Colombia: Exports posted first annual expansion in 12 months

Mexico: Banxico survey sees stronger growth, unchanged policy rate in 2021; February remittances set new records; outsourcing bill update

Peru: PEN strengthens sharply as radical presidential candidates lose ground

COLOMBIA: EXPORTS POSTED FIRST ANNUAL EXPANSION IN 12 MONTHS

According to DANE’s release on Tuesday, April 6, February’s monthly exports stood at USD 2.94 bn (up 0.04% y/y, chart 1), above January’s figure (USD 2.61 bn), but slightly below the best level registered since the pandemic began (Dec-2020’s USD 3.03 bn). Manufacturing exports expanded by 14.4% y/y, while the agricultural sector’s exports grew by 8.0% y/y; positive performance in those sectors was partially offset by the -12.9% y/y contraction in oil & mining-related exports.

Traditional exports as a whole were down by -8.6% y/y in February (chart 2), the smallest gap compared with the year before since the pandemic began and the best level since Dec-2019. Oil-related items represented 28% of February’s total exports, below the average of 40% in 2019. Lower production remained a challenge and helped drive the sector’s export volumes down by -36.5% y/y, which offset the effects from improving global oil prices. The value of coal exports contracted by -3.4% y/y owing to a reduction in international prices that counteracted gains in volumes exported (3.2% y/y). In contrast, the monthly value of coffee exports increased by a robust 24.46% y/y in February due to both higher prices and greater volumes (9.09% y/y). Overall, with lower oil production set against positive developments in coffee export volumes, the impact of improved international commodities prices was somewhat neutralized.

The value of non-traditional exports amounted to USD 1.40 bn in January, an increase of 11.9% y/y compared with a year ago (chart 2 again). Significantly expanded exports of gold (up 33% y/y), chemical products (a 23.8% y/y rise), and manufacturing products (a 7.2% y/y gain) drove the overall rise in non-traditional goods exports. The fact that these year-on-year growth rates were calculated on a pre-pandemic statistical base makes these expansions even more significant.

All in all, February’s strong export numbers could have shown even greater benefit from rising international commodity prices if not for softness in the production of oil and mining products. Still, the rebound in non-traditional exports indicated ongoing consolidation of growth in the manufacturing and agricultural sectors. We see room for further improvements in non-traditional exports as the world gets the pandemic under control and solidifies its recovery path. However, although exports should keep rising in 2021, imports could see even greater gains as domestic demand expands: we still expect a current account deficit of about -3.8% of GDP or wider in 2021, larger than the -3.3% deficit observed in 2020.

—Sergio Olarte & Jackeline Piraján

MEXICO: BANXICO SURVEY SEES STRONGER GROWTH, UNCHANGED POLICY RATE IN 2021; FEBRUARY REMITTANCES SET NEW RECORDS; OUTSOURCING BILL UPDATE

I. Banxico Economists’ Survey now sees stronger growth and unchanged policy rate in 2021

In Banxico’s Survey of Economists for March 2021, released on Monday, April 5, the consensus GDP outlook improved for a fifth consecutive month. Forecasts for real GDP growth averaged 4.53% y/y, up from the 3.89% y/y in the February survey. Scotiabank Economics continues to expect a 4.9% y/y gain in 2021 (see our March 10 global forecasts). The two main drivers for our outlook are: (1) stronger expected performance in the services sector in H2-2021 owing to the impact of vaccinations; (2) and the recently-approved US stimulus package that is expected to boost growth even further through remittances. The headline annual numbers on Mexico’s economic recovery over the next few months will principally reflect base effects and external factors, rather than local Mexican developments. Many domestic growth drivers, such as investment, have continued to lag, and with weak investment comes soft job creation which further dampens demand. Anaemic domestic demand is the main reason we see Mexico being among the last countries in Latam to recover to pre-COVID-19 levels of economic activity.

Other elements in the survey worth highlighting include:

- Headline inflation forecasts for end-2021 rose from 3.90% y/y to 4.14% y/y, surpassing the upper limit of the target band set by the Banco de México. However, expectations for core inflation remained nearly unchanged at 3.60% y/y versus 3.58% y/y previously, which implies that price increases are expected to be concentrated in the most volatile items;

- As for monetary policy, most analysts anticipate no changes in the overnight rate from Q2-2021 to Q3-2022. The median of responses moved from 3.75% to 4.00% for the end of 2021, while it remained unchanged for the end of 2022 at 4.00%. This change came in line with the recent rise in US yields and volatility in financial markets, which narrowed the space for rate cuts in emerging markets. Economists’ stable outlook for policy rates clearly sits in contrast with the 90 bps in hikes priced into the TIIE market over the next 12 months;

- Formal job creation expectations remain weak for both 2021 and 2022. However, we see a modest improvement in the projections for annual job creation, from 365k to 394k in 2021, which still only represents about half the annual average for the period between the ’09 and COVID-19 crises. Forecasts for formal job creation in 2022 rose from 364k to 385k;

- USDMXN forecasts moved up from 20.32 to 20.66 for the end of 2021, and from 20.70 to 21.06 for the end of 2022, following—but lagging—the rise in the implied exchange rate from the FX-swaps market. The moves reflected the rise in US interest rates, and the corresponding capital flight from EMs; and

- In terms of the survey’s consensus on the main risks to growth, analysts’ concerns were dominated by weak domestic economic conditions (43% of analysts), governance (42%); and public finances (7%).

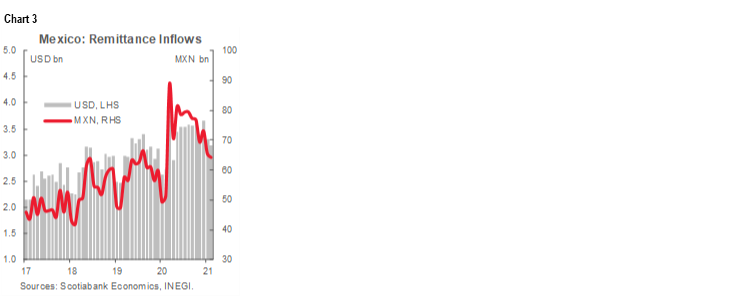

II. Remittances remained strong in February

According to data released by Banco de México on April 5, remittances in February reported record levels again, both for any second month of the year (USD 3,174 bn), and for any first two-month period (USD 6,471 bn), as shown in chart 3. The average remittance transfer for the month (USD 351) was the second highest monthly number since 2008 and the number of transfers (9.0 mn) also marked an all-time high for any February. Washington’s recently-approved fiscal stimulus package, as well as the infrastructure plan proposed by President Biden, will continue to boost the economic recovery and employment in the US, which should translate into a steady positive flow of remittances to Mexico this year. We expect the direct and indirect effects of remittance flows could boost growth in 2021 by up to 1 percentage point, which is reflected in our recently revised GDP forecast for the year of 4.9% y/y.

III. Agreement on outsourcing bill between government and private sector

Although details are still emerging, the Ministry of Labour announced on Monday, April 5, that unions, the government, and private-sector leaders had reached an agreement on pending labour legislation. The pact would lead to the prohibition of the use of outsourcing for so-called “core activities” and would regulate its use for non-core activities. In addition, the accord would adjust the application of the PTU (i.e., workers’ mandated share of profits, a rare mechanism under which employers in Mexico must distribute a slice of their gains to workers) by shutting down some means that companies have used to avoid paying it. The bill also proposes to “reduce distortions” that the PTU imposes on capital-intensive businesses. The government’s press release contends that these changes would increase the amounts paid to workers by 156%.

As details on the agreement emerge, the key issues to determine its economic impact are likely to include:

1. The extent to which it raises costs for private-sector businesses, which have been rising over the past two years, owing in part to accumulated minimum-wage increases of over 35% and other policy developments. The ongoing pension reforms are expected to increase burdens on employers by gradually raising contributions from 5.15% to 13.875% of gross wages. Potential changes to the regulatory framework for energy could also mean higher costs for businesses. This agreement seems to go in the same direction of increased burdens on businesses, but at this stage we cannot calculate by how much. For context, about one-fifth of formal workers function under some form of outsourcing; and

2. Definitions of key parts of the agreement that remain unclear. The definitions of core and non-core activities are likely to straddle grey zones for industries. Existing mechanisms and regulations not only shift from company to company within the same business sector, but sometimes even vary between business lines in the same firm: for instance, is a sales force “core” in a non-core business? Would this be true for all business lines? Such ambiguities could further put brakes on investment.

—Eduardo Suárez & Miguel Saldaña

PERU: PEN STRENGTHENS SHARPLY AS RADICAL PRESIDENTIAL CANDIDATES LOSE GROUND

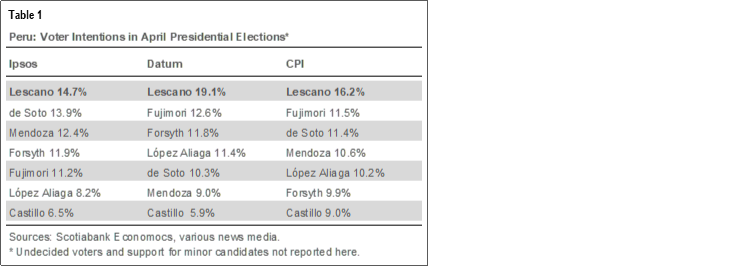

A number of polls were published over the weekend that showed some consolidation of support around centrist presidential candidates. Most polls had Yonhy Lescano in the lead, followed by Keiko Fujimori or Hernando de Soto; other polls have different leaders, but the three we follow are the best known, and are based on credible ballot-box simulations (table 1). Perhaps more importantly, Verónika Mendoza, the most left-leaning candidate, failed to gain ground in these surveys; similarly, other candidates who are viewed as populist, or otherwise unreliable, including López Aliaga, Acuña, and Urresti, have seen their support weaken.

The markets have reacted with tremendous relief to these new polls on the general view that moderate candidates have advanced and the campaigns of less market-friendly candidates have stalled. Of the five leading candidates, four are viewed as pro-market and pro-establishment: specifically, Lescano, De Soto, Fujimori, and Forsyth. The exception remains Verónika Mendoza; López Aliaga defies description.

Major macro pricing immediately reflected this shift in sentiment. The USDPEN rate, which had risen to an all-time high on Thursday, April 1, has since plunged as the sol has strengthened, going from 3.77 to 3.63 in three sessions (chart 4). We anticipated this type of correction, which is why we had not changed our year-end forecast of USDPEN 3.55 despite the magnitude of the PEN’s softening last week. That said, we had been expecting exchange rates to correct after the elections, not before. At the same time, the yield on the 10-year sovereign bond fell from 5.00% to 4.77%.

The market’s reaction is understandable given that the polls now imply a much weaker risk that anti-market or anti-establishment candidates could get into the second-round of voting. However, although the trends in voting intentions have moved to the center, the race remains open. It is still the case that less than 10, and as little as two, percentage points separate the six leading candidates, depending on the poll. Additionally, undecided voters significantly outnumber those expressing preferences for the leading candidates. Considering these two factors, it is quite possible that voter intentions could change meaningfully prior to Sunday’s vote.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.