- Colombia: Economic activity in November was below expectations but pointed to a consumer demand recovery

- Mexico: Retail sales continue to show weakness in November; Divided opinions among analysts over Banxico’s next move

COLOMBIA: ECONOMIC ACTIVITY IN NOVEMBER WAS BELOW EXPECTATIONS BUT POINTED TO A CONSUMER DEMAND RECOVERY

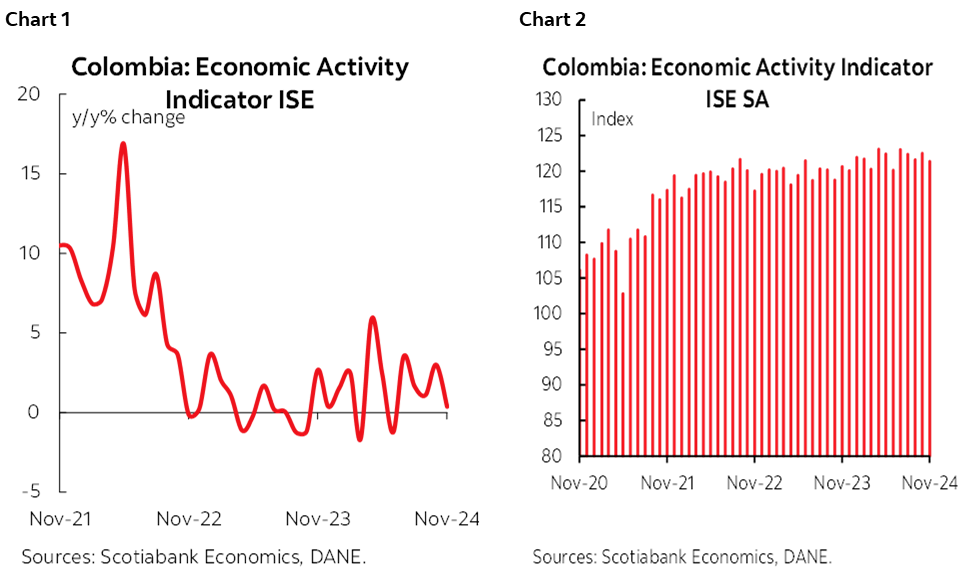

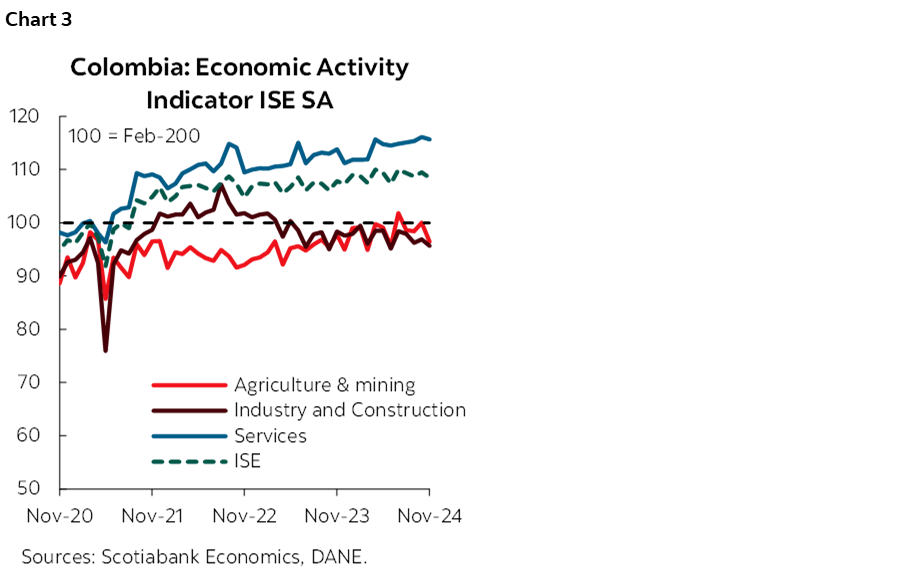

On Tuesday, January 21st, DANE released the November data for the Economic Activity Indicator (ISE). The indicator registered a +0.4% y/y increase (chart 1), below the +2.0% y/y market expectation and showing negative variations in six activities (out of the nine in the survey). In marginal terms, economic activity showed a weaker performance, falling by -0.9% m/m s.a. compared to October (chart 2).

Economic activity performed below expectations. The negative performance was due to weak activity in manufacturing, construction, and some services. Industry and construction showed a contraction of -2.6% y/y and -1.2% m/m, reversing the expansion of +0.7% m/m in October. Agriculture recorded a contraction of -1.7% y/y and -3.6% m/m, in contrast to the sector’s positive performance in previous months, so the agricultural sector may face challenges as expected weather conditions could affect the sector and counteract the growth achieved so far. Utilities and communication services registered a contraction of -1.2% y/y, communication services continue with a negative trend after a contraction of -5.9% y/y in October, the second sharpest contraction since the end of 2020. It is important to highlight the contraction in public administration, health, and leisure which contracted by -1.2% y/y, the first decline since June.

On the positive side, commerce showed an expansion of +5.8% y/y and +1.2% m/m, continuing with the expansion of +2.1% m/m registered in October, signaling further recovery, particularly in the demand for durable goods consumption. Moreover, real estate (+1.8% y/y and +0.1% m/m) and the financial and insurance sector (+1.5% y/y and +0.4% m/m) registered positive variations.

Despite the negative results, BanRep will not be in a hurry to accelerate the easing cycle. We affirm our call for rate stability at BanRep’s meeting on January 31st. The increase in inflation expectations and global uncertainty support the Board’s cautious approach. In addition, the central bank is more concerned about political issues related to fiscal policy and the impact of the minimum wage.

Key Highlights:

- The primary sector is losing traction and recorded a significant contraction in the period. In November, both agricultural and mining activities fell by -1.7% y/y. Coffee exports grew by 30.5% y/y, however, overall agriculture exports decreased by -3.0% y/y. On the domestic front, the supply of agricultural products saw a contraction of 1.4% y/y after the significant rise in October growing by 8.9%. Moreover, mining, coal, and extractive industries showed signs of contraction, mainly due to weaker domestic demand, which was reflected in a 13.0% y/y decline in mining exports.

- Secondary activities fell by -2.6% y/y. Both the manufacturing and construction sectors returned to negative trends, which was in line with the manufacturing output that contracted by -0.8% y/y during the same period. Therefore, the notable contributors to the manufacturing output included the sugar and panela production sector (+61.0% y/y), the transport equipment industry (+39.7% y/y), and beverage manufacturing (+2.2% y/y). Despite this, the pharmaceutical industry (-15.2% y/y), the fuel and oil industry (-7.1% y/y), and the iron and steel industry (-14.1% y/y) were the main sectors driving the negative outcome for the month. In contrast, construction is apparently still in negative territory. However, it has a possibility of accelerating due to a potential better performance in civil works and a potential recovery in the housing sector as home sales have increased +57% y/y, which is linked to declining interest rates.

- The services sector continued expanding but with heterogeneous performance compared to the previous month. On an annual basis, four of the seven service sectors registered negative variations. Utilities (-1.5% y/y and -1.4% m/m), communication services (-1.5% y/y and -0.8% m/m), public administration, health, and leisure (-1.2% y/y and -0.2% m/m) and professional activities (-0.6% y/y and +0.5% m/m), contributed negatively to the sector, offset by commerce (+5.8% y/y and +1.2% m/m), financial and insurance services (+1.5% y/y and 0.4% m/m) and real estate (+1.8% y/y and +0.1% m/m) (chart 3).

- Economic activity grew by 1.7% y/y in the YTD, improving vs the previous year’s growth of 0.7% y/y in the same period, but still below potential.

—Jackeline Piraján & Valentina Guio

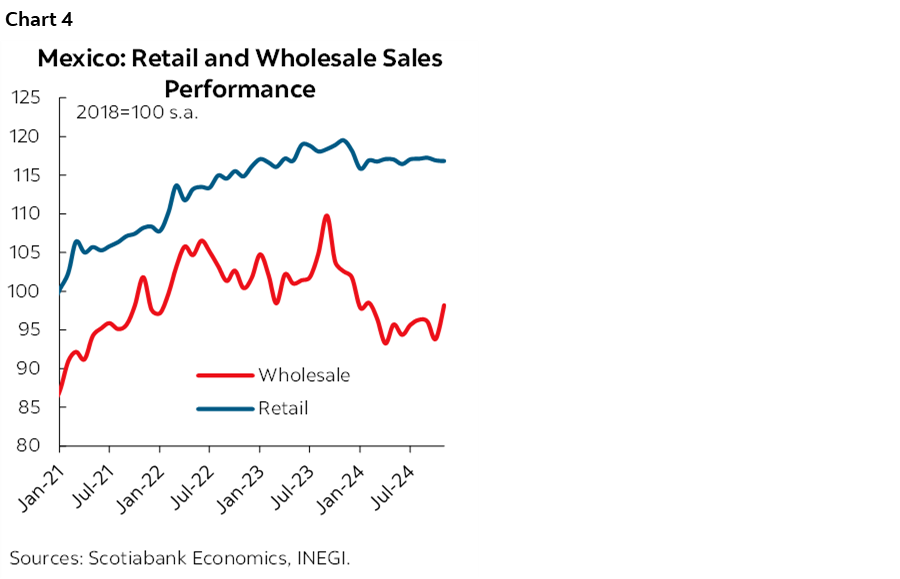

MEXICO: RETAIL SALES CONTINUE TO SHOW WEAKNESS IN NOVEMBER

In November, retail sales fell by -1.9% y/y, compared to -1.2% the previous month, marking the seventh consecutive month of declines. By components, the strength in grocery and tobacco trade stood out with an increase of 1.8% (3.5% previously), as well as online sales with a rise of 8.6% (16.4% previously), while textiles augmented by 0.1% (2.5% previously), and healthcare fell by -8.9% (-5.8% previously). On a monthly comparison, retail sales decreased by -0.1% (chart 4).

Additionally, wholesale trade suffered a decline of -5.0% y/y, from -7.7% previously, marking twelve consecutive months of declines, with five of its seven components in negative territory this time. Pharmaceuticals and entertainment showed the most pronounced drop, with -15.6% (-10.5% previously), while intermediation fell -13.6% (-12.7%), while groceries and tobacco increased by 4.8% (2.0% previously), as well as cars and parts 8.0% (-0.3% previously). Monthly, wholesale sales surged by 4.7%, from the previous -2.4%.

Data suggests a mixed outlook for retail sales. In the short term, we expect them to face challenges due to the sustained decline in several key components, such as textiles and healthcare. However, the positive performance in segments like groceries, tobacco, and online sales could provide a partial buffer, helping to mitigate some of the negative impacts and offering some support to the sector. Additionally, the political and economic uncertainty generated by Trump’s policies and the lower economic activity projected for 2025 could exacerbate these challenges, so retailers will need to seek strategies to maintain their business. Particularly, the monthly rebound in wholesale sales could be partly explained owing to advance purchases in anticipation of increased volatility and the expectation of USDMXN once Trump’s policies take effect. In a more complex environment, retailers will need to adapt their strategies amid a slowdown in their sales and the possibility of tariffs.

DIVIDED OPINIONS AMONG ANALYSTS OVER BANXICO’S NEXT MOVE

The results of the Citi Survey showed divided opinions on Banxico’s rate cut in February. Most respondents still anticipate a rate cut of 25 basis points, while 13 out of 30 now expect the cut to be 50 basis points, in line with the comments from the minutes of the last policy meeting, which indicated the intention of several Board members to increase the magnitude of the cuts. However, the forecasted rate for the end of the year remained at 8.50%, and 7.50% for the end of 2025. Regarding the exchange rate, the median of the forecasts also remained at $20.95, although it rose to $21.49 for the end of 2025. Concerning GDP growth, respondents expect to increase by 1.0% during 2025, below the 1.5% forecasted for 2024. Particularly for inflation in the first half of January, analysts anticipate a sequential increase of 0.27% in the headline rate and 0.23% in the core component, implying an annual variation of 3.76% and 3.67% respectively. By the end of the year, the consensus expects headline inflation of 3.90% and 3.68% in the core component.

—Rodolfo Mitchell, Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.