- Colombia: In August, the willingness to buy decreased

- Mexico: Industrial activity showed mixed data, highlighting the increase in construction and weakness in manufacturing

Overnight, US equity futures and yields generally held to the uptrend that began around 11ET on Wednesday, leaving behind the volatile swings around the release of US CPI as market sentiment improves (especially in tech) and Fed cut bets are reduced. The quiet Asia and Europe sessions had little to change the mood, though over the past hour market moves have been slightly pared (in yields) or frozen in ranges (equities, currencies, and oil prices).

With no major data in Europe, markets await the ECB’s decision at 8.15ET—where a neutral 25bps cut is widely expected—followed by US PPI and jobless claims figures 15 minutes later; the first will be watched for PCE implications while the latter is in focus given the greater emphasis placed on the labour side of the mandate. ECB Pres Lagarde’s presser at 8.45UK is where we may get the most volatility in EUR rates.

USTs, gilts, and core EGBs are offered from 1 to 4bps across the curve with the latter two more clearly bear flattening while the US belly outperforms. The $3/bbl intraday slide in crude prices on Tuesday has now been fully unwound with a combo of risk-on sentiment and Hurricane Francine in the Gulf that is adding about 1.5% to oil prices today. Iron ore and copper are catching a classic risk-on bid of 2-2.5%. SPX futures are up about 0,1/2% while cash European indices gain 1% on average as they catch up to US equity gains yesterday afternoon.

Currencies are mostly mixed and little changed against the USD with the MXN a small standout, up 0.2%. This morning, a majority of state legislatures approved the judicial reform proposal, thus clearing the last key step in its ratification. Lower house Morena leader Monreal tweeted overnight that he has put legislators on alert for a session tomorrow or Saturday to finalize procedural matters before AMLO can present the decree on the 14th and have it published on the 15th in Mexico’s official registry. The MXN may have strengthened from the 20.15 zone yesterday, though this may have mostly owed to the upbeat mood in markets and technical factors; the main Mexican stock market index lagged its Americas peers yesterday.

It’s a quiet data day in Latam today, with a long wait until the BCRP’s rate decision tonight. The Bloomberg median expects the central bank to cut rates by 25bps to 5.25%, supported by recent inflation data that showed headline inflation right in the middle of the target (2%) and core inflation falling inside the 2+/-1% band (2.8%) in August. We think the BCRP will opt for a pause today considering some recent PEN weakness (which may worsen on seasonal and technical factors this month and next. We’re also watching developments in Colombia, where Congress commissions rejected the government’s budget size proposal yesterday, as time runs out to the September 15th deadline for approval of the 2025 budget.

—Juan Manuel Herrera

COLOMBIA: IN AUGUST, THE WILLINGNESS TO BUY DECREASED

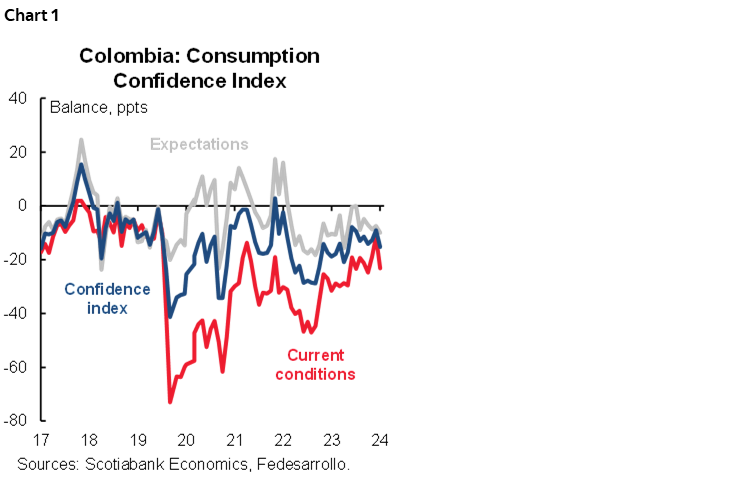

The Consumer Confidence Index (CCI) stood at -15.3% in August 2024, showing a deterioration of 6.3 ppts compared to July, and an increase of 3.5 ppts compared to August 2023 (chart 1). The result showed a deterioration in both components of the indicator, but the most significant reduction was the Economic Conditions Index (ECI).

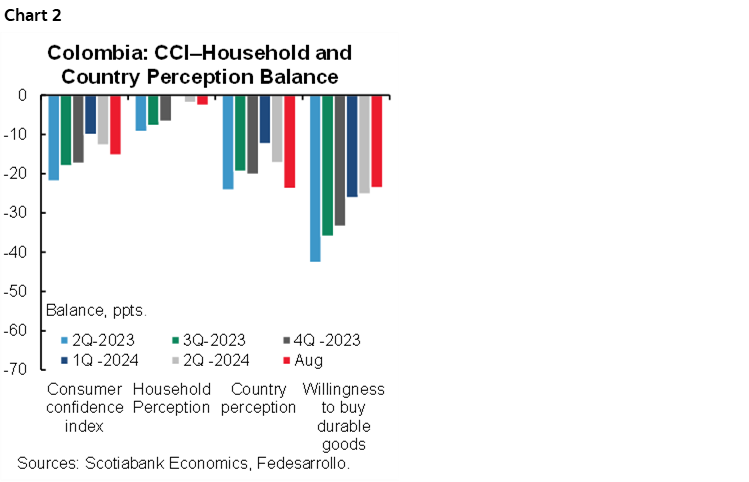

The Economic Conditions Index was the one that showed the greatest deterioration, going from -11.4 ppts in July to -23.2 ppts in August, which represents a fall of -11.8 ppts. We have seen that the response of consumers has remained volatile. However, this time, the deterioration of 11.8 ppts in the perception of their economic conditions vs. their conditions a year ago is surprising, and in turn, a fall of 11.6 ppts in the willingness to buy durable goods, even though August is usually a month with discounted prices in different stores.

The expectations index fell by 2.5 ppts compared to July, standing at -10%, the weakest level in a year. The deterioration of this component is mainly explained by more negative expectations about having good times in the forthcoming twelve months, a balance that may be influenced by uncertainty about tax reform. However, it is still curious to note that despite consumer’s feeling that the economy and country has worsened, the expectations for their own households is improving (chart 2).

There is no clear trend in the confidence indicator. However, it is evident that consumers do not have a sustained willingness to buy, which is in line with the behaviour of economic activity, in which we have observed that retail sales remain weak. Inflation remains a positive point for household finances. However, we expect that lower interest rates will be what contributes to the reactivation of domestic demand.

Looking at the August details:

- The Consumer Expectations Index stood at -10, showing a 2.5 ppts drop from the previous month. Consumers remain optimistic about an improvement in their economic conditions, however, the expectation that economic times will generally be good fell by -17.2 ppts to -32.3%, a balance that is even lower than in August 2023 (-27.7%).

- The Economic Conditions Index stood at -23.2% in August, falling 11.8 ppts from the previous month. Consumers’ perception of their current economic conditions worsened, at the same time willingness to buy declined. Willingness to buy housing decreased by 1.6 ppts from the previous month, standing at -15.3%, in which Bogotá was the only one of the five cities to show an improvement in willingness to buy housing.

- The willingness to buy durable goods fell 11.6 ppts compared to July, reaching -23.6%. Even though inflation in goods is among the lowest (0.75% YoY), consumers show an interest in purchasing, which is associated with a cycle in which the purchase of household appliances and other furniture has not been a priority in household expenses. At the same time, the willingness to buy vehicles fell 3.7 ppts, reaching -57.8%, one of the lowest balances of the year.

- By socioeconomic levels, consumer confidence decreased in the middle- and low-income levels. In August, confidence in low incomes was -18.7%, falling 10.6 ppts compared to July, while the middle-income level maintains the highest confidence compared to the other socioeconomic levels, reaching -10.1%, but showing a deterioration of 3 ppts. On the positive side, the high-income level showed an increase of 7.6 ppts in the indicator, reaching -30.9%.

—Jackeline Piraján & Daniela Silva

MEXICO: INDUSTRIAL ACTIVITY SHOWED MIXED DATA, HIGHLIGHTING THE INCREASE IN CONSTRUCTION AND WEAKNESS IN MANUFACTURING

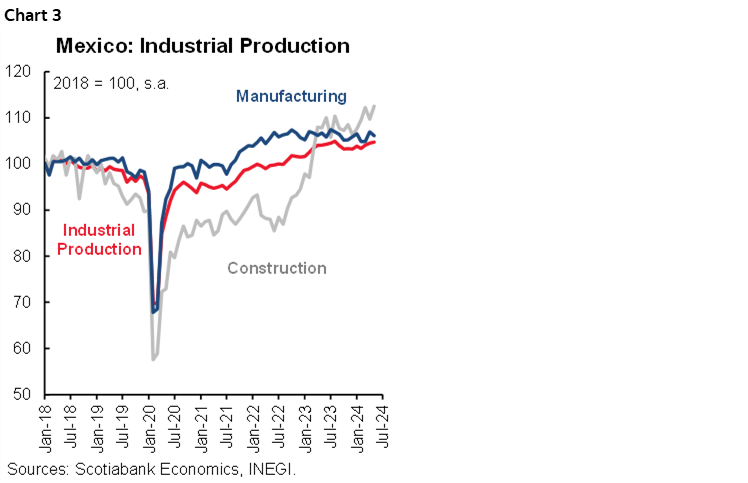

In July, industrial activity rebounded to 2.1% y/y from -0.7%, construction rose 5.3% y/y (1.6% previously), utilities 2.6% (3.6% previously), manufacturing 1.6% (-0.9% previously) and mining fell -0.4% (-4.3% previously), see chart 3. In the monthly s.a. comparison, the index rose 0.2% m/m from 0.4% previously. Manufacturing dropped -0.8%, utilities fell -0.9%, while construction increased 2.6%. In the January–July cumulative numbers, the index is up 1.5% YTD, compared to the same period last year.

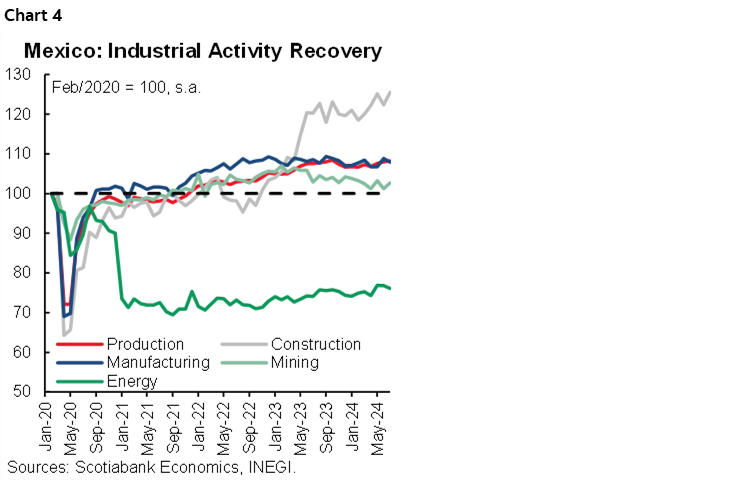

Manufacturing showed annual increases in ten of its twenty-one components. The best performing subcomponents were petroleum and coal products (+16.6%), other manufacturing (+6.7%), manufacturing of electronic products (+6.0%) and chemical products (+4.8%). The worst performers were the manufacturing of leather products (-13.0%), metal industry (-5.3%), textile inputs (-5.1%), among others. Overall, manufacturing has stagnated during this year (0.0% YTD) and will probably close this year in contraction. Considering this, we expect manufacturing to remain weak until the end of the year, affected by high interest rates (chart 4).

The figures are mixed, while the annual figures showed a good performance of the sector, the monthly figures suggest that the slowdown continues, in line with the worst performance of the Mexican economy, and this could extend into next year.

—Brian Pérez

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.