- Colombia: Momentum trends upwards as economic activity outperforms expectations; revised forecasts for GDP and 2022 rate

- Peru: Q3-2021 kickstarts with robust GDP growth in July; BCRP Q2 inflation report due Friday

COLOMBIA: MOMENTUM TRENDS UPWARDS AS ECONOMIC ACTIVITY OUTPERFORMS EXPECTATIONS; REVISED FORECASTS FOR GDP AND 2022 RATE

I. July economic activity beat expectations again; revised GDP forecast for 2021 to 8.2% (from earlier 7.4%)

July manufacturing production and retail sales data published by Colombia’s statistical agency (DANE) on September 15 showed that Colombian economic activity continued posting stronger-than-expected gains as the reopening consolidates. As economic activity is recovering faster than expected, we are again revising up our GDP forecast from 7.4% to 8.2% for 2021 and to 4.4% (from 4.2%) for 2022, considering July’s coincident indicators results and soft data such as commercial confidence, energy demand, gasoline demand and mobility indicators for July and August. This scenario affirms our expectation of a 25 bps rate hike at the next BanRep meeting (September 30), though consensus is split (see below article on economic survey results).

In July, both manufacturing and retail sales data came in above expectations, as was the case in August, while other activity indicators related to the service sector showed that some activities are operating above pre-pandemic levels. The only weak point is that employment is still not rebounding at the same pace.

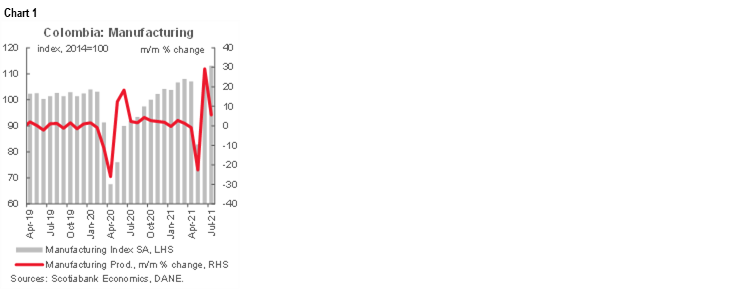

Manufacturing Production

Manufacturing production increased by a robust 20.1% y/y, well above market expectations (16.1% y/y) and our own expectation (13.2% y/y). Compared to the same pre-pandemic period (July 2019), the index grew by 10.1%. On a monthly basis, manufacturing increased 5.6% m/m in seasonally adjusted figures (chart 1), which confirmed the strong rebound of June’s data after the nationwide strike in May. In fact, manufacturing activity is now at its highest historical level and pre-pandemic no longer seems to be the benchmark to surpass.

In the YTD, manufacturing grew by 16.8% y/y. Compared to the same pre-pandemic period in 2019, manufacturing activity is 2.9% higher. Employment, however, continued lagging the manufacturing recovery, and it remains 4.5% below its level at the start of the pandemic. It is worth noting that recent employment recovery in the sector is 85% due to temporary contracts.

Only two activities contracted compared to pre-pandemic levels of activity: auto body manufacturing (-31%) and threshing coffee (-11.6%), while the rest of sectors are making gains versus the pre-pandemic period. The best performers were: beverages (+10.1%); oil refining (+10.1%) and chemical products (+37.9%). On the employment side, main lags are in the clothing sector with a 10.8% fall versus pre-pandemic, accounting for one third of total job losses.

From a regional perspective in a YTD basis, Antioquia (+24.0% y/y) and Cundinamarca (+18.1% y/y) led the rebound, while Cauca (-2.1% y/y) continues to lag the recovery as it was the most hard-hit region by the nationwide strike. In fact, in Cali (the capital city of Valle del Cauca), manufacturing activity fell -5.5% y/y. On the labour market side, Bogota accounts for around 58% of total job losses.

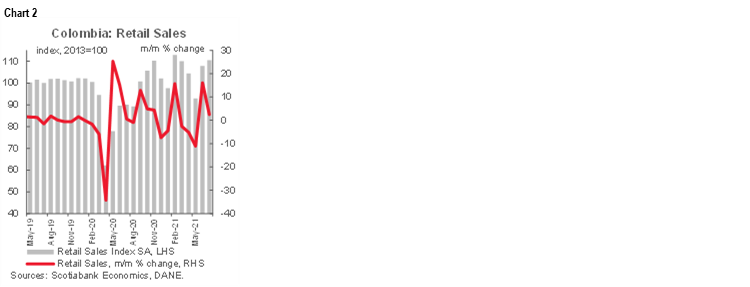

Retail sales

Retail sales expanded by 26.9% y/y, well above the expected 23% y/y in Bloomberg’s survey and our 18.3% y/y estimate. Compared to pre-pandemic levels (July 2019), retail sales are now 11.4% higher. On a YTD basis, retail sales increased by 5.4% relative to pre-pandemic (H1-2019). Total retail sales, excluding vehicles, increased by 2.5% m/m seasonally adjusted in July (chart 2), showing that activity normalization in the main cities is leading to higher demand of gasoline, among other products. However, employment again remains a concern as it remained -4.4% below pre-pandemic levels.

On a year-over-year basis, 57% of the increases were registered in gasoline demand (+32.1% y/y), vehicles for household use (+65.9% y/y), (non-car) vehicles and motorcycles (+75.9% y/y), and gasoline (26.5% y/y). The only line with y/y contraction was electronic devices resulting from a high base effect from July 2020 when Colombia had a VAT holiday that temporarily pushed up purchases of these products.

If we compare current retail sales versus pre-pandemic levels, the lines with best performance are: computers (+65%); gasoline (7%) and vehicles for domestic use (+34.7%). Additionally, DANE underscored that 2.6% of total retail sales excluding vehicles were through online channels, this ratio is below the 7.5% registered in July 2020, but still doubles the online transactions compared to the pre-pandemic period.

Other relevant indicators:

DANE also published July services sector data underscoring that the major lag in the economic activity recovery is in the film and TV production sector (-47.6% compared to pre-pandemic levels), while the best performers are postal services (+21.9%) and development of IT systems and data processing (+20.1%).

In addition, DANE data show that hotel occupation stood at 43.4% in July versus 36.1% in June, very close to those observed in H1-2019, the highest level since the pandemic began. In fact, 26.7 ppts were explained by leisure travelers, above pre-pandemic trends (25.5%), while hotel occupation for business travel lags as it contributed only with 13.9 ppts (pre-pandemic contribution was 18 ppts). That said, the sector’s income is still 19% below pre-pandemic and employment remains 37% lower. Bogota is the main contributor to the jobs contraction since business travel is very significant for the city. In fact, Bogota income is 55% below pre-pandemic levels, while the Caribbean coastal region is now above pre-pandemic levels, showing that leisure travels have almost normalized while business travel has not.

All in all, July’s activity data exceeded our expectations yet again. The fact that major cities lifted restrictions significantly boosted activity levels. However, the labour market remains a concern as employment remained stagnated across the board. On Friday, September 17, DANE will release the economic activity indicator (ISE), which probably would point that total activity is operating closer to pre-pandemic levels.

That said, we are increasing our GDP forecast for 2021 to 8.2% and for 2022 to 4.4%, which assumes that by Q4-2021 the economy will close its gap versus pre-pandemic and will start to make new gains.

II. Survey of Economists shows anchored inflation expectations but split opinions on rate decision at Sept. meeting; revised 2022 rate forecast

On Wednesday, September 15, the central bank, BanRep, released its monthly economic expectations survey. A top takeaway is that inflation will close above the ceiling of the central bank’s target range in 2021 while expectations remained broadly anchored for the long run, pointing that the current inflation spike continues to be seen as temporary. This view on inflation is consistent with last month’s survey results.

On the rate front, however, analysts are split on their expectations for the board’s decision at the upcoming September 30 meeting. Although the median points to a 25 bps hike (consistent with our own view), the survey shows divided expectations. In fact, some analysts still expect stability while others foresee a 50 bps hike. By the end of 2021 analysts expect monetary policy rate closing at 2.50% (again consistent with our forecast). The terminal rate for 2022, however, is now expected higher than in the previous survey (~4%), and we are ourselves revising up our forecast to 4.5% from an earlier 4%.The USDCOP, meanwhile, is still expected to appreciate by the end of the year.

- Near-term inflation. September’s monthly inflation is expected to come in at 0.30% m/m, putting annual inflation to September at 4.42% y/y (from the 4.44% in August). Having said that, survey dispersion remained high with a minimum expectation of 0.0% m/m and a maximum of +0.45% m/m, signaling still high uncertainty amid recent developments and their impact on prices. Scotiabank Economics expects September’s monthly inflation at +0.32% m/m and 4.44% y/y, given that food inflation, among other prices related to the reopening would rise again.

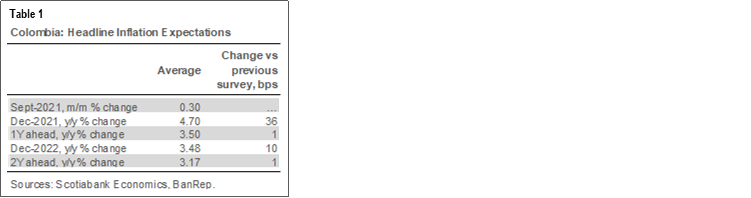

- Medium-term inflation. Inflation expectations rose to 4.70% y/y for December 2021, 36 bps higher than last month’s survey (table 1), however the recent inflation surprise is assumed to be temporary due to supply shocks, since expectations over the medium term continue slightly above the 3% y/y: 1Y forward inflation stood at 3.50% y/y (above last month’s reading at 3.49% y/y); and 2Y forward stood at 3.17% y/y (almost unchanged from the previous survey), underscoring that expectations remained anchored over the monetary policy horizon (chart 3) despite the recent increase. Scotiabank Economics expects CPI inflation to close 2021 at 4.77% y/y and end-2022 at around 3.3% y/y, noting that current inflation pressures are higher than the market’s expectation but transitory.

- Policy rate. Consensus on average expects three rate hikes of 25 bps this year in the policy rate, which would close at 2.50% in 2021 (from the current 1.75%); the first movement is anticipated in September (chart 4). Scotiabank Economics’ forecast is aligned with the consensus. For 2022, consensus expects a policy rate at 4.0% by the end of the year, 50 bps higher than in the previous survey. Scotiabank Economics’ forecast was recently changed we now expect a 4.50% rate for Dec-2022 assuming a path of 25 bps hikes at every decision-making meeting.

- FX. USDCOP forecasts for end-2021 stood at 3,740 (5 pesos below from the previous survey). For December 2022, respondents think, on average, that the peso will end the year at USDCOP 3,632 (+30 pesos above the previous survey). We believe that USDCOP would appreciate by the end of the year to 3,525.

—Sergio Olarte & Jackeline Piraján

PERU: Q3-2021 KICKSTARTS WITH ROBUST GDP GROWTH IN JULY; BCRP Q2 INFLATION REPORT DUE FRIDAY

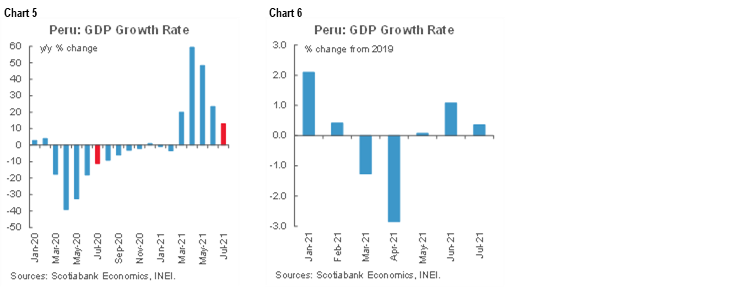

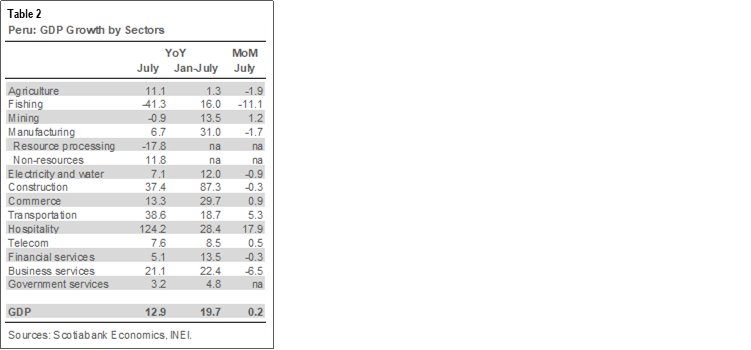

GDP growth totaled 12.9% y/y in July, according to figures released on September 15 by the National Statistics Institute, INEI (chart 5). This represented 0.4% growth versus pre-lockdown July 2019 levels, perhaps not much, but positive nonetheless (chart 6). In month-on-month terms, growth was a soft but positive, 0.2%. Growth by sectors was mixed but many of the sectors that grew the most were linked to domestic demand. Overall, there is little evidence that the political turbulence that took place after the June second round Presidential elections had much of an impact on growth in July. As much as financial indicators, such as the FX rate and capital flight, indicate that uncertainty did affect financial markets and business and household behavior, growth itself held up well.

July’s growth was largely aligned with the trend of previous months, which had led us to raise our full-year GDP growth forecast recently to 12.3% (from 9.9%). GDP growth in the YTD is 19.7% (down from 20.9% to June), and should continue on a downward trend towards our 12.3% forecast. Although our forecast is higher than that of most other analysts, this is likely to change over time. Julio Velarde, president of the BCRP, stated on Tuesday, September 14, that the BCRP will be raising its forecast during its quarterly inflation report tomorrow, Friday, September 17. Currently the forecast stands at 10.7%, so the change will bring their figure closer to ours.

All sectors that make up the GDP (table 2) grew in July in y/y terms, except fishing, as the season had already ended by July this year. In particular, all sectors linked to domestic demand showed robust growth. The greatest growth was in hospitality, transportation and business services, as mobility and capacity restrictions were eased. However, the more consistent leader in growth continues to be Construction, up 37% y/y in July, and a huge 87% versus 2019.

Agriculture surprised a bit, up 11% y/y, although that would mainly have been due to a low base effect, as agriculture actually fell, 1.9%, in month-on-month terms. Mining fell in y/y terms, 0.9%, but this was mostly exclusively due to oil & gas, down 13.6% y/y, whereas the more important metals mining component rose 1.4% y/y.

Looking forward, August and September y/y growth figures will continue to benefit from a low comparison base, as they compare with partial lockdown months in 2020. The impact will continue declining over time, but will only start to become negligible late in 2021. Perhaps only then, by the fourth quarter, will the degree of impact of political turbulence on growth become more clear.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.