- Colombia: Awaited fiscal reform plan shows government will seek income boost from: corporate taxes, government austerity

- Peru: Winner of presidential election to be declared next week

COLOMBIA: AWAITED FISCAL REFORM PLAN SHOWS GOVERNMENT WILL SEEK INCOME BOOST FROM: CORPORATE TAXES, GOVERNMENT AUSTERITY

Colombia’s Minister of Finance, José Manuel Restrepo, presented the much-awaited Fiscal Reform package. Labelled the “Social Investment Project,” its main goals are to protect vulnerable people, and pursue fiscal sustainability and economic growth.

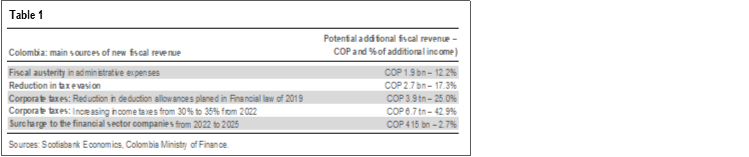

In his presentation (the official text will be presented before congress on July 20th), Minister Restrepo highlighted that the reform is expected to increase fiscal income by an estimated COP 15.2 tn, the majority of which is envisioned to come from corporate taxes. The package further contemplates challenging targets such as reducing both tax evasion and government administrative expenses. See table 1 for a breakdown of the proposed primary sources of new fiscal revenues.

The fiscal reform would also include changes to the fiscal rule, changing the anchor from fiscal deficit to debt-to-GDP ratio (55% of GDP in the long run); as well as some adjustments to the primary balance. The Minister has not yet provided additional details thus far.

The Government is also planning to extend direct monetary transfers to vulnerable households (ingreso solidario) until 2022 and increase their coverage. Other social measures will include the announced zero-fees at public universities and subsidies through to 2022 for companies that hire young workers. These programs will aim to reduce social tensions, notably ahead of a busy electoral calendar between now and 2022.

While the Minister’s presentation was meant as a broad-stroke announcement, the event was attended by important stakeholders including key economic groups, youth leaders, and political congressional representatives. In view of this, we believe that the Fiscal Reform is well-positioned to garner support to pass before the end of August, providing a strong message of fiscal responsibility.

It is important to note that the fiscal reform package as presented is insufficient to reduce the debt-to-GDP ratio over the coming years. Minister Restrepo highlighted that this reform represents two-thirds of what is needed, which means that a new reform should be presented in a couple of years to continue achieving debt sustainability.

Although we don’t expect Colombia to reach investment grade soon (it would take at least 5 years), we believe that fiscal commitment is essential to maintain credibility in local institutions.

—Sergio Olarte & Jackeline Piraján

PERU: WINNER OF PRESIDENTIAL ELECTION TO BE DECLARED NEXT WEEK

Peru’s electoral authorities announced yesterday (July 13) that the new President will likely be declared early next week, following the stipulated time needed to officialise the final, vetted results. This process consists of the electoral court sending the results to the 60 electoral colleges across the country for publication.

Earlier this week, media outlets reported that the electoral court had concluded resolving the appeals filed by Ms. Fujimori’s party, Fuerza Popular, concerning vote annulments. The total vote count, which concluded four weeks ago, sits at 50.12% for left-candidate Pedro Castillo, against 49.87% for the right’s-candidate Keiko Fujimori. New protests can be expected by Fujimori’s supporters in the coming days, even as all legal avenues to contest the election result appear to have been exhausted.

The courts and electoral authorities have been working against the clock, as the current president Franciso Sagasti is due to conclude his mandate on July 28, at which time the new Congress will have been sworn in, coinciding with the date when Peru will celebrate its bicentennial anniversary of independence.

—Adriana Vega

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.