- Peru: The significance of Peru’s pension fund withdrawals

We refer our readers to yesterday’s Latam Daily for our expectation for today’s BCRP rate decision (pause).

PERU: THE SIGNIFICANCE OF PERU’S PENSION FUND WITHDRAWALS

On March 15th, Peru’s congressional Economics Committee voted in favour of an initiative that would allow affiliates to the private pension fund system, AFPs, to withdraw up to PEN 20,600 (nearly USD5,700) from their (presumably intangible) individual funds.

The final vote for the initiative on the congressional floor is scheduled for April 11th. If approved, and there is a good chance that it will be, then the first of the four monthly withdrawals could begin in June, although this will depend on whether it is vetoed by the Executive—after which Congress is likely to override the veto—and on the time needed by the Bank Superintendent to produce the legally required regulatory framework.

If approved, this will be the seventh withdrawal from pension funds since 2020. Not all the previous withdrawals occurred under the same terms and conditions, however. The current initiative is similar to the fifth and sixth withdrawals in that it is open to all, and the ceiling is comparable in magnitude.

The fifth withdrawal saw a total of PEN 32.2 billion withdrawn, which represented approximately 20% of total funds under AFP management at the time. The sixth withdrawal involved PEN 22.0 billion or 17% of assets under management. Assuming a similar 17% to 20% range as likely, the seventh withdrawal could imply an outflow of anywhere between PEN 21.6 billion and PEN 25.4 billion from the AFP system.

This is a magnitude that is not likely to be regained quickly. Withdrawals since 2020 have occurred with a frequency that has not allowed assets under management (AUM) to recuperate its previous level entirely (see chart 1).

The time that elapsed since the sixth fund, approximately two years to date (May 2022) gives an idea of just how long it takes for the aggregate level of AUM to return to their pre-withdrawal level. Currently AUM are still 7% below where they stood in May 2022, the date of the sixth withdrawal (actual withdrawals were drawn out over several months). A seventh withdrawal of similar magnitude, then, would likely lead to a drop in AUM that would take at least two years to recoup.

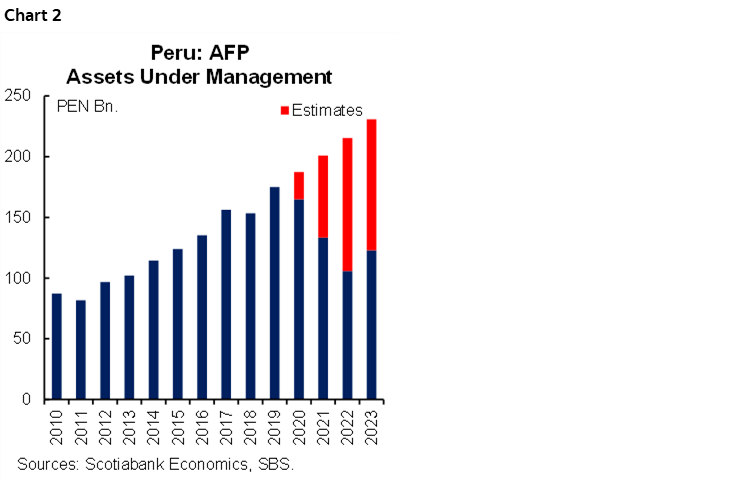

Due to the withdrawals, assets under management are currently at levels they were a decade ago, in 2014. One wonders what the situation would be if there had been no withdrawals. We’ve done the exercise, using the average annual composite growth rate of AUM that occurred between 2010 and 2019 for our estimates (see chart 2). Under this assumption, had there been no withdrawals, assets under management would currently be around PEN 250 billion, or approximately double the actual current level of PEN 127 billion. Thus, Congressional withdrawal initiatives have reduced assets available for pension funds by half. The impact on individual funds is, of course, disproportionate. Well-endowed individual funds should not have been impacted greatly, whereas many smaller individual funds have been pretty much depleted.

To put things into further perspective, at the end of 2023 AUM of AFPs represented 12% of Peru’s GDP, down from its 2019 peak level of 23% of GDP. That’s a huge difference of eleven percentage points. In comparison with other Pacific Alliance countries, ten years ago Peru’s pension fund system had a higher AUM than Colombia or México. At the end of 2023, AUM in Peru fell below all Pacific Alliance countries (see chart 3).

Past withdrawals produced knee-jerk reactions in sovereign bond yields, the FX rate and country risk measurements. Markets typically recovered partially from these initial reactions over the course of the following weeks. What has persisted over time, however, has been the decline in weight and significance that AFPs have in the bond markets and in the financial system. Currently, assets under Management represent 23% of domestic savings in Peru, which is a sharp decline from a 35% weight in 2019, before any withdrawal took place. We expect a seventh withdrawal to lower this ratio to 19%. Regarding the sovereign bonds market, AFP assets under Management represented 140% of total Peru sovereign bonds outstanding in 2023, a proportion that fell to 80% in 2023.

—Guillermo Arbe, Mario Guerrero & Ricardo Avila

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.