- Colombia: Exports improved again boosted by high prices; though volume of traditional exports remain subdued

- Peru: Inflation continues on the rise prompting likely rate hike on Thursday; Central Bank President Velarde ratified

COLOMBIA: AUGUST EXPORTS IMPROVED AGAIN BOOSTED BY HIGH PRICES; THOUGH VOLUME OF TRADITIONAL EXPORTS REMAIN SUBDUED

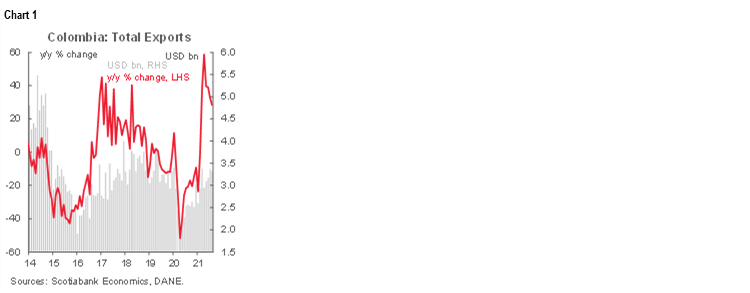

According to statistical agency DANE’s data release on Friday, October 1, August’s monthly exports stood at USD 3.32 bn (up 28.4% y/y, chart 1), slightly lower by value than the final figures for July, which amounted to USD 3.81 bn (we had initially reported USD 3.25 bn but figures were later revised). Oil and Mining led the gains rebounding by 26.6% y/y. Additionally, manufacturing-related exports and Agricultural-related exports expanded 50.7% y/y and 35.7% y/y, respectively.

Traditional exports as a whole were up 28.8% y/y in August (chart 2), compared to July’s 27.5% y/y, again benefitting from higher commodity prices, since oil and coal productions remained below from 2020 levels. Oil-related items represented 27% of August’s total exports, still below the average of 40% in 2019. Similarly to the previous month, better international oil prices offset Colombia’s lower production resulting in a dollar-terms increase of 6.2% y/y, despite the sector’s export volumes being down by -32.2% y/y (in July, volumes were down by -30.42% y/y). The value of coal exports contributed the most to traditional exports expansion increasing by 77.52% y/y, also owing to higher prices, while by volume it contracted by -6.46% y/y. Coffee exports also strongly rebounded by 62.66% y/y in August, showing recovery and normalization in operations since in the previous month, exports in the sector were negatively hit by the nationwide strike and logistic issues.

The value of non-traditional exports was USD 1.59 bn in August, an increase of 28.0% y/y (chart 2 again). Manufacturing exports drove the overall advance in non-traditional goods exports with an expansion of 26.6% y/y, on the back of chemical products (an 18.7% y/y rise), in the same way, transport equipment rose strongly (+75.5% y/y). On the other side, Agricultural products such as flowers (+23.1% y/y gain) and bananas and other fruits (+32.9% y/y) contribute to the overall rebound.

All in all, August’s exports are showing a positive dynamic on rising international commodity prices but also from improved demand for some manufacturing products. It is worth noting that, despite positive results, traditional exports remain below 2020 levels, especially due to losses in oil and coal-related products, showing that Colombia is not fully benefited by international price rebound since production lack this recovery. On the other side, non-traditional exports are on their best levels since 2012, showing that demand from main trading partners keeps improving. We expect a current account deficit of about -5.2% of GDP in 2021, compared against our earlier view of -4.4%, and larger than the -3.3% deficit observed in 2020 as exports rebound are lagging the imports recovery.

—Sergio Olarte & Jackeline Piraján

PERU: INFLATION CONTINUES ON THE RISE PROMPTING LIKELY RATE HIKE ON THURSDAY; CENTRAL BANK PRESIDENT VELARDE RATIFIED

I. Inflation continues to rise above levels not seen since 2009; rate hike expected on Thursday evening

Peru’s inflation increased by 0.40% m/m in September, lower than in the previous month (0.98% m/m in August) and than our forecast of 0.54% m/m, but above the Bloomberg consensus of 0.16% m/m. Headline yearly inflation jumped from 5.0% y/y in August to 5.2% y/y in September (chart 3), above the upper limit of the central bank’s target range (between 1% and 3%) for the fourth consecutive month, the highest figure since 2009. This pace also exceeds the recent update of the BCRP’s inflation forecast from 3.0% to 4.9% for this year. These results are in line with our inflation forecast of 6.5% for the full year in 2021 and 4.5% for 2022.

Core inflation also continued to creep upward, going from 2.4% y/y in August to 2.6% y/y in September, exceeding the 2% y/y target for headline inflation and rising.

Rising production costs have become more widespread, as higher raw materials and energy prices are compounded by higher global shipping costs. Wholesale inflation, linked to production costs, continues to rise, up 13% y/y, the highest rate in 27 years. These sources of pressure on prices have not fed through fully locally and are likely to persist for the rest of this year and into the next.

Given the risk of an incipient inflation-depreciation spiral, the BCRP needs to put the brakes on both, quickly. Although the depreciation of the PEN lost some speed in August (13% y/y), it picked up again in September (15% y/y) in response to persistent political uncertainty. The carry-over effects of the FX on inflation could persist in the coming months, effecting growing concerns at the BCRP. Over the last two months, the central bank has raised its reference rate by 75 basis points to 1.00% and strongly increased its reserve requirements for bank PEN deposits, thereby withdrawing PEN liquidity from the system. We see the BCRP likely to increase its benchmark rate again at its meeting on Thursday (October 7) by at least 25 bps.

—Mario Guerrero

II. Central Bank President Julio Velarde ratified by government

Incumbent Central Bank President, Julio Velarde, has been ratified by Peru’s administration, along with three board directors—a decision that will be published in the country’s official government gazette and later submitted to Congress for approval. Mr Velarde, who has been at the helm of Peru’s central bank since 2006, would remain at his post for another 5-year term. The government, through statements by Minister of Finance Pedro Francke, had previously communicated its intent to ratify Mr Velarde, however, the long two-month delay to do so had stoked uncertainty. Congress will now need to appoint three more board directors to complement the four government appointees (including Mr Velarde).

—Adriana Vega

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.