- Chile: Government issued debt for more than USD 2 bn in foreign currency as previously announced; an additional USD 5.8 bn remains

- Colombia: Government presents new Fiscal Reform before Congress; additional details on changes to Fiscal Rule revealed

CHILE: GOVERNMENT ISSUED DEBT FOR MORE THAN USD 2 BN IN FOREIGN CURRENCY AS PREVIOUSLY ANNOUNCED; AN ADDITIONAL USD 5.8 BN REMAINS

On Wednesday (July 21) the Ministry of Finance reported the issuance of Treasury bonds in international markets, for a total of 1.75 bn euros (approximately USD 2.15 bn). Including this issuance, Chile has now issued public debt for a total of USD 15.77 bn in 2021, of which USD 9.90 bn were bonds in foreign currency.

Earlier, on July 12, the Ministry of Finance had updated its estimation for the financing needs of 2021, anticipating additional issuances of up to USD 8 bn, authorized by the Transitory & Emergency COVID-19 Fund, mainly in foreign currency and for longer terms. Yesterday’s debt issuance is part of that additional financing plan for this year. Therefore, of the USD 8 bn mentioned above, there are approximately USD 5.85 bn remaining in debt issuances for this year, which is expected to be mostly in foreign currency denominated bonds.

—Anibal Alarcón

COLOMBIA: GOVERNMENT PRESENTS NEW FISCAL REFORM BEFORE CONGRESS; ADDITIONAL DETAILS ON CHANGES TO FISCAL RULE REVEALED

Colombia’s Legislature opened its new session on Tuesday (July 20), the same day the government presented its new tax reform. On the expenditures side, the government is planning to extend social programs in 2021 and in some instances through to 2022. Additionally, three VAT holiday days per year will become a permanent measure, as will certain stimulus for the tourism sector. The total fiscal deficit is expected to begin decreasing in 2022, with the primary fiscal surplus only arising until 2025.

Changes to the Fiscal Rule

As had been announced last week, the government is proposing changes to Colombia’s Fiscal Rule, departing from a fiscal deficit anchor to a debt to GDP ratio anchor. Aiming to steer clear of unsustainable debt levels, a defined debt ceiling has been set at 71% of GDP, with a long-term target of 55% of GDP—an estimated optimal level to sustain growth under healthy public finances.

The mechanism to adjust the debt to GDP ratio to the set targets will be through the primary fiscal balance. According to the rule, if the debt is already at 55% of GDP, the target primary fiscal surplus will be 0.2% of GDP, while if the debt exceeds 55% of GDP, the surplus should be higher under the following function:

Net primary balance in current period (% of GDP) = 0.2 +0.1 (Net debt in previous period -55) if net debt in the previous year is below 70% of GDP.

Or 1.8 if Net debt in the previous year is above 70% of GDP.

The net primary balance will also include effects of economic growth, oil cycles and one-time transactions (i.e. asset selling). The rule will calculate the oil cycle based on observable variables, while the methodology for the economic cycle will be more transparently prescribed. This is a positive change versus the previous rule where cycles were based mainly on unobservable variables and unknown parameters.

Net primary balance = Primary fiscal balance – growth cycle – oil cycle – one-time transactions.

In regard to implementation, the government has defined a transition period between 2022 and 2025 to gradually start converging to the long-term goal, given that the country is still affected by the pandemic shock.

From our perspective, the proposed new Fiscal Rule is positive as it will have a more transparent anchor and methodology, allowing for a simpler way to monitor fiscal performance. However, the transition period is long, and we have to wait until 2026 to see the rule working fully.

Additional Highlights:

- The Fiscal Reform bill aims to eliminate the withholding tax on fixed-income investments (public and private), looking to improve the competitivity and attract further investors. This last change also should contribute to improving conditions to financing the budgetary needs. The current withholding tax is at 5% after being reduced in the National Developed Plan in May 2019 from 14%.

- Budget Addition for 2021: In the financial plan 2021 (released in March), the Ministry of Finance (MoF) estimated a fiscal deficit of 8.6% of GDP for 2021. However, since then some conditions have changed: 1) The initial Fiscal Reform was withdrawn amidst social unrest; 2) Colombia’s downgrade in the credit rating, and 3) deteriorated financial market conditions. In the new Fiscal Plan, the MoF asked for a change in the budget while maintaining the fiscal deficit target.

Overall, main changes assume a lower fiscal income (COP 2.5 tn or ~ 0.2% of GDP), while also a need for greater resources to extend social programs. Therefore, net new sources will be COP 10.5 tn, which will be allocated to the Ministry of Finance from other areas of the national government budget. That said, the fiscal deficit of the central government is not expected to increase, maintaining the indebtedness plans from the Medium-term Fiscal Framework and avoiding higher debt issuances needs.

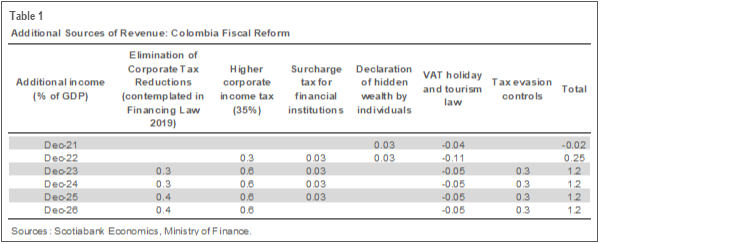

The Fiscal Reform bill, as presented, affirmed the main messages delivered at the Minister’s press conference last week, including the proposed additional sources of revenue (table 1). We expect the government to urge Congress to expedite passage of the Fiscal Reform as some social programs are due to expire in August, although the final law would be released in around five weeks at the earliest. We don’t expect substantial changes as the bill progresses in the legislature, given that the government has already discussed the text with the main social groups and congressional leaders.

—Sergio Olarte & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.