- Chile: Early indications from the weekend’s voting

- Colombia: Real year-on-year GDP growth returned to positive territory in Q1-2021, a quarter earlier than expected

- Peru: Polls tighten further in presidential race

CHILE: EARLY INDICATIONS FROM THE WEEKEND’S VOTING

Preliminary indications from the weekend’s voting imply that Chile’s governing coalition shall not control the one-third of seats needed in the new Constitutional Assembly to play a decisive role in the drafting of articles. By late on Sunday, May 16, about 90% of ballots cast in the low-turnout elections for Chile’s Constitutional Assembly had been counted and members of Pres. Piñera’s Vamos por Chile and allies had secured only about 21% of votes—which put them on track to hold only around 38 spots in the emerging155-member body. All draft articles for the new constitution to be proposed by the Assembly have to be endorsed by one-third of its members. With right-of-centre candidates looking unlikely to be able to secure 52 seats, they won’t be in a powerful position to block drafts or broker their support for compromise text. Most observers had expected more balanced results in the Assembly elections since the right-of-centre coalition campaigned under a single party list, while political movements in the centre and left of Chile’s political spectrum mounted more fragmented campaigns with multiple lists of candidates. As a result, Chilean asset prices are likely to experience some pressure in the near term.

Votes are also being tallied that were cast in elections for gubernatorial, mayoral, and city-council positions.

—Brett House & Jorge Selaive

COLOMBIA: REAL YEAR-ON-YEAR GDP GROWTH RETURNED TO POSITIVE TERRITORY IN Q1-2021, A QUARTER EARLIER THAN EXPECTED

In data out on Friday, May 14, Colombian real GDP grew by a robust 1.1% y/y in Q1-2021, better than both the consensus expectation of -0.4% y/y, and our forecast of -0.13% y/y. On a sequential basis, the economy gained 2.9% q/q sa, moderating from the 6.1% % q/q sa growth we saw in Q4-2020. In Q1-2021 the economy nearly closed its gap versus pre-pandemic quarterly production levels (chart 1). The results were a strong positive surprise since in January and at end-March, Colombia’s major cities implemented strict lockdowns. The Q1 data showed that the Colombian economy is gaining resilience, is handling restrictions more ably, and is responding more quickly to re-opening opportunities. Although we will put our 5% y/y GDP growth forecast for 2021 under revision following Q1-2021’s upside surprise, the first quarter’s performance is set to be offset by a weaker-than-expected Q2-2021 owing to social unrest. Since approximately 10 out of Q2’s 90 days have already been affected by protest, the combined impact of developments in the first half of the year could well keep our annual forecast unchanged. However, the situation has normalized in recent days.

According to the monthly economic activity indicator—the ISE—the economy rebounded strongly in March: on an annual basis, the gain was 11.8% y/y, which was above market consensus of 7.3% y/y and our expectation of 6.8% y/y. On a sequential basis, activity increased by 1.6% m/m sa, better than our projection of -1.5% m/m sa. March’s gains were led by agricultural activities (4% y/y and 9.5% m/m sa), construction and industry (24.9% y/y and 2.3% m/m sa), and services-related sectors (10.2% y/y and 1.0% m/m sa). It is worth noting that at end-March, the size of the overall economy was just -0.5% below pre-pandemic monthly levels (chart 2). In fact, the primary and services-related sectors were above their pre-pandemic monthly levels from February 2020.

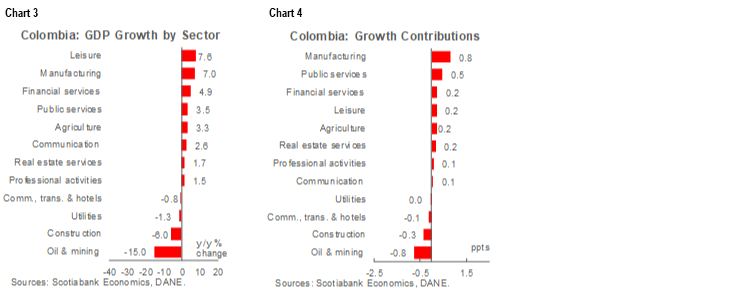

On the supply-side (charts 3 and 4), some of the worst-performing sectors in Q1-2020 were mining (-15.0% y/y); construction (-6.0% y/y ), and commerce, transport, and hotels (-0.8% y/y)—which together subtracted -1.2 ppts from the quarter’s topline GDP growth rate. On the positive side, manufacturing (7.0% y/y), public services (3.5% y/y), financial services (4.9% y/y), and agriculture (3.3 % y/y) dominated, contributing 1.7 ppts to the overall year-on-year growth rate for the quarter. One thing to highlight is that, according to the ISE monthly GDP proxy for March, mining was the only sector out of the 12 measured that showed a year-on-year contraction. Mining is facing a strong negative structural headwind from changing global demand for coal, while national oil production remains weak.

From the expenditure side, domestic demand increased by 1.6% y/y in Q1-2021 (chart 5) on the back of a 2.3% q/q sa sequential gain. Private spending expanded by 1.9% q/q sa and 1.5% y/y on better durable goods consumption growth (up 2.6% q/q sa and 13.1% y/y); services consumption was almost flat compared with a year ago (-0.5% y/y), but was up 3.1% q/q sa from Q4. Despite COVID-19 related restrictions, the recovery continued to progress on a solid path in March: the consumption basket was less focused on consumer staples and, instead, featured a new shift to leisure-related services.

Government spending was up 4.6% y/y in Q1-2021, a robust expansion, while in sequential terms it grew by 0.5% q/q sa. Investment expanded by 1.4% y/y owing to a remarkable 20.7% q/q sa gain in the first quarter. The investment rebound was located in construction-related spending (housing was up 22.7% m/m sa) and machinery and equipment purchases (up 11.7% m/m sa), which pointed to some confidence in the economic recovery.

Net exports contributed negatively to Q1-2021 growth (-0.4 ppts, chart 6) because imports were down (-3.9% y/y), but exports pulled back more (-8.3% y/y). The global shift to clean energies hurt coal exports and domestic oil production softened. On the other side, household consumption and business investment lifted imports from Q4-2020. Having noted all of this, we continue to expect the current account deficit to widen in 2021 to -3.8% of GDP as a result of the domestic demand recovery.

All in all, economic activity in Colombia continued to surprise to the upside in Q1-2021, and the gap versus pre-pandemic production levels is closing faster than previously expected. However, the composition of economic activity is changing. Sectors such as manufacturing, agriculture, and some traditional services are leading the gains. Leisure activities continued to lag other improvements, but a gradual catch-up has begun.

The Q1 real GDP print leads us to affirm our expectation of a rate hike by the end of the Q3-2021, followed by additional moves to close the year with BanRep’s main policy rate at 2.5%. Despite the fact that uncertainty remains high, the economy is showing resilience. We will continue to monitor the labour market closely since its recovery is proceeding more slowly than the overall economy’s progress.

—Sergio Olarte & Jackeline Piraján

PERU: POLLS TIGHTEN FURTHER IN PRESIDENTIAL RACE

Peru’s run-off presidential candidates saw their polls tighten further over the weekend. In an Ipsos poll released on Sunday, support for Pedro Castillo stood at 40% versus a 37% share for Keiko Fujimori. Ipsos said that 14% of respondents intend to cast blank ballots, while 9% remain undecided. Voting is mandatory in Peru and failure to cast a ballot can trigger a fine of around USD 24.

—Brett House

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.