- Colombia: Annual headline inflation decreased less than expected, while core ex-food and regulated increased a bit due to durable goods

- Mexico: November CPI Rises

Markets are trading with a risk-positive tone in global equities on the back of stimulus news out of China. The country’s Politburo signaled at its monthly meeting “more proactive” fiscal policy and “moderately loose” monetary policy in 2025 to offset risks from abroad (Trump) and continuously sluggish household consumption and investment at home. China also released weaker than expected CPI data in its early hours, but the data miss was set aside in favour of the Politburo tailwinds. The news lifted the Hang Seng to a 2.8% gain (with HS China Enterprises up 3.1%), but is giving US equities no real help at their open (and weighed by a China anti-trust investigation on Nvidia) while it did give European indices a decent helping hand, leaving FTSE and SX5E up 0.5% and 0.3%, respectively.

Global rates curves are mixed as USTs trade with a small bear steepening bias that is only slightly chipping away at the ~5bps rally in 2s after Friday’s small, unexpected uptick in the US unemployment rate (2s are only about 1.5bps cheaper today) while gilts are leading among rates in Europe (-3bps in 2s) while EGBs trade decently with 1–3bps gains spread around the different tenors and countries. Crude oil is bid about 1.5% thanks to China stimulus hopes and maybe to a smaller degree the eviction of Assad as Syrian president while brushing aside news that Saudi Arabia lowered oil prices to buyers in Asia by more than expected. Singapore iron ore is up about 1% while copper tracks a 2% gain. China-hopeful trading has most major currencies strengthening against the USD, with high-beta FX like the AUD and NZD leading the charge up ~1% while the MXN is somewhat of a laggard with only a 0.3% gain—still much better than the worst performer, the JPY with a ~0.5% decline.

Aside from developments out of China, it is an otherwise quiet start to a week where the main global events will begin on Wednesday with US CPI and the BoC’s decision, followed by the ECB’s announcement and US PPI on Thursday. Latam calendars have their fair share of events relevant to local markets, like this morning’s Mexican November CPI print (see below), Brazilian CPI tomorrow, and BCB and BCRP decisions on Wednesday and Thursday, respectively. Peruvian markets are closed today and Mexico’s are shut on Thursday.

—Juan Manuel Herrera

COLOMBIA: ANNUAL HEADLINE INFLATION DECREASED LESS THAN EXPECTED, WHILE CORE EX-FOOD AND REGULATED INCREASED A BIT DUE TO DURABLE GOODS

Colombia’s monthly CPI inflation stood at 0.27% in November, according to data released on Friday, December 6th. The result was above analysts’ average expectation of 0.21% m/m, according to the BanRep survey, and above Scotiabank Colpatria’s expectation of 0.18% m/m. During November, the main source of surprise was core inflation, while the food inflation group continued posting moderate inflation, given a good supply across the year, and regulated prices stayed under control. On the core side, price variations were relatively mild but generalized across groups; goods inflation accelerated as tradable goods, particularly vehicles, interrupted sixteen months in a row of negative inflation, probably showing the effect of the FX depreciation. Services inflation continued high, as indexation effects remain the main challenge, especially for rent fees; however, in November, we saw some increases in cinemas’ prices.

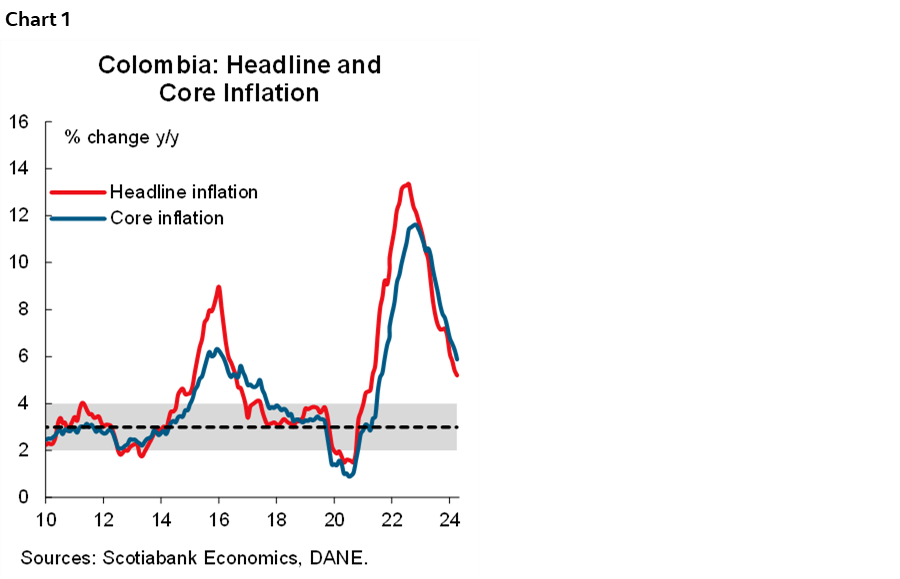

Annual headline inflation went down from 5.41% to 5.20% y/y, the lowest level since October 2021 (chart 1), while core inflation ex-food decreased from 6.29% to 5.88%, the lowest since March 2022. Inflation in ex-food and regulated prices accelerated from 5.34% to 5.36%, a behaviour that we should monitor in forthcoming months. Core goods annual inflation accelerated from 0.42% to 0.62% y/y. In comparison, service inflation decreased, although it remained elevated at 7.28% from the previous 7.34% y/y.

Inflation in Colombia continues to decrease consistently; however, there are some shoots to keep an eye on that are related to the effect of the FX depreciation. The previous results support an expectation for a 50bps rate cut at the upcoming BanRep meeting on December 20th; in the board’s discussion we still expect to see a balance between the macroeconomic progress on inflation, the negative output gap, domestic fiscal risks in the medium-term, and global volatility. It is worth noting that BanRep will decide after the Fed. Regarding the minimum wage negotiations, November’s data shows that the base to negotiate is 50% lower compared to the previous year, with inflation at 5.20% vs. the previous year’s register of 10.15%; however, productivity data released this week showed a total increase of 1.7%, in which labour productivity was of 3.43%, a parameter that put pressure on the negotiation. Our base case scenario is a minimum wage increase between 7% to 7.5%.

Complementary highlights:

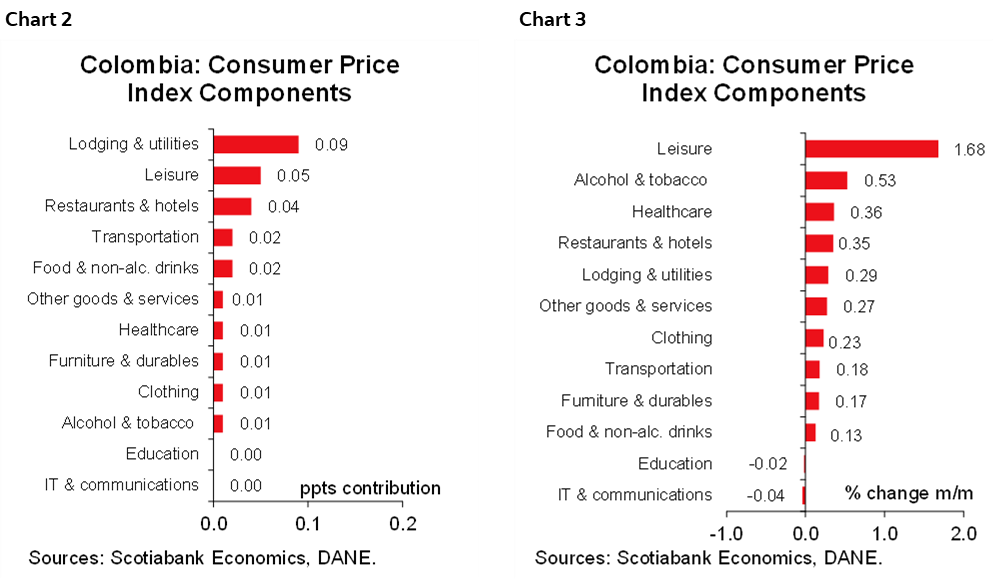

- The lodging and utilities group contributed the most to inflation, with a monthly variation of 0.29% and a contribution of 9bps to the total. Rental rates and the price of gas contributed the most to the variation of the lodging and utilities group. In contrast, energy prices fell for the fifth consecutive month (-0.16% m/m), although at a slower rate than in October (-2.25% m/m).

- Seasonal factors could explain 30% of November’s inflation. The leisure sector changed its trend and was surprised with an increase of 1.68% m/m, the second sector contributing the most to inflation. In November, there was an increase in the prices of tourist packages and airline tickets. Additionally, the restaurants and hotels sector also contributed significantly, with a variation of 0.35% and a contribution of 4bps. It is common for some goods or services to show price increases at the end of each year, given their seasonality in relation to the holidays and vacation period, which suggests that these effects could be reversed in the first part of 2025.

- The depreciation of the exchange rate is beginning to show some effects on prices. Durable goods inflation showed its first monthly increase in 16 months (+0.31% m/m). Vehicle prices increased 0.48% m/m, while furniture (0.47% m/m) and semi-durable goods (+0.17% m/m) showed price increases. Some increases may again be related to seasonality; however, a higher exchange rate level may have a more permanent effect (charts 2 and 3).

- November inflation sets the stage for negotiating the minimum wage for 2025. Although the salary adjustment will be lower compared to the increase for 2024, the productivity data generated surprises, widening the limits of the negotiation. Scotiabank Colpatria estimates a rise between 7% and 7.50%, with the upper limit being a scenario that generates a counterweight for a faster decline in inflation.

—Jackeline Piraján & Daniela Silva

MEXICO: NOVEMBER CPI RISES

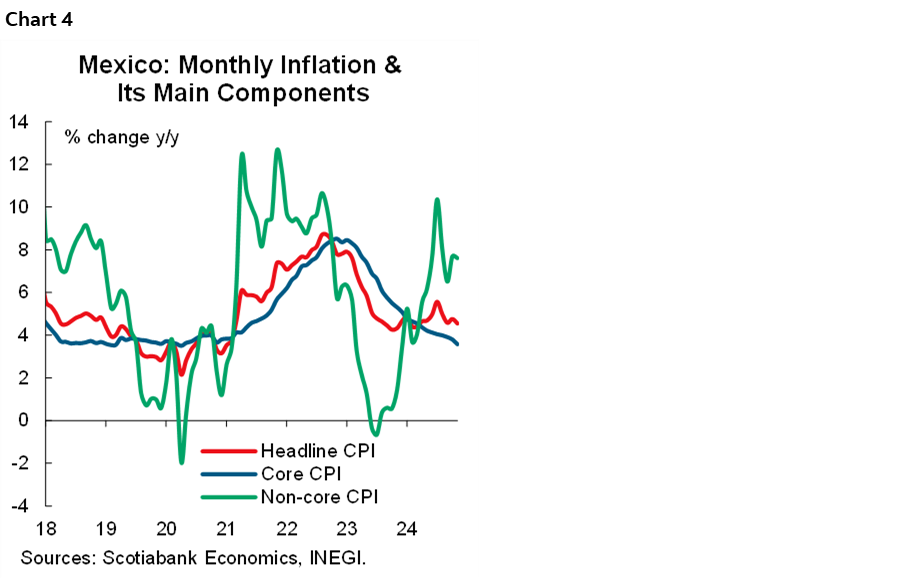

In November, inflation rose to 4.55% from 4.76% (vs. 4.61% consensus in the Citi Survey), while core inflation moderated to 3.58% from 3.80% (vs. 3.60% consensus) (chart 4). Goods slowed to 2.39% (2.81% previously), and services to 4.90% (4.98% previously). Meanwhile, non-core inflation increased to 7.60% (7.68% previously), with agricultural products rising 10.74% (10.92% previously), mainly due to fruits and vegetables at 16.81%. On a monthly comparison, overall inflation rose 0.44% (0.55% previously, 0.49% consensus), core inflation 0.05% (0.28% previously, 0.07% consensus), and non-core inflation 1.73% (1.46% previously).

The surprise was positive in these numbers, especially in core inflation, which continues to decelerate, albeit at a slow pace, supported by the deceleration in merchandise prices, and services. However, the space for further moderation in merchandise seems to be short, as it already stands below its historical average, and services remain at higher levels, while risks persist in non-core inflation in fruits and vegetables. In monetary implications, we expect Banxico to continue with a 25bps cut at the last meeting of the year, but remaining with different opinions among the Governing Board about the next movements in the objective rate.

—Rodolfo Mitchell, Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.