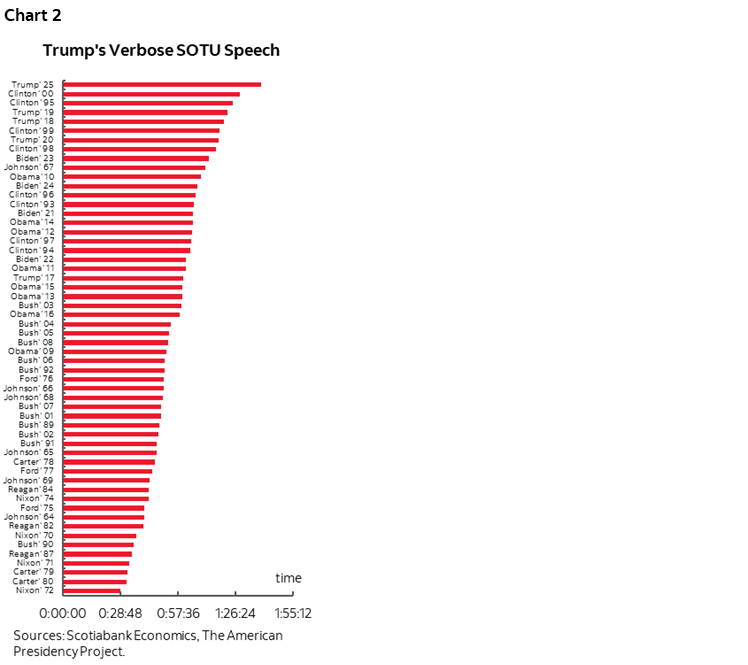

ON DECK FOR WEDNESDAY, MARCH 5

KEY POINTS:

- Global markets react to German spending surge, possible ‘Trump put’

- Trudeau, Trump to talk potential compromise this morning…

- ...after Lutnick hinted at a de-escalation…

- …demonstrating that retaliation and the stock market response may have worked

- The good and the dicey about Germany’s three-point plan to spend more

- Trump’s verbose not-SOTU speech offered nothing materially new

- US macro data on tap: ISM-services, ADP

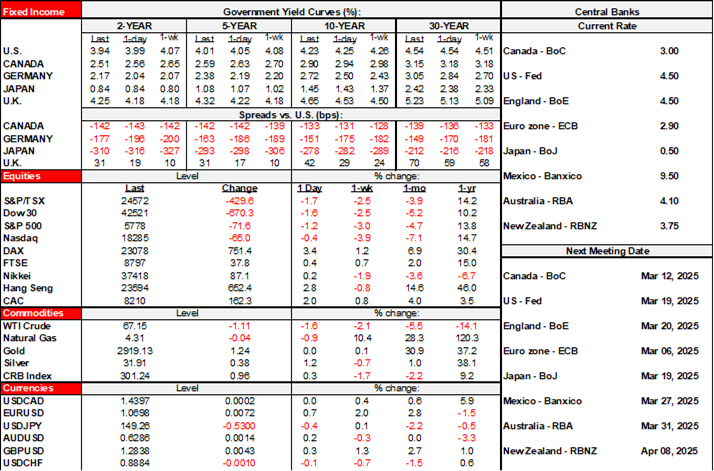

The ‘Trump Put’ and German defence spending are the two major drivers of global market developments this morning. Stocks are richer across major exchanges led by Europe with gains of 2–3½% (less in London) after mild overnight gains across Asia-Pacific markets and with N.A. futures up by up to ½%. EGB yields are up sharply by double digits across the curves and with gilts rising by a little less. The dollar is broadly weaker and N.A sovereign yields are broadly lower.

GERMAN DEFENCE SPENDING DRIVES EQUITIES HIGHER, SLAMS BONDS

Germany’s announcement arrived in three tape bombs yesterday after European markets had shut and so we’re seeing most of the market reaction now. First, Germany pledged to establish a €500 billion (about US$535B, C$770B) special fund for defence and infrastructure. Second, newly elected Chancellor Merz said that defence spending over 1% of GDP would be excluded from the constitutional debt brake. Recall that this ‘brake’ establishes a cap on the structural budget deficit of 0.35% of GDP with the exception of emergencies. There was also talk during the announcements of further changes to the debt brake by the end of this year that could open the door to even more spending. And this morning we have Germany urging the EU to relax fiscal rules for everyone in order to generate much higher defense spending.

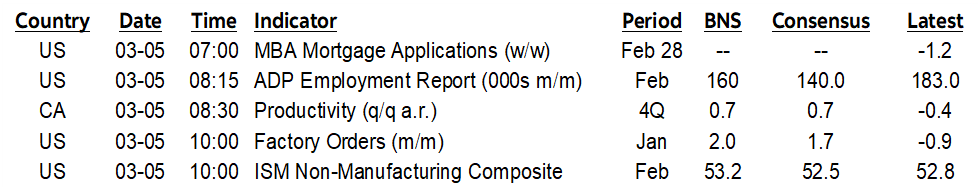

The 3½% jump by the DAX is leading global equity advances. Gains are uneven within the composite, but not just confined to a further surge by defence stocks (chart 1) as higher infrastructure spending and generally stimulative fiscal policy are perceived to drive quicker growth. Those are the positives. Among the concerns are the risks to the bond market and especially by way of the loose pledge to increase spending by even more and abandon the brake, uncertainty toward the possible escalation of war in Europe, plus knowledge of history in terms of what happens whenever Europe spends a lot on defence. Markets are only pricing the good outcomes for risk appetite at this point.

THE TRUMP ‘PUT’ MAY BE IN MOTION

The second major driver of global markets is speculation that a Trump Put’ is indeed a phenomenon. US Commerce Secretary Lutnick’s interview on Fox yesterday afternoon sounded like an off-ramp from high tariffs only hours after imposing them. You can watch it here if you wish. Cutting through all the unsavoury parts revealed that a phone call would happen between Canadian PM Trudeau and Trump this morning in order to possibly advance a compromise deal. I would still be cautious. There is nothing on PM Trudeau’s daily itinerary and so I’m unsure of what to expect—if anything—by way of announcements today, whether formal ones or—more likely—social media posts.

TRUMP’S SOTU SPEECH OFFERED NOTHING

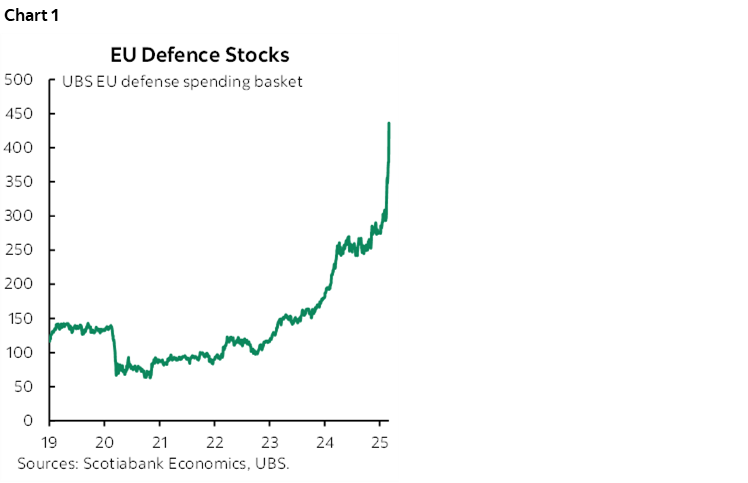

As for Trump’s not-SOTU-but-it-is-SOTU speech last evening, it was rambling, broke the all-time record for length by clocking in at one hour, thirty-nine minutes and 32 seconds (chart 2), was spoken in off-the-cuff fashion, and of course made no effort to bridge American divisions by instead choosing to drive deeper ones. The Democrats sucked lemons through the whole delivery while the GOP members of the house hooted and hollered. Nothing new was said by way of policy options which is consistent with SOTU speeches in general. These speeches merely lay out general goals.

US MACRO DATA ON TAP

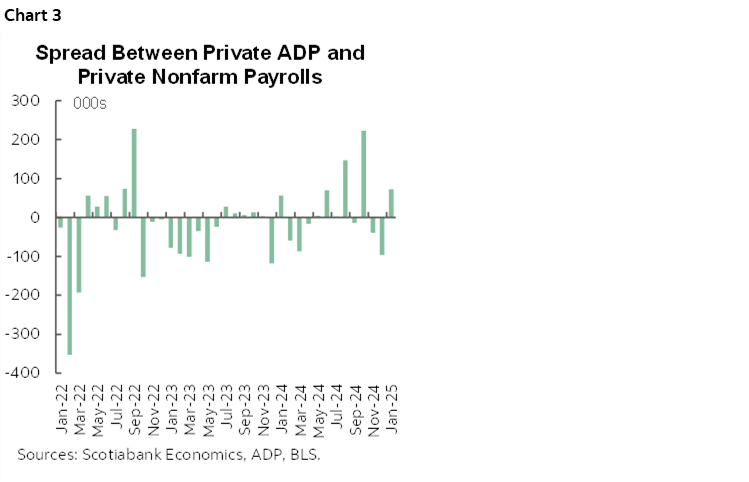

Last, there is significant US data on tap including ISM-services (10amET) and ADP private payrolls (8:15amET). Both are ‘noisy’ data series but fwiw ADP is expected to post a modest rise while ISM is expected by consensus to be little changed. ADP matters not one iota to nonfarm that is a different beast, but often triggers a market response. The employment component of ISM-services also typically offers very little useful information to payrolls.

Other more minor releases will include Canadian Q4 labour productivity figures (8:30amET) that—gasp—might actually rise in the wake of a strong Q4 GDP report, plus US factory orders (10amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.