Brazil: V-Shaped recovery moderated in November

Colombia: Expectations and activity consolidating gains

BRAZIL: V-SHAPED RECOVERY MODERATED IN NOVEMBER

Brazil’s V-shaped recovery moderated its pace in November as sequential growth slowed from 0.75% m/m sa in October (revised from 0.86% m/m sa) to 0.59% m/m sa, a bit better than the Bloomberg consensus of 0.50% m/m sa. Without the seasonal adjustment, this represented a slight pullback in level terms from the previous month (chart 1). In annual terms, real activity closed its gap from 2019 further, moving from a shortfall of -2.84% y/y in October (revised from -2.61% y/y) to -0.83% y/y, above the -1.00% y/y consensus expectation. Much of the recent pick-up in activity was led by both goods and service sectors, with further gains set to be dampened by the end of fiscal support.

—Brett House

COLOMBIA: EXPECTATIONS AND ACTIVITY CONSOLIDATING GAINS

I. BanRep’s January macroeconomic survey pointed to stronger economic growth and higher inflation in 2021

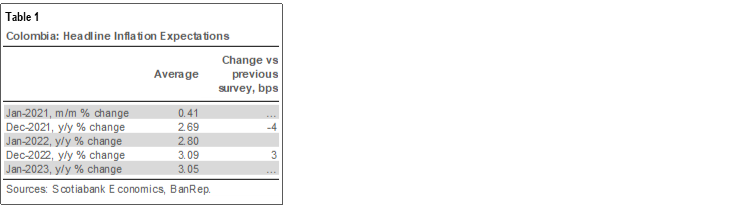

- Inflation expectations. According to BanRep’s January macroeconomic survey, released on Friday, January 15, analysts’ consensus expects inflation at 2.69% y/y in December 2021, -4 bps lower than last month. Inflation expectations for longer tenors did not change much as the 1Y consensus stood at 2.80% y/y, slightly above last month’s survey (2.73% y/y), and the 2Y view was at 3.09% y/y, pointing to anchored expectations over the monetary policy horizon (table 1 and chart 2). We expect (see our January 12 Global Forecast Tables) CPI inflation to close 2021 at 2.77% y/y, while in 2022, the year should end around 3.0% y/y.

- On average, January’s monthly inflation is expected to come in at 0.41% m/m, slightly below January 2020’s rate (0.42% m/m), which would leave the consensus on annual inflation at 1.60% y/y to start 2021. In January, Colombian inflation should reflect upside pressures from foodstuff prices, gasoline prices, and some utility fees. However, at Scotiabank Economics we anticipate only moderate indexing effects on prices such as rental fees, among others, which leads us to expect a lower-than-consensus rate of inflation at 0.34% m/m and 1.53% y/y for the first month of 2021.

- Growth. GDP growth for 2020 is expected to close the year at -7.03% y/y, while in 2021 a 4.55% y/y rebound is anticipated by analysts. Although recent lockdowns represent a downside risk, it is too early to change the overall recovery view. We continue to forecast 5% y/y growth in 2021.

- Peso. USDCOP forecasts for end-2021 stood at 3,435, an appreciation of -45 pesos from the previous survey. For December 2022, respondents think, on average, that the COP will end the year at USDCOP 3,388. We believe the COP, currently at about USDCOP 3,470, is slightly stronger than its fundamental level, which we estimate at 3,500 in the short run. Since uncertainty regarding the pandemic and fiscal risk remains high, we think the peso doesn’t have much room for a strong appreciation; instead, it should converge to 3,450 by end-2021 with only marginal further appreciation to USDCOP 3,400 by end-2022.

- Policy rates. BanRep’s repo rate is expected to close 2021 at 2.00%, according to the median of the respondents; additionally, it is worth noting that no analyst expects rate cuts in 2021. The first hike of 25 bps is expected by December-2021, later than when the previous survey estimated and our own forecast of a first hike in Q3-2021 (chart 3). Analysts, on average, expect the monetary-policy rate to hit 3.00% by end-2022; we are more hawkish with a 4.00% projection.

BanRep’s survey showed that market consensus has converged around a common scenario: economic recovery in 2021 with increasing inflation that would lead to higher monetary policy rates by the end of the year. Our forecast is slightly distinct: we see lower inflation at the beginning of the year on the back of weaker indexation effects in some traditional items. However, later in 2021 we expect to see stronger convergence to the central bank’s 3% y/y target, since in 2021 mitigating pressures on inflation will be replaced by the effects of rebounding economic activity and an unwinding of one-off influences from the response to the pandemic in 2020.

All in all, the balance of risks is tilted toward gradual economic recovery, with inflation returning to its traditional behaviour. We expect the BanRep to hold rates unchanged through the first half of 2021, with a first hike at the end of Q3-2021.

II. Retail and manufacturing sectors continued recovering in November as the “new normal” consolidated

On Monday, January 18, DANE released retail sales and manufacturing production data for November, and both sectors saw improvements that reflected a consolidation of the “new normal” re-opening process and positive effects from the VAT holiday. However, in both parts of the economy employment remained a concern. Retail sales grew 4.1% y/y, up from October’s 3.0% y/y, but below the Bloomberg survey’s 5.6% y/y consensus. Manufacturing also missed expectations, with a narrowing in its annual shortfall to -0.2% y/y from -2.7% y/y in October; consensus had expected a gain of 1.0% y/y. Employment contracted in both sectors by -6.5% y/y and -6.1% y/y, respectively, with the annual shortfalls concentrated mainly in clothing-related sub-sectors.

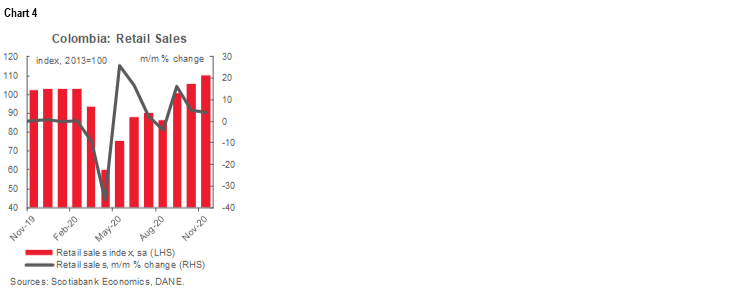

November retail sales growth led by the VAT holiday

Retail sales were up 4.1% y/y in November, as the VAT holiday incited household consumption ahead of year-end celebrations. In seasonally-adjusted terms, total retail sales, ex-other vehicles, rose by 4.4% m/m in November, a decent gain on October’s levels (chart 4). By sector, computer equipment (up 44.9% y/y), home appliances (up 43.4% y/y), and sound equipment (up 55.5% y/y) were the best performing segments, while annual sales growth in retail sales of gasoline (down -5.7% y/y), other vehicles (off -11.7% y/y), and vehicles for household use (down -6.3%y/y) remained in negative territory. In Bogota, retail sales, ex-fuel, grew by 37.8% y/y. For the first 11 months of 2020, retail sale sales contracted by -8.4% y/y, while employment fell by -6.5%, especially in the clothing segment. By region, Cundinamarca and Bogota accounted for two-thirds of 2020’s contraction through November.

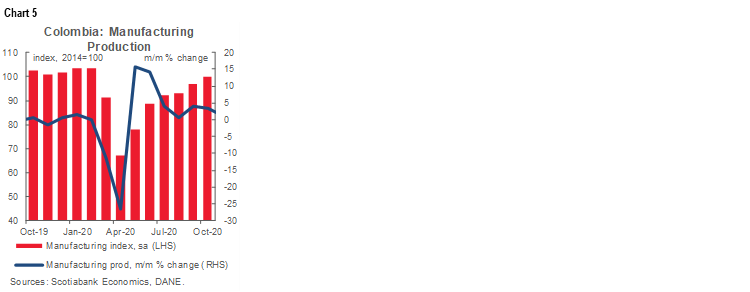

November manufacturing was almost flat in year-on-year terms, but employment remained below pre-pandemic levels.

Annual growth in real manufacturing production improved from -2.7% y/y in October to -0.2% y/y in November, but was still well off the Bloomberg consensus of 1.0% y/y. Either way, manufacturing activity keeps improving, but with a slowdown in growth from 3.30% m/m sa in October to 1.4% m/m sa (chart 5).

In November, output in 22 out of 39 segments contracted in year-on-year terms, which is the best balance since the pandemic started. For perspective, prior to the arrival of the “new normal” re-opening process that began in September, August saw 28 out of 39 segments below their production levels from 12 months earlier, while in October, it was 26 out of 39. The three sectors that were down the most in real terms in November were oil refining (-8.6% y/y), clothing (-8.1% y/y), and iron and steel industries (-12.6% y/y). On the positive side, some new industries saw year-on-year gains as the re-opening advanced: construction-related mining products (up 7.6% y/y), pharma (up 8.5% y/y), and electrical equipment (up 18.3% y/y) led the gainers. YTD through November 2020, manufacturing contracted by -8.9% y/y, while job destruction stood at -5.9% y/y; by region, Bogota and Antioquia accounted for almost half of the annual contraction in manufacturing output. By sector, the contraction in employment was concentrated in clothing-related manufacturing.

To sum up, November’s coincident retail and manufacturing indicators posted the best activity levels since the pandemic began as Colombia consolidated the “new normal” re-opening scheme. It is worth noting that monthly gains are moderating, while employment creation looks stagnant. In December, we expect better activity numbers in retail sales amidst the holiday season, while manufacturing will likely move sideways. We maintain our -7.5% y/y estimate for real GDP growth in 2020, while for 2021, we expect 5% y/y growth despite recent lockdowns (again, see our January 12 Global Forecast Tables).

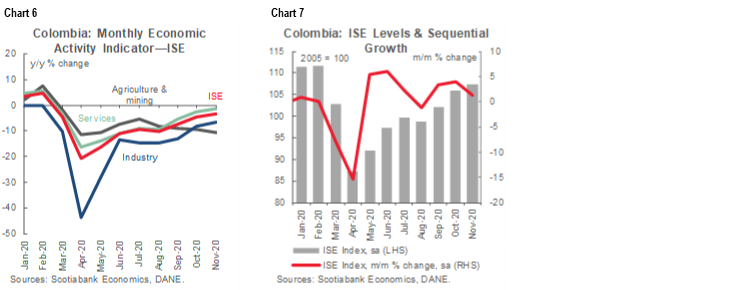

III. November’s economic activity reached its highest level since the pandemic started

On Monday, January 18, DANE released November’s Economic Activity Indicator (i.e., ISE, the main GDP proxy), which showed a new improvement from October’s levels mainly owing to the consolidation in the re-opening process (chart 6). November’s annual contraction of -3.4% y/y was the best performance since April’s low (-20.5% y/y), when Colombia went through the worst phase of the lockdown. On a seasonally-adjusted basis, the economy expanded 1.2% m/m, which pointed to a moderation in the recovery after October’s 3.9% m/m sa gains (chart 7). In the details:

- Primary activities were down -10.2% y/y after a fall of -1.3% m/m sa in November. The annual downturn was driven by low-production mining products, mainly coal;

- Secondary sectors were down by -6.8% y/y, although they expanded by 0.6% m/m sa, led by the construction sector’s recovery and industrial production normalization; and

- Services-related activities were also down -3.4% y/y, their best performance since the pandemic started after an expansion of 1.70% m/m sa in the month. Transportation services and retail sales activities led the advances. Financial and real-estate services also were up in year-on-year terms.

All in all, November’s economic activity numbers showed that the “new normal” re-opening scheme has led to better macroeconomic results. YTD to November 2020, the economy contracted by -7.3% y/y. In December, we expect another monthly expansion, especially owing to the usual positive effects of the holiday season in the retail sector. That said, we again reiterate our GDP growth projection of -7.5% y/y for 2020 followed by an advance of 5% y/y in 2021.

—Sergio Olarte & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.