- Chile: March unemployment rate ticked up; BCCh vol dampening measures; April inflation projections

- Colombia: BanRep held; Pres. Duque pulled proposed fiscal reform; labour market slowed in March, while exports gained

- Mexico: Q1 GDP surprised to the upside; Moody’s confirmed investment grade

CHILE: MARCH UNEMPLOYMENT RATE TICKED UP; BCCH VOL DAMPENING MEASURES; APRIL INFLATION PROJECTIONS

I. Unemployment rate stood at 10.4% in March, but employment was still down -900k jobs compared with the pre-pandemic period

In labour-market data published Friday, April 30, the unemployment rate stood at 10.4% for the moving quarter ended in March, slightly above the 10.3% registered during December–February (chart 1). The re-imposition of quarantines and some seasonal factors led to both slow employment growth and job destruction in March. In fact, it was the first month since July 2020 in which job destruction has been observed. The INE reported that the potential unemployment rate (i.e., which includes potentially active workers) remained at 21.3%, a high level, but one slightly lower than in previous months: the rate came down owing to less pressure from the female workforce, probably reflecting some discouragement in this group.

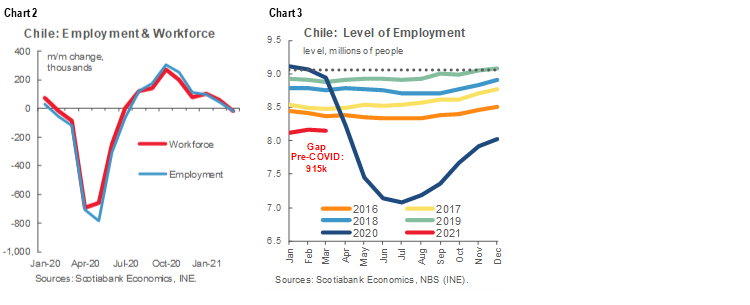

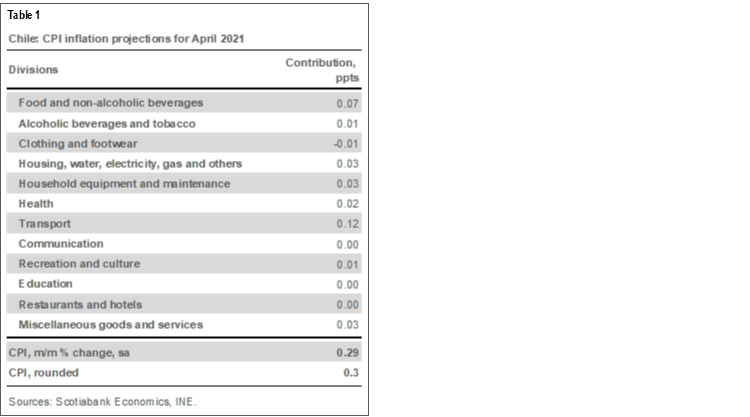

Job creation interrupted its slow, but sustained, recovery during March, a recovery that had been ongoing since August 2020. In the January–March moving quarter, 19.4k jobs were destroyed (chart 2), which slightly widened the economy’s gap with respect to the pre-pandemic level of employment. All in all, about 915k jobs remain to be recovered across the economy (chart 3).

At the sectoral level, we continue to see a high degree of heterogeneity and slower recovery of employment than observed in the activity figures, influenced by the differential impact of quarantines in different sectors (chart 4). While economic activity in some sectors such as commerce and manufacturing, has recovered to pre-pandemic levels, employment in these sectors continues to lag far behind. Labour-sensitive service sectors remain particularly impaired by mobility restrictions and social distancing, which has had tough impact on salaried jobs.

Informal jobs were not able to continue their trends of recent months. The informal occupancy rate was 26.7% during January–March, lower than the 28.9% observed in the same quarter of 2020, but up 0.2 ppts from December–February.

II. Central bank announces measures to counter market volatility following approval of a third round of pension withdrawals

On Thursday, April 29, the BCCh announced measures to counter market volatility stemming from the third round of withdrawals from pension funds that was approved on Wednesday, April 28. The central bank’s measures will be implemented from today, Monday May 3, 2021, and will include:

- Re-opening of the special program of Cash Purchases and Term Sales (CC-VP, Compra al Contado – Venta a Plazo in Spanish) to provide liquidity to the financial system. The total envelope of the re-opening amounts to USD 9.5 bn in addition to a window for renewals amounting to USD 0.5 bn. In the past, only bank bonds were accepted under the CC-VP program; this time, other bank instruments such as term deposits can be tendered. Renewals only after the second week of July; and

- Additionally, the repo window for one-month operations, open since November 2019, will be extended to August 2021.

Discount rates, the duration of available instruments, and participation limits per institution will be spelled out in the financial conditions of each facility. The BCCh noted that both the AFPs (pension funds) and insurance companies continue to have open and available market mechanisms at their disposal to obtain liquidity and facilitate an orderly adjustment of their portfolios.

III. Pension withdrawals’ implications for April inflation: we project 0.3% m/m sa, 3.2% y/y

The third round of withdrawals of pension-fund assets is likely to put pressure on goods prices, but this could be more than mitigated by a possible reduction in VAT rates, if approved. Either way, inflation uncertainty is set to increase into the second half of 2021.

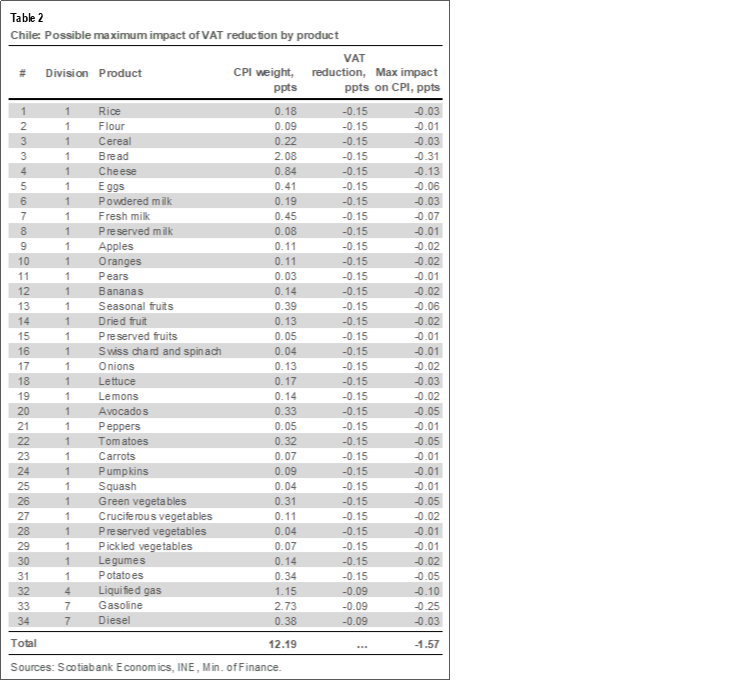

In the April price data set to be released on Friday, May 7, we expect to see a monthly inflation rate of 0.3% m/m sa (down from 0.4% m/m sa in March), in line with both the Survey of Economic Expectations and the Survey of Financial Operators; this slowing in sequential inflation would still lead to an increase in the annual inflation rate from 2.9% y/y in March to 3.2% y/y. On the upside, inflationary pressures are likely to be concentrated in gasoline prices, which could see a fourth consecutive month of price gains. Rental costs and some food products, such as avocados, cheese, and lettuce, are also likely to see gains, according to the Odepa (Office of Agricultural Research and Policy) price survey. On the other side, some downward pressures are likely to come from condo fees, which typically see seasonal declines in April.

April is set to be the twelfth consecutive month in which no price changes are officially recorded for products and services where data collection isn’t feasible, such as air transport services and tourist packages, and/or social distancing is difficult (e.g., gyms, sports classes, cultural shows, etc.). The re-imposition of quarantines during March, which were maintained through April, makes it difficult to resume collecting prices for these products; as a result, we expect the carry-over imputation method, which implies a zero monthly changes, to be maintained for a 13th month in May.

At the sectoral level, the aforementioned rise in gasoline prices implies that transportation could add nearly 0.12 percentage points due to the sequential monthly gain of 0.3% m/m sa (table 1). April could also see a 0.07 ppts contribution from food and non-alcoholic beverages owing to some seasonal effects in the sector. On the negative side, the clothing and footwear sector could cut -0.01 ppts from month-on-month inflation, again driven by some seasonal developments that would more than offset pressures from pension-fund withdrawals. In total, we expect eight divisions in the consumer-price index (CPI) basket to show price increases in April, while three are expected to see flat prices, with only clothing and footwear showing disinflation.

For May, we preliminarily project monthly inflation between 0.2% m/m sa and 0.3% m/m sa, which would bring annual inflation to around 3.5% y/y. On the one hand, the third round of withdrawals from pension funds, which should begin in the coming days, would add pressure on mass consumer-goods prices, in line with what we saw following the first and second rounds of withdrawals. Gasoline prices are likely to continue driving up inflation at least until June, owing to the evolution in international prices and the usual pass-through to local prices under the MEPCO (El Mecanismo de Estabilización del Precio de los Combustibles in Spanish).

Looking further ahead through the end of 2021, very preliminary estimates of the impact of the possible VAT reductions implies that their effects could be significant. The proposed VAT cuts, contained within the bill before Congress that would increase taxes on high-income earners and large companies, would reduce VAT rates on food from 19% to 4% and on fuels from 19% to 10% on a temporary basis until December 2022. Based on the limited information on this proposal that we have so far, we believe this could cut headline inflation by -1.6 ppts, which would likely be concentrated in the initial months of these changes. To generate this projection, we employ an assumption that the prices of goods fall in the same proportion as the reduction in the VAT (i.e., we assume unitary price elasticity). The tax cuts on food are expected to be focused on bread, flour, eggs, milk, cheese, fruit, vegetables, legumes, tubers, and cereals (table 2). The proposal to reduce the rates of VAT applied to food and fuels could be amended or may not be approved; additionally, if passed, these tax cuts may not be fully passed on to consumers.

—Jorge Selaive, Carlos Muñoz, & Waldo Riveras

COLOMBIA: BANREP HELD; DUQUE PULLED PROPOSED FISCAL REFORM; LABOUR MARKET SLOWED IN MARCH, WHILE EXPORTS GAINED

I. BanRep held its benchmark monetary-policy rate at 1.75% in a split vote; staff outlook improved

On Friday, April 30, BanRep’s Board left its benchmark monetary-policy rate at 1.75%, as expected by both ourselves and market consensus—although in a split decision, with six votes for stability and one member voting for a -25 bps cut. The Board’s unanimity lasted only for one meeting. Having said that, only six members attended the last Board meeting in March since Jaime Jaramillo wasn’t yet on the Board at that point. At the April meeting, the central bank’s staff presented to the Board fresh forecasts that highlighted positive revisions on its GDP outlook that raised the 2021 projection from 5.2% y/y to 6% y/y. Governor Leonardo Villar underscored in the press conference following the meeting that the Bank’s monetary policy stance remains very expansionary and supports economic recovery. Also, Gov. Villar emphasized that a rejection of fiscal reform could limit the bank’s room to maintain countercyclical monetary policy.

Some additional key features of the decision included:

- Although the growth outlook improved, uncertainty remains high owing to new COVID-19 waves, which could lead to longer lockdowns and delay fiscal discussions. Further information about staff's projections is expected today, Monday, May 3, with the release of the Monetary Policy Report, and on Wednesday in the ensuing explanatory press conference;

- Regarding inflation, the communiqué underscored that market expectations and staff projections are aligned with a convergence to the 3% target between 2021 and 2022; and

- The communiqué underscored the relevance of fiscal adjustments since an adverse scenario would lead to higher funding costs for Colombia.

To sum up, BanRep’s decision to hold was in line with market projections. Despite the split vote, we assign a low probability to a rate cut; instead, staff’s improvements to their economic projections tilted risks to the hawkish side. That said, it will be relevant to monitor the May Monetary Policy Report due to be released today, Monday, May 3, and its related press conference on Wednesday, May 5. The minutes of the meeting, also due out today, will be key to understanding how the Board members skew on these issues.

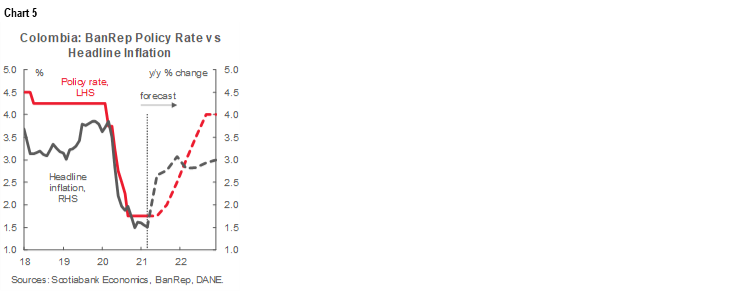

We maintain our call that the BanRep will remain on hold over the coming months with the possibility of a first rate hike by Q3-2021 (chart 5). The lift-off in policy rates we anticipate later in 2021 would be backed on further consolidation of the economic recovery, with inflation rising closer to the BanRep’s 3% y/y inflation target.

II. President Duque withdrew the fiscal reform from Congress and will negotiate a new proposal

On Sunday, May 2, President Duque decided to withdraw the fiscal reform proposals from Congress due to the great opposition that this initiative had created among dominant stakeholders and the general population. In fact, on April 28, Colombia entered a nationwide strike that lasted until Saturday, May 1, with some violent outbursts in the country’s main cities.

Significant political parties in Congress (i.e., Cambio Radical, Partido de la U, Partido Liberal) that jointly account for 41.5% of the Senate and 53% of the House, rejected the bill, asked for its withdrawal, and emphasized that if the proposals remained under discussion, they would vote against them. Therefore, the possibility of the original fiscal reform proposals being approved was nil. We had initially thought that a watered-down reform package could make it through Congress. However, rising social discontent and low political support, even from the governing Centro Democrático (17.92% of votes in the Senate and 18.71% of votes in the House), led to the announcement of the proposal’s withdrawal.

President Duque said that the government would draft a fresh proposal in an effort to forge a consensus with other political parties that would gain Congress’ approval. But he did not lay out any deadline for the new proposal, which raises concerns about the likelihood that any fiscal reform package will pass before June—and whether any new reform will increase revenues enough to send a clear message of fiscal consolidation to the markets and the ratings agencies that would be sufficient to retain Colombia’s investment-grade status. The looming expiration of some social programs by mid-year could motivate a quick debate in Congress, though this might mean the resulting reform would be less ambitious than hoped.

It is clear that modifications to the VAT (intended to increase revenues by 0.6%) and efforts to broaden the base of personal income taxpayers are both dead. We think a revised proposal will focus on taxing high-income earners, delaying some tax reductions for companies, and increasing some corporate taxes. It is too early to try to project how much revenue a revised proposal would generate; however, any package will need to raise an amount equivalent to at least one percentage point of GDP to stabilize Colombia’s fiscal situation.

Given these developments, it’s fairly certain that the next president will have to develop and pass another tax-reform package in two-years’ time—continuing a well-worn custom for Colombia. The country’s fiscal rule may also be up for revision.

The withdrawal of the fiscal reform proposal will increase volatility, steepen the yield curve even further, and bring more COP depreciation in the short-run—at least until President Duque brings forward his new plans.

III. Labour market slowed down its speed of recovery

On Friday, April 30, DANE reported that the March nationwide unemployment rate came in at 14.3%, still well above March 2020’s 12.6%. At the same time, the urban unemployment rate (i.e., for 13 major cities) was 16.8%, lower than the 17.4% expected by market consensus and still high compared with the 13.4% in March 2020. The seasonally adjusted series revealed that the national unemployment rate improved slightly to 13.9% versus 14.5% in February 2021, while the urban unemployment rate improved from 16.7% in February 2021 to 16.1% in March (chart 6).

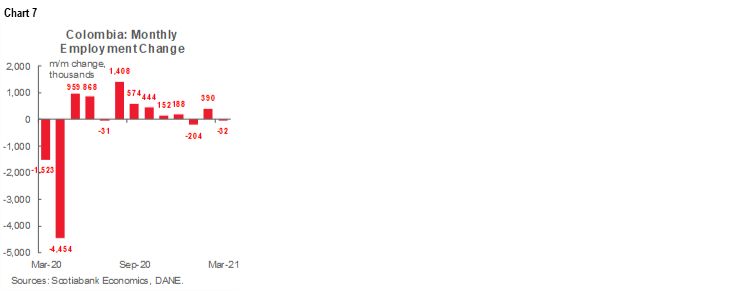

In March, the labour market mildly improved despite the existence of some minor restrictions at the end of the period. Total active jobs in March were still down by 1.3 mn positions relative to the pre-pandemic period (March-2019), but compared with March-2020, when the first lockdown started, employment was up by 271k. We also saw a significant increase in unemployment (up by 468k), led by the people who are coming back to the labour market from the inactive population that, in fact, was smaller by -239k versus March 2020. As expected, monthly labour market gains are gradually shrinking (chart 7): the main cities still face challenges in job creation, especially in the services-related sectors most sensitive to new lockdowns.

It is worth noting that in March 2020, Bogotá implemented a hard lockdown on March 20, while in the rest of the country it started on March 25. Restrictions at that time shut down around 30% of the economy, and immediately impacted the labour market. Although the job market posted year-on-year gains in March 2021, at this point it is more useful to compare the latest jobs numbers with March 2019 as the relevant pre-pandemic benchmark. From a sectoral perspective, employment losses as of March 2021 versus pre-pandemic levels remained concentrated in the leisure sector (-482k), and the public administration, education, and health sectors (-451k), which together accounted for 71% of the contraction in jobs versus March 2019 (down -5.94%). Year-on-year employment expanded (up 271k compared with March 2020), mainly due to the construction sector (up 152k) and the commerce sector (up 148k), which underscored the positive effects of recent re-openings. The gap between the female unemployment rate (18.8% versus 16.1% one year ago) and male rate (10.9% versus 10.1% in March 2020) continued to be a source of concern.

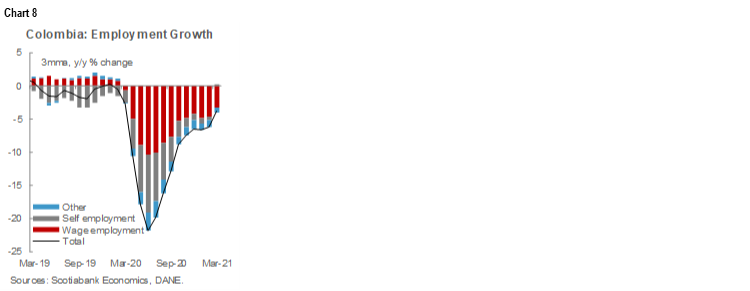

The evolving quality of jobs also remains a worry. Growth in informal jobs continued to lead to the overall employment recovery into March (chart 8). We attribute these dynamics to the relative flexibility of the informal economy. However, it is worth noting that informality increased from 46.7% in March 2020 and its share stood at 48.8% in March 2021.

Summing up, March labour market data showed that employment keeps improving, although with diminishing marginal gains from previous months as the economy is still operating below capacity and is facing changing conditions due to the latest waves of COVID-19. We believe the employment recovery will continue at a gradual pace, with a slower decline in the unemployment rate as members of the inactive population return to the labour market.

IV. Exports strongly rebounded amid better commodity prices, but also on better trade-partner dynamics

According to DANE’s release on Friday, April 30, March’s monthly exports stood at USD 3.33 bn (up 36,4% y/y, chart 9), the best monthly export performance since the pandemic began—but skewed by the year-on-year comparison with the first month of lockdowns in 2020. Manufacturing exports grew by 15.2% y/y, while the agricultural sector’s exports expanded by 11.9% y/y; additionally, oil & mining-related exports rebounded by 17.6% y/y to complete the positive picture.

Traditional exports as a whole were up 40.9% y/y in March (chart 10), on the back of higher commodity prices. Oil-related items represented 32% of March’s total exports, close to the average of 40% in 2019. Despite the significant recovery in oil prices, lower production remained a challenge and drove the sector’s export volumes down by -21.6% y/y; however, the positive price effect took the overall figure up 71.5% y/y. The value of coal exports contracted by -17.91% y/y owing to a reduction in volumes exported (-43.4% y/y)—even when compared with the first month of lockdown—which was partially offset by higher international prices. The monthly value of coffee exports increased by a robust 63.5% y/y in March due to both higher prices and greater volumes (up 38.11% y/y). We expect the positive performance of traditional exports to continue to be supported by better prices, although production will need to be monitored.

The value of non-traditional exports amounted to USD 1.69 bn in March, an increase of 32.3% y/y compared with a year ago (chart 10 again), and the best level since the record high in November 2007. Significantly, expanded exports of gold (up 36.5% y/y), chemical products (a 9.3% y/y rise), and flowers (a 32.2% y/y gain) drove the overall advance in non-traditional goods exports.

All in all, March’s exports numbers showed some benefits from rising international commodity prices and the economic re-opening of Colombia’s main trade partners. The rebound in non-traditional exports pointed to the ongoing consolidation of growth in the manufacturing and agricultural sectors. Despite traditional exports being close to record highs, we still see room for further improvements as the world gets the pandemic under control and solidifies its recovery path. That said, although exports should keep rising in 2021, imports could see even greater gains as domestic demand expands: we still expect a current account deficit of about -3.8% of GDP or wider in 2021, larger than the -3.3% deficit observed in 2020.

—Sergio Olarte & Jackeline Piraján

MEXICO: Q1 GDP SURPRISED TO THE UPSIDE, MOODY’S CONFIRMED INVESTMENT GRADE

I. Q1 GDP recovery lost momentum, but still surprised to the upside

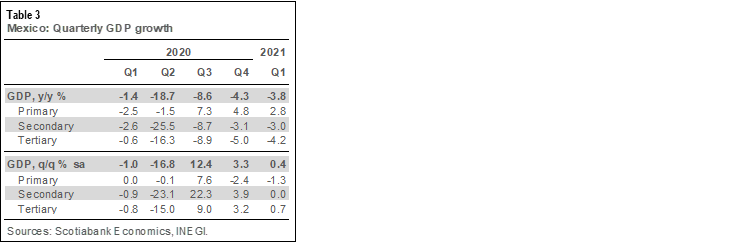

On Friday, April 30, INEGI published the Q1-2021 GDP data. Even though the Mexican economy registered its sixth consecutive quarter of year-on-year declines in Q1-2021 (chart 11), we also witnessed a third consecutive quarter-on-quarter improvement and three consecutive quarters of positive sequential prints (table 3). The positive sequential print in Q1 was a surprise given that the Bloomberg consensus anticipated a flat print.

The first quarter of 2021 saw overall activity register a -3.8% y/y drop, which was 20 bps better than the consensus and 10 bps better than our own expectation (consensus -4.0% y/y; Scotiabank -3.9% y/y), and showed a somewhat more balanced composition in growth than in anticipated. Up to Q1, growth had been primarily driven by external factors; in contrast, domestic demand seemed to pick up toward the end of Q1. This local improvement had been foreshadowed in the March trade release, where Mexico surprisingly swung into a trade deficit—driven by stronger imports. During previous quarters, the primary drivers of the Mexican recovery had come from external factors such as remittance flows to support consumption and abnormally strong net exports.

Looking at the sequential data, it was noteworthy that despite being a weak quarter compared to the second half of 2020, we still saw services activity hold up relatively well. This adds to the early evidence of recovery in domestic demand, even though the start of 2021 saw a new round of pandemic induced lockdowns around the country.

—Eduardo Suárez

II. Moody’s confirmed Mexico’s credit rating

On Thursday, April 29, Moody’s ratified Mexico’s credit rating, confirming its long-term foreign and local-currency assessments at Baa1, three notches above investment grade. In its statement, Moody’s said that this decision reflected two key factors: “First, the deterioration of the fiscal accounts has been contained, and is very likely to remain so, partly as a consequence of the austere fiscal stance adopted during the crisis. Second, the significant economic contraction—also a consequence of the government’s austere fiscal policy—is likely to be reversed, and medium-term growth is likely to return to its pre-crisis trend, supported in the short term by strong growth in the United States.” In this regard, the Ministry of Finance and Public Credit pointed out that Moody’s decision “is in line with the confirmations issued by Fitch and S&P at the end of last year”, and with this, “The three rating agencies have recognized the robust track record of effectiveness of the macroeconomic policies” of Mexico.

—Paulina Villanueva

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.