- Chile: Central Bank cuts the policy rate by 50bps (6.0%)

- Mexico: Setbacks in headline inflation during May H1 coming from food items; GDP moderated in Q1-2024 as manufactures drop and services moderate; Discerning perspectives among Banxico's Board point to a divided decision in June

CHILE: CENTRAL BANK CUTS THE POLICY RATE BY 50 BPS (6.0%)

- We estimate the next move will be of similar magnitude.

- No surprises but reaffirming “flexibility” of monetary policy. Less risks perceived for inflationary convergence.

As expected by surveys, asset prices and Scotiabank, the Board cut the policy rate by 50bps with a stimulating bias but reaffirming the “flexibility” of the next decisions, in terms of magnitude and temporality. Regarding the Chilean peso (CLP), the Central Bank (BCCh) describes an appreciation of the peso greater than other currencies driven by the increase in the price of copper, without mentioning the short- and medium-term implications.

What is new is the bias: the flexibility of monetary policy is reaffirmed, after having eliminated the said adjective in April’s meeting. In this context, our view is confirmed that the BCCh would continue with the process of cuts in line with what is reflected in the rate corridor of the March IPoM, but open to making adjustments in magnitude and timing in accordance with short-term data. At Scotiabank we expect a new cut of 50bps at the June meeting that will be accompanied by a new IPoM where we hope that the BCCh will analyze in detail the implications of the improvement in the terms of trade and the short-and medium-term effect of the appreciation of the exchange rate. Certainly, we should see an analysis of the magnitude of the positive medium-term impact generated by the increase in the price of copper, with special attention to the effect on mining investment. At Scotiabank, we reaffirm our policy rate expectation as of December 2024 between 4.5% and 5.0%, marginally below the central scenario of the current interest rate corridor.

We estimate that the BCCh evaluated the 75bps cut options and 50bps, eliminating outright a 25bps cut. The rejection of the 75bps option would have been justified in an economic activity and inflation scenario in line with the base scenario that contemplated 50bps. Accelerating the cuts is valid given the appreciation of the peso with short-term disinflationary implications, but it would also have been ruled out given the lack of analysis on its medium-term impact, which we hope will be revealed in the next IPoM. The impact of rising copper prices must be seen in both the short- and medium-term to properly tabulate monetary policy.

Regarding local economic activity, although the statement mentions that there are no major surprises for the base scenario of the last IPoM, there seems to be less conviction that the positive dynamism of Q1 was due solely to transitory factors. The GDP growth of 1.9% q/q (7.8% q/q annualized) would be related to a genuine recovery of activity in sectors such as commerce and services, together with a relevant and sustainable increase in mining production. Furthermore, without mentioning it, the role of public consumption was very significant and will continue to support domestic demand during the rest of the year. At Scotiabank, we estimate that GDP growth projected by the BCCh for Q2 (2.7% y/y) would be surprised upwards, after April figures which would show GDP growth between 4–5% y/y, exceeding current expectations. Also, indicators for May anticipate positive dynamism, both in the production of goods and in some services.

Regarding inflation, the Board reports that the accumulated records for March and April were in line with the IPoM scenario, which would accumulate a projected inflation of 0.4% between May and June. One of the Board’s concerns was the exchange rate pass-through of the depreciation of the CLP (relevant but temporary), which was strongly expected for April according to some members. Since the IPoM, the CLP appreciated 7% and market expectations accumulate zero inflation for the next two months. If the above materializes, it would be a downward surprise for the central scenario of the March IPoM. At Scotiabank, we raised in advance the risk of seeing negative records in one of these two months, to which the market has added (especially due to the June CPI).

—Aníbal Alarcón

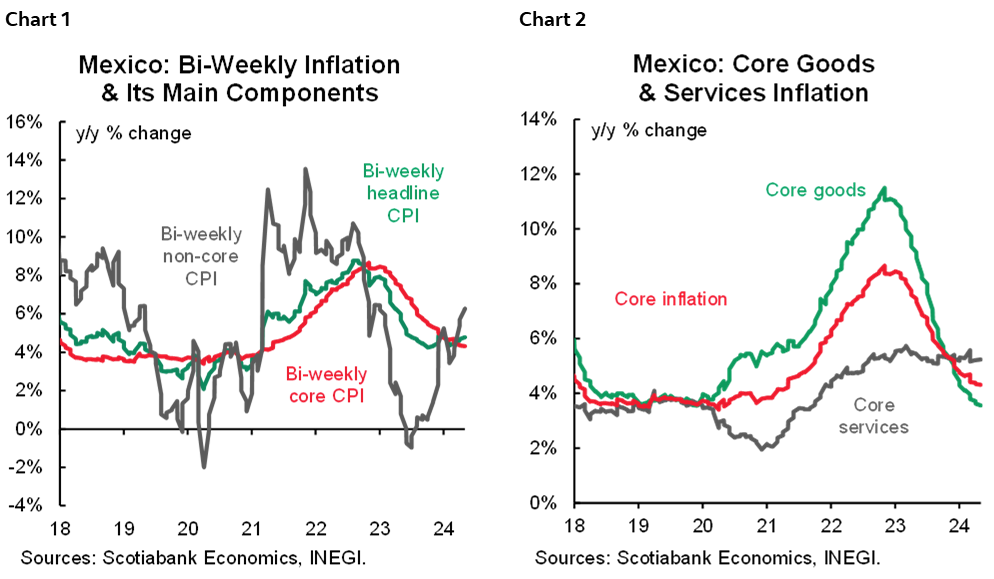

MEXICO: SETBACKS IN HEADLINE INFLATION DURING MAY H1 COMING FROM FOOD ITEMS

In the first half of May, inflation rose to 4.78% from 4.67% y/y (vs. 4.78% consensus). The setback came from non-core items that increased 6.27% (5.69% previously), with agricultural products rising 8.75% (7.72% previously). On the other hand, core inflation moderated slightly 4.31% (4.34% previously, 4.31% consensus) as merchandise decelerated 3.55% (3.62% previously), and services rose marginally 5.23% (5.22% previously). In its sequential bi-weekly comparison, headline inflation fell -0.21% 2w/2w (0.25% previously, -0.22% consensus), core inflation rose 0.15% (0.07% previously, 0.15% consensus) and non-core inflation decreased -1.31% (0.80% previously).

The data came out in line with consensus, showing a significant increase in the most volatile components, mainly in agriculture and livestock. Mexico is suffering from extreme temperatures, putting at risk not only primary activities, but electricity consumption, as the increases in demand from the hot temperatures are pressuring the power capacity. In addition, services remain sticky, pressured by wage cost increases. In the short term, as some members of Banxico’s Board noted in the minutes of the last meeting, an increasing risk to consider is the possibility that increases in energy and food prices from climate adverse effects will impact the prices of goods and services by increasing the cost of inputs. Therefore, although we maintain the perspective that the next monetary policy cut will take place in June, we believe that the outlook presents a high degree of uncertainty and continues to be marked by the development of the data.

GDP MODERATED IN Q1-2024 AS MANUFACTURES DROP AND SERVICES MODERATE

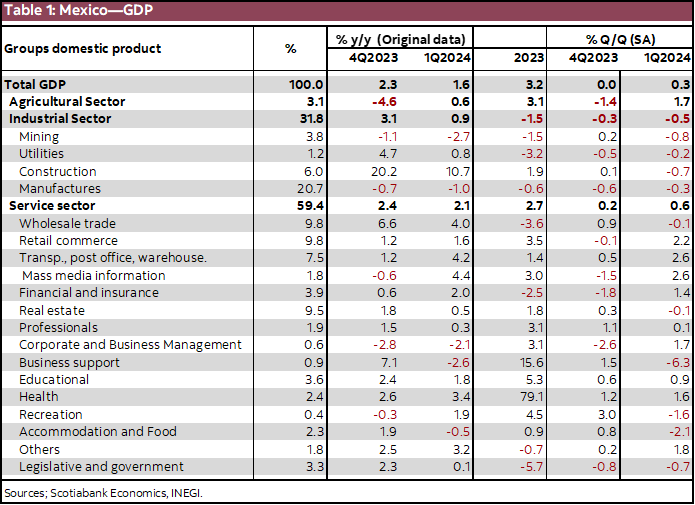

Q1-2024 GDP decelerated to 1.6% y/y in real terms, from 2.3% previously, as expected by consensus. By sectors, industry cooled to 0.9% y/y (3.1% previously), the services sector moderated to 2.1% (2.4% previously), while the primary sector bounced back at 0.6% (-4.6% previously).

In seasonally adjusted quarterly terms, GDP surprised with an increase of 0.3% q/q, from 0.0% previously and consensus. Industry slowed down -0.5% q/q (-0.3% previously), the services sector increased 0.6% (0.2% previously) and the primary sector increased 1.7% (-1.4% previously).

In March, the IGAE (monthly proxy) reported an annual decline in economic activity of -1.3% y/y. So far this year, economic activity data shows a slower pace than initially anticipated. On the industry side, construction is slowing down but still holds a double-digit increase (10.7% y/y) fostered mainly by the public infrastructure projects, while manufacturing is showing some weakness with annual declines (-1.0%), affected by restrictive policy rates and by the decelerating industrial production in the US. On the other hand, the increase in fiscal spending has not been reflected in a greater dynamism in services, where retail (1.6%) is still at a moderate pace. However, for the following quarter, we expect a greater advance in GDP, derived from a greater dynamism in services.

DISCERNING PERSPECTIVES AMONG BANXICO'S BOARD POINT TO A DIVIDED DECISION IN JUNE

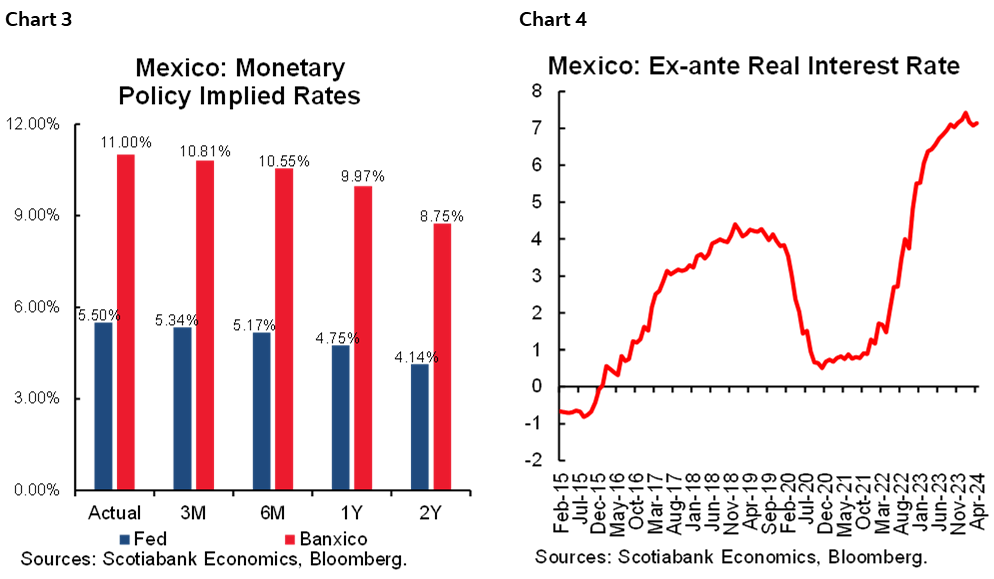

The minutes of Banxico’s May meeting, where the interest rate remained unchanged, revealed divergent opinions regarding inflation risks and the monetary policy path.

At the meeting, Banxico revised upwards the inflation forecast along the horizon, expecting now to converge to the 3.0% target for headline inflation by the end of 2025. According to the statement, the changes in the estimates are mainly owing to the stickiness in the services subcomponent.

In the discussion on inflation, we highlight the weather-related effects that could impact the non-core component. In this regard, some members added the possibility that the non-core component may not tend to its long-term average as an upside risk. A member of the Board recalled that the forecasts estimate that non-core inflation will return to 3.0%, so that, given the recent rebounds, it is likely that the forecasts will be revised (again) to the upside. Also, some members of the Board mentioned after the meeting that Banxico should remain vigilant because increases in agricultural and energy prices do not generate second-order effects on other inflation components, and that forecasts incorporate structural changes, including weather conditions. In addition, we noted concerns by members about the persistence of services, although some of them noted that the latest revision of the forecasts incorporate this risk.

On monetary policy, the minutes reinforce our view that the next meeting will have a split vote. On the more restrictive side, we noted comments from two Board members. One of them (most likely Deputy Governor Irene Espinosa) mentioned their concern about the behaviour of public finances. They highlighted the concern about the impact that Pemex’s results could have on public finances and inflation, as well as the importance of reducing the fiscal deficit being in 2025 as programmed (from 5.9% to 2.9% in the PSBR), since otherwise it could generate pressures on demand and debt markets. Another member considered that there is no space for further “fine-tuning” of the rate in the coming months due to stagnant inflation, the deteriorating balance of risks, and the expectation of above-target inflation for longer. They considered that the monetary stance should prevent increases in the non-core component from spilling over to core prices. We agree with this member’s argument when they mention that the direction of rate adjustments is a stronger signal than the rate level itself.

We believe that the bias in the Governing Board, despite being divided, remains dovish. In this regard, some members argued that monetary policy has heterogeneous effects among inflation components, with the services component having the most lagged effect. For one member, “the monetary policy stance should consider the trends in the inflation outlook overall and avoid adopting an overly data-dependent approach or focusing on a single variable.” Another member focused again on the restrictive level of the ex-ante real interest rate. One more member considered that the current environment is less adverse than in 2022 and 2023, thus allowing for contemplation of rate cuts. Two members explicitly considered a rate cut at the June meeting would be appropriate if inflation meets their forecast.

In conclusion, after the release of the minutes, we believe that the Governing Board remains biased towards a rate cut at the June meeting, although with two members with a more restrictive stance. However, this outlook could change if inflation in May and the first half of June does not meet expectations. Given the recent weather events, we believe there is a high risk of higher-than-expected inflation readings in the short term, especially in agriculture and energy, which could also impact the merchandise and services components. Thus, we believe there is some possibility that Banxico will postpone the next cut until the second half of the year, marked by a high degree of uncertainty.

—Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.