- Colombia: President Duque signed into law long-awaited fiscal reform following congressional approval

COLOMBIA: PRESIDENT DUQUE SIGNED INTO LAW LONG-AWAITED FISCAL REFORM FOLLOWING CONGRESSIONAL APPROVAL

Colombia’s administration at last succeeded at delivering a much-awaited Fiscal Reform package, following last week’s congressional approval on September 9. President Duque signed it into law yesterday (Tuesday, September 14), despite the turmoil that surrounded Colombia’s fiscal reform at the beginning of the year and after losing the investment grade by two out of three international agencies. The reform, although far from the structural change that Colombia needs, sets out a path to stabilize public finances.

The initial proposal presented by the government had 34 articles, but following its congressional passage, the total number of articles increased to 65. Nonetheless, the main structure of the government’s proposal was not changed and, potential additional fiscal income is still estimated at 1.2% of GDP in the long term (~COP 15.2 tn). Congress also approved the changes to the fiscal rule without significant changes, which means that now Colombia will operate under a debt anchor for the Central Government in a gradual reinstatement starting next year.

Five articles were withdrawn from the original proposal, including the one about the reduction from 5% to 0% in the withholding tax for debt investments by offshore agents. Among the 36 new articles are proposals to modify some fiscal programs to: formalize micro and small business; rules on declaration of hidden assets by natural persons; the management of some special assets under government administration (property seized for illegal activities); and the use of excess of liquidity by regional governments; among other measures such as the three VAT holidays.

All in all, the fiscal reform passed without substantial problems as main sources of additional revenues will come from the corporate sector (~1% of GDP) and from fiscal programs of austerity and reduction on tax evasion (0.2% of GDP). We consider the latter as ambitious, given that in previous administrations the nation already encouraged significant spending cuts and reinforcement of the tax administration entity DIAN.

What about the fiscal rule?

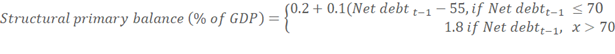

Proposed changes were approved by congress for the most part unchanged. As we discussed in a Latam Daily in July, the fiscal rule establishes a debt limit at 71% of GDP and, a long-term anchor of 55% of GDP for the Central Government. Each year the country should achieve a primary balance (excluding extraordinary transactions such as asset sales) under the following rule:

The fiscal rule will be fully implemented in 2026, in the meanwhile net primary fiscal balance for the Central Government shouldn’t be less than -4.7% of GDP in 2022, -1.4% of GDP in 2023, -0.2% of GDP in 2024, and +0.5% of GDP in 2025, regardless of the current debt level. In 2021 the fiscal rule will remain suspended, which means a deficit of -8.6% of GDP for the Central Government, according to the latest MTFF.

Another change in the fiscal rule was creating an autonomous fiscal rule committee, which will have seven members, five experts designated by the Ministry of Finance, and two representatives from Congress (the president of each chamber for the economic affairs committee). A relevant change is that now the committee will have a budget to make a more robust analysis supported by technical staff.

Our take:

The fiscal reform approval is positive news. While it was not structural, it outlines a road towards more sustainable fiscal accounts. The potential additional revenue is almost guaranteed by the corporate sector; however, the fiscal austerity and tax evasion control metrics are things to keep an eye on.

On the fiscal rule side, we think it was a positive gain, however, it wouldn’t be implemented until 2026. Nonetheless, talking about debt metrics instead of only fiscal balance is a more transparent approach.

Either way, as Minister Restrepo said, Colombia will need yet a new fiscal reform in a couple of years in view that the current Law represents only two-thirds of the total required adjustment. That said, Colombia will continue its tradition of being a “serial fiscal reformer” and the next government will have again to face this challenge.

—Sergio Olarte & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.