- Colombia: Job creation stagnated and reflected the uneven behaviour of economic activity

Asia trading had a risk-off feel that was followed by more risk-positive early dealing in Europe with markets having little to trade on given mostly empty calendars and Treasury markets closed for US Labour Day. Mixed to weak Chinese official PMIs released over the weekend are the data highlight, weighing on iron ore (down 4%) as one of the country’s sole bright spots, manufacturing, may also be losing its shine.

Weakness in Chinese and Hong Kong indices (-1.5%+) is only slightly pulling on European indices and US equity futures that are trading about 0.2% lower, while currencies trade mixed with no obvious narrative—some high-beta FX are firmer (AUD, MXN) but others are weaker (NZD). The MXN has been chopping around vs the USD overnight, but is attempting to break higher against the JPY from depressed levels. European rates curves are trading 3/4bps weaker with a steepening bias while UST 10yr futures imply a 2bps rise in yields.

On Saturday, Peru’s INEI released CPI data for August that showed a larger than expected increase in headline inflation, at 0.28% vs 0.22% median that translated into a small y/y beat at 2.03% vs 2.00% median. On the flip side, the data showed a nice deceleration in core inflation to have it sit within the BCRP’s 1–3% target range for the first time since January 2024, and at its lowest point since September 2021. The 2.78% y/y rise, down from 3.02%, owed to unchanged prices over the month; the 0.02% m/m ‘rise’ was the lowest August print since 2014. With core inflation within the target band and headline inflation right in the middle of it, it may be that the BRCP chooses to cut once again at its September 12 policy announcement.

After the start of Mexico’s 66th legislature yesterday, local lawmakers will move along president AMLO’s package of constitutional reforms ahead of Sheinbaum’s presidency beginning on October 1st. According to Morena leader Monreal, lower house lawmakers will debate and vote on the president’s judicial reform proposal over the course of Tuesday and Wednesday, to then make its way to the senate. Given the near-three-quarters majority enjoyed by the governing coalition in the lower house, the passage of the proposal is a given, but its progression may brew anxiety in Mexican assets.

On the data front, today’s highlight is the release of Chilean economic activity at 8.30ET. Following a strong manufacturing reading in Friday’s data, today’s release has a higher chance of surprising to the upside than the downside, with the median economist expecting a 2.7% y/y rise in output after a very soft 0.1% reading in June that owed to manufacturing and utilities sector weakness. Despite the solid print, the BCCh is still likely to lower its policy rate by 25bps at tomorrow’s decision; with markets implying about an 80% chance of a cut, in line with the rough 8/2 cut-hold ratio among economists (including us).

—Juan Manuel Herrera

COLOMBIA: JOB CREATION STAGNATED AND REFLECTED THE UNEVEN BEHAVIOUR OF ECONOMIC ACTIVITY

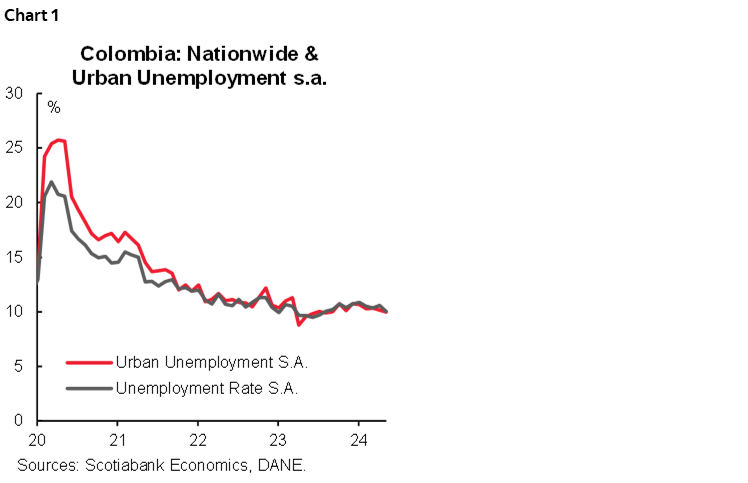

On August 30th, DANE published the labour market data for July. The national unemployment rate stood at 9.9%, increasing 0.3 ppts from 9.6% in July 2023. The urban unemployment rate also deteriorated, going from 9.8% in July 2023 to 10.2% in July 2024. However, on a seasonally adjusted basis, the national unemployment rate fell from 10.6% in the previous month to 10%. In comparison, the urban unemployment rate slightly decreased from 10.1% in June to 10% in July (chart 1). Having said that, apparently the labour market is showing a weaker balance in main cities compared to what we observed on a nationwide basis.

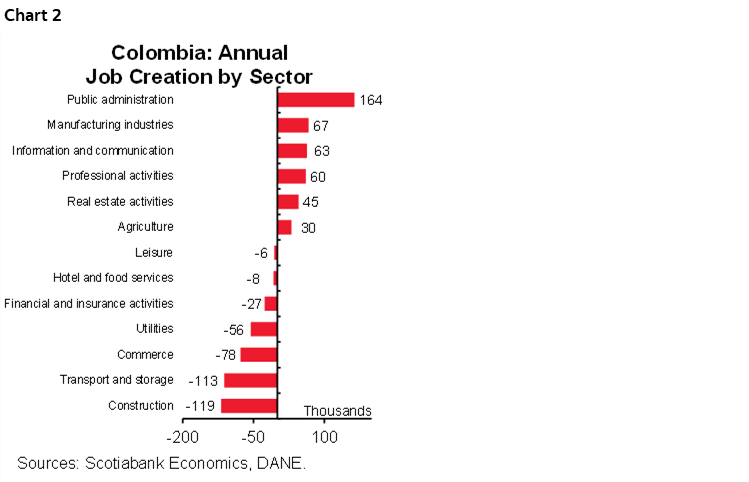

The labour market reflects the uneven economic recovery. In annual terms, 21 thousand jobs were created, but it reflects the average of two opposite scenarios in which the public sector leads the job creation, while the private sector still faces a challenging context. In the case of the public administration sector, job creation could be associated with the normalization of administrative activities that one year ago were partially interrupted. The second subsector in job creation was manufacturing, which despite maintaining a weak performance of economic activity, has generated jobs in the last three months, probably pointing to better production perspectives in the future. Meanwhile, the agricultural sector, which has had the best economic performance this year, maintains a weak job creation. On the negative side, seven of the thirteen subsectors had job reductions. The construction sector stands out with a loss of 119 thousand jobs, something that can be associated with lower activity around housing construction projects, followed by a deterioration in employment in the transport and storage sector, and the commerce sector (chart 2).

Job creation in the services sector continues to deteriorate despite services having been relatively resilient to the economic slowdown. In July, 60% of services activities had job cuts. Excluding public administration activity from the service sector, the balance would be negative with the loss of -119 thousand jobs in the tertiary sector. This supports the idea that economic growth has been leveraged by specific activities thanks to transitory events that in the near future could offset the performance of economic activity.

The labour market figures add to the theory that economic activity is having an uneven recovery, in which labour intensive sectors maintain a weak performance. This supports our expectation that BanRep will find an adequate macroeconomic scenario to accelerate a 75bps easing cycle at its meeting on September 30th, however, the board has been emphatic that inflation data and expectations are the key elements to consider a larger cut, therefore, the next relevant data will be inflation for August, which will be known on September 6th.

Employment data highlights:

- In annual terms, +21 thousand jobs were created. The public administration sector was the one that contributed the most with the creation of +164 thousand jobs, followed by the manufacturing industry (+67k) and communications (+63k). On the negative side, construction was the one that counteracted the most with -119 thousand layoffs, followed by transportation (-113k) and commerce (-78k).

- The population outside the labour market increased by 3.3%. In July, 455 thousand people left the labour market, and most of them were placed in household activities (+338 thousand), which could be associated with higher income from workers abroad (remittances), which in July reached US $1 billion, increasing 32% compared to July 2023. However, it is not ruled out that this is due to the increase in mandatory “in-person” policies at companies, which prevents some people from carrying out their positions given their responsibilities at home.

- The unemployment gap between men and women widened. The female unemployment rate stood at 12.9%, while the male unemployment rate stood at 7.7%, which widened the gender gap from 4.0% in July 2023 to 5.2% in July 2024. The male population was the one that absorbed the most jobs (+78 thousand), while 57 thousand jobs were lost in the female population. Public administration was the one that generated the most jobs for the male population, while commerce activity was the one that destroyed the most jobs in the female population.

- Informality improved from 56.4% in July 2023 to 56% in July 2024. In annual terms, 67 thousand informal jobs were lost, and 88 thousand formal jobs were created. However, in urban areas there was a deterioration in informality, going from 41.9% to 42.3%, with the creation of +75 thousand informal jobs.

—Jackeline Piraján & Daniela Silva

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.