- Chile: BCCh cuts benchmark rate by 25bps, in line with consensus

- Colombia: Exports start the second half of the year with positive results; Low current account deficit reflects still-weak economic activity

- Peru: July GDP growth should kickoff moderate/stable trend

Global yields are extending declines as risk-off sentiment spreads amid sharp losses in equity markets, but with no obvious economic or geopolitical signals flashing bright red. The overall risk tone looks set to drive G10 markets while we wait for the Bank of Canada’s 25bps cut at 9.45ET and the release of US JOLTS job openings at 10ET. Today’s Latam highlight will be the release of the BCCh’s monetary policy report, on the heels of yesterday’s cut decision, where the focus will be on the bank’s policy rate projection corridor. Mexico’s judicial reform approval in Mexico’s lower house is also likely today.

After yesterday’s 7bps rally in US 10s, USTs, gilts, and EGBS are broadly bid 2 to 3bps with a steepening bias. SPX futures are down about 0.3% this morning, with NDX off about twice that, while SX5E and FTSE took a big hit at the open to trade steady since then while tracking 1% losses. The negative pull that Nvidia losses have on broad markets should not be overlooked, as the company’s shares track a 1/8th decline since Friday including after-hours losses. However, the shares drop seemed to owe more to AI returns optimism being checked rather than growing global growth pessimism.

Currencies are mixed but with a clear pro-haven bias as the CHF and JPY lead with 0.2% gains while high-beta FX, including the MXN’s 0.4% decline, underperform though not massively. Crude oil is chopping around but trending towards unchanged, up about a dollar from intraday lows, after yesterday’s 5% drop (its biggest since early May) on the possibility of shuttered Libyan supply resuming and broad economic outlook malaise. Roughly 1% drops in iron ore and copper prices track with the negative sentiment in markets today and China pessimism.

Shortly before writing, after multiple rounds of debate, Mexico’s lower house lawmakers have approved ’in general’ (i.e. agreement on the broad proposal) the ruling party’s judicial reform proposal, with a 359 for and 135 against vote split. Later today, they will vote ’in particular’ on each article, but the result should be the same, with the project due to be submitted to the senate and likely approved next week. On that note, senators agreed yesterday to move AMLO’s proposal under a ‘fast track’ process following the receipt of the law decree from the lower house—while approving an alternative location for the session were the Senate to be blocked off by protesters. Mexican lawmakers debated the judicial reform proposal overnight at an alternative venue after protestors cut off access to the lower house yesterday; Supreme Court Justices have also joined the judicial sector workers’ strike after a majority vote of 8–3. Ultimately, this did not prevent its approval but merely delayed it.

—Juan Manuel Herrera

CHILE: BCCH CUTS BENCHMARK RATE BY 25BPS, IN LINE WITH CONSENSUS

- The BCCh points to a faster pace to converge to the neutral rate, though not necessarily over the remainder of 2024

On Tuesday, September 3rd, the central bank (BCCh) cut the policy rate by 25bps as widely expected. The main novelty refers to the bias that signals that the path towards the neutral rate will be somewhat faster than expected in June. We reflect on that in this reaction.

Considering that the September IPoM will be released, where the new monetary policy rate corridor and the consistent economic projections will be known, we can only reflect on the BCCh’s view regarding inflationary risks. In that dimension, undoubtedly the news from the Fed and the depreciation of the DXY seem to have contributed somewhat, giving greater confidence to the BCCh regarding inflationary convergence despite the significant increase in costs linked to the increase in electricity rates.

Recalling the June IPoM rate corridor, the rate was expected to reach its neutral level of 4% by mid-2026. Given that the release states that it will arrive somewhat earlier than expected, we see that the BCCh could converge to that level by the end of 2025. However, our reading is that we will not necessarily see further cuts in the last quarter of this year, but that these could be concentrated during the first part of 2025, as total inflation and the second-round effects of the electricity rate hike are contained. It will also be important to check the intensity of cuts by the Fed and their consequent impact on key variables before introducing or accelerating cuts locally. The June corridor had 50bps of cuts during the first half of 2025, which will likely be revised to 75/100bps in the September corridor. In the scenario, we do not take for granted that the BCCh will continue to cut the policy rate in the October and December meetings, but rather, if the new baseline scenario of the BCCh were to occur, the cuts would be concentrated during the first half of 2025.

—Aníbal Alarcón

COLOMBIA: EXPORTS START THE SECOND HALF OF THE YEAR WITH POSITIVE RESULTS

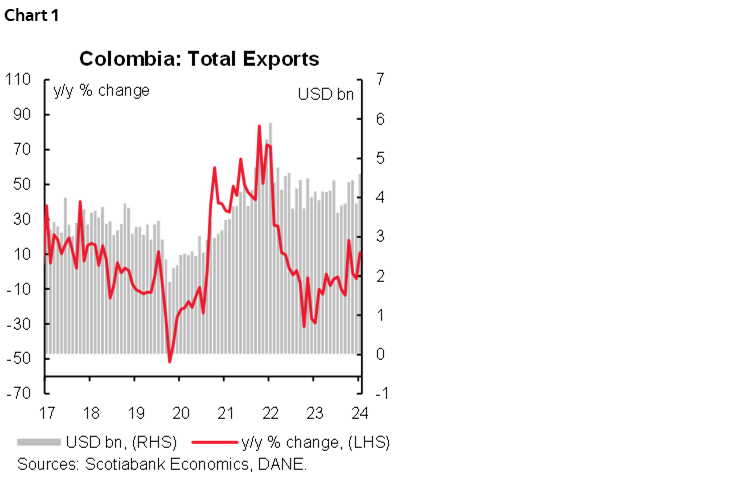

DANE published export data on Tuesday, September 3rd. Monthly exports in July stood at USD $4.82 billion FOB, registering an increase of 10.8% compared to July 2023 (chart 1), the second largest increase since October 2022, showing growth in traditional and non-traditional exports. Compared to the previous month, exports showed a growth of 19.7%, being the largest month-on-month increase since May 2023.

The results for July showed a positive balance between traditional and non-traditional exports. Traditional exports registered the highest value of the year, mainly due to an increase in coffee and coal exports that helped offset the drop in oil and ferronickel exports. Meanwhile, non-traditional exports reached one of the highest levels of the last year, showing an increase in food exports and manufacturing industry products.

- Traditional exports totaled USD $2.54 billion FOB, representing an increase of 7.04% y/y. The recovery in coal exports compared to the previous month stands out, which went from USD $461 million in June 2024 to US $885 million in July 2024, that is a growth of 92% m/m, a performance that is attributed to greater export volume. In annual terms, coal exports registered an increase of 30.5%, being the largest expansion since May 2023. Coffee completed four months in positive territory, registering a growth of 26.7% y/y in July. Meanwhile, oil exports registered a fall of 6.41% y/y, explained by a lower oil price compared to the previous year and lower volume.

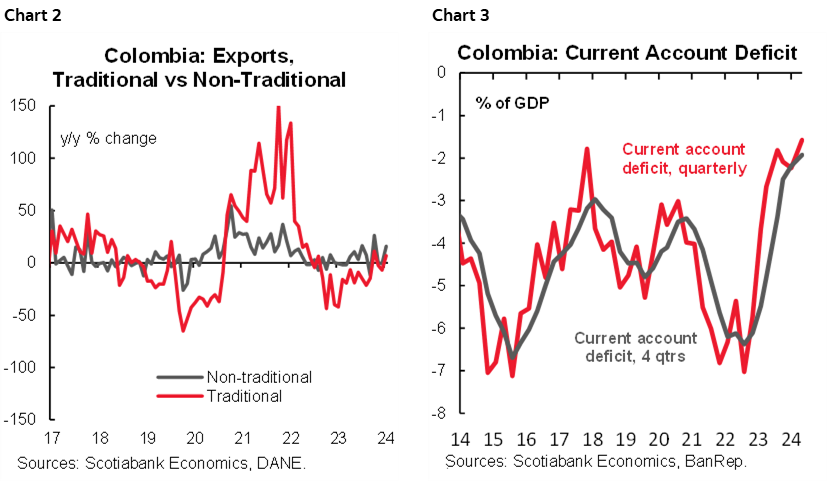

- Non-traditional exports regained momentum, totaling USD $2.07 billion FOB. In July, non-traditional exports grew by 16.3% compared to June of this year, returning to levels of April and May 2024 (chart 2). Compared to the previous year, non-traditional exports increased by 15.9%, showing an increase in food product exports of 21% y/y (excluding coffee), where an increase in exports of vegetables and fruits stands out (+40.6% y/y). In addition, manufacturing exports increased by 14.8% y/y.

—Daniela Silva

COLOMBIA: LOW CURRENT ACCOUNT DEFICIT REFLECTS STILL-WEAK ECONOMIC ACTIVITY

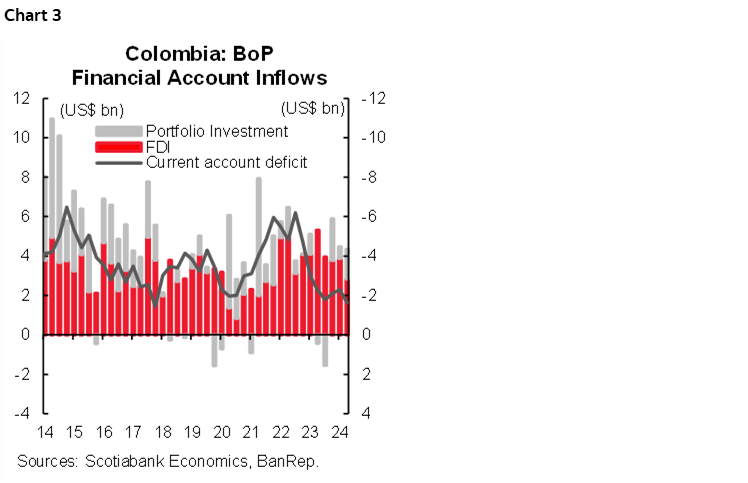

On Monday, September 2nd, the central bank (BanRep) released the Q2-2024 Balance of Payments (BoP). The current account deficit stood at USD $1.63 bn, equivalent to 1.6% of GDP, the narrowest since 2009 (chart 3). During Q2-2024, non-traditional exports related to agricultural products performed better, while imports of goods, especially transport equipment and fuel, decreased further. In the case of services, tourism activities are maintaining the services’ trade deficit at low levels. The income account shows lower outflows as Foreign Direct Investments have lower earnings, especially in the mining, oil, and utilities sectors. In terms of transfers, remittances continued growing and represent 12.2% of the current inflows in the balance of payments. Meanwhile, other transfers were supportive of inflows to Colombia. On the financing side, FDI inflows decreased compared to the previous quarter and posted the lowest inflow since Q4-2021; despite that, net FDI inflows remain the main source of financing for the current account deficit (chart 4). On the other side, capital account inflows improved amid the demand for public debt issuance in the international market.

The current account deficit is a new symptom that demonstrates that Colombia’s economic activity has stagnated in a weak spot of the economic cycle. Imports in nominal terms are increasing, but they are associated to higher international prices, as the GDP data statistics reported imports volumes weakened, and it is strongly related to a weak investment activity. In the case of exports, the positive outlook on the agricultural-related activities is helping exports, but it may not be sustainable. All in all, trade flows do not point to a structural pressure on the FX; instead, real flows support the stability of the USDCOP by around 4100 pesos.

Regarding monetary policy, the persistently low current account deficit may raise concerns for the central bank, potentially prompting an acceleration of the easing cycle in September. As of now, we stand by our projection of a 75bps rate cut at September’s meeting, with a year-end monetary policy rate of 8.50%.

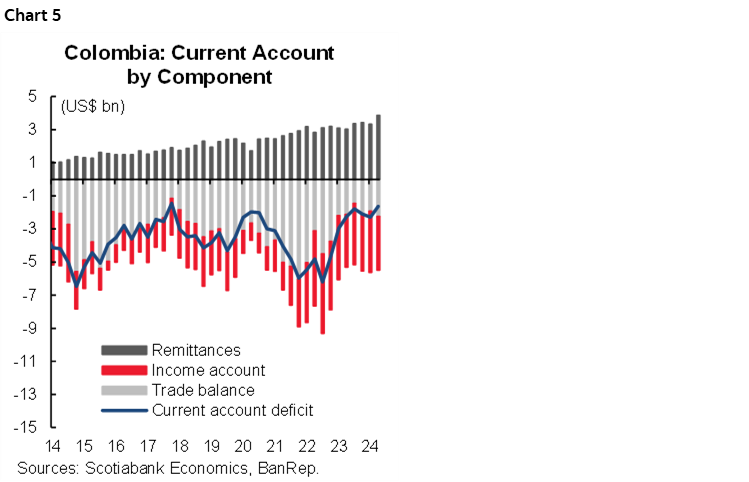

Current account:

In Q2-2024, the current account deficit stood at USD $1.63 bn (1.6% of GDP, chart 5), shrinking by 30% q/q and -28% y/y. Compared with the previous quarter, the trade deficit widened. However, this effect was offset by a lower deficit in the income account and still a supportive balance in the transfer account. Despite the widening in the trade deficit suggesting better domestic economic activity, the GDP data suggests that the recovery is due to transitory events. On the other hand, the income account reflects the challenging moments for private businesses. In H1-2024, the current account deficit stood at USD $3.92 bn, and the perspective for H2-2024 is that the current account deficit is still moderate as the recovery of economic activity is taking longer.

- Trade balance of goods: in Q2-2024, the trade deficit in goods was USD $2.25 bn, taking the H1-2024 figure to a USD $4,67 bn deficit. In the first half of 2024, exports contracted by 5.3% y/y, mainly on lower coal exports, which offset the better performance of some agricultural goods and oil. It is worth noting that the coal activity has been impacted by lower international prices that have contracted by 41.4%, while in terms of exported volume, there has been an increase of 12.6%. In the case of agricultural products, exports of bananas and flowers led to gains. However, we associate that with the fact that during the H1-2024, the harvest of some products was better due to sunny weather conditions and due to the fact that some producers anticipate the potential impact of the “El Niño” phenomenon, producing more than usual in this part of the year. Having said that, this positive performance may be temporary.

- In the case of imports, in Q2-2024 it stood at USD $15.12 bn, the best level in a year, while in H1-2024, imports of goods contracted by 3.1% to USD $28.96 bn, reflecting lower imports of transport equipment and fuel. It is worth noting that after the significant spike in 2022, imports have been stagnant, in fact it was a mild signal of rebound but it could be attributed more to an effect of higher prices than volumes.

- Trade balance of services: import of services increases due to the increase of tourism; the COP appreciation is favouring better demand for international services. Regarding exports, tourism is also the main factor of expansion.

- Income account: the income account also reflects the weak performance of economic activity. During H1-2024, the income account deficit stood at USD $6.75 bn, lower compared to the deficit in H1-2023. The majority of income account outflows were due to interest payments of credits in foreign currency and payments associated with capital investment. On the other side, the earnings of the FDI fell, and this contraction was mainly in the mining, oil, and financial sectors. That said, during the second part of the year, we don’t anticipate a significant rebound as the economic activity is taking longer to improve.

- Transfers: continued contributing to a lower current account deficit. Transfers stood at USD $3.87 bn in Q2-2024, and in the YTD are at USD $7.2 bn. In the H1-2024, remittances stood at USD $5.3 bn, increasing by 15.5% y/y. However, remittances were not the main source of the increase in total transfers. During the H1-2024, insurance payments, current transfers, and donations led to the increases. Either way, remittances remain an important inflow for Colombia as imports represent 2.7% of GDP and 12.2% of the overall current inflows. It is worth noting that remittances could stabilize in the future as there is high uncertainty about the potential migrant policies ahead of the US presidential elections.

Financial account:

The financial account registered net inflows of USD $2.77 bn (1.3% of GDP) in H2-2024, which were complemented by the USD $1.87 bn international reserve accumulation from the central bank.

- Foreign Direct Investment: in H1-2024, FDI inflows stood at USD $6.72 bn (3.3% of GDP), decreasing by 28.6% y/y. The main sectors that received FDI were oil and mining (34%), financial Services (21%), and manufacturing (17%). It is worth noting that investment inflows are weakening and are now at the weakest level since December 2021 and are around 15% below the pre-pandemic average (2014–2019), which suggests the economic activity is far from its best shape.

- Capital Investment: in H1-2024, Colombia registered capital inflows of USD $20.86 million (1% of GDP). In Q2-2024, inflows improved due to the debt issuances in international markets (USD $1.33 bn) that accounted for the most of this behaviour, while net purchases of offshore investors in the local market stood at USD $757 million during the first part of the year. Capital inflows are still weak as international investors are still balancing risk scenarios around the international monetary policy and the evolution of BanRep decisions.

—Jackeline Piraján

PERU: JULY GDP GROWTH SHOULD KICK OFF MODERATE/STABLE TREND

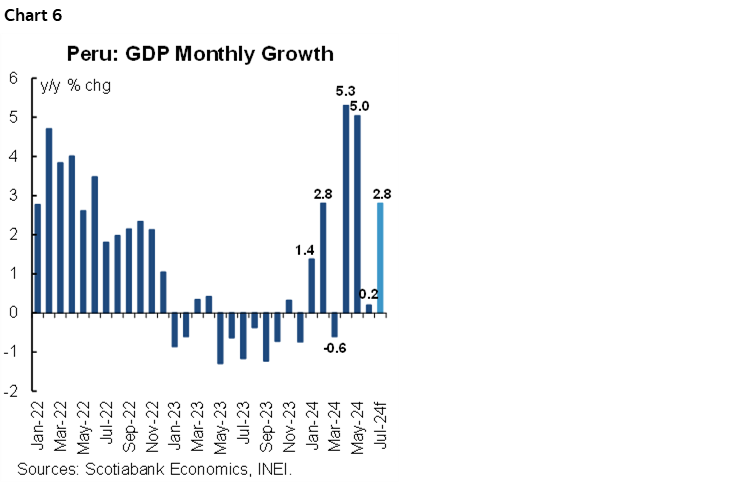

Early indicators for July GDP growth were published on September 1st. In aggregate, the indicators suggest GDP growth of between 2.5% and 3.0% in July. More precisely, we are forecasting 2.8% YoY growth for the month (chart 6). The early indicators include the following:

- Fishing GDP rose 14.9%, YoY, in July. This is of little consequence, as July is off-season for fishing, and the sector has a low weight.

- Mining GDP was up 0.7%, YoY. Not much, but let’s be thankful that growth was positive, as mining GDP had fallen 8.1% in June. Copper output, down 3.0%, continues underperforming.

- Oil & gas GDP rose 21.6%, which was a pleasant change from trend.

- Cement demand fell 0.5%, YoY. This compares favourably with an average decline of 3.3% between January and June and, as such, is actually a hopeful sign that growth may turn positive soon. This is a major component of construction GDP. Given that government investment rose 34%, construction GDP growth should be moderately positive.

The bottom line is that the rebound effect compared to last year’s El Niño has dissipated significantly, and growth is now more organic. As expected, GDP growth is beginning a longer-term trend approaching 3.0%. Consumer demand sector have yet to be released, and once they are, it will be interesting to see to what extent the pension fund withdrawals are impacting consumption. This gives some upside to our growth figures.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.