- Colombia: Facts and takes around diplomatic shock and resolution with the US

On January 26th, the Colombian government refused to accept two planes with people deported from the US, which generated discontent on the part of President Donald Trump, who then announced a series of measures against Colombia.

The announced measures included:

- The imposition of 25% tariffs on all products entering the US from Colombia, which could possibly reach 50%.

- Travel bans and visa revocation for government officials.

- Visa sanctions for all members of the current governing party.

- Customs inspections and border protection for Colombian citizens.

- Tax, banking and financial sanctions under the IEEPA Act (International Emergency Economic Powers Act).

What worried analysts most were the sanctions related to the treasury, banking and finance sanctions of the IEEPA, given the impact on the freezing of assets, the restriction of capital financial transactions against individuals and companies, and the total prohibition of commercial relations. If these measures are implemented, we could end up very isolated from the US and limited in using US deposits.

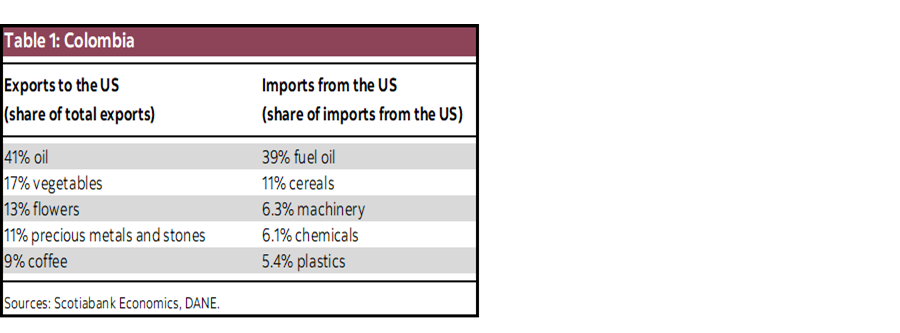

In trade terms, Colombia represents ~0.80% of total US imports (~USD 13.5 billion in 2024), while the US represents 30% of Colombia’s imports (~USD 16 billion). The impact of a higher tariff will be directly on input costs rather than final goods. Therefore, sanctions would imply a drop in GDP, higher inflation, exchange rate depreciation, and higher interest rates, with the magnitude of the impact strongly dependent on the lasting of the sanctions.

Main impacted industries:

In any case, the Colombian government finally accepted Donald Trump’s migration terms, avoiding the imposition of sanctions. The arrival of the deported Colombians is expected to put an end to the tension between the parties and the normalization of the bilateral relationship. However, it will be necessary to maintain a diplomatic relationship consistent with the country’s economic needs, avoiding any retaliation by the US, given Colombia’s high commercial dependence.

Market reaction:

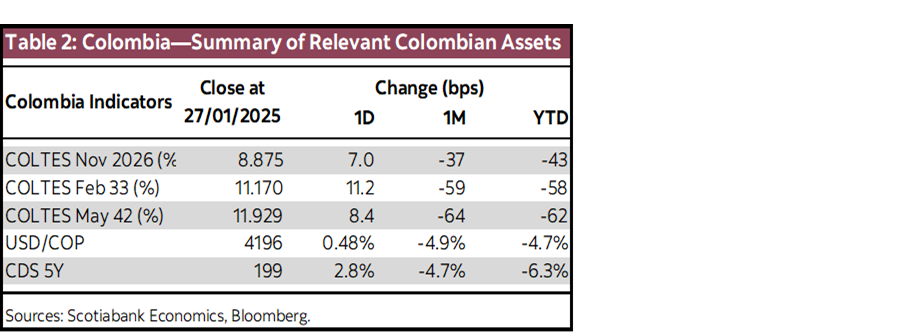

International markets opened with a risk-off environment due to Donald Trump’s measures and the rise of artificial intelligence in China that could threaten technology projects in the United States. In addition, assets in Colombia suffered an increase in volatility at the beginning of the day due to the political risks. The initial depreciation of 1.8% vanished throughout the day to close the day with an upside movement of just 20 pesos closing at 4196 pesos. It is worth noting that despite the FX market staying under control, macroeconomic models favour a fundamental value around 4350 pesos in the long term.

Fixed income in the US opens the week with appreciations of 7bps on average, with 10-year treasuries at 4.55%, being the security with the highest value. In contrast, in Colombia, COLTES opened with average widening of 13bps and it remained around that level throughout the day, with the 10-year COLTES above 11.547%. The Colombian 5-year CDS risk indicators increased by 5 points (+2.8%), opening the day above 199 and remaining at that level throughout the day (table 2).

It is important to note that after the diplomatic shock with the US, many government officials have emphasized that President Petro’s posts on X are one thing, and the government’s actions are another. This kind of quote is bittersweet since the noise from the President’s X account could continue despite his team continuing to work to contain any adverse situation, and in the end, it will continue being reflected in high premiums in Colombian assets.

Trade risks are likely to dissipate throughout the week, putting the focus back on the fiscal outlook. The MoF is still pending publishing relevant data, such as the Financing Plan for 2025 and the expected declaration for fiscal rule compliance. Meanwhile, the monetary policy decision on January 31st could have an additional tone of caution, given the new risks incorporated into local assets and inflation expectations that will not reach the target range in 2025. At Scotiabank Colpatria, we believe that the board will pause at 9.50%, given a high degree of uncertainty regarding international and fiscal issues.

—Jackeline Piraján, Valentina Guio & Daniela Silva

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.