- Colombia: Consumer confidence rebounds in July

- Mexico: Above target inflation to trigger rate rise; auto sector setbacks; investment and consumption

- Peru: Rates likely on hold; press reports on central banker; external strength

COLOMBIA: CONSUMER CONFIDENCE REBOUNDS IN JULY

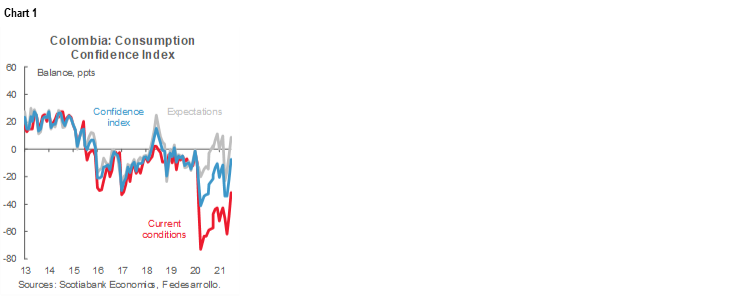

Data released by the Fedesarrollo statistical agency on Monday, August 9 show the Consumer Confidence Index (CCI) data for July at a balance of -7.5 ppts, improving from the -22.3 ppts in June. In July, continued progress was made towards the goal of reopening the economy, nationwide strikes ceased, and the vaccination rollout expanded to cover more age groups. Additionally, the third COVID-19 wave eased significantly. An improvement in the “current conditions sentiment” led the gains, while the expectations index is again in positive territory (chart 1).

Looking at July’s details:

The Current Conditions Index rose to -31.7 ppts from June’s -48.8 ppts, its highest level since February 2020. Although consumers’ perceptions of the current situation remained deep in negative territory, the rebound in July is encouraging since it suggests that people believe that the worst of the pandemic and social discontent is over. Consumers’ appetite to buy new durable goods remained low at -43.3 ppts, but it is the highest level since the pandemic began (chart 2).

- The Expectations Index improved by 13.2 ppts from June’s –4.6 ppts level (chart 1 again). This index is again in positive territory reflecting improved perceptions of households’ future economic wellbeing. The country assessment also improved and returned to a positive balance (+1.8 ppts) ahead of the 2022 elections. If positive sentiment consolidates, we would expect further positive effect on the economic recovery.

- Consumer confidence numbers improved in the five major cities surveyed at the regional level, with Bogota leading the gains. Cali was the city with the lowest gain, likely reflecting the fact that it was significantly affected by the nationwide strike.

- July readings varied across socioeconomic status: high-income households had the most positive index (+10.7 ppts), while the low-income population had the worst perceptions (-15.4 ppts). However, medium-income households posted the largest rebound in sentiment (-2.9 ppts in July versus -20 ppts in June) supported by an increased willingness to purchase homes (+3.9 ppts versus previous -19.4 ppts).

July’s consumer confidence numbers posted a positive surprise and reflect the consolidation of the reopening across the country. Consumer confidence will be tracked closely in the months leading to the 2022 elections and could have an impact on the outcome. For now, with nationwide strikes ended and major cities reopening, including for large events, we think consumer confidence will continue to rebound, which would be positive for expected GDP growth.

—Sergio Olarte & Jackeline Piraján

MEXICO: ABOVE TARGET INFLATION TO TRIGGER RATE RISE; AUTO SECTOR SETBACKS; INVESTMENT AND CONSUMPTION

I. Inflation outside Banxico’s 3% target range

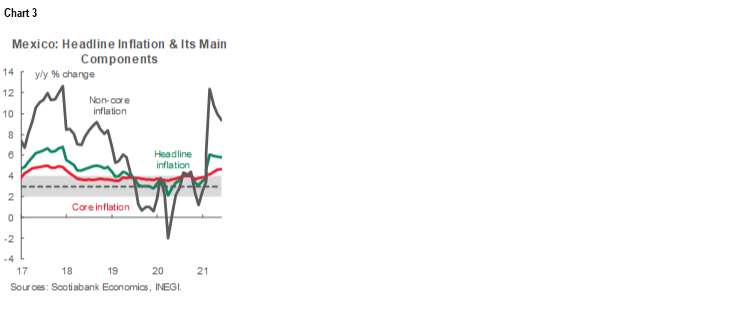

According to data released on August 9 by Mexico’s statistical agency (INEGI), consumer inflation in July of 0.59% m/m was slightly above the Citibanamex survey of economists consensus of 0.55% (chart 3). By components, core inflation rose 0.48% m/m, in line with expectations, while non-core inflation advanced 0.93% m/m in July. On an annual basis, the consumer price index stood at 5.81% y/y, slightly above the 5.77% y/y forecast by the latest surveys, but showing a modest deceleration from the 5.88% y/y registered in June.

With July’s figure, inflation has remained outside Banxico’s 3% target range for five consecutive months. By components, core inflation continued to increase to 4.66% y/y from 4.58%, while the non-core component decreased only slightly from 10% y/y to 9.39% y/y. Within the core category, merchandise prices decelerated slightly to 5.74% y/y from 5.81% y/y, but services inflation rose from 3.22% y/y to 3.46% y/y, in sync with the reopening of the economy and normalization of demand. In contrast, non-core inflation was higher owing to higher prices of agricultural products, probably still affected by the weather shocks that occurred in recent months.

Our view is that, with inflation and expectations both materially above Banxico’s target rate, the August 12 meeting is likely to see another 25 bps hike, which would leave the reference rate at 4.50%. We will be looking closely at the changes to Banxico’s communication strategy announced on August 5, under which it will update forecasts for both core and headline inflation over an eight quarter policy horizon.

II. Auto industry setback in July, as input shortages remained and contagions dampened consumer confidence

INEGI data released on August 6 show monthly declines in automotive industry production and foreign and domestic sales in the month of July. Light vehicle production continued to be disrupted by chip shortages and supply bottlenecks, declining -16.0% m/m following a 9.3% m/m increase in June. This is equivalent to 221,843 assembled units. On an annual basis, the number of vehicles assembled shrank by -26.5% y/y in July from the previous rise of 5.5% y/y. Likewise, the decline in exports deepened, falling -13.8% m/m in July (from -3.2% m/m in June) owing to lower production levels and inventory shortages. On an annual basis, exports dropped -23.6% y/y, with 202,021 exported units. Domestic sales fell -7.4% m/m on a monthly basis to 82,157 units, in line with the weakness in consumer confidence during the same month, as well as with the spread of the delta variant. In comparison, sales increased by 12.7% y/y over July 2020, but were -22.6% y/y below the same month of 2019.

Finally, for the year to date, production, exports, and domestic sales grew by 20.2%, 22.0%, and 18.3%, compared to January-July 2020 (chart 4). However, these indicators were -20.9%, -21.4%, and -19.3% below their levels in the same period of 2019, respectively.

Looking ahead, supply-side bottlenecks and input shortages could persist over the coming months, pushing production below its potential and reducing exports along with it. On the demand side, particularly domestic demand, the latest COVID-19 wave could further undermine consumer confidence, depressing durable goods sales, particularly of vehicles, over the coming months. This outcome would exacerbate the slow pace of recovery of domestic demand. Meanwhile, differences between the US and Mexico with respect to USMCA rules of origin and workers’ conditions in Mexican plants (also stipulated in the trade agreement) could be a source of disruption going forward. While this scenario seems unlikely at the moment, further disputes over these issues could result in vehicles trade reverting to WTO rules under which Mexico could lose advantages, especially light trucks exports.

III. Investment bounced back in May, but lagging the rest of the economy

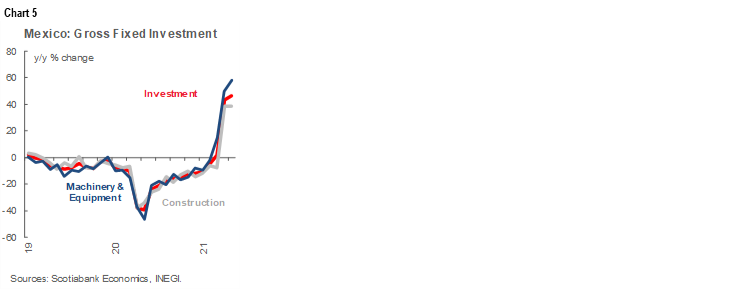

INEGI, also released investment and consumption indicators for May. Fixed investment bounced back 0.7% m/m in May, after contracting -0.9% m/m during April (chart 5). The recovery was driven by construction spending, which increased 2.1% m/m in May (-1.2% m/m in April), while machinery and equipment continued in negative territory and further declined -1.3% m/m (-0.9% m/m in April).

Base effects continue to weigh on year-over-year investment growth rates, which showed a 46.5% y/y growth in May, up from 43.0% y/y in April. Thus, in the first five months of 2021, INEGI reported a year-to-date surge of 10.0% in real investment compared to the same period a year earlier, the highest pace for an equivalent period since 2008.

However, investment has lagged behind the rest of the economy, despite favorable conditions as the recovery widens. This could be explained by the prevailing domestic uncertainty, resulting in an excess of installed capacity, probably for the rest of 2021.

IV. Private consumption advances at a moderate pace in May

Private consumption rose modestly in May 0.9% m/m after increasing 1.2% m/m in the previous month. By components, consumption in goods and services of national origin remained unchanged with respect to the previous month. The increase in goods moderated from 2.2% in April to 1.6% in May, but services dropped from 1.8% to 1.0%. The imported goods component edged up at 6.9% m/m from -3.0% m/m in April.

In its annual comparison, consumption benefited from comparison base effects, advancing 28.8% y/y from April’s 25.5% y/y (chart 6). On a cumulative annual basis, real consumption increased 5.8% real y/y, the highest figure for a similar period since 2000.

We maintain our view that conditions will be favourable for the rest of the year, as the vaccine rollout continues and the economy reopens at a faster pace. Uncertainty remains, however, and the possibility of another wave of COVID-19 poses the main downside risk for consumption.

—Miguel Saldaña & Paulina Villanueva

PERU: RATES LIKELY ON HOLD; PRESS REPORTS ON CENTRAL BANKER; EXTERNAL STRENGTH

I. The BCRP is likely to keep its reference rate stable on Thursday, despite rising inflation

We expect the central bank (BCRP) to maintain its reference rate at 0.25% in its meeting Thursday, August 12. In this we are aligned with the market. Julio Velarde the BCRP President of the Board seemed to suggest as much over the weekend when he said that the recent increase in inflation was temporary. If this is what the BCRP truly believes, then there would be no urgency to raise rates. One does wonder, though, if the BCRP is more nervous than they are admitting. Annual inflation in July came in at 3.8%. Moreover, inflation expectations jumped to 3.03%, which means that the real reference rate is -2.78%, a historically low figure. There is, however, the risk, which may weigh on the BCRP decision, that in the current environment of heightened sensibilities in Peru, raising the rate may end up sending the self-defeating message that the BCRP believes the domestic situation is worse than it actually is.

II. Press reports on central banker

Most of the media is reporting that Julio Velarde may have accepted to remain as President of the Board of Directors at the BCRP. However, no official announcement has been made, and it is not clear how this information was made available. Most media simply state that the information comes from “our sources”. Some news reports also state that Velarde is waiting to meet with the government to determine the other three members that the Executive must appoint to the Board. One interpretation would be that Velarde and government officials may have agreed to agree on the three additional board directors, but who they will actually be has not been determined yet. We would take this information with care until an official announcement is made.

III. External accounts soar

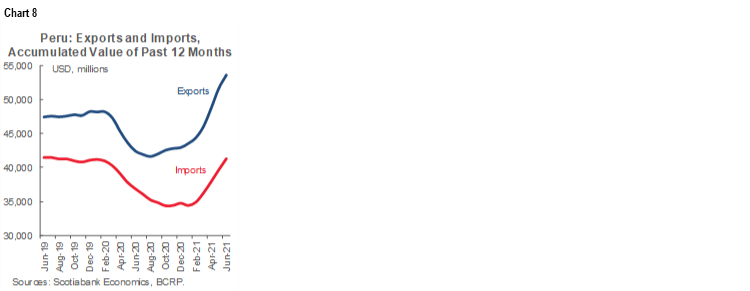

Peru’s trade balance has soared this year, reaching USD 12.3 bn for the 12 months ending in June 2021 (chart 7). This was the third consecutive record month in history. In comparison, the trade balance had been trending at half that level, about USD 6 bn, throughout 2019 and much of 2020. With the trade surplus at USD 5.2 bn in the first six months of 2021, the current trend is mildly below our forecast of a USD 15 bn trade surplus for the full year 2021, mainly because of the sharp rise in the prices of soft commodities and energy products that the country imports.

Exports have risen 62% y/y, during the first half of 2021 (chart 8). The figure is distorted, however, by its comparison with the lockdown period in 2020. A better, but also strong comparison, is the 21% increase over exports in H1 2019. Imports were up 41% compared to H1 2020, and 11.8% versus the same period in 2019. Note that if the increase in energy and soft commodities is excluded, imports growth versus 2019 would have been marginal at best.

Unsurprisingly, the main driver of the strong external results were high metal prices. Resource exports, mainly mining, increased 72% y/y (nearly 26% versus 2019) in H1 2020. However, non-resource exports also contributed, rising 40% y/y and 11% versus 2019.

The main message is that the country’s external accounts are as strong as they’ve ever been. Although high prices are the main reason behind the historical surplus levels, non-resource exports—mainly volume—are also contributing. The strong external accounts are in stark contrast with the weak PEN in the FX market, which underscores to what extent the FX market is dominated by domestic political events.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.