- Colombia: BanRep kickstarts hiking cycle; concerns on inflation; August employment posts solid gains

- Mexico: Banxico hiked its reference rate 25 bps, as was widely expected

- Chile: Sustained positive economic activity and labour market data in August

- Peru: Renewed tension between the President and Congress

COLOMBIA: BANREP KICKSTARTS HIKING CYCLE; CONCERNS ON INFLATION; AUGUST EMPLOYMENT POSTS SOLID GAINS

I. BanRep starts hiking cycle increasing the rate by 25 bps to 2% in a hawkish split vote

On Thursday, September 30, the Board of the central bank (BanRep) started its hiking cycle increasing the monetary policy rate by 25 bps to 2%. The move was widely anticipated, however, the split vote signalled a hawkish tilt as 4 members voted for a 25 bps hike, while 3 members voted for a 50 bps hike. Colombia was the sole country among the Pacific Alliance nations yet to begin a hiking cycle in the pandemic recovery period.

The hiking cycle started amid an improved macroeconomic environment but with some concerns that current temporary shocks on the headline inflation would have long-lasting effects. At the press conference, Governor Villar and the Ministry of Finance (MoF) highlighted that uncertainty remains high, thus requiring a gradual approach in adjusting the monetary policy rate. As we explain below, upcoming inflation prints will be critical to determine the pace.

The central bank staff revised up, again, its GDP growth forecast for 2021 from 7.5% to 8.6% (our own is 8.2%), while in 2022 the expansion is expected at 3.9%.

Some key features of the decision included:

- GDP growth forecast was revised up from 7.5% to 8.6% for 2021. The positive revision was on better expectations for the domestic demand, that said, the output gap is closing faster than expected by the central bank and from our perspective, it justifies a gradual hiking cycle, as the uncertainty remains high and risk of a new COVID-19 wave remains.

- On the inflation side, the Board emphasized that current shocks are temporary, however, in the press conference, Governor Villar emphasized that the main risk is the current shocks to have long-lasting effects amid the indexation effect for 2022. We think September's inflation (to be released on October 5) is critical since it would trigger a 50 bps hike if it comes significantly above expectations. On the other side, if September inflation is a non-event, we expect that for the rest of the year annual inflation to stay below 5% as the VAT holiday would moderate somewhat (-15 bps to total inflation approx.) inflation pressures by the end of 2021, and moderate indexation effects.

- Regarding the external sector, the central bank increased its estimation for the current account deficit to 5.0% of GDP in 2021 (previous estimate: 4.5% of GDP) due to a widening in the trade balance deficit. However, the central bank considers the financing will still be supported by capital inflows and FDI.

- Balancing risks: BanRep highlighted that uncertainty remains high, and downside risks prevail for economic activity; while inflation, closing 2021 at high levels, could produce a higher indexation effect.

During the press conference, Governor Villar highlighted that monetary policy will continue to be expansionary, and that a gradual approach is still appropriate. Language was cautious, however, underscored by inflation as the main concern, given the possibility of long-lasting effects that could affect inflation expectations. We think that September’s CPI inflation will be key to anticipate a more hawkish movement for the October meeting. For now, although we know is a close call, we still expect a 25 bps hike, closing the year at 2.50% and reaching 4.5% by Dec-2022.

II. August employment data shows consistent narrowing of gaps versus pre-pandemic; strong recovery amid reopening consolidation

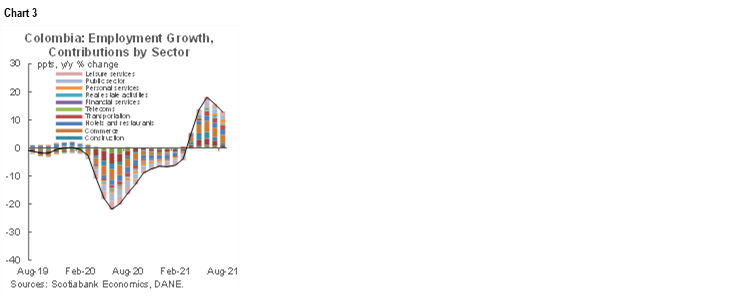

Employment data for August, released on Thursday September 30, again delivered a positive surprise in the Colombian labour market amid consolidation of economic reopening and “back to the normal” measures in main cities. The economy created more than 400 thousand jobs for the second month in a row (see July’s figures here), significantly contributing to closing the employment gap versus the pre-pandemic period.

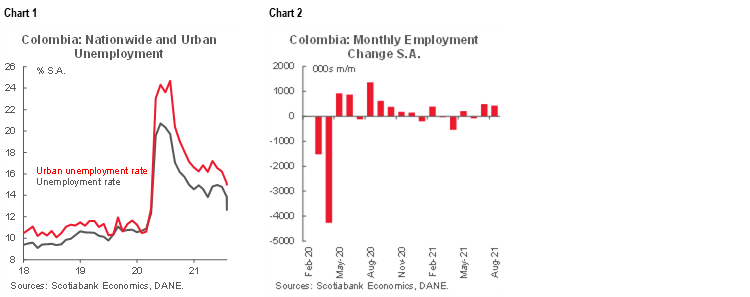

Colombia’s nationwide unemployment came in at 12.3% and urban unemployment (main 13 cities) at 14.2%. In seasonally adjusted terms, the nationwide unemployment rate was 12.6% (improving from the 13.9% in July) and for the urban area 15.0% (improving from the 15.1% in July), reaching the best figure since the pandemic began (chart 1). It is worth noting that in July total active jobs were down by 1.23 million (-5.5% versus pre-pandemic in 2019), and in August this gap reduced to 424 thousand (-1.9% relative to August 2019) (chart 2). By August, Colombia had recovered 90% of the job losses registered in the worst of the pandemic (April 2020).

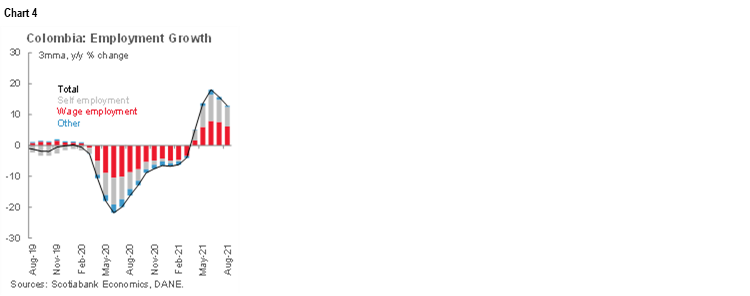

From a sectoral perspective, services-related sectors were the best performers amid the almost complete normalization that is taking place. Around 60% of yearly employment gains came from commerce (+466 thousand y/y), professional and administrative services (+426 thousand y/y), and hotels and restaurants (+311 thousand y/y) (chart 3). On the other side, if we compare with pre-pandemic employment levels, main lags are concentrated in the manufacturing sector, especially in the clothing-related subsector (-157 thousand y/y versus pre-pandemic). In the same vein, domestic services and jobs for education-related services remain below pre-pandemic levels. We highlight that job creation was more balanced between rural and urban areas, contrary to the July dynamic when we saw better results in main cities.

The gender gap is improving since the female unemployment rate (16.4%) and male rate (9.4%) differential is narrowing. However, we underscore that around 94% of job losses since the pandemic began affected women. Going forward, we think that the rebound in services sectors and children going back to school will continue improving opportunities for women to reintegrate in the labour force.

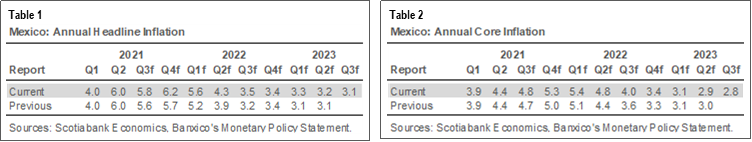

Regarding formality, in August, 71% of employment gains were attributable to self-employment, while formal jobs contributed in a lower proportion (chart 4). It is worth noting that compared with the pre-pandemic, self-employment increased by 8.6% (+781 thousand), while formal jobs are lagging the recovery (-7.6% versus August 2019). Informality for urban areas (in 13 major cities) is a high of around 45.5%, while for a wider sample (23 cities) it is 47%—both still concerning levels.

Summing up, August posted a positive surprise for the labour market recovery, showing that services sectors are leading the gains and are contributing to closing the gender gap. We expect the labour market to continue gradually improving, as major cities are now broadly operating normally, but the quality of the jobs remains a concern. For the months ahead, the employment recovery would continue but at a slower pace and concentrated in services sectors related to massive events. For now, the pandemic is still under control, a crucial element to maintain free mobility and sustain job gains.

—Sergio Olarte & Jackeline Piraján

MEXICO: BANXICO HIKED ITS REFERENCE RATE 25 BPS, AS WAS WIDELY EXPECTED

In its September 30 meeting, Banxico delivered the 25 bps hike that was widely expected by analysts (all but one of the 26 economists surveyed by Bloomberg) and priced into the TIIE curve. Although the change in the voter composition (which went from 3–2 in the previous meeting to 4–1 in the latest decision) marks a “hawkish turn” to the vote, it fell short of recent discussions by market watchers of whether a 50 bps move was in the cards. In our view, a 50 bps more is not justified at this point, but we consider the more committed Board to be a positive signal, as we still had lingering uncertainty about the pace of hikes given the lone former swing voter (Deputy Governor Heath) had signaled wavering commitment to tightening. On the latest meeting, the sole dissident was Deputy Governor Esquivel, who supported a pause (as he has done all year long).

Deputy Governor Borja, who is seen as close to future Governor Herrera made the switch from supporting a pause, to a 25 bps hike. A former colleague of Mr Herrera, Ms Borja’s switch could lead to market watchers re-evaluating their expectations of Herrera, whom we believe has been seen as dovish given his comments over both the operating surplus transfer and rate hikes earlier in the year. Before the decision, in the weeks heading to the September 30 decision, the TIIE curve had gone from discounting a ceiling to the tightening cycle at 6.00% (our own call, and what we believe are “neutral policy settings”) to a terminal rate at 7.25%. We would not be surprised if over coming days the TIIE market reacts to the more hawkish CB signal by pricing out some rate hikes. At this point in time, we do not see enough evidence to revise our own call for a terminal rate of 6.00%.

It was also noteworthy that Banxico revised its inflation forecasts higher once again, with the 2021 year-end inflation forecast going from 5.7% to 6.2% (table 1), while the 2022 year-end inflation forecast stood at 3.4% (table 1, again). In some ways, the forecast change we saw as most relevant was the revision to core inflation expectations for the end of 2021 from 5.0% to 5.3%, and for the end of 2022, from 3.3% to 3.4% (table 2). We think the upward drift in core inflation expectations is worth watching, as we believe that if we eventually see a more aggressive tightening cycle materialize, this will be the justification.

—Eduardo Suárez

CHILE: SUSTAINED POSITIVE ECONOMIC ACTIVITY AND LABOUR MARKET DATA IN AUGUST

I. Quarterly employment data shows recovery consolidation; narrowing gaps versus pre-pandemic

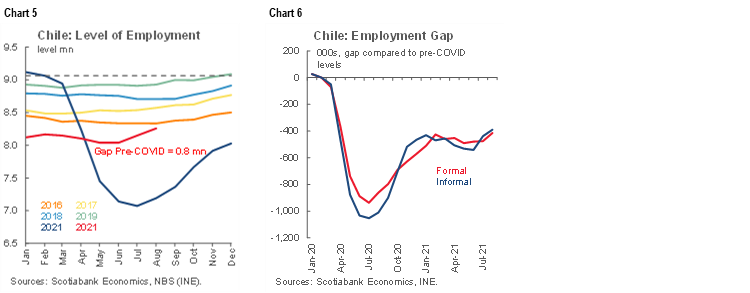

On Thursday, September 30, Chile’s statistical agency (INE) published the unemployment rate for the quarter that ended in August, which fell from 8.9% to 8.5% (Bloomberg: 8.3%). Compared to the quarter that ended in July, the decrease in the unemployment rate was explained by a higher increase in the level of employment (1.3%) compared to the workforce (0.9%). With these figures, the employment gap with respect to the pre-pandemic levels decreased to 805,000 (chart 5), of which 415,000 corresponds to formal employment to recover, while 390,000 to informal employment (chart 6).

II. Economic activity expanded 19.1% y/y (1.1% m/m) in August

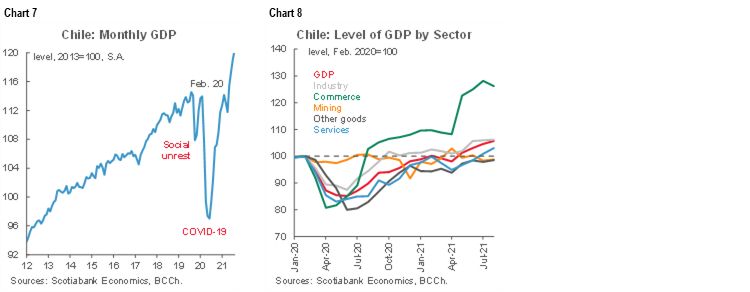

Subsequently, on Friday October 1, the central bank released the Imacec (leading economic activity index) for August, which expanded 19.1% y/y, below market expectations (consensus: 16.5% y/y) but close to our forecast of 18.5% y/y. According to the BCCh, the main contributions to the annual economic growth came from services and commerce, but also from construction and manufacturing sectors. In seasonally-adjusted figures, the Imacec expanded 1.1% m/m, below the rate observed in recent months (charts 7 and 8).

For September, we are expecting a new acceleration in the economic activity of services, mainly in restaurants and hotels, which more strongly benefitted from the reopening process. Our preliminary assessment forecasts an expansion between 13% and 14% y/y for the September’s Imacec. Lastly, we maintain our projected GDP growth of 10.7% y/y for 2021 and 5% for 2022, significantly above the expectations of the market consensus and central bank for the next year.

—Jorge Selaive, Anibal Alarcón & Waldo Riveras

PERU: RENEWED TENSION BETWEEN THE PRESIDENT AND CONGRESS

On Thursday, September 30, Congress called the Minister of Labour, Iber Maraví, in for an enquiry (locally, called “interpelación”) which focused mainly on Maravi’s past history with possible links to terrorist group, Sendero Luminoso. Following the enquiry, opposition groups in Congress were joining forces on Friday morning behind a motion to vote to censure Maraví—a form of impeachment.

At the time of writing, it appears possible, but not certain, that there will be enough votes for the censure. If that happens, it could open up a number of scenarios. One is that the government simply accepts the censorship decision by Congress and replaces Maraví. Another possibility is that the government submits a request for a vote of confidence on the issue. In this regard, the government seems divided. Whereas the Head of the Cabinet, Guido Bellido, has stated the intention of requesting a vote of confidence, President Castillo and other members of the cabinet have denied this intention. Given the government’s decision-making track record, it is uncertain at this point how they will proceed.

If the government submits a request for a vote of confidence, Congress will likely need to take a vote awarding or denying the cabinet its confidence. It the vote is to deny, then the cabinet would fall. President Castillo would need to replace the Head of Cabinet Bellido, and a new head of cabinet will need to put together a new cabinet.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.