- Chile: Third withdrawal of pension assets and possible new fiscal support leads the BCCh to signal early start of rate normalization in hawkish hold

- Colombia: Manufacturing and retail sales showed a stronger Q1-2021

- Mexico: Banxico kept policy rates on hold, as widely expected, even with inflation 300 bps over target

- Peru: The BCRP held at 0.25% with no changes in forward guidance

CHILE: THIRD WITHDRAWAL OF PENSION ASSETS AND POSSIBLE NEW FISCAL SUPPORT LEADS THE BCCh TO SIGNAL EARLY START OF RATE NORMALIZATION IN HAWKISH HOLD

At its third rate decision of the year, the BCCh’s Board meeting on Thursday, May 13 concluded with a decision to keep the key policy rate at its technical minimum of 0.5% and to maintain unchanged the central bank’s unconventional measures to support liquidity and credit. On the basis of the Board’s assessment of new and forthcoming liquidity injections to the Chilean economy, we have brought forward our projection for the BCCh’s first 25 bps rate hike from January 2022 to October 2021 (chart 1).

The Board’s assessment of Chile’s economic activity was positive, and implied that growth in 2021 could exceed the bank’s central scenario of 6–7% y/y, with a specific projection of 6.8% y/y. We have maintained our growth projection for 2021 at 7.5% y/y for a few months now, while the consensus continues to move upward toward it: the current median of the BCCh’s Economic Expectations Survey is located at 6.2% y/y.

The BCCh also made a favourable assessment of the international scene. It highlighted that global growth projections continue to strengthen as public-health restrictions have become more flexible, particularly in developed countries. It also noted increasing appetite for risk, which has lifted developed-market equities, restored capital flows to emerging markets, and boosted commodity prices—especially for copper, which has generated a relevant improvement in Chile’s terms of trade.

Although some local risks persist—elections and political uncertainty, a fragile public-health situation, and lags in job creation—that could affect the road to recovery, the improved domestic and external outlook would put Chile at the top of the economic forecasts provided in the March Monetary Policy Report.

In terms of the policy-rate path, all of this would imply levels in the upper part of the range defined in the “policy-rate corridor” in the March MPR: that is, increases would begin toward the last quarter of this year. Under this optimistic scenario, the BCCh could move in October or December 2021; however, we think October looks more likely since the Chilean economy is about to receive two major injections of additional liquidity that could accelerate inflation (chart 2). First, the third drawdown of pension assets will put upward pressure on goods prices. Second, an imminent political agreement on “common minimums” in response to an Opposition proposal for increased transfers and direct support to SMEs and households, which all told could amount to the equivalent of 5.8 ppts of GDP, would provide an additional lift to domestic demand and prices. For now, we do not rule out the possibility that after an initial 25 bps hike in October a second increase could follow in December to leave the benchmark rate at 1% at end-2021.

Nevertheless, we do not see the BCCh starting an aggressive rate normalization process; hence, we do not expect the policy rate to reach its neutral level—which we estimate at a nominal rate of 3.5%—in either 2022 or 2023. Political uncertainty around the constitutional process and still-soft labour markets imply that the central bank will move cautiously as it monitors developments.

The BCCh decision is likely to be reflected in pricing of an earlier start to monetary normalization, both in rates and the fx markets.

—Jorge Selaive, Carlos Muñoz, & Waldo Riveras

COLOMBIA: MANUFACTURING AND RETAIL SALES SHOWED A STRONGER Q1-2021

On Thursday, May 13, DANE published manufacturing production and retail sales data for March that, again, were significantly better than expected.

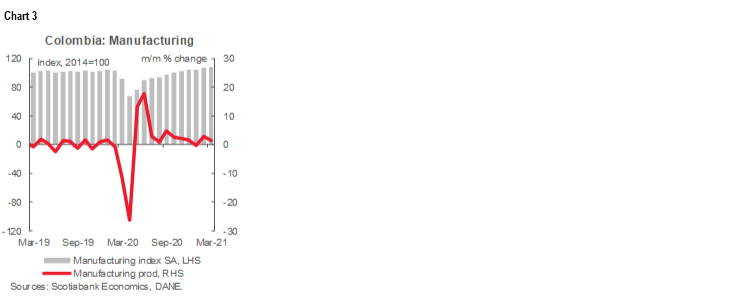

Manufacturing. In March, we saw a sequential 1.3% m/m sa expansion, a remarkable gain on the already good performance of February (2.8% m/m sa, chart 3). In April, manufacturing should again post a positive figure, however in May, it could weaken since some industries are having troubles with their operations due to social unrest. Having said this, we remain constructive on the sector’s prospects for 2021.

In annual terms, March manufacturing data showed an expansion of 20.7% y/y, above the Bloomberg market consensus of 15.3% y/y and our own 16.2% y/y estimate—and up from 0.6% y/y in February as skewed year-on-year comparisons with last year’s pandemic-affected numbers begin. In March, the sector operated at close to pre-pandemic norms as relatively mild public-health restrictions affected services more than manufacturing activities. In fact, compared with March 2019, manufacturing output was up by 10.7% in March 2021. The March figures round out the first quarter and in Q1-2021 manufacturing expanded by 6.2% y/y, while employment losses in the sector remained large (-3.7% y/y).

In March, output in 36 out of 39 sectors expanded in year-on-year terms. Three industries accounted for the majority of the year-on-year gains: beverages (34.5% y/y), construction-related mining products (44.9% y/y), and oil refining (26.7% y/y), which jointly contributed 7.6 ppts to March’s total 20.7% y/y increase in manufacturing production. Compared with pre-pandemic levels (March-2019), the best performing sectors were beverages (up 17.3%), chemical products (47.4%), and plastic products (20.5%).

Antioquia, Bogota, and Cundinamarca led these gains and contributed 58% of Colombia’s year-on-year growth in manufacturing. Compared with March 2019, Antioquia, Cundinamarca, and Atlantico accounted for 50% of gains. In April, production data for the country’s northern cities will likely be hit hard by the strong lockdowns that were implemented, while in data for May, Valle del Cauca (10% of GDP) is set to be the region hardest hit by the nationwide strike.

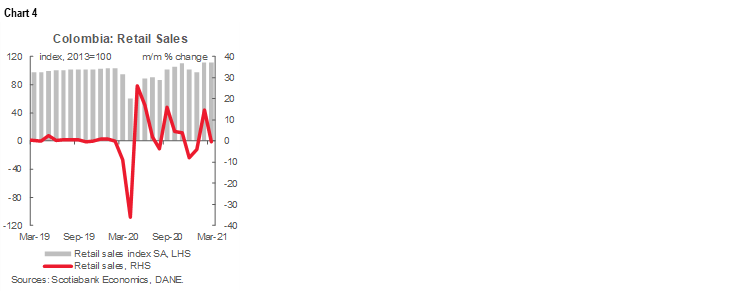

Retail sales. In seasonally adjusted terms, total retail sales, ex-vehicles, fell by -0.5% m/m sa in March (chart 4), owing to the impact of lockdowns implemented in some of Colombia’s major cities at the end of the month. In April, lockdowns continued, especially in Bogota, for at least one-third of the month. Restrictions eased in May, but retail activity was again hit by the nationwide strike.

In annual terms, retail activity increased by 20.1% y/y in March, posting a big positive surprise versus the Bloomberg survey consensus (14.6% y/y), but close to our expectation of 20% y/y. The big increase from February’s 1.2% y/y gain was largely accounted for by March 2020’s imposition of public-health restrictions. Compared with pre-pandemic levels (March 2019), retail sales were up by 14.3% y/y, affirming the considerable recovery of the sector. For Q1-2021 as a whole, retail sales expanded by 4.7% y/y.

At the sub-sectoral level, the largest expansions were registered in sales of fuel (39.1% y/y), vehicles for household use (85.1% y/y), and spare parts for cars (42.2% y/y). On the negative side, the largest contractions occurred in foodstuffs (-19.3% y/y) and cleaning products (-12.5% y/y), which one year ago were the most in-demand items amid the start of the pandemic.

By region, Bogota led the gains with a 14.5% y/y increase in retail activity, but, paradoxically, it also registered the sector’s largest employment contraction (-7.8% y/y) amid the country-wide -5.6% y/y pullback in retail jobs. For Q1-2021 as a whole, employment contracted by -6% y/y with one-third of these retail jobs losses in Bogota. We expect hiring to improve as the re-opening consolidates, especially after the current nationwide strike winds up.

To sum up, March’s coincident manufacturing and retail indicators were significantly better than expected, suggesting that the economic recovery in Q1-2021 was remarkably resilient to the lockdowns at the start of this year. The labour market, however, remains a concern, although it could improve further if the economic recovery consolidates. Although the nationwide strike implies a moderation of economic activity going into the rest of the year, we affirm our expectation of 5% y/y GDP growth in 2021. We also maintain our view that the BanRep will continue to stay on the sidelines for the time being and will begin moving toward hikes in the course of H2-2021.

—Sergio Olarte & Jackeline Piraján

MEXICO: BANXICO KEPT POLICY RATES ON HOLD, AS WIDELY EXPECTED, EVEN WITH INFLATION 300 BPS OVER TARGET

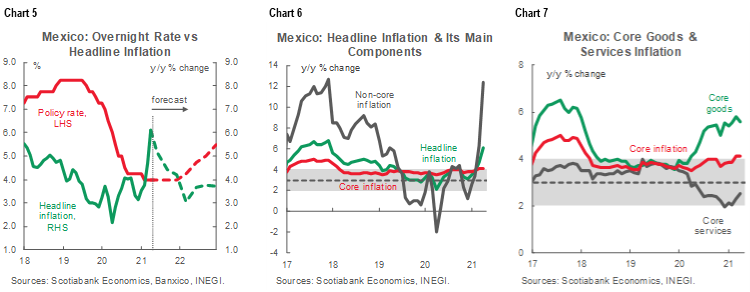

In a unanimous decision at its Thursday, May 13 meeting, Banxico’s Board held its policy rate at 4.00%, in line with expectations (chart 5). Inflation dynamics in Mexico have lately been quite uneven, with core inflation stable (4.13% y/y), while non-core has soared (12.34% y/y)—which led headline to print at over 6.0% y/y in April (chart 6). Within core prices, services inflation been subdued (just above 2% y/y), which has offset higher core-merchandise and non-core energy price increases (chart 7).

In this environment, Banxico’s Board held onto its “data-dependent guidance”, but seemed to adopt a more cautious tone, highlighting the need to anchor inflation on a downward trajectory. Financial markets have already started pricing a full 25 bps rate increase during Q4–2021 and almost 100 bps of hikes over the next 12 months. Our own call is that Banxico’s initial rate rise won’t come until the first meeting of 2022; dates have not yet been released for next year’s rate decisions.

The Board took note of the slowdown Mexico went through during Q1-2021, but argued that growth will re-accelerate and that the balance of risks to economic activity now looks relatively even. However, the Board’s statement also pointed toward continued unevenness in Mexico’s recovery. While we agree with the Board’s assessment, since the end of Q1 some indicators have pointed to improvements in lagging sectors such as investment and services.

On the inflation front, the Board acknowledged that recent prints have diverged substantially from its forecasts and that inflation risks have increased. This represented a contrast with the Board’s previous statements where it contended that the outlook for inflation was uncertain; still, the Board maintained its view that inflation will converge toward its 3% y/y target in Q2-2022. The Board’s outlook is somewhat more optimistic on inflation than both our own call and the market consensus: the mean in Banxico’s expectations survey sits at 4.58% y/y for end-2021 and 3.65% y/y for end-2022.

Finally, the Board spoke about the need to safeguard the country’s macro and institutional framework, including through the conduct of sound fiscal and monetary policy. It also noted the imperative to preserve financial stability, which seemed like a nod toward fiscal reform efforts expected in the second half of the Lopez Obrador Administration’s term.

—Eduardo Suárez

PERU: THE BCRP HELD AT 0.25% WITH NO CHANGES IN FORWARD GUIDANCE

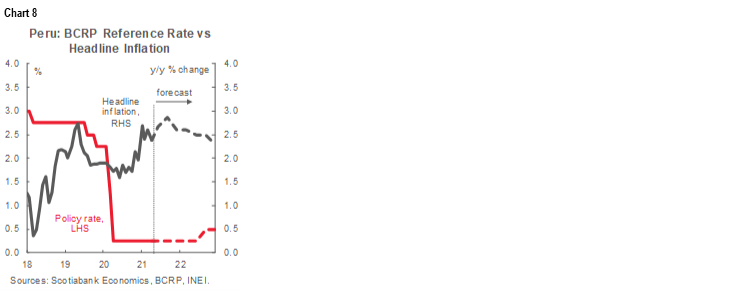

At its monthly meeting on Thursday, May 13, the Board of Peru’s BCRP decided to keep its key interest rate unchanged at its current record low of 0.25% for a thirteenth consecutive month, as widely expected by both Scotiabank Economics and the market consensus (chart 8). The BCRP reference rate has been at 0.25% since April 9, 2020 following the onset of the pandemic. In its statement, the Board reiterated its forward guidance from previous months: it advised that the benchmark rate would remain low for an extended period and, in any event, for so long as the pandemic’s effects on inflation and its determinants persist. The Board also repeated its commitment to use “diverse instruments” to support the monetary stimulus it is providing, should this prove necessary. The current policy mix seeks to strengthen long-term interest rate transmission mechanisms.

Inflation showed a slight decline in April due to supply factors, going from 2.6% y/y in March to 2.4% y/y, but it was still above both the BCRP’s 2% y/y target; (chart 9); still, it remains in line with our 2.6% y/y forecast for end-2021 (chart 8, again). Recent price pressures have come from non-core items and fuels. In contrast, core inflation fell slightly from 1.8% y/y in March to 1.7% y/y in April, but it remained below the 2% y/y target for headline inflation. The Bank's most recent survey of inflation expectations 12 months ahead moved from 2.2% y/y to 2.3% y/y. We see little immediate reason for the Board to change its current stance, even though level effects are expected to push headline inflation close to 3.0% y/y in the coming months. Slack is expected to persist in Peru's economy well into 2022.

Taking recent developments into account, we reconfirm our forecast that the BCRP Board will keep its reference rate on hold at 0.25% until Q3-2022 (chart 8, again). An eventual rate increase would be preceded by a gradual shift in the Board’s forward guidance toward a less data-dependent line. Monetary expansion, one of the most powerful in the region, reached its highest rate in Q3-2020, but it has since showed a slight slowdown. The growth rate of loans shows a more visible slowdown, from 12% y/y at end-2020 to 9% y/y in March (chart 10).

The statement highlighted that business expectations showed some moderation in April after having improved in March. This deterioration likely reflected electoral uncertainty. Our 2021 economic growth forecast remains at 8.7% y/y, but we maintain an upward bias due to the better-than-expected economic performance we saw during Q1-2021. After the results of the run-off presidential election on June 6 are confirmed we may review our forecasts.

Regarding the FX market, the BCRP has sold USD 249 mn in the spot market so far in May and has provided liquidity amounting to USD 1.71 bn via repos, in the context of higher demand for dollars due to electoral uncertainty. The PEN has been registering unusual volatility on par with that experienced during last year’s pandemic shock. The BCRP has accumulated sales in the FX spot market totalling USD 2.9 bn YTD, although its net FX position has increased by USD 1.9 bn YTD, reflecting other positive developments in the balance of payments. The supply of derivatives, which increased significantly in March (USD 4.4 bn) and April (USD 1.3 bn), has been stable so far in May. The imbalance in the spot FX market remained high in April, reaching a deficit of USD 5.7 bn; it has likely continued to increase so far in May, due to higher demand for spot dollars.

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.