- Chile: Activity continues strong, driven by investment and consumption

- Colombia: October employment down overall, but urban job market improves

CHILE: ACTIVITY CONTINUES STRONG, DRIVEN BY INVESTMENT AND CONSUMPTION

Economic activity grew 15% y/y in October. We anticipate a slight upward revision to 12% in the central bank’s 2021 GDP growth forecast.

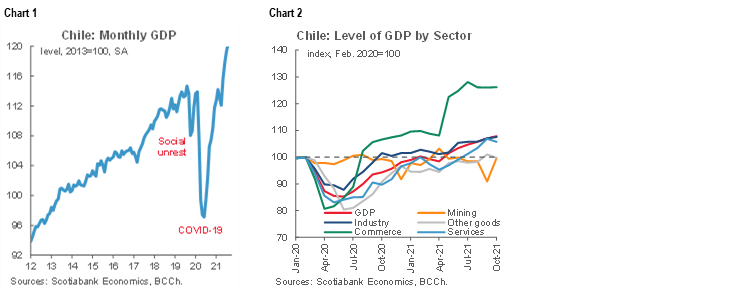

On Wednesday, December 1, the central bank (BCCh) released the October economic activity index (IMACEC), which increased at a robust pace of 15% y/y (+0.8% m/m) despite high levels of political uncertainty. October's IMACEC showed y/y growth in all sectors and a new high in the level of total GDP (chart 1). However, on a seasonally adjusted basis, the index shows a slowdown in services (-1.0% m/m) after a strong expansion in September (chart 2). Construction sector remains flat, though at a level of activity similar to pre-COVID-19. Mining activity recovered from the slowdown registered in previous months, while commerce shows no signs of slowing down. Overall, the IMACEC posted a healthy-looking record and is not currently signalling an imminent slowdown alert.

On December 15, the BCCh will present its Monetary Policy Report, which is likely feature a slight upward revision in 2021 GDP growth, approaching 12% (September’s Report: between 10.5% and 11.5%). With respect to the implications for monetary policy, annual inflation ending this year at 7% y/y; good job creation; high inflationary expectations; and multilateral depreciation of the CLP, would support an accelerated normalization process that would leave the Monetary Policy Rate (MPR) at around 5% by the end of Q1-2022. For the short term, we expect a rise in the MPR of “not less” than 100 basis points (bps) at the December 14 meeting.

We do not rule out a slight upward correction in the BCCh’s 2022 GDP growth projection towards the 2.0%–3.0% range (from 1.5%–2.5%) in the next Monetary Policy Report. In our view, this could be explained by the maintenance of high liquidity, which has not drained significantly despite the high propensity for consumer spending; an improvement in the terms of trade; a significant increase in the wage bill (employment and wages); and a good statistical entry point towards 2022 given the good records of the second half of 2021.

The BCCh had considered a technical recession beginning in the Q4-2021 in its September baseline scenario. While that scenario cannot be ruled out, for now, all activities continue to grow m/m. According to our analysis, the drop in services during October (-1% m/m) was explained by a strong expansion of 3.3% m/m in September, given the start of the reopening process. Activity has shown a more homogeneous recovery by sector and the impact of political uncertainty has been less (for now).

Lastly, we believe that GDP would continue to show a favourable momentum in the first half of 2022 with either Gabriel Boric or José Antonio Kast as President. Some changes and reallocations are expected with respect to the budget, which would likely occur in April and limit the expected drop in public spending (-22.5% according to the Fiscal Budget). The contemplated recapitalization of sovereign funds (USD 2 bn according to the Budget) and the use of the USD 800 million in freely available funds by the new administration could limit the drop in the fiscal stimulus next year. Meanwhile, if a fourth withdrawal of pension funds is approved, the upward correction in GDP would be immediate, partially offset by the negative financial effects it would generate.

—Jorge Selaive, Anibal Alarcón, & Waldo Riveras

COLOMBIA: OCTOBER EMPLOYMENT DOWN OVERALL, BUT URBAN JOB MARKET IMPROVES

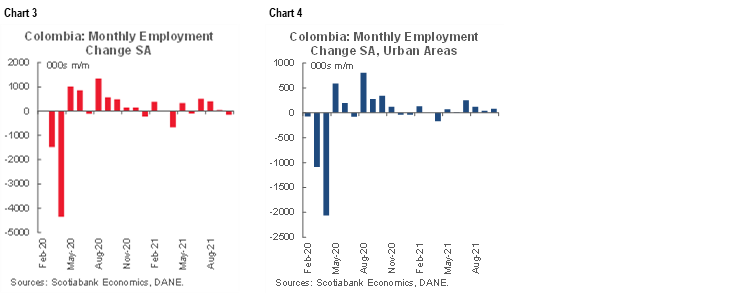

Employment data for October 2021, released on Tuesday, November 30, show the economy lost ~154 thousand jobs (chart 3), with losses concentrated in rural areas where the jobs recovery lost momentum. In contrast, the recovery in urban employment accelerated and 84 thousand jobs were created (chart 4). Formal jobs account for ~90% of the employment growth in October. Services-related sectors led the gains, contributing to a narrowing of informality and gender gaps. Employment levels remain 3.7% below the pre-pandemic level on a national basis, with the gap now lower in urban areas at 2.8% below the pre-pandemic level. Inactivity also remains above pre-pandemic levels and according to DANE’s report is especially affecting the older population.

Colombia’s nationwide unemployment came in at 11.8% and urban unemployment (main 13 cities) at 12.3%. In seasonally adjusted terms, the nationwide unemployment rate was 12.8% (increasing marginally from 12.7% in September) and for the urban area 13.7% (falling from 14.1% in September). These rates are, or remain close to, the lowest figure since the pandemic began (chart 5). In October, total active jobs were down by 685 thousand versus pre-pandemic in 2019, pointing to a marginal deterioration compared to September (500 thousand vs. pre-pandemic). That said Colombia has recovered 85% of the jobs lost during the pandemic.

In October, Colombia operated under broad normality, which led to strong job creation in services-related sectors. In fact, on a sectoral basis, compared with one year ago, more than 50% of jobs gains were in restaurants and hotels (+113 thousand), professional activities (+212 thousand) and manufacturing (+137 thousand). Compared with pre-pandemic levels, sectors that lag behind include harvest-related activities (-229 thousand), commerce (-188 thousand), and restaurants (-136 thousand).

It is noteworthy that, on a yearly basis, the biggest employment gains are concentrated in urban areas, especially in services dominated by women. As a result, despite the female unemployment rate of 15.9% compared to the male rate was 8.7%, gender gaps improved as the differential between female and male unemployment rates narrowed. In fact, in October, two women were employed for every man who found a job, showing that female employment has gained ground in commerce, professional services, accommodation, restaurants, and domestic services. The incidence of inactivity in young women has been reduced.

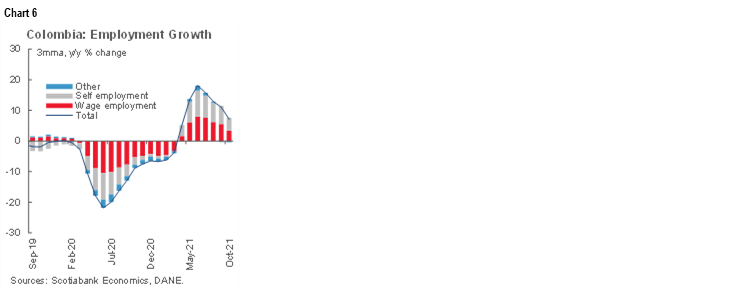

Other labour market indicators improved in October, with around 90% of job creation in the formal sector, especially in urban areas. However, compared with pre-pandemic labour market conditions, Colombia still has a higher rate of informal jobs (chart 6). In September, informal jobs accounted for 46.8% of total employment in urban areas (13 major cities) and 47.9% in the 23 main cities. These figures represent an improvement from the previous month figure, but still show a sizeable gap to close. Meanwhile, inactivity remains high. The inactive population is now concentrated in people above 55 years in age, especially women; DANE has indicated that this population is likely made up of discouraged people who previously worked in the informal sector but who have discontinued their job search. We think inactivity warrants close monitoring, since it remains 10% above pre-pandemic levels.

Summing up, October’s employment data posted mixed results. A positive result for services-related, and formal sectors in urban areas, while for the rural data, jobs in agriculture continued to decline. The data also showed that inactivity is reducing for the young population, while people above 50 years of age are leaving the job market. We expect the labor market to continue gradually improving, especially in major cities, however, the quality of the jobs remains a concern. It would be relevant to monitor if the pandemic continues under control to ensure normality continuity.

—Sergio Olarte & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.