CANADA: RESILIENT IN THE FACE OF HEADWINDS

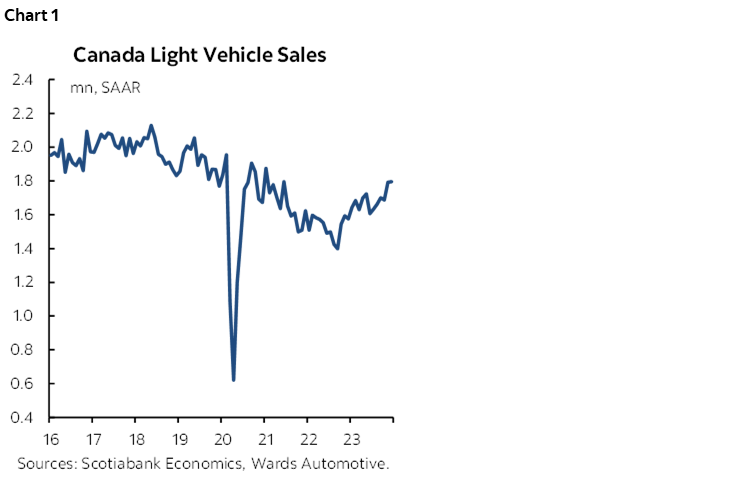

Canadian auto sales remained resilient in December, up slightly (0.2% m/m sa) to 1.80 mn (saar) units, the fastest seasonally adjusted monthly pace since January 2021 according to Wards Automotive (chart 1). Seasonally adjusted auto sales resumed their trend recovery following the summer slowdown in June—sales increased in all but one month of 2023H2 and averaged 1.76 mn (saar) in Q4-2023, up 5.6% q/q—as Canadians dealt with wildfires, strikes, and additional hikes to the Bank of Canada’s policy rate.

In a year marked by elevated interest rates and inflation above the BoC’s 2% target, 2023 was a year of recovery for Canadian new light vehicle sales that increased 10.6% y/y to 1.68 mn units. There is still lots of road left to a full recovery in the auto sector as new light vehicle sales remain down by more than 10% relative to pre-pandemic volumes despite extraordinary population growth. The rebound in sales was primarily concentrated in light trucks, which increased 12.2% y/y to 1.42 mn units, as opposed to sales of cars which increased 2.3% y/y to 267,000 units (chart 2). And within the car segment, sales of luxury cars increased by the greatest percent in year-over-year terms (21.5% y/y), accounting for just over one-in-four car sales.

The divergent recovery by vehicle type was aided by the increased North American production and inventories for larger vehicles, which recovered faster as manufacturers likely prioritized their initially constrained production to these higher margin vehicles that consumers wanted (chart 3). We are expecting further rebalancing within the auto sector this year amid still improving production and inventories, while elevated interest rates continue to weigh on new light vehicle sales in the near term (chart 4).

Our outlook for Canadian auto sales expects continued albeit slower growth to 1.71 mn units in 2024 and 1.78 mn units in 2025 as inventory levels improve and rates pressures ease.

UNITED STATES: STRONG GROWTH DESPITE VEHICLE SALES STALLING IN 2023H2

US auto sales increased 3.2% m/m (sa) to 15.8 mn (saar) units in December, rounding out Q4 which averaged 15.5 mn (saar) sales (-0.9% q/q), for a second consecutive quarterly decline (chart 5). Momentum in the trend recovery of US auto sales stalled in the second half of 2023, resulting in annual sales of 15.5 mn units for the year. While total new light vehicle sales increased 12.4% y/y from 13.8 mn in 2022, annual sales remain 9% below 2019 levels.

Sales of new light trucks increased 13.5% y/y to 12.4 mn units, recovering to pre-pandemic levels and surpassing the 12.2 mn light trucks sold in 2019 (chart 6). Meanwhile, the recovery in sales of cars, which increased 8.3% y/y to 3.1 mn units, remain nearly a third below pre-pandemic levels as a rebound in production and inventories growth begins to ease supply-side constraints.

Higher interest rates posed further headwinds to demand-side factors. The average 48-month new car loan rate reached 7.7% at the end of 2023, surpassing the previous peak from 2009 as hikes to the Fed’s policy rate and tightening financial conditions drove up financing costs (chart 7).

Our outlook for US new light vehicle sales forecasts an increase to 16.2 mn in 2024 and 17.0 mn in 2025 as inventory levels continue to improve and rates pressures ease.

GLOBAL AUTO SALES: PACE EASING TOWARDS END OF YEAR

Global auto sales declined marginally in November 2023, -0.3% m/m (sa), as sales at the regional level were mostly flat or down in seasonally adjusted terms (chart 8). Auto sales in Western Europe were in line with the global average at -0.3% m/m (sa), remaining slightly above 11.5 mn (saar) units on a three-month moving average since April 2023, though still below the 14.1 mn units sold in 2019. Despite eight of the 15 countries covered seeing positive seasonally adjusted growth, higher sales in major markets such as France (2.2% m/m sa), Italy (1.3%), and the UK (1.2%) were offset by declines in Germany (-1.9%) and Spain (-5.2%). Meanwhile in Eastern Europe, auto sales eased from the recent peak by -2.1% m/m (sa) to 3.1 mn (saar) units, the second fastest seasonally adjusted monthly pace since mid-2021. The pace of Asia Pacific auto sales continued to hold steady at the regional level (0.2% m/m sa), albeit slowing in four of the six countries covered. Increased sales in China (2.0% m/m sa), which accounts for two thirds of Asia Pacific sales, and South Korea (2.7%) were offset by declines in Australia (3.1%), India (-6.9%), Indonesia (-0.4%), and Japan (-1.3%). Seasonally adjusted auto sales in Latin America fell -5.0% m/m (sa) in November, remaining volatile on a monthly frequency, increasing in Colombia (21.9%) and Mexico (3.8%), but decreasing in Chile (-3.7%), Peru (-7.3%), Brazil (-7.9%), and Argentina (-26.2%). Our outlook for global auto sales is that the pace of growth will slow from an estimated 10.6% in 2023 to 3.9% in 2024 and 3.3% in 2025 as elevated interest rates weigh on global consumer spending and economic activity (chart 9).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.