- Mexico: Headline inflation rose less than expected in March, but services remain sticky

- Peru: BCRP evaluates new pause

Range-bound Asia markets (again) continued the trend established in post-London trading, leaving US yields around their Tuesday lows, with European traders coming in with little appetite to shake things up. A late-session surge in SPX, on nothing obvious aside from megas staging a comeback, was tracked by European equities at the open and left intact in SPX futures through overnight trading that was bare of major risk sentiment catalysts.

Most major FX are little changed against the USD, but with a slightly dollar-negative mood in European trading that is leaving the MXN 0.3% firmer to roughly net out yesterday’s decline. Crude oil prices are flat to a touch stronger ahead of the US inventory report (note the API reported a larger than expected build), while copper adds 0.8% to its 10%+ rally for the year but iron ore falls close to 1%, halting a three-day streak. Global markets await the release of US CPI at 8.30ET, followed by the BoC’s decision and press conference (9.45/10.30ET), and the Fed’s meeting minutes at 14ET.

Brazil closes out the Latam CPI week at 8ET, with economists projecting a 4% headline inflation print for March, down from a 4.5% reading in February (0.25% m/m vs 0.83% previous). Headline inflation may show the impact of slowing food and energy prices, so the focus should remain on underlying inflation measures, especially in services. Markets still think that the BCB will still roll out a 50bps move at its May decision, but expect a downshift at the June meeting. Considering recent trends in commodity prices and a sense that the Fed may wait even longer to begin (possibly shallow) rate cuts, risks look more tilted towards a reduction in cut bets rather than an increase.

In Chile, we get the latest results to the BCCh’s economists survey at 8.30ET. Coming at the same time as the US CPI data, it will be nearly impossible to gauge the impact of the survey release on Chilean assets. Still, we’re watching for signs that economists are doubting their rate and inflation forecasts. The March edition had the median economist expecting a 4.50% end-2024 policy rate with a 75bps move between the expected (and realised) 6.50% BCCh policy rate set at the April 2 decision. Risks now are tilted towards a 50bps reduction instead despite the lower-than-expected inflation print on Monday.

Elsewhere in the region, Peruvian lawmakers have officially set Thursday as voting day for the seventh pension withdrawals bill—which should breeze through Congress (widely expected). Local markets seem to have already partly incorporated assimilated the withdrawal of funds as local stock indices harshly lag regional peers, and sovereign debt took a hit following the first approval of the bill in the congressional economy and banking committee on March 25. We also have officials from the BCRP, BanRep, Banxico, and the BCCh participating in a Center for Global Development seminar that kicks off at noon ET.

—Juan Manuel Herrera

MEXICO: HEADLINE INFLATION ROSE LESS THAN EXPECTED IN MARCH, BUT SERVICES REMAIN STICKY

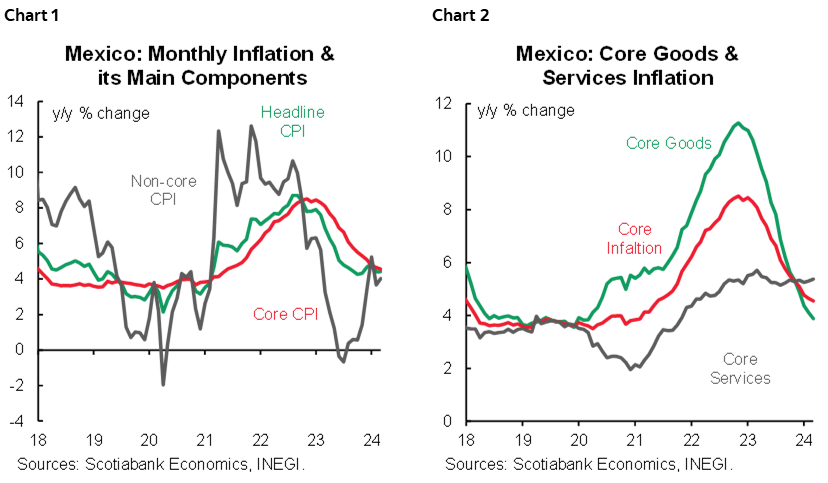

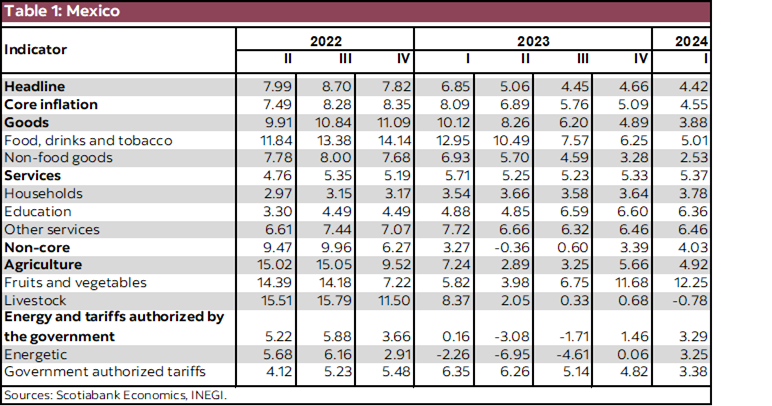

In March, inflation edged up less than expected, to 4.42% y/y from 4.40% previously (4.50% consensus). However, core inflation moderated to 4.55% y/y from 4.64% previously (4.62% consensus), derived from a deceleration in merchandise to 3.88% (4.11% previously), although services rose for the second consecutive month, to 5.37% (5.30% previously), as they have stood above 5.0% since August 2022. Thus, non-core items (raw food and energy) drove the increase as they grew to 4.03% y/y from 3.67%. In its monthly comparison, headline inflation registered a lower-than-expected increase at 0.29% m/m (0.09% previously, 0.36% consensus), core inflation increased 0.44% m/m (0.49% previously, 0.51% consensus), with a slower pace in merchandise. Finally, non-core inflation dropped -0.16% m/m (-1.10% previously).

Inflation recorded its ninth month in the 4.0%–5.0% range, while core inflation has barely been below 5.0% for three months. This difference is partly explained by more resilient services than merchandise, and the trend is not expected to change for a while, as demand for services such as education, housing and transportation will remain strong this year, according to economic activity expectations. On the other hand, this month’s headline rebound was also explained by a rebound in the most volatile components, i.e., energy, agriculture, and livestock.

Despite the better-than-expected data in March, upside risks remain, so the market will closely monitor future prints, particularly in the core components, which are merchandise and services, where wage cost pressures and higher public spending represent some of the upside risks. It is important to keep in mind that weather disruptions during the year and an escalation in geopolitical tensions could also affect non-core inflation. On the positive side, at least in the short term, the recent appreciation of the exchange rate—that reached 16.16 USDMXN earlier this week—could help the disinflation process of imported goods, although we believe it is likely that this may not last until the end of the year.

—Brian Pérez & Miguel Saldaña

PERU: BCRP EVALUATES NEW PAUSE

We see a probable new pause for the BCRP in its meeting this Thursday, April 11th, in line with what the market consensus expects according to a Bloomberg survey, since inflation is showing some resistance to continually decreasing, at least at the speed that it was during the second half of 2023.

The international environment doesn’t help either. Inflation is slow to subside around the world and the US economy has been showing signs of strength in the labour market, putting upward pressure on US interest rates (UST10 years is close to 4.50%, the highest level in five months). This could delay the start of the Fed’s rate cut cycle. The PEN vs. USD rate spreads now have a greater preponderance in monetary policy discussions than in the past. The BCRP expects in its base scenario that the Fed will begin the rate reduction cycle during the second half of the year.

The first readings for April inflation are favourable and suggest that inflation would be below the historical average (0.22%), making it likely that inflation will return to the target range (between 1% and 3%). But this is just a forecast. The BCRP could wait to confirm that this is the case and only resume the interest rate cutting cycle starting in its May meeting.

Twelve month inflation expectations have stabilized around 2.6% in the latest survey, within the target range for the fourth consecutive month. If the pause materializes, the real interest rate would be around 3.7%, for the sixth consecutive month, and still well above the neutral level of 2%.

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.