Chile: Economy fell -0.4% y/y in December, closing 2020 with a -6% y/y drop for the year

Colombia: Expect key fiscal announcements in February; BanRep minutes showed the Board is waiting for more information

Peru: Inflation jumps beyond expectations

CHILE: ECONOMY FELL -0.4% Y/Y IN DECEMBER, CLOSING 2020 WITH A -6% Y/Y DROP FOR THE YEAR

December economic activity levels delivered positive surprises despite greater mobility restrictions. The month’s recovery in services particularly stood out in data released on Monday, February 1.

December’s monthly GDP contracted -0.4% y/y, positively surprising market expectations (Bloomberg: -2.3% y/y; BCCh’s Economist Survey: -1.0% y/y) and also beating our estimate (-4.1 % y/y) based on the month’s weak sectoral figures. December showed a re-acceleration in the monthly dynamism of GDP, which should allow output gaps to narrow somewhat faster than we saw in the later months of 2020. Although the economy has a long way to go to close these gaps completely, real economic activity is now well above the lows of 2019’s social unrest and is homing in on pre-pandemic levels (chart 1).

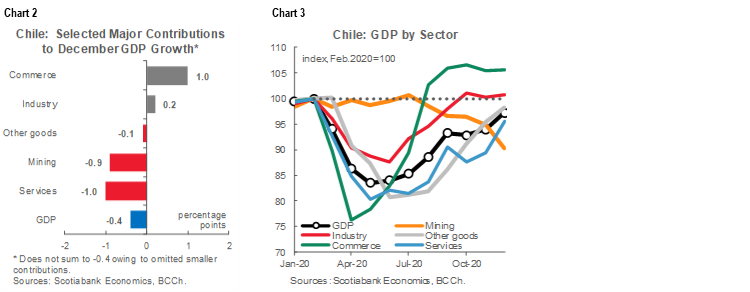

In year-over-year terms, December’s beat was explained by the good performance of the commerce sector, which expanded 10.8% y/y after the second withdrawal of pension assets came into force just before Christmas. Commerce made by far the largest contribution to annual growth in December (chart 2). The industrial sector also showed positive figures, growing 2.0% y/y in December, despite greater mobility restrictions. Industry’s gains reflected better operating protocols and greater adaptability to the new requirements. Commerce and industry are now both recording levels of activity above their pre-pandemic watermarks (chart 3). Although services made a negative contribution to December’s year-on-year real GDP growth, their drag was substantially smaller than in past months, which contributed to progress in the overall recovery of the non-mining sector.

In seasonally-adjusted terms, total activity expanded 3.5% m/m: the 4.4% m/m gain in non-mining sectors (chart 4) compensated for the poor performance of mining at the end of the year. This re-acceleration in the economy’s monthly dynamism occurred even as mobility restrictions returned in various regions of the country. This gives us some confidence that the economy will still achieve the 6% y/y rate of grow we have forecast for 2021 (see the January 25 Latam Weekly).

Services provided the main positive surprise in terms of sequential monthly growth, with an expansion of 7.0% m/m sa from November to December. It appears that the sector is adapting flexibly to the new round of public-health protocols Given that services is in part linked to investment, this upturn could point to a further recovery in investment. Sequential monthly growth in industry and commerce was relatively stable by comparison, while mining’s poor performance was compensated for by the persistent recovery in construction, which we think helped to fuel demand for goods.

Mining activity contracted by -9.2% y/y in December. This drop was explained by a fall in metallic mining, fueled by less extraction and processing of copper. Lower mineral grades at the sector’s main companies drove these reduced numbers. This should be a transitory phenomenon linked to temporary stoppages in some relevant tasks. Calendar idiosyncrasies didn’t play a role in December’s poor year-on-year mining numbers since December 2020 and December 2019 had the same number of business days.

With December’s GDP proxy data, our preliminary sense is that 2020 GDP fell by -6.0% y/y, a touch better than our previous estimate of -6.2% y/y. For now, we maintain our 6.0% y/y projection for real GDP growth in 2021. We believe that our forecast will soon become the consensus projection for 2021, up from the current 5% y/y rate. In any case, it remains to be seen how much of this rebound is attributable to transitory factors, such as the withdrawal of pension assets, and whether the rebound in the services and other goods (i.e., construction) sectors manages to be maintained over the next few month through stronger investment.

—Carlos Muñoz & Waldo Riveras

COLOMBIA: EXPECT KEY FISCAL ANNOUNCEMENTS IN FEBRUARY; BANREP MINUTES SHOWED THE BOARD IS WAITING FOR MORE INFORMATION

I. Expect key fiscal announcements in February

Local news agencies anticipated that the Ministry of Finance would release its 2021 Financing Plan 2021 on Monday, February 1, but the MoF hasn’t yet scheduled its publication. The document, which lays out the government’s planned financing sources for the year—including COLTES auctions, external debt issuance, etc.—will remain a point of interest while fiscal plans stay in the spotlight through February. The Fiscal Rule Committee, news about eventual fiscal reform, and the Financing Plan will all keep fiscal issues in the headlines this month.

In the meantime, some key assumptions regarding the government budget for 2021 are starting to look more feasible. Specifically, assets sales, especially in the electricity sector, are becoming more likely as a complement to usual sources of fiscal revenue.

In fact, last week Ecopetrol submitted a non-binding offer to acquire the Colombian government's 51.4% equity stake in Interconexion Electrica (ISA). The transaction could generate a USD 3.8–4.0 bn inflow to the government’s books, which would allow the authorities to increase their immediate liquidity while at the same time indirectly retaining ownership in ISA.

Assets sales would also ease the immediate pressure for structural fiscal reform. President Duque recently anticipated that the government would introduce a financial law instead of a comprehensive fiscal reform package. We expect the law’s main proposal to be a broadening in the range of items subject to VAT.

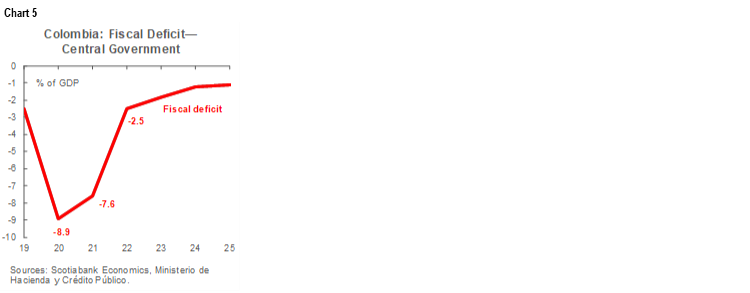

February and the months following are ripe to be filled with fiscal news, though we do not have a set calendar for announcements. News is likely to be oriented around ensuring the government will be in a position again to comply with its fiscal rule in 2022. The current rule points to a reduction in the deficit from 7.6% of GDP in 2021 to 2.5% in 2022 (chart 5).

II. BanRep minutes showed the Board is waiting for more information

On Monday, February 1, the central bank released the minutes from its Board’s most recent monetary-policy meeting on January 29 where Directors decided to maintain the benchmark rate at 1.75% in a split 5–2 vote. From the minutes, we highlight that:

- The majority, which voted for the hold, emphasized that it wasn’t necessary to cut the monetary-policy rate further since inflation expectations remained anchored relatively close to the BanRep’s 3% y/y target and the economy’s recovery is expected to continue. Additionally, Directors indicated that it was prudent to wait for further information and avoid sending uncertain signals to financial markets through frequent policy changes; and

- The minority group, which voted for a -25 bps rate cut, argued that the current rate of inflation is low and could decrease further within the policy horizon, which would lead to less expansive real rates. Additionally they emphasized that uncertainty around the recovery in economic activity remains high as the second COVID-19 outbreak led to new lockdowns in January.

All in all, we think BanRep’s Board is sending a careful message that, for now, the monetary-policy rate’s 1.75% setting is sufficient to support the economic recovery, but if the situation deteriorates the Board would be prepared to act. We think the coming months will be crucial to the future of monetary policy in Colombia since, since after Q1-2021, inflation should begin to converge to the 3% y/y target. Additionally, the economic recovery should resume its advance once Colombia’s main cities begin lifting their recent restrictions. All of this warrants rate stability in the coming months and eventually discussions on rate hikes by the latter half of 2021.

—Sergio Olarte & Jackeline Piraján

PERU: INFLATION JUMPS BEYOND EXPECTATIONS

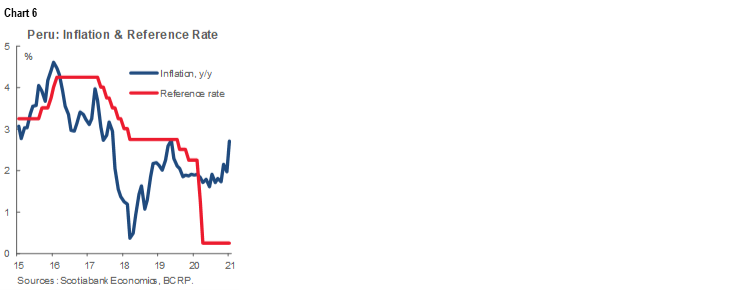

In January price data published on Monday, February 1, inflation jumped 0.7% m/m, which took the yearly rate to a rather uncomfortable 2.7% y/y (chart 6). This is still within the BCRP’s target range (i.e., 1% y/y to 3% y/y), but the recent trend is worrisome. We had been expecting a moderately high inflation rate in January, but more along the lines of 0.4% m/m. As a result, the figure was not surprising in its direction, but was a bit surprising in its magnitude.

Since nearly half of January’s monthly inflation corresponds to two items—poultry and domestic gas—it’s tempting to argue that the bump in prices is temporary. This may be the case for domestic gas, but poultry prices may be reacting to the sharp rise in imported maize feed prices. Moreover, the uptrend has been exceeding expectations a bit too persistently for only temporary factors to be responsible.

One aspect that may need to be considered more closely is the how the weakening of the PEN over the last year may be feeding into domestic prices. Furthermore, capacity restrictions, as well as increased costs for logistics and health protocols, may also be having a bit of an impact on inflation, although the detailed data do not show much evidence of this.

Indeed, there are two issues that give us pause before rushing to revise upward our inflation forecasts (n.b., our full-year 2021 forecast is 2.0% y/y, see the January 25 Latam Weekly). The first is that core inflation is only 1.7% y/y. The second is that the new quarantine may have a softening impact on demand and inflation in February, as occurred during the 2020 quarantine.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.