- Colombia: May data shows significant impact of nationwide strikes on economic activity; modest recovery even from low 2020 base

- Peru: GDP growth continues to show robust rebound; unaffected by political uncertainty

- Chile: Weekend’s coalition party primaries to deliver key presidential candidates

COLOMBIA: MAY DATA SHOWS SIGNIFICANT IMPACT OF NATIONWIDE STRIKES ON ECONOMIC ACTIVITY; MODEST RECOVERY EVEN FROM LOW 2020 BASE

May manufacturing production and retail sales data published by Colombia’s statistical agency (DANE) on July 15 showed the extent of the impact of the nationwide strikes and lockdowns. Compared to the very low basis of 2020 when activity was heavily suppressed due to lockdowns, May 2021 showed only modest positive y/y gains.

MANUFACTURING PRODUCTION

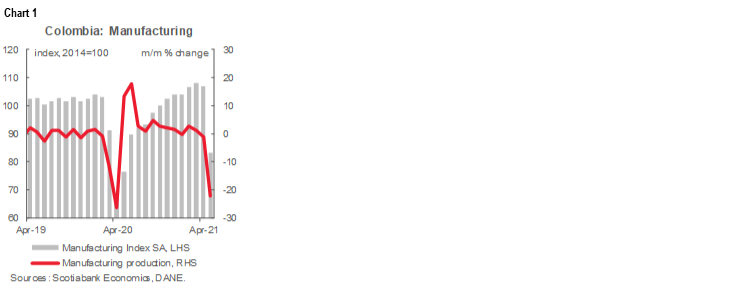

In May, manufacturing production was hard-hit by the nationwide strike, growing by a modest 8.6% y/y compared to the same month of 2020—one of the slowest months due to the COVID-19 lockdowns imposed at that time. May’s figure came in below Bloomberg’s survey consensus of 21.6% y/y and our own expected 33.2% y/y. Compared against the same period pre-pandemic (May 2019), the contraction was 20.1%. And, on a monthly basis, manufacturing fell by 22.1% m/m in seasonally adjusted figures (chart 1), a reduction similar to the one observed in April 2020 at the onset of strict lockdowns that suppressed around 30% of economic activity.

The most affected activities in May were concentrated in industries in the country’s southwest, consisting mainly of food and chemical-related production. Notably: beverages (-18%m/m), cleaning products (-38.3% m/m), paper and craft (-39.0% m/m); sugar and cane sugar production (-57.6% m/m) and threshing coffee (-59.9% m/m). The most affected locations were Valle del Cauca, Cauca, Risaralda and Tolima (accounting for 13.4ppts to the annual variation); those were offset by improved dynamics in Antioquia and Bogotá (which added 9 ppts to the total annual variation). YTD, industrial production has increased by 15.1%, mildly above pre-pandemic levels (YTD up to May 2019), while employment in the sector is 4.9% below pre-pandemic.

RETAIL SALES

Retail sales expanded by 22.8% y/y, below the expected 26.7% in Bloomberg’s survey and our 40.5% y/y estimation. Compared to pre-pandemic levels (May 2019), retail sales are still 10.2% below. Total retail sales, excluding vehicles, fell by -13.1% m/m seasonally adjusted in May (chart 2), showing a huge sensitivity to the nationwide strike, noting particularly a contraction in gasoline demand.

On a yearly basis, large increases were registered in other (non-car) vehicles and motorcycles (+116.5% y/y) and vehicles for household use (+85.1% y/y). In a reflection of life during a pandemic, the best performing lines were computers for domestic use (+37.4%), and cleaning products (+33.3%), compared to May 2019. On the negative side, the most significant declines relative to pre-pandemic times, were gasoline (-26.4% y/y), again showing impacts from the nationwide strike. By region, Valle del Cauca also led the contraction (-1.9%), while Bogota led gains with a 28.3% y/y increase.

While May’s manufacturing and retail activity showed weakness due to disruptions resulting from social unrest, we believe that the worst is behind us. We therefore expect to see a strong recovery in June’s activity, given the moderation of social protests and a broad economic reopening in main cities. As is the case elsewhere in the region, the labour market remains a concern as employment remains around 5% below pre-pandemic levels in manufacturing and 4.4% below in retail sales. On Monday, DANE will release the economic activity index (ISE) which will show a more precise impact from the strike. Our expectation for GDP growth in 2021 is 6%, but we think this could skew to the upside despite impacts from the nationwide strike. On this basis, we reaffirm our view that the central bank (BanRep) will begin moving toward hikes in September 2021.

COLOMBIA: BANREP’S JULY SURVEY OF ANALYSTS SHOWS HIGHER INFLATION EXPECTATIONS FOR END-2021, THOUGH ANCHORED OVER MEDIUM TERM; RATE HIKE EXPECTED IN Q4

The Central Bank, BanRep, released the July edition of its monthly survey of economic analysts. A top takeaway is an expectation that inflation will close above the 3% y/y target in 2021; but remain anchored over the long run. Analysts further affirmed the expectation of a rate hike in October/2021, to close the year at 2%; while the terminal rate for 2022 is now expected to be 25bps higher than in the previous survey, to reach 3.25%. The economic activity forecast also increased, and the USDCOP is expected to appreciate by year-end.

- Near-term inflation. July’s monthly inflation is expected to come in at 0.04% m/m, putting annual inflation to July at 3.67% y/y (from the 3.63% in June). However, survey dispersion remained high with a minimum expectation of -0.35% m/m and a maximum of +0.26% m/m, signaling still high uncertainty amid recent developments and their impact on prices. Scotiabank Economics expects July’s monthly inflation at +0.26% m/m and 3.90% y/y, given that food inflation is not falling as expected due to long-lasting effects in the supply chains of critical products due to the recent protests and bottle necks in import goods logistics; additionally, utility fees are expected to rise.

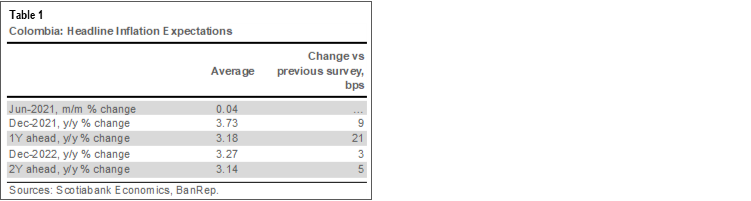

- Medium-term inflation. Inflation expectations rose to 3.73% y/y by December 2021, 9 bps higher than in last month’s survey (table 1), which shows that the recent inflation surprise is attributed to temporary shocks. Expectations over the medium term continue to hover around 3% y/y: 1Y forward inflation stood at 3.18% y/y (above last month’s reading at 2.97% y/y); and 2Y forward stood at 3.14% y/y, underscoring that expectations remained anchored over the monetary policy horizon (chart 3) despite the recent increase. Scotiabank Economics expects CPI inflation to close 2021 at 3.93% y/y and end-2022 at around 3.0% y/y, noting that current inflation pressures are higher than the market’s expectation, but indeed transitory.

- Economic activity (this data point is released quarterly): The market expects GDP growth for 2021 at 6.41%, better than what was expected in April’s survey (4.81%), but below the central bank expectation of 6.5%. For 2022 a 3.53% expansion is expected.

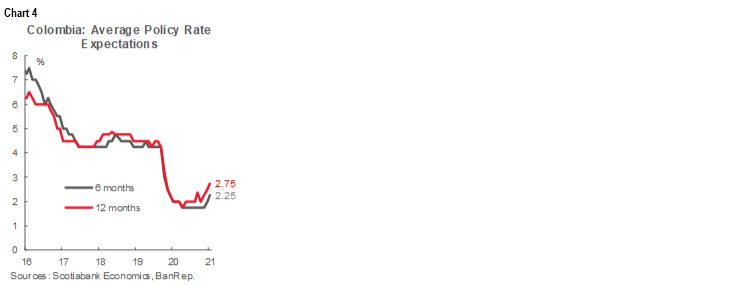

- Policy rate. Consensus still expects one hike this year in the policy rate to 2% (from the current 1.75%); the first movement is anticipated in October (chart 4). Scotiabank Economics’ forecast is more front-loaded, with a hike expected in September 2021 given the better economic recovery and as inflation is likely to consolidate well above 3% y/y. For 2022, consensus expects a policy rate at 3.25% by the end of the year, 25bps higher than what analysts expected in the previous survey.

- FX. USDCOP forecasts for end-2021 stood at 3,655 (79 pesos above from the previous survey). For December 2022, respondents think, on average, that the peso will end the year at USDCOP 3569 (+47 pesos above the previous survey). We believe that USDCOP would appreciate by the end of the year to 3,525.

—Sergio Olarte & Jackeline Piraján

PERU: GDP GROWTH CONTINUES TO SHOW ROBUST REBOUND; UNAFFECTED BY POLITICAL UNCERTAINTY

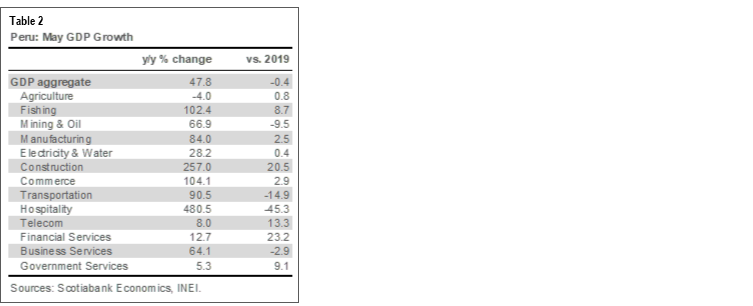

GDP growth came in at 47.8% y/y in May, according to figures released on July 15 by Peru’s statistical agency, INEI. This is higher than our expected 42% y/y growth. As has been the case since March, such huge growth figures reflect the very low base of comparison against May of 2020, a time of stringent pandemic lockdowns. Compared against pre-pandemic figures, May 2021 was only 0.4% lower than in May 2019, per our estimates. Peru GDP is now very near pre-COVID levels, attesting to a robust rebound, but also meaning that there has been no real growth in two years. The data is nonetheless encouraging.

GDP growth for the January–May 2021 period was 19.7% y/y (which includes the April–May ’20 period, at the height of COVID-19 lockdowns). Monthly GDP growth should begin softening over the coming months as base effects dissipate, however, we see an upside to our full year forecast of 9.9%, given the trend so far.

The data by sectors for May is highly distorted due to the unequal impact by sector of the lockdown. For instance, hospitality (hotels and restaurants) rose by a whopping 480% y/y in May, but mainly because the sector was nearly entirely shut in 2020 and still has a ways to go to return to normal, as it remained 45% below 2019 levels. Construction is the sector that stands out the most. Construction GDP was not only 257% higher than in 2020, but a hefty 20% higher than in 2019. Mining and oil & gas, meanwhile, continue to disappoint as they are down nearly 10% from 2019 levels. Sectors closely linked to domestic demand and particularly consumption are also notable as all surpassed 2019 levels. Manufacturing was up 2.5%; and commerce rose 2.9%.

POSITIVE JOBS RELEASE

The INEI also released employment figures for Q2-2021. The figures were indeed quite positive. Unemployment in Lima fell to 10.3%, and formal jobs rose to 4.6 mn in Q1. Employment increased especially in construction, matching the strong growth in construction GDP. However, the quality of new jobs appears to be somewhat below previous jobs, as household incomes are nearly 8% below 2019 levels.

—Guillermo Arbe

CHILE: WEEKEND’S COALITION PARTY PRIMARIES TO DELIVER KEY PRESIDENTIAL CANDIDATES

Chile’s busy 2021 electoral calendar will reach another milestone this weekend, as the main party coalitions on both the left and the right will hold their presidential primaries election on Sunday, July 18. A total of six candidates (four from the right’s Chile Vamos ruling coalition and two representing left parties) will compete for their coalition’s nomination. These primaries are the first step in a long presidential race that will include a first-round election on November 21, and—if no candidate wins a majority outright—a runoff vote on December 19. The weekend’s primaries are significant as contenders include high profile candidates who have polled high in recent weeks and are sure to set the tone of the presidential campaign. They include two (a former and a current) mayors of Santiago municipalities: Daniel Jadue, running with the Communist Party; and Joaquin Lavin on the centre-right, who also served in cabinet under President Piñera’s first presidential term. It is still early days in Chile’s presidential election and surprise candidates could yet emerge either as a result of the primaries, or further along as political parties make direct nominations.

—Adriana Vega

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.