- Chile: Benchmark rate cut to 6.50% with a cautious tone in light of recent high inflation prints

- Colombia: Political, fiscal policy, and international financial conditions risks keep BanRep’s board cautious

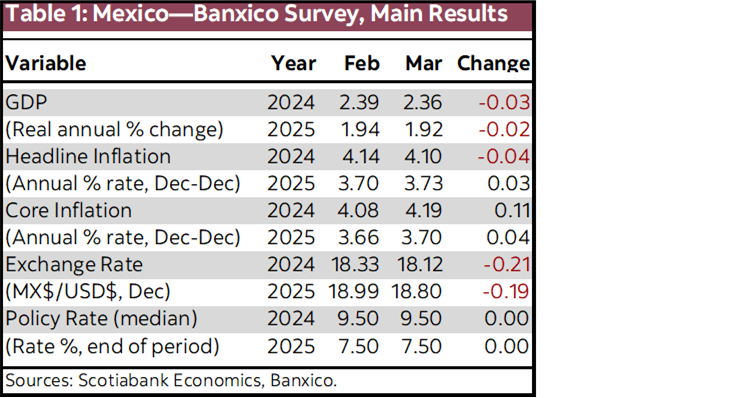

- Mexico: Banxico Survey showed higher core inflation expectations and somewhat lower growth forecasts for 2024

- Peru: Yet another cabinet shake-up

CHILE: BENCHMARK RATE CUT TO 6.50% WITH A CAUTIOUS TONE IN LIGHT OF RECENT HIGH INFLATION PRINTS

- 75bps cut but no commitment to similar magnitudes in the future. No more rush to cut. “Temporariness” would mean they might even take a pause.

As expected by us and the consensus median, Chile’s Central Bank (BCCh) cut the policy rate by 75bps to 6.50%. The cut is in line with the weakness in domestic demand following the release of the National Accounts, but of a magnitude no larger than expected given recent high inflationary records. Anything less than 75bps was off Scotiabank’s radar given the evident drop in private consumption and the deterioration of investment, together with a surprising February GDP but which may have a high transitory component. In this context, the BCCh’s arguments are very much in line with our quantitative and qualitative expectations.

More important is the forward guidance of monetary policy in which the BCCh indicates that it will continue to cut the reference rate, but at a data-dependent pace. We interpret this as a commitment to continue cutting, but at rates at a 75bps or lower click. We cannot rule that out at the next meeting in May, with two new inflation figures (March and April CPI’s), where Scotiabank expects them to outperform forwards, the BCCh will opt for a 50bps cut. Similarly, we cannot rule out the possibility that, in case inflation records are higher than our forecasts and those of the BCCh’s baseline scenario to be revealed in the IPoM, the central bank will even opt for a pause (made explicit by mentioning “temporariness” in the statement’s bias). The strong aggressiveness to cut the policy rate shown last January is now behind us.

This statement should be interpreted by the market as more aggressive and conservative than that incorporated in the swap rates, with the consequent appreciation impact on the Chilean peso. Indeed, even if the BCCh opts for 75bps as expected, the absence of commitment to cuts of similar magnitude in the future and the concern about the transitory nature of this “summer inflation” coming from the rise in the exchange rate and adjustments in some services would have an upward impact on nominal swap rates. This would support a new wind of carry trade positions by non-residents in favour of CLP. If external conditions are favourable for commodity exporters, we could consider that an appreciation of the peso, with volatility, will begin in the near future.

Rising external prices (transportation and fuel costs) and greater caution on the part of the Fed are the main concerns of the Board regarding the international scenario. The communiqué reports risks associated with rising costs in the US, where recent inflationary surprises also stand out. The increase in external prices and the stronger USD are part of the elements that the Board identifies as the main drivers of local inflation at the beginning of this year, which, if transitory, could give the Board more room to maneuver in the next meetings. On the other hand, although the more cautious tone of the Fed and the greater probability that the market assigns to the postponement of the cuts mentioned, the Board has been explicit in previous interventions that the policy rate should converge to its neutral level despite the differences between the Chilean monetary policy cycle and that of other countries.

—Aníbal Alarcón

COLOMBIA: POLITICAL, FISCAL POLICY, AND INTERNATIONAL FINANCIAL CONDITIONS RISKS KEEP BANREP’S BOARD CAUTIOUS

The central bank released minutes regarding March’s monetary policy meeting on Monday, April 1st. The inflation deceleration and lower external deficit motivated the board to accelerate the easing cycle in March. However, the majority of the board argued that they should maintain a cautious approach given that the international context continues to be volatile. Additionally, they said that uncertainty around the compliance of the fiscal rule and noisy political announcements are a challenge to the credibility of institutions that could turn in the deterioration of risk premiums and in the exchange rate.

Monday’s minutes were very interesting. On the economic front, the board agreed that the progress of inflation has been significant, while the deceleration of economic activity has contributed to reducing macroeconomic imbalances, especially in the external sector. However, the main difference between the board members who voted for a 50bps cut and the board directors who voted for 75bps and 100bps cuts is the assessment of the economic activity deceleration. In fact, for the two members who voted for 75 and 100bps cuts, the motivation to implement a stronger cut is to drive economic activity, especially investment. At the same time, for the most conservative group, the uncertainty around the possibility of complying with the inflation target in mid-2025 is still a key factor in remaining cautious in the easing cycle, even if it comes as a cost in the GDP performance.

However, an interesting point this time was the reference to political concerns, which is not usual for the central bank. However, this concern is associated with its impact on Colombia’s risk premium. The majority group who voted for a 50bps cut argued that noisy political announcements and the uncertainty around compliance with the fiscal rule could deteriorate the domestic risk premium and the FX level, which in turn could be a challenge to inflation to reach the target by mid-2025.

Our take from yesterday’s minutes is that the central bank board will continue to tilt to make cautious moves in the easing cycle, even though a traditional Taylor rule could suggest the strongest cut amid the reductions in inflation expectations. However, we think the limit to continuing with the cautious approach is in the macroeconomic variables; maintaining a cautious easing cycle could increase the probability of achieving the inflation target range by mid-2025; but, it could have a further negative cost in economic activity that could materialize with a weaker recovery during 2024. That said, we maintain our call for a year-end monetary policy rate of 7.50% and a long-term rate of 5.50%, which could be achieved during 2025, but the main teak will be in the timing; the central bank could continue with a cautious move at the early stages of the easing cycle but could accelerate the easing cycle in the H2-2024 when we expect to have a clearer picture about the Federal Reserve moves and economic activity data supporting the necessity of lower rates.

Other highlights from the minutes:

- Credibility is a critical point in the majority group who voted for a 50bps rate cut. Despite the progress in the disinflation process, this group emphasized that going too fast in the easing cycle could have a cost on the credibility and compliance of the inflation target. On the economic front, they believe that easing the monetary policy rate will contribute to economic activity recovery. In our opinion, for this group, a further correction on inflation, coupled with more evidence that the Colombian economy is operating with a negative output gap, could trigger the willingness to accelerate the easing cycle.

- Concerns for this group involve uncertainty around international financial conditions and the domestic risk premium, which we think is important to define the terminal point of the easing cycle. In that regard, we maintain our call for a 5.5% rate by the end of the easing cycle in H2-2025, when we expect to see a consolidation in the easing cycle for most economies around the world and a better understanding of real fiscal and political risks.

- Members who voted for 75bps and 100bps cuts see that inflation progress has been significant and see encouraging signals for inflation convergence to the target by mid-2025. For this group, the main concern is achieving timely monetary policy support for economic activity recovery. The member who voted for a 100bps cut (the Finance Minister) said that an increase in diesel prices is still in negotiations, which remains an uncertainty for inflation.

—Sergio Olarte & Jackeline Piraján

MEXICO: BANXICO SURVEY SHOWED HIGHER CORE INFLATION EXPECTATIONS AND SOMEWHAT LOWER GROWTH FORECASTS FOR 2024

Private sector analysts raised their estimate for core inflation from 4.08% to 4.19% by the end of 2024, while for the following year, it also rose from 3.66% to 3.70%, implying that analysts anticipate pressures on the less volatile component of inflation (merchandise and services) during the year. This is also shown in the last numbers of fortnight inflation, where the core component edged up in Feb H2 (4.66% y/y) and Mar H1 (4.69% y/y) and services shows stronger stickiness (5.57% y/y). Expected year-end headline inflation averaged 4.10% from 4.14% previously, and 3.73% from 3.70%, still far from Banxico’s inflation target of 3.0%, and above Banxico’s forecast as the Board expects inflation to converge to 3.1% in Q2 2025.

In contrast, the GDP consensus declined slightly from 2.39% to 2.36%, possibly owing to the latest IGAE print, which came in below analysts’ expectations, and marked three months of sequential declines in economic activity in January (-0.6% m/m sa, 2.0% y/y nsa). Nonetheless, analysts continue to anticipate a higher-than-historical-average pace of growth in 2024, driven mainly by higher public spending amid elections and strong consumption.

On the other hand, the year-end exchange rate also declined reacting to the appreciation observed in recent weeks, now at $18.12 USDMXN, from $18.33 USDMXN. Despite this, analysts still foresee a depreciation in 2025, ending the following year at $18.80 USDMXN.

Lastly, the median of responses of year-end interest rate expectations remained unchanged at 9.50% and 7.50% for 2024 and 2025, respectively. Later this week, the minutes of Banxico’s last meeting will shed light on the debate within the Governing Board on the dynamics of inflation—as the core component surprised to the upside in the first half of March—and on the future of monetary policy. In addition, the Citibanamex Survey responses, to be published this Friday, will detail the timing of when private sector analysts consider Banxico will make the next cut. We will wait for the release of the minutes (and possibly the March inflation print to be released next Monday) for a little more clarity on the direction of monetary policy, although as we have previously commented, we believe that the downward cycle in Mexico is likely to be a paused one.

—Brian Pérez & Miguel Saldaña

PERU: YET ANOTHER CABINET SHAKE-UP

When Presidente Boluarte appointed Gustavo Adrianzén as new head of the cabinet on March 6th, one of the most remarkable aspects at the time was that only one other cabinet member was changed (José Arista at the Ministry of Finance). This suggested stability.

Less than one month later, everything is different. Five more cabinet changes have taken place and things appear to be as unstable as ever.

On April 1st, the following new cabinet members were sworn in:

- Angel Manero as Minister of Agricultural Development

- Elizabeth Galdo as Minister of External Trade

- Sergio Gonzales as Minister of Production

- General Walter Ortiz as Minister of the Interior

- Morgan Quero as Minister of Education

- Angela Hernández as Minister of Women’s Affairs

This occurred just two days before the original Adrianzén cabinet was to comply with its legal requirement to introduce itself to Congress and obtain its vote of confidence, in a session scheduled for today, April 3rd.

Political analysts have been suggesting that the last minute changes have to do with a desire to appease Congress so as to assure that a vote of confidence would be given. The replacement of the former Minister of the Interior, Víctor Torres by Walter Ortiz certainly gives that impression, as Torres had been criticized by the opposition given the country’s domestic crime issues. It isn’t as easy to make a similar case for the other changes. None of the new cabinet members have a political profile and, although most have worked for periods inside the State apparatus, none are well known. President Boluarte may be hoping that the newly structured cabinet will receive a vote of confidence in Congress and take some of the limelight off her own issues, thereby helping in preventing a motion in Congress for her impeachment being brought to fruition.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.