Central banks & macro data: Peru’s BCRP and Brazil’s BCB expected to hold

Colombia: Update on recent macro events

Mexico: Key insights for the 2021 economic outlook; December headline inflation closed 2020 near Banxico’s target; minutes of the last 2020 Banxico rate decision

Peru: What the holidays brought us

CENTRAL BANKS & MACRO DATA: PERU’S BCRP AND BRAZIL’S BCB EXPECTED TO HOLD

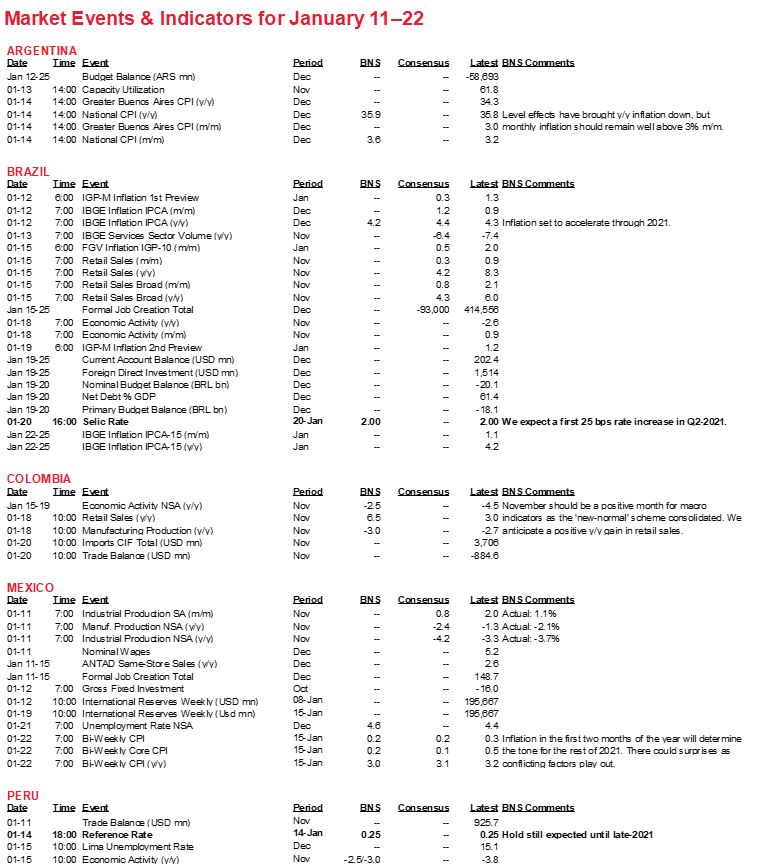

Key policy rates are expected to be held unchanged in Peru on Thursday, January 14, and in Brazil on Wednesday, January 20.

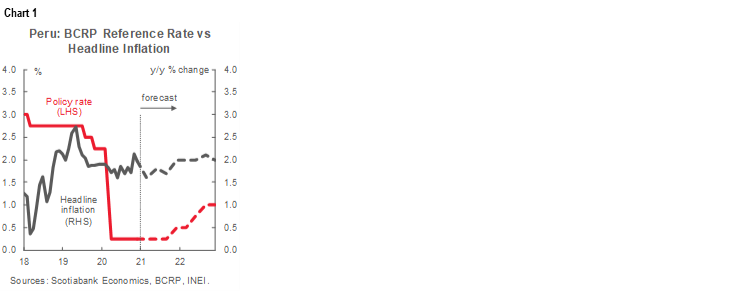

- Peru. The BCRP’s first rate decision of 2021 is scheduled for Thursday, January 14, where we expect the Board to hold the central bank’s reference rate at 0.25% for another month (chart 1). In the Board’s last rate decision on Thursday, December 10, it held the rate at 0.25% and maintained its strongly expansionary stance, in line with market expectations. In its statement, the BCRP kept its forward guidance unchanged from earlier meetings, noting that “The Board would consider it appropriate to maintain a strongly expansionist monetary posture for a prolonged period and so long as the pandemic’s negative effects on inflation and its determinants persist.” The Board also reiterated that “The central bank would remain ready to expand its monetary stimulus through various instruments”, implying that it would not be inclined to cut rates if the economy were to require further support. Our team in Lima expects that the BCRP will view the recent increase in inflation as transitory.

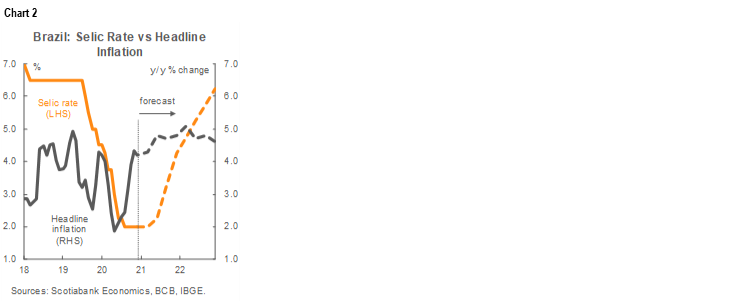

- Brazil. The BCB’s Copom is scheduled to consider afresh its setting of the Selic on Wednesday, January 20, and our Brazil economist expects the committee’s members to keep the rate on hold again at 2.00%. At its last rate meeting on Wednesday, December 9, the Copom held the headline Selic rate at its record low of 2.00% for a fourth straight meeting, as had been universally expected. In its statement, the Copom observed that inflation expectations have risen, but remain below target over the monetary-policy horizon; in the meantime, fiscal settings have remained stable. The Copom did, however, tweak its forward guidance with a more hawkish bent, noting that: “… over the coming months, the 2021 calendar-year should become less relevant than the 2022 calendar-year, for which projections and expected inflation are around the target. A scenario of inflation expectations converging to the target suggests that the conditions for maintaining the forward guidance may soon no longer apply, which does not mechanically imply interest rate increases, since economic conditions still prescribe an extraordinarily strong monetary stimulus”. This new language points toward less constrained, data-dependent moves over the next few meetings, with a first hike still expected by Scotiabank Economics in Q2-2021 (chart 2). As we noted in our December 18 Latam Daily, both the minutes from this meeting and the December Inflation Report were broadly consistent with the hiking cycle we have laid out and that the market has priced.

Key data releases, indicators, and events scheduled for the period January 11 to 22 are summarized with our related forecasts in the risk calendar at the end of this report. The first 2021 Scotiabank Economics Latam Weekly is set for publication on Saturday, January 23.

—Brett House

COLOMBIA: UPDATE ON RECENT MACRO EVENTS

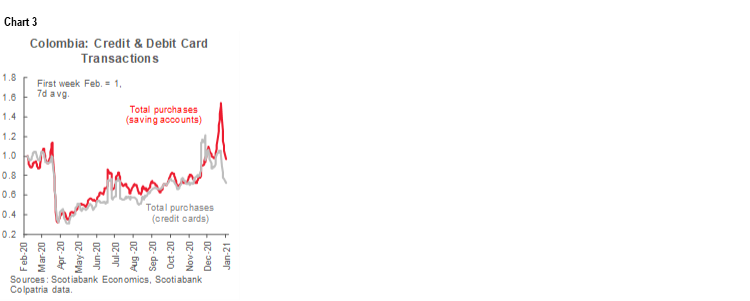

In the last month of 2020, Colombia consolidated the re-opening process, although with mild tweaks close to the country’s Christmas and New Year celebrations, such as ID restrictions to go shopping (i.e., pico y cédula), curfews on the nights of December 24 and 31, and, among other moderate controls, the enforcement of the “Dry Law”. In the event, credit and debit card purchase volumes increased significantly, pointing to an improving demand dynamic by the end of 2020 (chart 3). However, as December usually implies high degrees of social contact, the spread of COVID-19 accelerated and closed the year with fresh records for new daily positive cases.

Moving into the first week of January, Colombia’s main cities registered significant ICU occupation rates, which motivated the strongest restrictions yet ahead of the long holiday “Puente de Reyes”, whose celebrations began on Friday, January 8. In Bogota, one-third of the city started a strict quarantine for four days from Friday January 8 to Tuesday January 12 at 5am; a “red alert in the health system” was then declared as the occupation rate of ICUs surpassed 85% and the whole capital was put into a complete lockdown. Additionally, important regions such as Antioquia were put into three days of full quarantine. The long-weekend restrictions are likely to slow the economic recovery, and although we don’t anticipate that these severe conditions will be prolonged, they are likely to dent business and consumer confidence. However, for now, we maintain our 5% y/y GDP growth projection for 2021 (see the December 13 Latam Weekly) and our expectation of another hold at the BanRep’s Friday, January 29, monetary-policy meeting.

On the macro data front, November employment numbers showed that the jobs recovery almost stopped in the middle of Q4-2020 despite the consolidation of the re-opening. But in the details, we saw that working hours increased, which implies that business opted to intensify the burdens of existing employees rather than hiring more workers. Looking ahead into 2021, Colombia’s labour market is set to remain challenged by the fact that post-pandemic job creation has been concentrated in informal activities.

Additionally, December inflation surprised to the upside in data published late on Tuesday, January 5, by DANE. In the last month of the year, inflation stood at 0.38% m/m, interrupting two months in a row of negative sequential inflation readings. December inflation was well above consensus expectations (i.e., 0.17% m/m in the Bloomberg survey and 0.19% m/m in the BanRep survey) and our projection of 0.19% m/m. The overshoot on expectations was driven by reversal effects on clothing prices following the most recent VAT holiday, the withdrawal of subsidies from some utility fees, and better demand for some services such as hotels and restaurants. On the other hand, education school fees were revised downward in an extraordinary measurement that partially offset other gains. Headline inflation by the end of 2020 stood at 1.61% y/y, while core inflation was broadly unchanged at 1.03% y/y, up only slightly from 1.01% y/y in November (chart 4).

We still forecast annual inflation rate to converge by end-2021 to a level of 2.8% y/y that would be slightly below the BanRep’s 3% y/y target. We also anticipate that base effects could initially dampen year-on-year inflation numbers in Q1-2021, but annual inflation rates are expected to begin rising again by Q2-2021 as negative price pressures from items such as education are difficult to repeat. That said the BanRep monetary-policy rate would still be expected to remain at 1.75% at least until September-2021: the continuation of the economic recovery is a concern after the recent announcement of new public-health restrictions.

Finally, December’s Consumer Confidence Index (CCI), released on Friday, January 8, stood at -10.4 ppts, up 3.2 ppts from November’s level (-13.6 ppts) and the best print since the pandemic started. In December, the CCI showed us an improving picture of Colombians’ sentiments since both the assessment of current conditions and the index of expectations about the future improved; in fact, the index of expectations is at its best level since mid-2018 (chart 5). The December readings confirm that as the re-opening consolidates it is translated into better consumer sentiment, but this improved sentiment is vulnerable to the uncertainty created by recent COVID-19 control measures announced by Colombia’s regional and national governments.

—Sergio Olarte & Jackeline Piraján

MEXICO: KEY INSIGHTS FOR THE 2021 ECONOMIC OUTLOOK; DECEMBER HEADLINE INFLATION CLOSED 2020 NEAR BANXICO’S TARGET; MINUTES OF THE LAST 2020 BANXICO RATE DECISION

I. Key insights for the 2021 economic outlook

- The outlook for the Mexican economy in 2021 looks a little better than before, but remains subject to a high degree of uncertainty, especially because of the evolution of the COVID-19 pandemic. The arrival of vaccines has generated optimism, but for now the virus continues to spread and the authorities need to encourage containment measures.

- Fiscal policy will continue to be under pressure, with difficulties in maintaining tax collection and sustaining PEMEX’s finances.

- For monetary policy, we now anticipate a resumption of easing in the monetary reference rate from 4.25% at end-2020 to a low of 3.50% in 2021 following the change in the composition of Banxico’s governing Board and in the face of a relatively benign inflation performance.

- Economic activity will continue to recover, with a more significant boost from exports due to the reactivation of the US economy, while private consumption and investment will increase at a much weaker pace.

- Inflation is expected to be within the target range in 2021, given the low level at which it likely ended 2020. However, a “hump” is anticipated during the months of April and May given level effects from the price behaviour observed in 2020. It is likely that inflation will continue to present significant surprises, as it did in the year that just ended, because of the uncertainty associated with the pandemic.

- The exchange rate will continue to be very sensitive to changes in the global environment, especially in the perception of risk, which for the moment is being diluted by the liquidity injections provided by major central banks.

- Various risks continue to mark the global environment, including the transition of power in the US, as demonstrated by the invasion of the Congress building in Washington on Wednesday, January 6, by President Trump’s radical supporters. Other relevant risks that could affect international financial markets would be the impact of Brexit, the situation of the international financial system in the midst of the pandemic, and geopolitical tensions, among others.

II. December headline inflation closed 2020 near Banxico’s target

In data released on Thursday, December 7, headline inflation for December came out in line with expectations at 3.15% y/y, just above Banxico’s 3% target. As a result of this print and changes to Banxico’s Board, we now anticipate that monetary policy will be looser this year and that the reference rate will resume its downward cycle to a level of 3.50%.

Sequential monthly inflation came in at 0.38% m/m versus the 0.39% m/m expected, driven by a smaller change in non-core components that partially offset advances in the index’s core sectors. Core inflation saw a monthly change of 0.55% m/m, its highest rate since May 2017, while non-core prices fell -0.13% m/m, affected mainly by the agricultural component.

December’s 3.15% y/y change compared with a 2.83% y/y gain in December 2019 (chart 6). The greatest contribution to the slowdown in annual headline inflation came from its non-core components, which moderated even more, from 2.33% y/y in November to 1.18% y/y (versus a gain of 0.59% y/y in December 2019). Agricultural goods-price inflation went from 7.20% y/y in November to 3.94% y/y in December, especially driven by the behaviour of fruit and vegetable prices, whose gains moderated from 9.50% y/y in November to 0.10% y/y in December, and a negative change in energy prices. On the contrary, core prices advanced at a higher rate, going from 3.66% y/y in November to 3.80% y/y in December (versus a gain of 3.59% y/y in December 2019, again returning core inflation to the upper bound of Banxico’s target range.

Inflation in the coming months will continue to be influenced by the uncertain supply and demand effects of the pandemic, as well as the behaviour of the exchange rate, among other factors. Inflation’s low starting point at the beginning of 2021 represents a “buffer” for it to remain within the target range for much of the year, unless there are considerable upward surprises. Therefore, we anticipate that monetary policy will be eased further in 2021 and the target rate will come down from its current 4.25% level.

III. Minutes of the last 2020 Banxico rate decision

The minutes of Banxico’s last monetary policy decision of 2020 on Thursday, December 17, were released on January 7 and revealed important differences among the Board’s members. At that meeting, the Board voted 3–2 to keep the reference rate at 4.25%. Board members Heath and Esquivel supported cutting the reference rate by -25 bps to 4.00%.

The Board’s “doves” were more concerned about growth than inflation, and believed that monetary policy should be used to “support” economic activity, especially in times of crisis like the present; therefore they favoured a cut in the reference rate. The Board’s “hawks”, on the other hand, were more focused on controlling inflation and maintaining financial stability, and were more skeptical about the power of monetary policy to drive economic growth.

On the majority, hawkish side of the vote, arguments were made that were focused on justifying the pause in the easing cycle in order to gain more information and to confirm that inflation will indeed converge towards the 3% y/y target. In the same vein, hawkish Board members expressed some concerns about the credibility of monetary policy and the possible repercussions that an overly accommodative stance could have on financial stability. On the minority, dovish side of the decision, Messrs Heath and Esquivel expressed a clear intention to extend the cycle of monetary easing as Deputy Governor Heath noted that the economic recovery is likely to remain fragile, difficult, and prolonged.

With recent changes to the Board, the balance of power is set to shift toward the doves. Deputy Governor Guzmán Calafell has finished his term and has been replaced by the new Deputy Governor Galia Borja, who is expected to be less hawkish than her predecessor. While there is no objective evidence that would reveal whether Deputy Governor Borja will be a “hawk” or a “dove”, her closeness to Deputy Governor Esquivel and her background imply that she will be more of a “dove” than Deputy Governor Guzman.

—Paulina Villanueva

PERU: WHAT THE HOLIDAYS BROUGHT US

First of all, the holidays brought more COVID-19. From mid-August to mid-December, COVID-19-related hospitalizations had plummeted from 14,100 to 3,700. But more recently, hospitalizations rose over the past three weeks by 66% to 6,200. This is still well off the country’s highs, but the trend is clearly worsening.

President Sagasti announced on January 6 that the government has finally secured vaccines. The government has acquired 38 million doses from Sinopharm. The first batch of one million will reportedly be available in January. In addition, 14 million Astra Zeneca doses were acquired, although these are not scheduled to arrive until September. The government hopes to have vaccinated some 15 million people by the onset of the southern winter in June.

Early indicators for November were robust, and point to a GDP growth range of between -2.5% y/y and -3.0% y/y. This would be in line with our forecasts of Q4 GDP growth of 3.3% y/y and a full-year contraction of -11.5% y/y. In November, cement consumption was up 17.7% y/y (chart 7), while agriculture rose by 1.3% y/y, which was weak, but positive. Mining continues to disappoint, down -3.1% y/y. The trade balance registered a strong USD 763 mn surplus in November, taking the year-to-date surplus to USD 6.3 bn. Exports in November were up 2.4% y/y, although this was due more to an 18.9% y/y increase in prices than to a normalization of volumes. Perhaps more interestingly, imports rose 1.5% y/y, which is a comforting indication of how domestic demand is improving.

December data so far has been mixed. Public sector investment rose 36.8% y/y in the month (chart 8). This was strong, and a hopeful sign of the intentions of the new Minister of Economics and Finance to ramp up public investment. As a result, public investment ended 2020 down -9% for the full year. Car sales were off -12.4% y/y in December. This was a bit of a disappointment as car sales had risen compared with a year ago in October and November. However, it is our understanding that the decline in December had more to do with the lack of supply than with a decline in demand. Given the December result, automobile sales fell -25.8% in full-year 2020. This was, actually, better than the -30% y/y decline we expected at the height of the lockdown.

On Monday, December 21, the BCRP came out with new GDP growth forecasts. The BCRP improved its forecast for 2020 from -12.7% y/y to -11.5% y/y, thus lining it up with our own forecast. For 2021, the BCRP now expects 11.5% y/y growth, up from its previous projection of 11% y/y; this is stronger than our forecast of 8.7% y/y. BCRP President Julio Velarde noted that private and public investment is now doing much better than expected after a lull earlier in the year.

Inflation ended 2020 at 2.0% y/y, as we expected. Although this is a reasonable rate and right at the mid-point of the BCRP target range (i.e., 1% to 3%), it still came as a bit of a surprise for the BCRP, which had been expecting the drop in demand due to the lockdown to hurt prices. Sequential monthly inflation in December was a negligible 0.05% m/m. Core inflation was 1.8% for the full-year, and 0.3% m/m in December.

The FX rate ended 2020 at USDPEN 3.62. This represented a -9.2% depreciation for the year 2020. The same factors that have been weakening the PEN in recent months appear set to continue broadly in January, but we expect some mild appreciation later in Q1-2021.

Congress closed out 2020 by voting on Wednesday, December 30, in favour of a law affecting bank loan rates and fees. The law enables the BCRP to put caps on bank interest rates and prohibits certain credit card, deposit withdrawal, and mortgage fees. It also prohibits the capitalization of interest and the collection of penalties in cases of non-payment or late payment of debt service. The main targets are consumer and SME loans. The government has announced that it is likely to veto the law. If the veto is overridden, the government is likely to take the law to the Constitutional Court.

On December 30, Congress also voted in favour of a new law for agriculture. The law replaces a previous statute that had been withdrawn by Congress earlier in the month and which promoted investment in agriculture. The law mainly targets agroindustrial activities, on two fronts: labour and taxes. The law provides a special monthly “bonus” to the sector’s workers that would be equivalent to 30% of the minimum wage. The bonus is, in fact, a wage increase, but it does not count toward the calculation of other legal labour benefits. Furthermore, agricultural workers will receive a share of the sector’s profits, which will increase over time from 5% beginning in 2021 to 10% by 2027. In terms of taxes, larger agroindustrial companies will see income taxes raised from the current 15% to the normal corporate income tax rate of 29.5% by 2028.

December 21 was the deadline for Presidential hopefuls to register their candidacies for the April 2021 elections. Since then, the country’s elections officials have eliminated a few potential candidates due to non-compliance with registration regulations. This has narrowed the field. Out of 22 registration requests, 12 have been accepted so far by the electoral court. These include: Keiko Fujimori, Verónica Mendoza, Julio Guzmán, Yonhy Lescano, Marco Arana, Alberto Beingolea, Daniel Salaverry, and Nidia Vílchez.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.