- Mexico: Headline inflation decelerates in September as food prices pull back

It was a relatively quiet Asia session, going into an uneventful European morning while global markets await the release of US CPI data at 8.30ET. The PBoC opening its swap liquidity facility for stock buying triggered solid gains of about 3% in HK and mainland equities but SPX futures and European indices are trading slightly weaker. In the FX space, there’s an even number of winners and losers against the USD with no clear risk-on or -off feeling to overall markets. It’s in rates markets that we have the biggest moves today, with gilts cheaper by 3–4bps across the curve (rather evenly) on no obvious catalyst but perhaps just the continued fiscal negativity surrounding UK debt, while EGBs are bear flattening and USTs trade little changed at all tenors.

There’s a few items to monitor in Latam today, starting with the BCCh’s economists survey at 7.30ET followed by Brazilian retail sales at 13ET, Banxico’s September meeting minutes at 11ET, and finally the BCRP’s rate announcement at 19ET. Chile’s economists survey will likely show the median expecting a 25bps cut next week, though some may now be projecting a 50bps move after Tuesday’s ‘miss’ in inflation—though we see it as mostly volatiles-driven.

As for Banxico’s meeting minutes, there will be a clear split between the 4 that supported the 25bps rate cut and the 1 (Heath) that preferred a rate hold. The main thing to watch will be whether there’s any appetite among the cutters to upsize rate cuts, but for now a 25bps pace looks the most appropriate. In Mexico, the Lower House approved overnight Pres Sheinbaum’s move to reclassify PEMEX and CFE (electricity utility) as “public companies”, i.e., turning them from profit maximization to objectives more aligned with the government’s social or economic ambitions.

Tonight, we expect that the BCRP will reduce its reference rate by 25bps to 5.00%; only 1 of the 11 economists polled by Bloomberg anticipates a hold. CPI data for September released last week (see here) surprised to the downside in headline and core terms, clearly allowing additional easing by Peru’s central bank. Maybe don’t expect a dovish message, however, as September’s 1.8% inflation print likely marked the near-term low for prices growth before rebounding into year-end—and as early GDP indicators for August point to another strong month for growth, somewhere between 3.5% and 4.0%.

—Juan Manuel Herrera

MEXICO: HEADLINE INFLATION DECELERATES IN SEPTEMBER AS FOOD PRICES PULL BACK

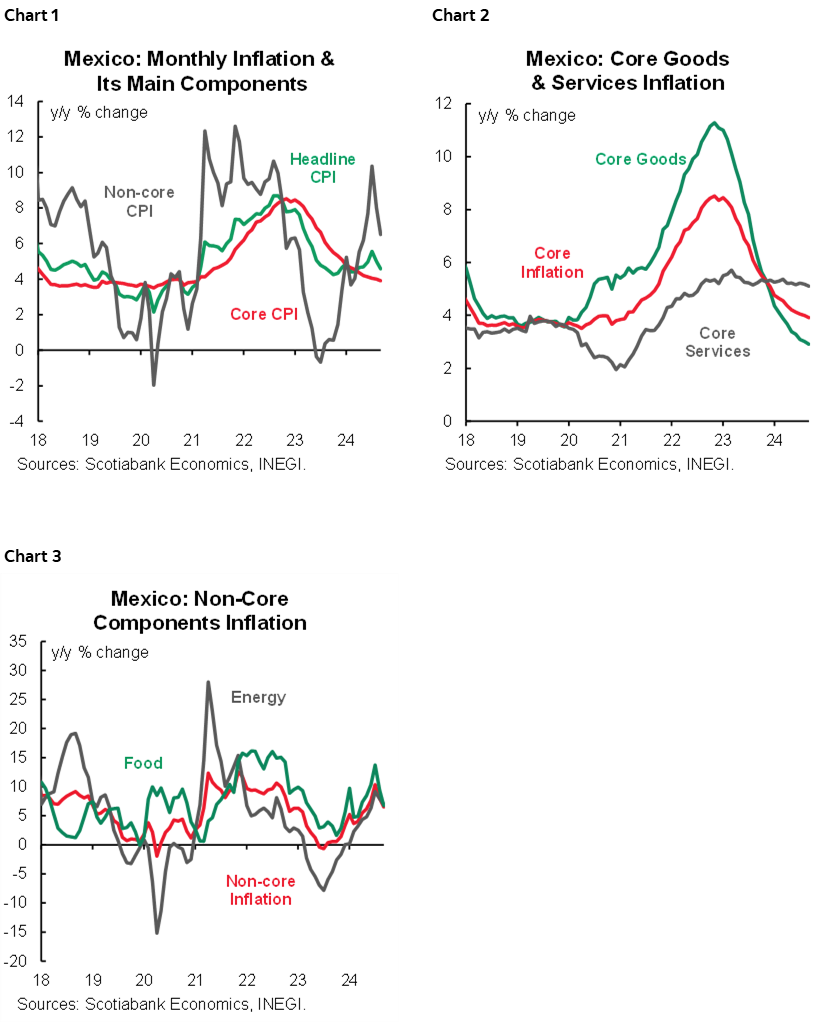

In September, inflation fell to 4.58% from 4.99% (vs. 4.62% consensus in the Citibanamex Survey), core inflation moderated to 3.91% from 4.0% (vs. 3.94% consensus). Merchandise decelerated to 2.92% (3.02% previously), and services 5.10% (5.18% previously). On the other hand, non-core inflation showed a sharp deceleration of 6.50% (8.03% previously), with agricultural inflation standing out, which fell 6.76% (9.45% previously). In its monthly comparison, general inflation rose just 0.05% (0.01% previously, 0.09% consensus), the core component 0.28% (0.22% previously, 0.31% consensus) and non-core inflation fell -0.72% (-0.70% previously).

This lower-than-expected print is mainly due to the drop in prices of the most volatile components, especially fruits and vegetables (-3.43% m/m), which have been affected by weather phenomena and problems in the local supply chain. Given the recent hurricanes, we could see some rebound in these components in the coming weeks. The good news comes from core inflation, which continues to decelerate, albeit at a slow pace, supported by the slowdown in merchandise prices, although services remain high in its three components (housing, education and other services). Despite the slowdown, we expect Banxico to maintain a cautious stance and continue cutting by 25bps for the two meetings remaining this year.

—Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.