- Colombia: Inflation continued decline in January, but showed higher prices indexation

- Mexico: Banxico to thread the needle ahead of (likely) March cut

Aside from developments in China and Japan (another CPI miss, relatively dovish BoJ comments), it was a very quiet overnight session and, so far, European morning. Asia trading had a slightly rates negative mood to which EGB/gilts opened to, European traders curbed rates losses in early-dealing… but now are in sell mode. It’s a choppy, erratic market. The USD is mixed to stronger (the MXN is flat), US equity futures are little changed to weaker, while oil and copper trade firmer, and iron ore rallies on Chinese support hopes for the nth time. It’s a quiet day ahead in the G10 with only a couple of key ECB/BoE/Fed speakers and the release of US jobless claims followed by the US30y auction.

In contrast to the quiet G10 calendar, the Latam schedule is as busy as it gets, with Banxico and BCRP deciding on policy after a morning round of January CPI data from Mexico, Chile, and Brazil. Today’s data follows yesterday’s (roughly) as expected Colombian figures (see below) that showed the first sub-10% y/y print in core ex. food inflation since late-2022. Overall, Colombian inflation is expected to decelerate considerably in February, which should see BanRep consider a 75bps cut at its March meeting.

Inflation in Brazil is set to continue the downtrend it regained in Q4 after a temporary rise that owed to base effects. The focus for the BCB clearly remains services inflation, with the bank’s meeting minutes out earlier this week showing the uncertainty among the COPOM around the persistence of high inflation; at the very least, that worry would suggest the bank is not ready to study 50bps cuts. Today, the median economist expects headline inflation to slow to 4.42% from 4.62% in December.

Mexican inflation for January is already well informed by the results of mid-month data released a couple of weeks ago, with some upside surprises in non-core items prices. Economists project that headline inflation accelerated to 4.9% from 4.66% in December owing to these greater than expected increases, but core inflation is expected to maintain its downtrend, at 4.7% from 5.1% in December, to print a 4-handle for the first time since September 2021. At Banxico’s decision today (see preview below), we’ll watch whether they shrug off somewhat the recent rebound in inflation that owes to energy/food prices and/or refine guidance around the possibility of a March rate cut.

As for Chile’s CPI data and the BCRP’s decision, we refer you to Monday’s Latam Daily, where our economists previewed the release and announcement. Briefly, we expect Chilean inflation at 0.4/5% m/m (in line with the median Bloomberg median) that would translate into a 3.7% y/y print, or only a small drop from the 3.9% in December; for ex volatiles inflation we see a solid decline to 4.7% from 5.4%. In the case of the BCRP, it will be a 25bps, and while there may be an avenue towards a larger hike at one of their following meetings, the bank is probably not going to guide this—and it could simply continue at a 25bps click without raising eyebrows.

—Juan Manuel Herrera

COLOMBIA: INFLATION CONTINUED DECLINE IN JANUARY, BUT SHOWED HIGHER PRICES INDEXATION

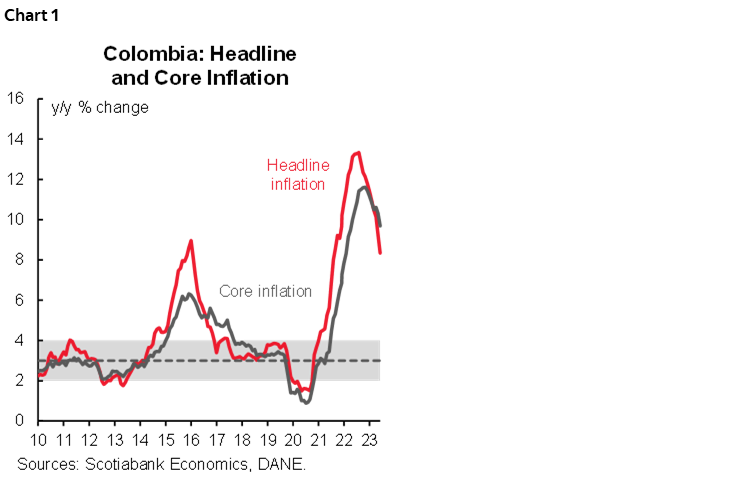

Monthly CPI inflation in Colombia stood at 0.92% m/m in January, according to DANE data released on Wednesday, February 7. The result was in line with economists' expectations of 0.93% m/m, according to BanRep's survey, but above Scotiabank Colpatria's expectation of 0.76% m/m. Annual headline inflation continued its downward path for the ninth consecutive month, registering a variation of 8.35% from 9.28% in December 2023 (chart 1), the lowest level since February 2022.

Core inflation (ex food) decreased from 10.33% y/y in December 2023 to 9.69% Y/y in January, while inflation excluding food and energy stood at 8.01% y/y. Underlying inflation metrics show a significant disinflation, mainly explained by the behavior of durable goods, going from 16.82% in January 2023 to 1.16% in January 2024, explained by a more stable ad lower exchange rate, and the domestic demand deceleration. Services inflation was 8.68% y/y in January 2024, down from the 9.33% y/y recorded in December 2023, but above the January 2023 figure (8.19% y/y).

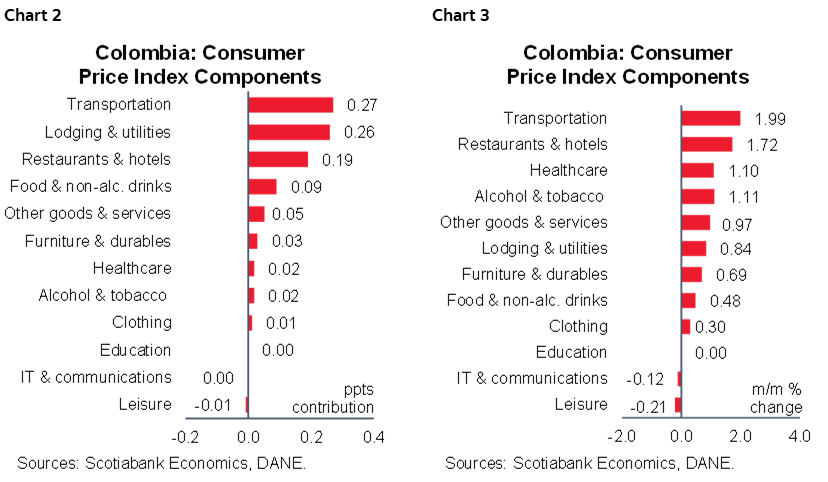

Transportation inflation was the item that contributed the most to total monthly inflation, explained by the increase in toll fares and an increase in transportation ticket prices. Accommodation and utilities were the second largest contributor to the total variation, with a variation of 0.84% m/m and a contribution of 26bps, due to price indexation in rents and the increase in energy tariffs, followed by restaurants and hotels, mostly explained by the increase in the prices of meals outside the home, due to seasonality effects (expected). Meanwhile, food continued with a moderate behavior, registering a monthly variation of 0.48%, explained by the increase in some fruits and vegetables.

The reduction in inflation has been significant for the headline inflation, but slower in the case of services, something highlighted by Banrep in its last monetary policy meeting, emphasizing that the higher-than-expected minimum wage increase contributes to a higher price indexation, added to a high energy inflation, which in January 2024 stood at 27.09% y/y. In any case, the BanRep is expected to continue with the path of cuts at a pace that will depend on the progress of inflation. In addition, the board will not only have two inflation readings (January and February) but also the 2023 GDP result among other macroeconomic indicators. Since statistical base effect will continue in February, we expect y/y inflation to be below 8% in February allowing Banrep to speed up easing cycle to 75bps cut in March 29th.

Other highlights:

- The transportation group was the largest contributor to monthly inflation. The group registered a month-over-month inflation of +1.99% and a contribution of +27 basis points. Although in January there were no increases in fuel prices, toll fares did increase, pushing up m/m expansion to this group; additionally, the increase in the price of urban transportation fares was also a significant contributor to the general transportation group.

- Indexation effects were reflected in the accommodation and utilities group, with a variation of 0.84% m/m, and a contribution of +26 basis points to total inflation. The increase in the price of rents was one of the components that added the most. Although it is usual that in the first quarters of each year rent prices are adjusted, January 2024 presented a quite high value in the contribution of this component (+17 bps), being higher than the contribution observed in January 2023 (+10 bps). On the other hand, utility tariffs increased by 0.89% m/m, with a significant increase in energy prices (+2.15% m/m), and a drop in gas prices (-0.77% m/m).

- Food inflation continued to moderate. The food group registered a monthly variation of 0.48%, contributing +9bps to the total. Among the food items that contributed the most were fresh fruits, vegetables, poultry meat and some milk derivatives. Meanwhile, counteracting foods were eggs, bananas, and tomatoes. In annual terms, food inflation stood at 2.96%, easing from its highest peak in December 2022 (27.81% y/y). Although the performance of food has contributed significantly to the decline in inflation, the risks of a stronger than expected El Niño phenomenon are not ruled out for the months ahead.

—Sergio Olarte & Daniela Silva

MEXICO: BANXICO TO THREAD THE NEEDLE AHEAD OF (LIKELY) MARCH CUT)

At 14ET, Banxico will release its monetary policy statement. According to this week’s Citibanamex survey, most analysts continue to expect the first rate cut to occur in March; if Banxico wanted to maintain this expectation, all it would have to do is signal in the statement that they feel comfortable with the current inflation trend. However, recent data prints, indicate a possible rebound in inflation and resilient activity, as well as a change in the Fed's tone, which was reflected in the forecasts of some of the surveyed analysts. Now, the median year-end rate projection rose from 9.25% to 9.50%, with some respondents forecasting a rate of 10.25%, which implies only four 25bps moves during the year.

Recent data prints could also impact the views of Board members. In January, headline inflation surprised on the upside, rebounding due to a sharp increase in food prices and the stickiness of core components. One argument for maintaining guidance of an upcoming cut lies in the restrictive stance of the ex-ante real interest rate which, given the decline in inflation expectations, could continue to rise further in the absence of rate cuts. Another argument is that most of the recent upturn in inflation has come from more volatile items, where monetary policy has little influence. Finally, another point in favor of an dovish tone points out that core inflation showed a somewhat normal sequential print in January; however, persistence in the goods and merchandise components remains. In particular, higher demand for goods and services could lead to greater price pressures in the coming months. Nevertheless, uncertainty regarding data trends remains high; we believe that mentioning data-dependent decisions would imply a greater possibility of rate cut until the second quarter. For our part, a change in the tone would also lead to a revision in our expectations for fewer cuts during the year. In terms of exchange rate implications, we believe that the USDMXN will be sensitive to the changes in the tone of the statement; thus, in the event of a less dovish tone, we do not rule out the possibility of a return to 16 pesos per dollar during the session.

—Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.