- Chile: GDP grew 18.1% y/y in July due to mobility and ample liquidity; economy on course for double-digit growth in 2021

- Colombia: Q2 balance of payments—deficit widens; portfolio investment main source of financing; FDI slowed amid uncertainty

- Mexico: Survey of expectations sees higher inflation, median policy rate of 5.00% by year-end; remittances hit new record

- Peru: Inflation surprises in August to highest y/y figure since 2009; updated CPI forecast for 2021 and 2022; rate hike expected next week

CHILE: GDP GREW 18.1% Y/Y IN JULY DUE TO MOBILITY AND AMPLE LIQUIDITY; ECONOMY ON COURSE FOR DOUBLE-DIGIT GROWTH IN 2021

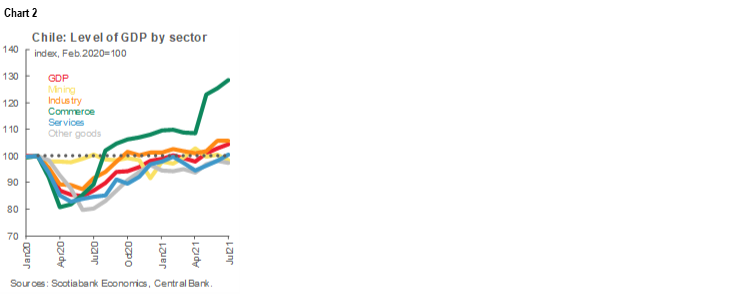

On Wednesday, September 1st, the Central Bank (BCCh) released July’s monthly economic activity index (Imacec), showing GDP grew 18.1% y/y (+1.4% m/m), in line with consensus and our own expectation. According to the BCCh, services activities were the ones that contributed the most to the y/y and m/m figures, in part due to higher degrees of mobility given the gradual economic reopening and the adaptation of households to the COVID-19 emergency. With this, the seasonally adjusted Imacec reached historically high levels, similar to those of the trend existing before the social unrest (chart 1).

Only mining and construction sectors remain marginally below pre-COVID GDP levels (chart 2). Construction is the only important sector within the GDP that remains low due to persistent lower mobility compared to pre-pandemic, which has affected the progress of private works. The production of goods (excluding manufacturing and mining) fell 0.7% m/m, while mining registered a fall of 2.2% m/m.

The Central Bank also highlighted the growth of trade, which grew 43.5% y/y and further had a significant impact on the m/m growth. This would be related to the fiscal support measures and the partial withdrawals of pension funds.

Given the above, Chile is now on course to hit double-digit GDP growth this year. Yet we do not regard this as a relevant factor for determining the prices of local asset in a context of a fluid political scenario with a major election towards the end of the year.

Data on sales and trade transactions up to the third week of August shows the highest level of real sales (pressured by inflation) in Chile. In this context, we expect a new monthly acceleration in the commerce and private consumption sector which, together with the greater mobility, would leave the Imacec between 17% and 18% y/y for August.

On the other hand, on Wednesday, September 1, the Central Bank (BCCh) published its Monetary Policy Report for the third quarter of 2021, in which it raised its GDP growth forecast for 2021 by two percentage points (pp), to a range between 10.5% and 11.5%, due to the most recent positive surprises and the greater dynamism of consumption. It also revised down the projected growth for 2022, to a range between 1.5% and 2.5%, mainly due to the high comparison bases of 2021.

Consistent with the above, we further highlight the significant increase in the BCCh’s inflation projection for 2021, which increased from 4.4% y/y up to December to 5.7% y/y for the same period, again due to the greater dynamism of consumption, the increase in the exchange rate and fuel prices. The BCCH projects that inflation will remain above 5% y/y throughout the first half of 2022.

All in all, the scenario described by the BCCH considers a Monetary Policy Rate (MPR) that will increase rapidly to its neutral level towards the first quarter of 2022 (3.5%), and potentially above said level towards the second quarter of next year. Finally, the BCCH pointed out that, considering the upside risk on the inflation scenario forecast in the short term, the risks of following a path with a higher MPR are greater. Yesterday, we covered the BCCh’s surprise hike of 75 bps at its Tuesday meeting.

—Jorge Selaive, Anibal Alarcón, & Waldo Riveras

COLOMBIA: Q2 BALANCE OF PAYMENTS — DEFICIT WIDENS; PORTFOLIO INVESTMENT MAIN SOURCE OF FINANCING; FDI SLOWED AMID UNCERTAINTY

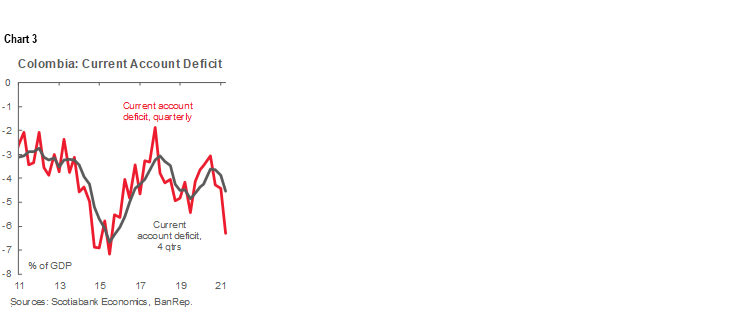

On Wednesday, September 1, the Central Bank, BanRep released Q2-2021 current account data, showing a deficit of USD 4.64 bn in Q2-2021, equivalent to 6.3% of GDP (chart 3), and significantly higher from the earlier USD 3.1 bn in Q4-2020; and USD 3.63 bn in Q1-2021. A wider trade deficit and relatively steady net outflows in the income account explained the much higher overall current account deficit as domestic economic activity recovered despite nationwide strikes in May.

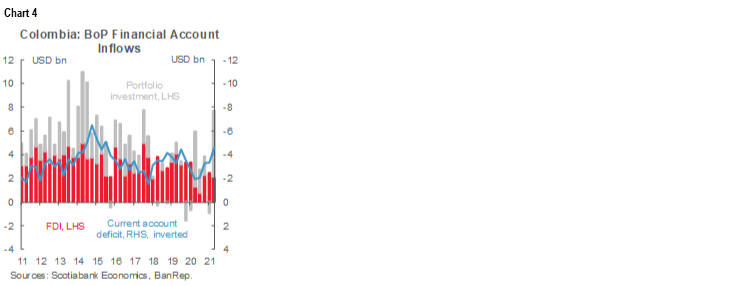

Portfolio investment with net inflows of USD 5.8 bn was the main source of financing in Q2-2021 on the back of strong appetite from offshore agents to COLTES (between March and June offshore agents bought ~USD 2.8bn of COLTES and now represent 25% of TES holders). Net FDI (net USD 2.1 bn on inflows of USD 1.1 bn, chart 4), meanwhile, showed a fall of 34% y/y and 32% q/q, amid the social unrest and the third wave of COVID-19 that resulted in some delays in investment decisions, although we expect this to recover over time. Remittances remain very strong and showed net inflows of USD 2.6 bn on the back of higher inflows from the United States due to social expenditure programs in that country, which temporarily increased immigrants’ disposable income.

In Q2 we did not see strong dollar monetization from Government. We expect monetizations to speed up in 2H-2021 that will finance a good part of the 2H-2021 current account deficit. We anticipate around USD 6 bn of monetizations due to the recent sale of ISA to Ecopetrol (USD 3.6 bn) and recent higher dollar cash increment in the government accounts due to the DEG´s of the IMF that MoF bought from BanRep (USD 2.8 bn).

The balance of payments in Q2-2021 reflected, on one side, the ongoing recovery in domestic economic activity (and especially investment) that increased capital and raw materials imports but also reflects the well-known vulnerability of Colombia with a structural high current account deficit. Therefore, Financing for the current account deficit is key to keep markets calm and a sustainable current account deficit. So far, financing has remained sustainable, with some coming from FDI and some of the portfolio investment, however, it is very important for long-run current account sustainability that FDI return to pre-pandemic levels and not only finance higher imports but also ensure that domestic demand will continue to recover.

Looking ahead to Q3-2021, the current account deficit will likely remain high, although since we have seen better oil and non-traditional exports, we expect the current account deficit to return to levels close to 4% of GDP. The current account should see financing from greater capital inflows and liquidation of external public assets.

We have not changed our end-2021 forecast for the current account deficit which sits at 4% of GDP, although we are aware that the bias is more towards a 4.5% of GDP, rather than under 4%. Colombia’s economic recoveries typically feature a widening in the external deficit via capital goods imports. However, these imports are usually financed through greater FDI, which makes them sustainable.

Additional Information by Lines in The Current Account:

- The overall trade deficit widened by a significant USD 1.6 bn from the previous quarter to USD -5.47 bn from USD -3.86 bn in Q1-2021, mainly owing to a higher deficit in the trade of goods (up by USD 1.25 bn), while the services deficit widened by USD 479 mn. The total combined goods and services trade deficit in Q2 was the widest it has been since December 2014. Exports continue below pre-pandemic levels by about -18%, while imports already recovered pre-pandemic levels, showing some impact of higher international prices, but also that domestic demand is recovering at a much faster pace than external demand from Colombian exports;

- Goods exports expanded by 1.4% quarterly and 19% y/y to USD 9.41 bn; mining product exports influenced the overall export dynamic due to better international prices, even though mining volumes have in fact continued to fall;

- Goods imports increased by 10.6% q/q and 56.2% y/y, which is consistent with the recovery in domestic demand. According to DANE, imports rose in Q2-2021 due to greater capital goods and raw materials purchases, while consumption goods imports remained soft;

- In the services balance the Q1 trend continues, traditional services exports, such as tourist package deals, continue soft, although showing a small recovery, while modern services exports, such as call centers, continued to be the best performer and increased by 15% y/y in 1H-2021;

- Income account outflows increased from the previous quarter as better export dynamics boosted profits across Colombia’s main economic sectors, especially in sectors with higher FDI such as oil and mining (USD 481 mn in outflows) and financial services (USD 152 mn); and

- Remittances inflows also increased to a new historical high of USD 2.7 bn (up USD 218 mn versus Q1-2021), likely stemming from fiscal stimulus efforts in developed economies. Remittances from the US and Spain were the main driver of the strong increment, in both cases remittances were up by more than 30% y/y in Q2-2021. Worth saying that current high levels in remittances would be temporary, likely falling by next year when additional social expenditures in the United States expire.

On the financing side, in Q2-2021, Portfolio investment were the main source of financing, while FDI continued soft.

- Portfolio investment stood at USD 5.6 bn, increasing 19.5% y/y, and the highest since Q3-2014. Offshore agents showed a significant interest in COLTES after Colombia´s downgrade in the first quarter of the year due to better yields in a worldwide low interest rates environment.

- FDI inflows stood at USD 2.1 bn, falling 15.7% q/q, and still a half of pre-pandemic levels. FDI inflows were concentrated in financial services (32%), transport and communication (15%), and the oil and mining sector (14%). Q2’s FDI inflows showed that the third wave of COVID-19 in April and nationwide strike in May brought uncertainty to the Colombian economy and investors postponed some investment in the country, especially in mining sectors that fell USD 556 mn in Q2. We expect FDI to recover gradually due to the consolidation of domestic demand recovery and better political and social environment.

—Sergio Olarte & Jackeline Piraján

MEXICO: SURVEY OF EXPECTATIONS SEES HIGHER INFLATION, MEDIAN RATE OF 5.00% BY YEAR-END; REMITTANCES HIT NEW RECORD

I. Central Bank Survey of Expectations revises inflation upwards; expectations for policy rate also increased but median stayed at 5.0%

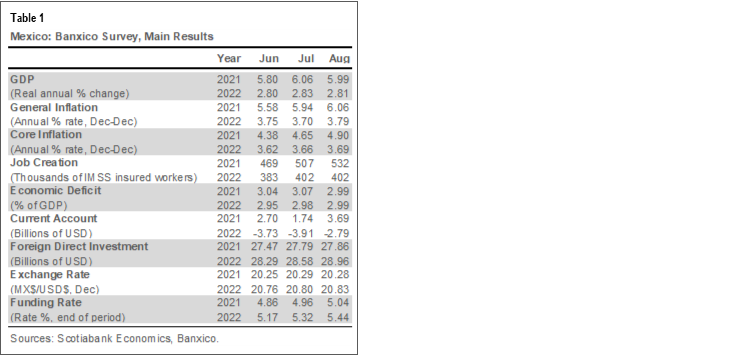

According to the Central Bank’s (Banxico) August Expectations Survey, conducted between August 20–30, the expected headline inflation rate for end-2021 increased for the eighth consecutive month, this time from 5.94% to 6.06%, moving even further away from the central bank's 3.0% target (to be reached by Q1-2023) and it’s forecast of 5.70%. Expected core inflation jumped from 4.65% y/y to 4.90% y/y, possibly influenced by changes in consumption dynamics favoring essential goods such as food and non-food commodities (table 1).

In view of higher anticipated inflation, expectations for the policy rate also increased, this time from 4.96% to 5.04%, the highest expectation for the policy rate since March 2020, although the median for the MPR for end-2021 stayed at 5.00%. This would imply two additional increases of 25 basis points each, distributed among the three remaining decisions, which differs slightly from our forecast that anticipates a 25-basis point increase for each of the three remaining meetings to close the year at 5.25%.

As for GDP expectations, analysts anticipate real annual growth of 5.99% for this year from the previous estimate of 6.06% y/y, slightly below Banxico’s expectations , which recently published in its latest quarterly report an anticipated economic recovery at a real annual rate of 6.20% this year. For 2022, the growth expectation remained practically unchanged at 2.83% real annual growth.

Regarding the labor market, the analysts' consensus increased the number of formal employment positions to 532 thousand new jobs this year, compared to the 507 thousand expected in the July survey. Thus, the recovery is expected to be driven not only by the dynamism in the United States (Mexico’s main trading partner) — expected to grow at a real annual rate of 6.51% this year, but also by an improvement in domestic demand.

On the other hand, exchange rate projections for the end of 2021 remained practically unchanged with respect to the previous survey and the Mexican currency is expected to close the year at 20.28 pesos per dollar (vs. 20.29 ppd previously). For 2022 the currency shows an expectation of 20.83 pesos per dollar, slightly above 20.80 previously.

Finally, as for expectations related to the business climate for private sector productive activities in the next six months, 53% of respondents answered that they expect the climate to improve, 15% believe it is a good time to make investments and 85% believe that the economy is better than a year ago. For the next six months, respondents believe that growth in economic activity will depend largely on governance (50% of responses) and domestic economic conditions (27% of responses). At the individual level, the main factors are: uncertainty about the domestic political situation (15% of responses); problems of public insecurity (15% of responses); weakness of the domestic market (10% of responses); domestic economic uncertainty (10% of responses); and other problems associated with weaknesses in the rule of law (10% of responses).

—Paulina Villanueva

II. Remittances reach new record in July

In July, remittances continued to reach record volumes, this time of USD $4.54 billion (chart 5), reaching 5 months above US$4 billion, and 15 months of straight annual upsurges (28.6% y/y in July 2021, vs. 7.2% y/y a year earlier). In the cumulative January to July period, remittances totaled USD $28.197 bn, equivalent to an annual increase of 23.5% YTD with respect to the same period in 2020, and 35.9% YTD with respect to January–July 2019. The trend of remittances during the pandemic is explained by the US fiscal stimulus to households, as well as the recovery of its labor market, in which Mexican migrants have also benefited, in turn increasing transfers to their relatives in Mexico. Remittances have mitigated the drop in Mexican household incomes, thus encouraging the recovery of domestic consumption.

—Miguel Saldaña

PERU: INFLATION SURPRISES IN AUGUST TO HIGHEST Y/Y FIGURE SINCE 2009; UPDATED CPI FORECAST FOR 2021 AND 2022; RATE HIKE EXPECTED NEXT WEEK

Peruvian inflation soared 0.98% m/m in the month of August, significantly above the Bloomberg consensus of 0.21% m/m and our own forecast of 0.65% m/m. Headline annual inflation jumped from 3.81% y/y in July to 4.95% y/y in August (chart 6), above the upper limit of the Central Bank target range (between 1% and 3%) for the third consecutive month and reaching the highest figure since 2009. Core inflation was more subdued, at 2.39% y/y in August, exceeding the 2% y/y target for headline inflation and rising.

As a result of the sharp rise in m/m inflation and other factors that we explain below, we are sharply increasing our inflation forecast for the full year in 2021 from 3.5% to 6.5%, and for 2022 from 3.0% to 4.5%.

The recent spike in inflation mainly reflects an increase in costs. Wholesale inflation, linked to production costs, was up 12% y/y, the highest pace in 26 years. These cost factors include both contagion from globally rising raw materials and energy prices, and a domestically determined sharp weakening of the PEN against the dollar linked to political uncertainty. These sources of pressure on prices have not fed through fully locally and are likely to persist for the rest of this year and into the next.

Given the risk of an incipient inflation-depreciation spiral, the BCRP needs put the brakes on both, quickly. Although depreciation of the PEN has lost some speed during the first month of the new government, going from 12.3% until July to 13.0% until August, the carry-over effects of the FX on inflation could persist in the coming months if pressures on the PEN persist due to political uncertainty. The BCRP has begun to show increasing concern. It raised its reference rate by 25bps to 0.50% at its August 12 meeting and on August 31 it sharply increased its reserve requirements for bank PEN deposits, thereby withdrawing PEN liquidity from the system. The BCRP is therefore likely to increase its reference rate again next week, the question being whether by 25bps, or by more.

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.