Brazil: No surprises as the BCB held the Selic rate at 2.00%

Colombia: Imports rose in November, but remained down -12% y/y; YTD trade deficit narrowed by 9.5% y/y

BRAZIL: NO SURPRISES AS THE BCB HELD THE SELIC RATE AT 2.00%

As was widely expected, the BCB’s Copom unanimously voted to leave the Selic rate at its record-low of 2.00% at its Wednesday, January 20 meeting. In its statement, the Copom acknowledged that activity closed 2020 stronger than expected, while the inflationary impulse was described as more persistent than previously envisioned.

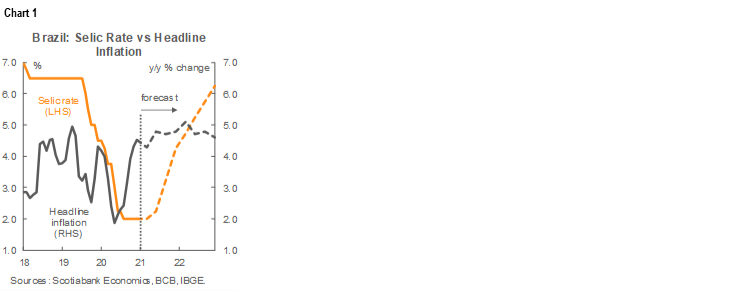

The Copom’s baseline scenario expects 125 bps of rate increases in 2021 followed by 150 bps in 2022. This rate path is more gradual and muted than the 550 bps of hikes anticipated by the DI curve for the coming two years—and our own forecasts (chart 1). Our sense is that the extent of the hiking cycle will depend on whether it is early and front-loaded so that tightening gets ahead of inflationary pressures to avoid a spiral driven by inertia and indexing.

The BCB appears to be gradually adjusting its bias towards a more hawkish bent under the rationale that the deterioration of the country’s fiscal outlook is skewing risks toward the necessity of higher rates. In particular, the Copom highlighted an asymmetry in the balance of risks, noting that:

“...an extension of fiscal policy responses to the pandemic that aggravate the fiscal path or a frustration with the continuation of the reform agenda may increase the risk premium. The relative increase in the risks of these events implies an upward asymmetry to the balance of risks, i.e., in the direction of higher-than-expected paths for inflation over the relevant horizon for monetary policy”.

As expected, the Copom also formally eliminated the forward guidance it introduced in August 2020 since inflation expectations are now close to target. We see this as another step that the BCB is inching closer to the start of a tightening cycle. The statement noted that:

“According to the forward guidance introduced in the 232nd meeting, the Copom would not reduce its monetary stimulus as long as specified conditions were met. Based on new information, the Committee judges that those conditions no longer hold, as inflation expectations, as well as inflation projections for its baseline scenario, are sufficiently close to the inflation target over the relevant horizon for monetary policy. Therefore, the forward guidance no longer holds and, henceforth, monetary policy will follow the usual analysis of the balance of risks for prospective inflation.”

We think the BCB is getting ready to start tightening earlier than has been generally anticipated—or at least it is now putting its finger on the trigger in case pre-emptive moves become necessary—which we think is good news. For now, we maintain our longstanding call, reaffirmed in our January 12 Global Forecast Tables, that the Copom would introduce its first hike to the Selic in Q2-2021, with a material risk that it could come earlier. Overall, this statement by the BCB seems supportive of the potential scenario we outlined last week in the January 12 Latam Daily, where the BRL could end up being one of the top performing EM currencies in 2021.

—Eduardo Suárez

COLOMBIA: IMPORTS ROSE IN NOVEMBER, BUT REMAINED DOWN -12% Y/Y; YTD TRADE DEFICIT NARROWED BY 9.5% Y/Y

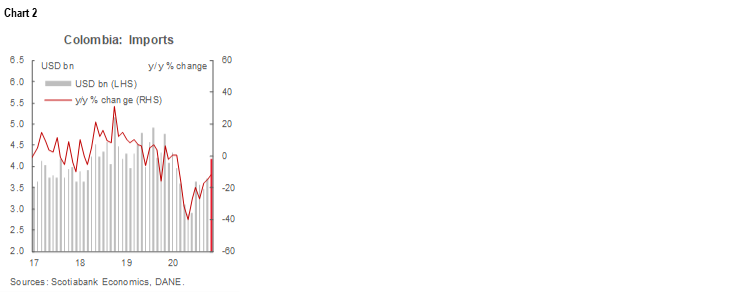

November’s imports data, released by DANE on Wednesday, January 20, came in at USD 4.19 bn, down -12% y/y, but higher than October’s imports of USD 3.7 bn (chart 2). Manufacturing-related imports were off by -6.7% y/y, while fuel oil and other mining-related imports fell by -60.3% y/y and accounted for most of the year-on-year decline. Year-to-date, imports were still down by -19.1% y/y. The trade deficit narrowed by 10.3% y/y in November and 9.5% y/y YTD on the back of weak economic activity compared with 2019’s levels.

From the perspective of imports by use, all three major segments remained in negative territory compared with a year ago (chart 3).

- Consumption-goods imports were off by -9.51% y/y, owing mainly to a significant decline in durable-goods imports (-14.2% y/y), especially vehicles (-18.3% y/y); meanwhile, non-durable goods imports were down by a more modest -5.1% y/y, mainly on lower clothing imports (-11.6%y/y).

- Raw-materials imports were down by -18.8% y/y, principally due to a drop in fuel oil imports (-68.5 % y/y) and imports for the industrial sector (-2.6% y/y).

- Capital-goods imports were off -5.6% y/y due to contractions in construction-related sub-sectors (-27.8% y/y) and transport equipment purchases (-5.6% y/y).

The trade deficit came in at USD -1.44 mn in November (chart 4), a 10.3% y/y narrowing that took the YTD deficit to USD -9.25 bn, down 9.5% y/y.

All in all, total imports were down less in annual terms than in the previous month, although their volumes recovered significantly and are closer to those observed in 2019, mainly owing to better dynamics in the agricultural sector with respect to raw materials and capital-goods imports. On the negative side, consumer-goods imports remained down compared with a year ago, although volumes have recovered to levels similar to those of 2019 as the re-opening has consolidated and the employment situation has improved. For 2021, we expect imports to continue closing gaps in consumption and investment-related imports.

The narrowing in the YTD trade deficit compared with last year was in line with domestic demand weakness. We expect the economic recovery to continue in 2021 and imports should keep increasing, which would put an end to the relatively narrow monthly trade deficits of 2020. In fact, as the economic recovery consolidates, we expect a small deterioration in Colombia’s external balance. We foresee a current account deficit at around -3.2% of GDP for 2020 and a widening to

-3.8% of GDP in 2021.

—Sergio Olarte & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.