- Chile: No move on rate as BCCh holds onto 0.5% but signals October hike; CPI increased to 0.3% m/m in May; Fuels prices to cap off June inflation but food prices abate

- Colombia: May’s consumer confidence remains subdued amidst third COVID-19 wave and protests

CHILE: NO MOVE ON RATE AS BCCh HOLDS ONTO 0.5% BUT SIGNALS OCTOBER HIKE; CPI INCREASED TO 0.3% M/M IN MAY; FUELS PRICES TO CAP OFF JUNE INFLATION BUT FOOD PRICES ABATE

I. No move on rate as BCCh holds onto 0.5% but signals October increase

On June 8, the Central Bank of Chile (BCCh) held its monthly monetary policy meeting, deciding again to hold the benchmark rate at 0.5%. This more hawkish stance affirms our view that the first hike will indeed occur in October 2021.

The Board highlighted April’s monthly GDP as a positive surprise, noting the economy’s success at adapting to recurring quarantines. The BCCh nonetheless acknowledged that weakness persists in some sectors more exposed to lockdowns.

The assessment of the labour market is also positive, showing a recovery in salaried jobs, although still lagging behind economic activity. The BCCh noted only a few negative elements, including the contraction of consumer credit, which is closely linked to the ample liquidity of households.

We expect an increase in the 2021 GDP growth projection to the range of 7%–7.75% y/y, in line with our forecast of 7.5% y/y. Structural parameters will be revealed in the June 9 Monetary Policy Report (IPoM).

All in all, the central bank expects a stronger economic scenario given the greater fiscal impulse implemented since March and the approval of a third withdrawal of pension funds, amidst an external scenario that has become more favourable. Assessing the external scenario, the BCCh’s statement highlighted the positive short-term indicators in developed economies, which have been accompanied by steady advances in vaccination efforts and the reopening of economic activity in those countries. Although prospects for emerging economies, especially in Latin America, continue to depend on the evolution of the pandemic, China’s recovery stands out for having led to the consolidation of copper prices around USD 4.5/ pound.

Regarding unconventional monetary measures, the BCCh will gradually reduce the stock of corporate bank bonds, according to their maturity. In view of this, the BCCh has clearly deemed it unnecessary to continue putting pressure on its balance sheet, given the information currently available.

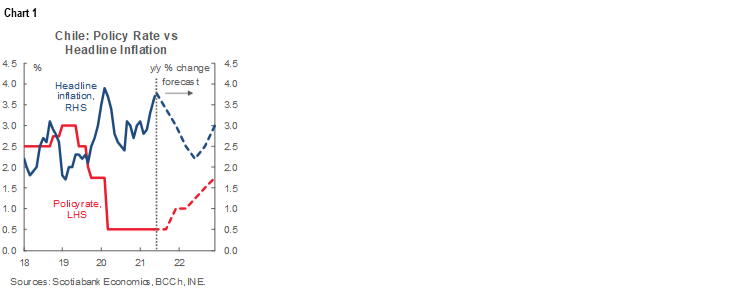

Although we share some economic policy considerations (linked to Chile’s presidential elections in November and the appointment of a new BCCh president in December) that could lead to a more cautious approach to normalization, the BCCh has reaffirmed its technical and independent evaluation, detached from political events. However, it is worth noting that any process of normalization would be highly conditional on the evolution of investment and employment as well as sanitary conditions. This leads us to expect that the policy rate will not surpass 1.75% by December 2022 (chart 1).

Market reaction: This statement confirms the BCCh’s assessment from its last meeting, signalling (for now) that the first rise in the MPR will indeed occur in October 2021. This could place some appreciative pressure on the peso, also pushing up short-term nominal rates.

—Jorge Selaive

II. CPI increased 0.3% m/m in May; fuel prices to cap off June inflation, food prices abate

In May, the Consumer Price Index increased 0.3% m/m (3.6% y/y), slightly above our forecast of 0.2% m/m, and below forward contracts (0.37% m/m). This was driven by a higher core inflation, both in goods and services, as well as an increase in fuels prices: core inflation rose 0.3% m/m (3.1% y/y), with an increase of 0.5% m/m in goods (4.5% y/y) and 0.3% m/m in services (2.3% y/y), chart 2.

Interurban bus services increased 23.1% m/m (above historical variations), to which we attribute the high increase in core services and subsequent higher-than-expected CPI (0.26% effective against 0.20% forecast). Food prices (chart 3), meanwhile, appear to be subsiding despite households’ renewed liquidity injection. In effect, the spread of food and non-alcoholic beverages prices is close to the lower historical range. This was also observed in February and March. In this context, we question the view of continued increases in food prices above historical variations for the rest of the year.

Our preliminary forecast for June sits between 0.2 and 0.3% m/m, again with significant pressure from fuels. We do not expect further incidences from fuels on the CPI from July onwards, especially in view of relevant legislative initiatives in Congress that, if approved, could effect minor adjustments in fuel prices or other products in the CPI basket. All in all, we maintain our 2021 annual inflation forecast at 3% y/y, below market expectations.

—Jorge Selaive, Aníbal Alarcón, Carlos Muñoz, & Waldo Riveras

COLOMBIA: CONSUMER CONFIDENCE REMAINS SUBDUED AMIDST THIRD COVID-19 WAVE AND PROTESTS

May’s Consumer Confidence Index (CCI) data, contained in a Fedesarrollo release on Tuesday, June 8, stood at a balance of -34.3 ppts, broadly unchanged from the -34.2 ppts in April. The index approached its lowest levels since the pandemic began (April 2020’s -41.3 ppts, chart 4). In May, nationwide protest continued, while the third COVID-19 wave worsened, both weighing against current conditions sentiment. Expectations have improved, but they are back to negative territory (chart 4, again).

Looking at May’s details:

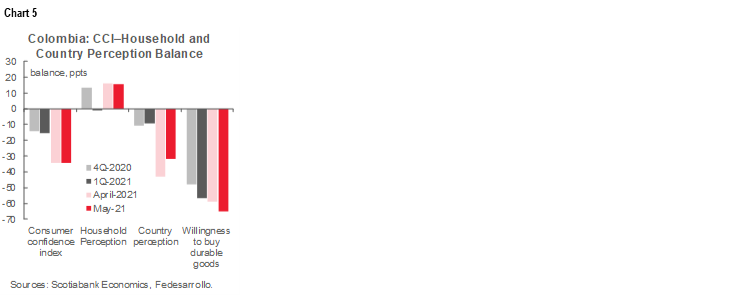

- The Current Conditions Index fell to -61.7 ppts versus April’s -50.5 ppts. Consumers’ perceptions softened markedly due to the protests. For instance, consumers’ appetite to buy new durable goods remained low, falling from -58.7 ppts in April to -65.1 ppts in May, the lowest level in a year (chart 5).

- The Expectations Index improved by 7.3 ppts from April’s level (-23.3 ppts, chart 4, again). This index recovered given the improved perception of the country’s economic future, though it remained negative. Households’ perception of wellbeing weakened slightly, but nonetheless remained positive. We believe the expectations index will improve in June as large cities are resuming activity.

- At the regional level, consumer confidence numbers deteriorated in two out of five major cities surveyed, with Medellin leading the retreat with an 11% contraction. Health and mobility restrictions lifted in Bogota and Medellin since June 8 will improve consumer sentiment over the following months, but willingness to buy houses fell by a significant -22.6 ppts, led by Bucaramanga (-54.3 ppts falling by 30 ppts) and Medellin (-34 ppts, worsening from -6.5 ppts).

May’s consumer confidence numbers reflect Colombians’ negative sentiment amid current public-health conditions and social protests, but future expectations have improved. We expect sentiment to improve in June as main cities have lifted restrictions, but ongoing strikes and demonstrations remain a concern.

—Sergio Olarte & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.