- Global auto sales posted a slight decline of -0.5% m/m (sa) in September, bringing the annualized sales rate to 69.5 mn saar units, but the year-to-date shortfall narrowed to -1.1% relative to 2021.

- Sales in North America and Western Europe have been playing catch up (+1.9% m/m and +1.7% m/m sa, respectively) as strong momentum in Asia-Pacific markets stabilizes (-1.6 m/m sa, with year-to-date sales rate 10.7% higher than in same period last year).

- As we continue to expect levels of supply to be a major factor in determining sales and pricing trends, deteriorating financial conditions worldwide are becoming more prevalent. A global recession is assured in light of dim economic prospects in China and Europe, which weighs on demand going forward.

- The production outlook turned brighter around the world (although still gloomy here in Canada). The energy crunch in Europe could impose new risks on the global auto supply chain through parts and components supplied by European manufacturers.

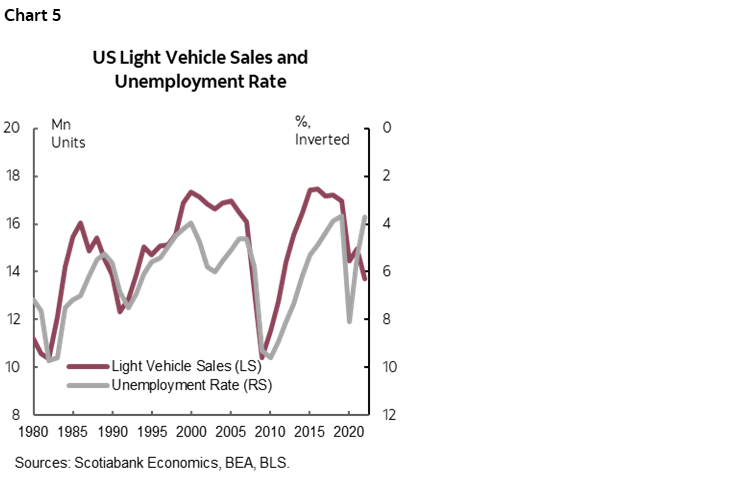

- Past downturns in the auto industry were mostly the result of a demand erosion associated with deteriorating labour markets and softer income. This report discusses our assessment of labour market conditions in Canada and the US, which should support continued recovery in auto sales.

- We expect continued pressures on vehicle prices (especially new cars) and financing costs—car ownership will likely remain expensive for the foreseeable future.

WHEN AUTO PRODUCTION RECOVERY MEETS GLOBAL RECESSION

Global auto sales slid further by -0.5% m/m (sa) in September following a slight contraction in August. Sales in Asian-Pacific markets have started to level off after several months of strong growth with a setback of -1.6% m/m (sa) in September, yet still at elevated levels. Outside of Asia-Pacific, sales have been recovering slowly but surely in most parts of the world—purchases in Western Europe climbed back further by 1.7% m/m (sa) in September, and North American sales also posted a sizable gain of 1.9% m/m (sa) on the back of strength in the US. South American sales seem to have run out of steam after strong gains in the first half of this year and declined by -4.2% m/m (sa) in September. As of the third quarter, global sales stood at 67.5 mn saar units year-to-date—a slight improvement from the 66.7 mn light vehicles sold in 2021 as we expected—but still below pre-pandemic sales of 75 mn units in 2019.

In the near-term, global auto sales recovery should continue to be supported by strong performance in Asia-Pacific, while a looming global recession weighs on demand and production going forward. China’s property market correction imposes imminent risks to growth and combined with a dim outlook in Europe, a global recession is inevitable. Heightened inflation and significantly tighter international monetary conditions remain the main drag to global growth, with a strong US dollar presenting additional risks to the outlook.

SUPPLY PRESSURE GRADUALLY EASES AS NEW CHALLENGES EMERGE

The global auto production landscape is improving but still facing challenges (chart 2). Automakers worldwide continue to cut production targets, but nowhere near the scale of last year’s revisions—AutoForecast Solutions estimated a total cut of 4.26 mn vehicles from their 2022 production plans, well below the 10.5 mn units lost in 2021. As the effect of COVID-19 restrictions subsides, production in Asia-Pacific has rebounded to levels close to its 2017–18 highs. German production has picked up but still struggles to recoup the sharp losses from the past two years.

In North America, vehicle inventory saw significant improvements in September, yet is still well below normal levels, especially for Asian brands and European luxury brands. 70–80% of North American purchases are manufactured in the region, which has roughly returned to pre-pandemic levels despite declining production in Canada. The easing supply outlook should offer some relief to market tightness and allow for downward pressure on pricing as we enter 2023.

That said, as the industry slowly recovers from production disruptions caused by the semiconductor shortage that started a year ago, climbing production costs could impose further pressure to supply. The energy crunch in Europe resulting from Russia further restricting natural gas exports could likely increase costs of gas and electricity by over 14 times per vehicle, as estimated by S&P Global Mobility. As EU countries take measures to address the energy shortage, the potential utility restrictions could affect automakers around the world through parts and components supplied by European manufacturers, on top of further production cuts in Europe through 2023.

SOLID LABOUR MARKETS PROVIDE BUFFER IN NORTH AMERICA

Despite recent softness in sales, current labour market conditions should support continued recovery in both Canada and the US. Sales in the US ticked up by 2.9% m/m (sa) in September, yet the sales rate is still -20.5% below the 17 mn units sold in 2019. Improving inventory sparked hopes of some relief in market tightness, while high vehicle prices and deteriorating consumer sentiment likely weigh on sales in an environment of pent-up demand and still-strong economic fundamentals. Decent job growth has been keeping labour markets tight and the unemployment rate fell to 3.5% in September. Although the slowing pace of job creation, slight uptick in initial jobless claims, and downtrend in JOLTS job openings are clear signs of modest cooling, the US market remains tight.

Sales in Canada have been weak this year, but the economy still has some near-term momentum, which benefits auto demand in the context of heightened uncertainties. Purchases continued the five-month decline with another -3.0% m/m (sa) contraction in September following a -7.3% m/m (sa) dip in the month prior. The Canadian labour market is even tighter than the one in the US—the unemployment rate dropped to 5.2% in September, which roughly equivalates to 3.8% in the US-comparable measure, and further below the level needed to not cause more wage growth and inflationary pressures (NAIRU). Hence, while some labour market softening is also expected, labour shortages and job vacancies will likely persist. Wages have been rising rapidly with relatively high breadth (chart 3), and 56% of firms still expect to pay higher wages over the next 12 months. Real wage growth—which underpins auto demand—could pick up next year while inflation comes down as we anticipate (chart 4). The $20 bn in fiscal measures announced at the federal and provincial level will also help consumption, but add to inflationary pressure in the meantime.

Unlike the latest supply-driven dip, past downturns in North American auto sales were mostly the result of labour market weaknesses and declining economic activity (chart 5). We are now expecting technical recessions in both Canada and the US by early next year (see here for details on Scotiabank Economics’ latest economic outlook). This is due to the additional monetary tightening needed to stave off persistent inflationary pressures faced by both sides of the border, particularly in the US, which would lead to an uptick in unemployment rates. That said, given that the recessions will likely be mild and short-lived, unemployment rates would remain far below the recessionary-type spikes. Hence, we anticipate strengthening sales alongside inventory improvements over the remainder of this year and next.

AFFORDABILITY COULD TAKE OVER AS A RESTRAINT TO SALES

While North American auto sales should see some material recovery in 2023 as supply constraint abates, affordability could play a more fundamental role and impact sales and production in the medium-term (chart 6). Rising vehicle prices and financing costs drove average monthly obligations of auto loans to $544 for mortgage holders and $496 for non-mortgage holders in Q2 2022 (chart 7). The average auto loan rate has gone up over one percentage point since then, which easily adds another $100 to monthly payments. The markets have priced in more monetary policy tightening ahead, yet risks will be tilted to even higher policy rates on both sides of the border until inflation shows material signs of abating. On the pricing side, used vehicle prices have stabilized with signs of decline, but new vehicle price growth has been accelerating (chart 8). With supply chain hurdles and high input prices still in play, we don’t expect a sharp loosening in the high vehicle pricing environment.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.