- Peru: Headline and core inflation continue to decline in February

Tariffs on Mexico and Canada are finally here. After a one-month reprieve, the White House has launched additional 25% duties on all Mexican and Canadian goods—with only some small exceptions like de minimis imports or Canadian energy at 10%. The US also raised tariffs on Chinese goods by an additional 10ppts, over the 10% additional rate levied in early-February, to which China again responded in measured fashion (as much as 15% on US farm products this time). Canada has already rolled out its own retaliation of 25% tariffs on CAD30bn in imports from the US with another CAD125bn subject to a 25% tariff hike in three weeks if the US does not lift their tariffs, and PM Trudeau may announce more measures shortly.

Mexican Pres Sheinbaum expressed her disappointment over Trump’s tariff’s in today’s morning presser, given the efforts made on immigration and drug trafficking, and stated that she will announce retaliatory tariff and non-tariff measures on Sunday at the capital’s main square. There are no details yet on what goods may be impacted by Mexican tariffs, but these measures are unlikely to cover all imports from the US so as to prevent massive damage to manufacturing supply chains and lessen the inflationary blow (similarly to Canada). Sheinbaum also said that she will speak to Trump later this week (possibly Thursday), which helped alleviate some of the negative pressure on the MXN that just about grazed the 21 pesos per USD level this morning as Sheinbaum teed up retaliation.

Markets have by and large already reacted to the news yesterday after Trump said that the 25% would start today, which sent the MXN closed to 1% weaker to the 20.75–80 zone and also took the CAD briefly through 1.45. Today, while the CAD is sitting unchanged, the MXN is the worst performing major currency, falling 1%, mostly on the back of Sheinbaum’s pledge. At the opposite end, the CHF and JPY lead with 0.6–0.8% gains supported by haven-seeking trading, while the EUR is also trading 0.3% higher, relatively unscathed by a ramp-up in protectionism and helped by lower US rates (even if the EU “is next” when it comes to Trump tariffs, likely in early-April).

The risk tone remains negative today, as losses at the open roughly around 1.5–2% in the main US, Mexico, and Canadian indices extend yesterday’s downtrend on risk-off trading. Note that the S&P 500 has today erased all gains made since the US election, a development that may catch Trump’s eye in gauging the negative impact of his tariffs. US yields were driving marginally higher in Asia hours before trading lower since around the European open to now sit about 6/7bps lower in 2s and 2bps in 10s (in contrast to yesterday’s bull flattening that had a more haven-driven feel to it) with similar moves seen in EGBs though gilts are more evenly bid about 5bps across the curve. Early dealing has Mexican debt trading cheaper across the curve with a steepening bias, though 1–2bps yield increases in the front-end and 2–3bps rises in the 10yr space are relatively limited.

It is a very quiet day ahead as far as on-calendar risks are concerned both for Latam and for the G10 with no key data on tap, but with markets liable to remain volatile on the flood of headlines regarding trade relations with the US. Trump also addresses Congress tonight, when he will likely take a victory lap for his disruptive tariffs and perhaps announce major geopolitical moves (NATO exit?). For now, markets dislike the tariffs decision, but they also seem to believe (based on bad but relatively contained losses) that these may be watered down or removed in coming weeks/months (partly based on Trump precedent). We’re less optimistic, however, as the US has not presented a clear measure of “success” in tackling drug and immigrant flows by Canada and Mexico, and Trump has (so far) paid little to no attention to the negative reaction in markets or complaints by US business leaders; it may take plummeting approval ratings or steep increases in inflation to push him to reassess his damaging trade policies.

—Juan Manuel Herrera

PERU: HEADLINE AND CORE INFLATION CONTINUE TO DECLINE IN FEBRUARY

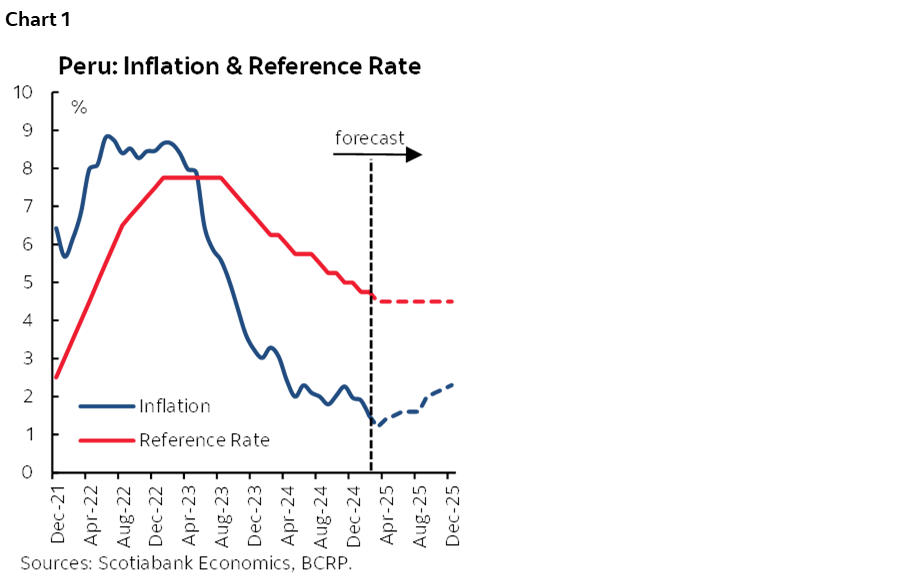

Monthly inflation was positive in February, however, due to a stronger base effect, annual inflation continued to decrease. We maintain our 2.3% scenario for general inflation in 2025 and 4.50% for the terminal reference rate (chart 1).

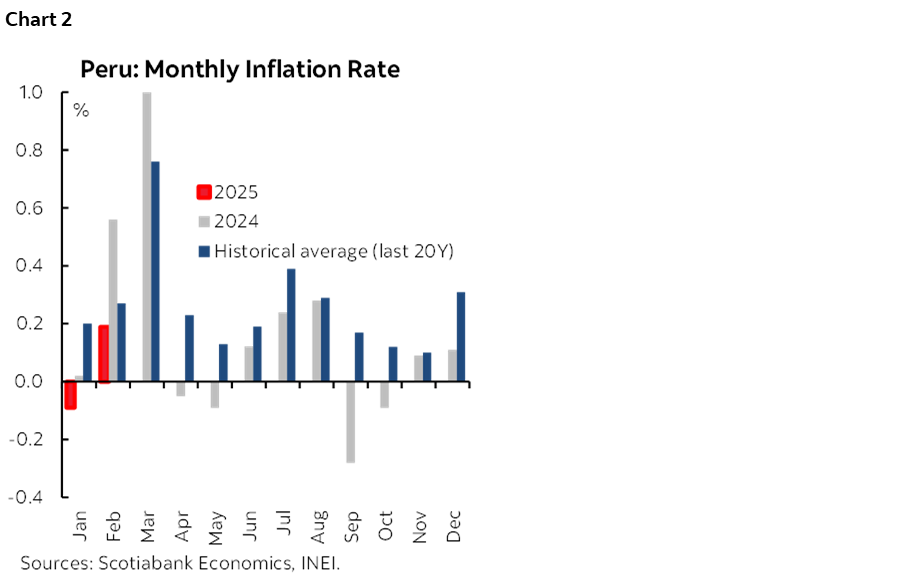

Headline inflation stood at +0.19% monthly in February, in line with the +0.2% expected by the Bloomberg market consensus but below that recorded in the same month of 2024 (+0.56%) and the historical average of the last 20 years (+0.27%). With this, annual inflation slowed from 1.9% in January to 1.5% in February, continuing below the midpoint of the Central Reserve Bank’s (BCR) target range (chart 2).

The increase in general inflation during the month is explained by higher prices in the restaurants and hotels category (+0.39%) mainly due to higher prices on the menu in restaurants, food and non-alcoholic beverages (+0.19%) and education (+0.37%)—although the school season begins in March, price movements have already been observed since February.

Core inflation, the trend component that excludes food and energy, also increased by 0.19% in February, close to the historical average of the last 20 years (+0.17%) but below that recorded in the same month of 2024 (0.51%). In year-on-year terms, it decreased from 2.4% in January to 2.1% in February.

The base effect is expected to persist in March, with annual general inflation falling to 1.2% or 1.3%, before beginning to rise in the following months. Inflation would remain below the midpoint of the target range (2.0%) until Q3-25 and would continue to increase to 2.3% towards the end of the year due to a base effect.

Regarding the BCRP reference rate, we anticipate a final 25bps cut, bringing the terminal rate to 4.50%. We expect this final cut to take place in either March or April, with a higher probability assigned to March, given the low levels of inflation, an exchange rate below S/3.70 and good dynamics in economic activity, in addition to maintaining the pace of cuts that has been taking place since September 2024.

—Ricardo Avila

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.