusted core CPI in m/m terms starts off higher than historically normal (chart 1) against which an average to slightly above average SA factor in the post-pandemic era is applied (chart 2) before we start to see SA factors overinflate readings in future months. New seasonal product lines will rotate into retailers’ offerings and each year that happens in the post-pandemic environment has entailed notable price spikes reflecting the past year’s cost pressures. There could be ongoing effects of harsh weather and LA fires on several categories. Big declines in January’s clothing prices could rebound as seasonal offerings rotate.

What does it all matter? Not much. It’s CPI, and we also need tomorrow’s PPI to inform expectations for the Fed’s preferred core PCE gauge that arrives at month-end—after next week’s FOMC. The Fed is very clear in signalling patience versus extreme data sensitivities to one or two reports. It’s also forward-looking and that’s the right way to play an economy that is still in excess aggregate demand that is toying with adding tariffs as an upside risk to inflation. Key will be the extent to which the Trump administration’s policies harm growth but also while curtailing the supply side via less appetite to invest and more restrictive immigration policy.

BANK OF CANADA—CUT, HOLD YOUR CARDS CLOSE

This one is a statement-only affair (9:45amET), sans forecasts/MPR, and will be followed by the BoC’s press conference (10:30amET). -25bps is priced and widely expected with only two shops including one of the major Canadian banks in the hold camp which seems like a stretch to me! In the other direction, upsizing again would go against everything Macklem has said to date.

Data to date does not merit easing as argued in my weekly. Everything from GDP to jobs to consumer spending to final domestic demand and, of course, core inflation all says don’t cut, to the extent to which backward-looking data matters against forward-looking risks. The narrative that the consumer has been dead for a long time is belied by the actual data; consumption in inflation-adjusted terms few by 3.6% q/q SAAR last Q1, then 1% in Q2, then 4.2% in Q3 and a whopping 5.6% in Q4. The response to lower rates and immigration’s lagging effects plus pent-up demand and pent-up financing supports is readily apparent in the data despite the popular street narrative that the consumer is dead in the water while grappling with mortgage resets. That’s just not true.

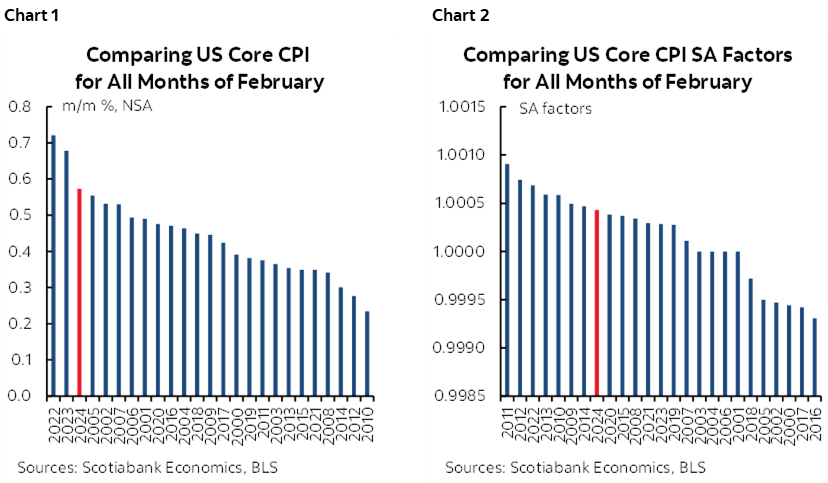

Further, the tariff threat may be subsiding. We only have steel and aluminum tariffs so far, and while there is no economic rationale for those tariffs, they translate into a minimal impact on the weighted average tariff rate on overall Canadian exports that remains well under what we have incorporated as a shock within our forecasts. Chart 3 shows that the weighted average tariff effect from steel and aluminum tariffs is very small and that the US would have to apply tariffs in other categories in order to meaningfully raise the average tariff shock which it has not done to date compared to the rhetoric. The US administration was very clearly seeking an off-ramp from its ruinous trade policies until provoked, and both sides have backed down again. Macklem is unlikely to commit to future easing in part because of the prospect that US trade rhetoric is so far in a pattern of getting repeatedly pushed out and tamped down. I remain of the view that Trump and the GOP won’t wish to be fighting widespread trade wars once midterm election campaigning starts later this year into next and that Trump is frontloading his mischievous and thoroughly unwise trade frictions.

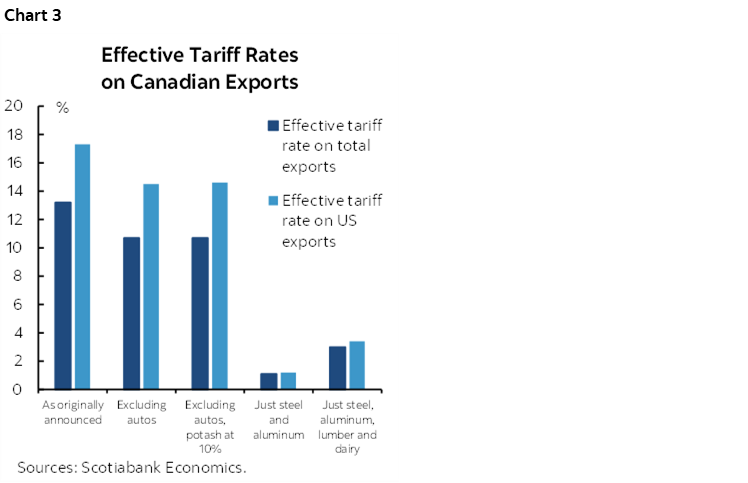

As for dairy tariffs, gimme a break. The US dairy producers pay no tariffs when exporting into Canada because the tariff rates on dairy products from the US coming into Canada kick in at very high levels and US exports are at a fraction of those caps (charts 4, 5). The US uses the same protective system and they were included in Trump’s greatest, best ever, more fabulous I-did-it-all CUSMA/USMCA trade deal. And if we want to talk about distorting agricultural sector policies, then any day, Trump; start by ending the hundreds of billions of dollars in subsidies your government grants corporate farms each year through the wasteful Farm Bill.

The BoC is already essentially at neutral, as Macklem has previously stated, unless anyone believes we can estimate the precise level. I don’t, so the argument you cut in order to land on neutral doesn’t hold water. The BoC’s neutral rate range runs from 2.25% to 3.25% and the current policy rate of 3% lies within that range.

The easy thing to do would be to give the market its cut, since the confidence hit to spending and investment is already probably invoking damage on both the supply and demand sides that is yet to show up in most of the data. The key lies in terms of where the balance of the effects sits in terms of spare capacity. Reduced confidence and high uncertainty may reduce appetite to spend and take on debt. But it’s also restricting the supply side through damaging appetite to invest and by roiling supply chains and by now we know full well how that could impact inflation.

On the bias, I expect Macklem to be very careful in keeping with his prior multiple speeches dating back to September on how the BoC could deal with a trade war. He won’t pre-judge potential tariff moves not least of which given how extremely unglued and volatile Trump can be and given the small actions to date. He will repeat the line about how they can help the economy adjust in a trade war—versus the tariff tiffs to date—but that there is a limit given the damage that could be done to the supply side. He also has some help from a weaker currency and fiscal policy measures, both actual to date and potential future measures.

The bottom line is this: Macklem (hopefully) learned through the pandemic experience that it’s not all about the demand-side effects. You must pay close attention to the supply side as tariff uncertainties damage supply chains, and you cannot ignore how other policy levers respond. The risks posed by tariffs are not just on the demand side.

The next decision on April 16th may have more fireworks. We might know the outcome of the April 2nd tariff threat. We’ll have a lot more data. The April meeting will have a full forecast revision including revised annual estimates for potential growth (the economy’s noninflationary speed limit) and for the neutral rate. And so tomorrow is probably about delivering what’s expected, sounding careful on the bias, and see ya in April.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.