- Colombia: BanRep’s economic survey expects anchored inflation in the long run and higher repo rate down the road

- Peru: Overall economic rebound evidenced in June’s strong GDP, better-than-expected employment and sharp improvement in fiscal accounts

COLOMBIA: BANREP’S ECONOMIC SURVEY EXPECTS ANCHORED INFLATION IN THE LONG RUN AND HIGHER REPO RATE DOWN THE ROAD

On Friday August 13, Colombia’s central bank, BanRep, released its monthly economic expectations survey. A top takeaway is that, while expectations remain anchored over the long run, inflation will now close 2021 above the 4% y/y target, noting that only two months ago, the target sat at 3% y/y. Analysts’ consensus, meanwhile, is that the initial rate hike will happen in September 2021—a view that we share—to close the year at 2.5%, again consistent with our forecast. The terminal rate for 2022 is now also expected to be higher than in the previous survey, to reach 3.75%. The USDCOP is also expected to appreciate by the end of the year.

- Near-term inflation. August’s monthly inflation is expected to come in at 0.19% m/m, putting annual inflation to July at 4.17% y/y (from the 3.97% in July). However, survey dispersion remained high with a minimum expectation of -0.16% m/m and a maximum of +0.38% m/m, signaling still high uncertainty amid recent developments and their impact on prices. On the other side, Scotiabank Economics expects August’s monthly inflation at +0.21% m/m and 4.19% y/y, given that food inflation is not falling as expected due to long-lasting effects in the supply chains of critical products due to the recent protests and bottle necks in import goods logistics; additionally, utility fees are expected to rise.

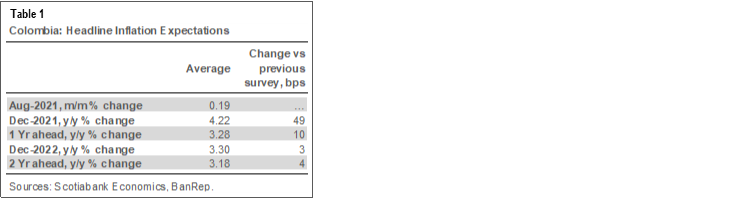

- Medium-term inflation. Inflation expectations rose to 4.22% y/y by December 2021, 49 bps higher than in last month’s survey (table 1), which shows that recent inflation surprises are expected to last a bit longer than before. Expectations over the medium term continue to hover around 3% y/y: 1Y forward inflation stood at 3.28% y/y (above last month’s reading at 3.18% y/y); and 2Y forward stood at 3.18% y/y, underscoring that expectations remained anchored over the monetary policy horizon (chart 1) despite the recent increase. Scotiabank Economics expects CPI inflation to close 2021 at 3.9% y/y and end-2022 at around 3% y/y, with an upside bias, noting that current inflation pressures are higher than the market’s expectation, although transitory.

- Policy rate. Consensus also increased it expectations on the hiking cycle, as analysts think that first hike will happen in September’s meeting and the policy rate will end 2021 at 2.5% in 2021 (chart 2) and at 3.75% in 2022.

- FX. USDCOP forecasts for end-2021 stood at 3,744 (89 pesos above from the previous survey). For December 2022, respondents think, on average, that the peso will end the year at USDCOP 3,669 (+100 pesos above the previous survey). We believe that USDCOP would appreciate by the end of the year to 3,525.

—Sergio Olarte & Jackeline Piraján

PERU: OVERALL ECONOMIC REBOUND EVIDENCED IN JUNE’S STRONG GDP, BETTER-THAN-EXPECTED EMPLOYMENT AND SHARP IMPROVEMENT IN FISCAL ACCOUNTS

I. Solid economic recovery evidenced in June’s GDP growth as most sectors surpass pre-pandemic levels

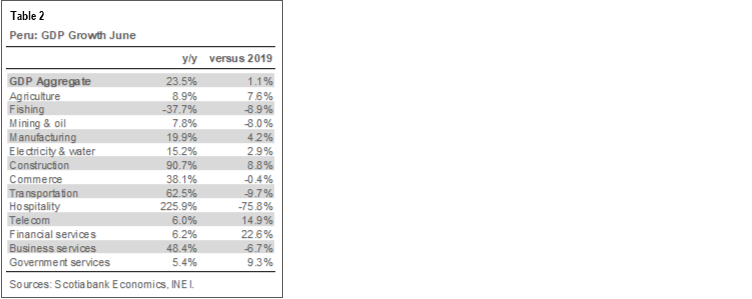

GDP growth was 23.5% y/y in June, according to Peru’s statistical agency, INEI. This brought GDP growth for the first half of 2021 to 20.9% y/y. The strong growth benefitted from significant base effects compared to June 2020, a month when lockdowns had only partially lifted. Unlike in previous data releases, the INEI did not provide data on growth compared to the same period in 2019, however, we estimate that June’s GDP this year was about 1.1% higher versus June 2019 (pre-COVID-19).

All economic sectors were up, except fishing (-37.8% y/y) which was unaffected by COVID-19 in 2020 and reflects seasonal issues. Construction, up 90.7% y/y and an estimated 8.8% versus June 2019, continues to be the strongest growth sector of the economy, outside of key service industries which never ceased to operate (telecom, financial services, government services). Hospitality, a sector that was still on lockdown in June 2020, rose the most in y/y terms, nearly 226%. Compared to 2019 (pre-COVID-19), however, hospitality continued to be severely lagging (-75.8% is our estimate). Other double-digit growth rate figures belonged to sectors still very much locked down in 2020, whereas single-digit growth rates belonged to sectors that had remained opened (table 2). All in all, June was a robust month, with most sectors surpassing 2019 levels.

Beginning in July, monthly GDP growth figures should diminish significantly, as the base effects of the 2020 lockdowns begin to fade given the more robust reopening that took place after June. Thus, GDP growth in the second half of 2021 should be in the lower to middle single digits. However, the GDP growth trend of 20.9% (INEI figure) for the first half of 2021 has been so strong, that we see upside to our forecast of 9.9% GDP growth for full-year 2021 despite the slowdown going forward.

II. Employment improved in July, undaunted by domestic uncertainty, but still below pre-pandemic

The INEI also published information on employment in Lima for the three-month period ending in July. Jobs rose mildly, from 4.6 million to 4.7 million since June (chart 3). Employment in Lima is now 7.4% below pre-COVID-19 levels from January 2020. As a result, the unemployment rate has fallen to 9.4%, much better than our expectation of 10.3%. Unemployment still has a way to go before it returns to pre-COVID-19 levels that were closer to 7%. The job market results are reassuring. July was a month of significant uncertainty over the election results and profile of the new government, and yet there is no sign, so far, that this impacted the job market during the month.

III. To round out the good results for the economy: fiscal accounts improved sharply in July

Fiscal accounts continued to improve in July. According to figures by the central bank (BCRP), the fiscal deficit fell to 6.0% of GDP, the sixth consecutive monthly improvement, after peaking at 8.9% of GDP in January-February (chart 4). July was especially positive for the economy, as the lower deficit is more the result of a strongly increasing tax revenue, rather than of slower spending. Tax revenue rose 41% y/y in the January–July period, whereas fiscal spending was up a still hefty, but lower, 23%. Since the 2020 comparison base is again distorted by last year’s lockdown, it is particularly interesting that both fiscal revenue and spending were also sharply up versus 2019, pre-COVID-19. Higher metal prices were, no doubt, behind the 35.7% y/y increase in income tax (17.5% versus 2019), but the 38.3% increase in domestic sales tax (8.8% versus 2019) is due to domestic factors, both the recovery in domestic demand, and the greater formalization of sales brought about by increased digitalization.

The fiscal balance is well on the way to falling through the 5.4% official forecast, in line with expectations expressed by Finance Minister Pedro Francke, and is increasingly aligned with our forecast of 4.5% deficit at year end 2021. Recently, Minister Francke stated that the Ministry of Finance is drawing up a 2022 budget which targets lowering the fiscal deficit to 3.7% of GDP.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.