- Global auto sales posted a slight decline of -1.3% m/m (sa) in August after three months of consecutive gains. The year-to-date shortfall relative to 2021 narrowed to -4.0%.

- Sales volume improved to an annualized 70.1 mn saar units in August from the 66.2 mn saar units at mid-year, closer to the 72 mn vehicles trending over the first half of 2021.

- Strong sales in China drove 2022 global auto sales forecast higher and we now expect sales volume to end the year slightly above last year’s level. Meanwhile, recovery has been subdued in North America, Western Europe and Japan in the second half of 2022 so far as supply shortfalls remain a major strain.

- Headwinds for auto demand are mounting—rising interest rates, heightened inflationary pressures and weaker financial markets will likely dampen demand and curtail purchases down the road—but so far these impacts have been masked by limited inventory. A demand erosion will alleviate some market tightness, which could remove some pricing pressure in new vehicles.

- Nevertheless, we expect resilience in Canada and the US as the economic slowdown unfolds owing to pent-up demand from the past two years, especially given still-healthy household balance sheets and tight labour markets.

- Production recovery in North America has not yet led to a meaningful rebound in inventory. Due to a continued lack of signs of easing supply constraints, we are revising down our 2022 sales forecast from 1.65 mn units to 1.60 mn units for Canada, and from 14.2 mn units to 13.7 mn units for the US.

A SLIGHTLY BRIGHTER GLOBAL PICTURE

Global auto sales saw growth stagnate in August after some encouraging improvements since May (chart 1). Purchases declined by -1.3% m/m (sa), 13.7% y/y higher than the same month last year, bringing the year-to-date sales rate to -4.0% below 2021. The annualized selling rate reached 70.1 mn units in August, only slightly below the 72 mn vehicles trending over the first half of 2021 before the microchip shortage largely disrupted global production. So far, sales recovery in the second half of 2022 has been sluggish in some major markets, which is especially evident in North America, Western Europe as well as Japan where supply shortfalls continue to keep sales below fundamental demand. Strength in Asia-Pacific markets persists despite minor setbacks in August—China’s incentives drove year-to-date sales rate to +11.8% above last year, while India is also having a stellar year of +18.6% sales growth so far this year. China’s incentives mask impact of a broader economic slowdown underway, which, along with deteriorating outlook in Europe, suggests that a global recession is inevitable. Despite mounting headwinds, in an environment of tight supply, global auto sales will likely end the year slightly higher than last year as the inventory shortage gradually improves.

NORTH AMERICAN SALES STILL STRAINED BY SUPPLY SHORTAGES...

In North America, auto sales recovery remained weak and volatile. Production bottleneck persists as a major strain on sales—North American auto production edged up by +4.4% in August m/m (sa) to 14.7 mn units saar after a -6% m/m (sa) drop in July, still well below the 16.2 mn units saar in 2019 (chart 2). Meanwhile, automakers around the world continue to cut their 2022 production targets, according to Auto Forecast Solutions, and North America accounts for over 30% of projected production losses. The good news is that the semiconductor shortage in North America is seeing signs of relief—the S&P Global PMI™ Commodity Price & Supply Indicators reported notable moderation of pricing pressure for semiconductors in August. Broader indicators of supply chain health such as delivery times are also heading in the right direction. We consequently expect to see a stronger production recovery over the course of 2023.

Canadian auto sales faced a setback in August as purchases pulled back by -6.5% m/m (sa), bringing the year-to-date selling rate to -8.4% below last year. Proprietary data suggests that inventory sits at a very depressed level, indicating that still-tight supply continued to mask the impact of demand-side factors. Consumer sentiment remained gloomy around the country—the Conference Board of Canada’s Consumer Confidence Survey reported that only 10.7% of respondents believed now is a good time to purchase large-ticket items, compared to 31% in 2019. Despite souring sentiment, in our latest forecast note, we expect consumer demand to remain resilient and contribute to predicted real growth of 3.1% in 2022, before slowing to 1.0% in 2023. Given August’s weak number, we are removing another 50,000 units of purchases from our 2022 forecast (chart 3). We expect sales to pick up in 2023 to 1.8 mn units on the back of improved supply and strong pent-up demand in Canada.

US auto sales dropped by -1.1% m/m (sa) after two months of slight improvement, with the year-to-date selling rate sitting at -15.3% below last year’s level, providing a reminder that the path to recovery will be long and bumpy. Helped by weaker sales, inventory-to-sales ratio improved very modestly in August and remained at a depressed level, suggesting that the supply-demand imbalance persists (chart 4). On the demand side, deteriorating affordability likely took a toll on consumer confidence, according to the University of Michigan's Surveys of Consumers. According to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index, the number of median weeks of income needed to purchase the average new vehicle set another record in August at 42.6 weeks, much longer than around 33 weeks in 2019. We are removing another 500,000 units of purchases from our 2022 forecast to account for the slower-than-anticipated production recoveries (chart 5). Anticipating weaker consumer spending next year, we also brought down our 2023 forecast to 15 mn units, representing a 9.6% sales growth from this year.

...WHILE DEMAND-SIDE CHALLENGES MOUNT

As risks tilted to the upside for policy rates, some erosion in pent-up demand could dampen sales once production catches up next year. In the context of heightened inflation risks, central banks have been raising interest rates aggressively to tame inflation. Canada's softer August CPI reading reinforces our view that inflation should pivot in the near term, mainly due to signs of improving supply chains (chart 6) and slowing global growth—both should remove some inflationary pressure. However, we see increasing upward pressure from lagged wage effects both in Canada and the US against exceedingly tight labour markets, hence we continue to expect inflation to remain well above targets through 2023 (4.4% in the US and 3.8% in Canada next year). Consequently, additional policy rate increases are warranted with heightened uncertainties around terminal policy rates.

Consumer demand should still have some steam left—especially in Canada given healthy household balance sheets and resilience in the economy. In Canada, household savings rate remained elevated as of the second quarter of 2022, suggesting more spending to be unwound. Stripping the mortgage component, household debt service ratio for non-mortgage debt remained close to the long-term average despite 125 bps rate hikes by the time the data was collected (policy rate was raised by another 175 bps after that), which suggests some financial buffer against the rising rate environment (chart 7). Meanwhile, both federal and provincial governments are at various stages of rolling out new stimulus amounting to about 1% of GDP in the coming months which should provide a boost to household consumption. The US household savings rate has returned to pre-pandemic levels, but labour market tightness and high job openings should support continued gains in disposable income. Although growth is clearly slowing, we continue to view recession as a risk, not a certainty in North America.

NEW VEHICLE PRICING UNLIKELY TO SEE MATERIAL RELIEF ANY TIME SOON

With still-acute supply-demand imbalance, vehicle pricing pressure has not seen any material relief. CPI inflation for new vehicle prices remained elevated, at a rate of +0.8% m/m in the US and +0.4% m/m in Canada (chart 8). While shipping costs have been gradually edging down, manufacturers will likely face rising wage pressure. Meanwhile, the producer price for motor vehicle parts continued to accelerate despite declines in raw material prices (chart 9). Automakers and dealerships have been able to pass higher input costs to consumers, but with improving supply and weakening demand, it will likely become increasingly difficult to do so.

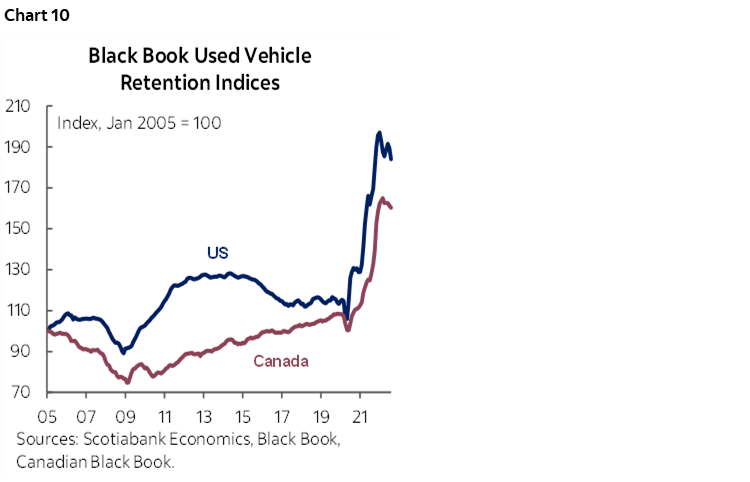

SOME SIGNS OF NORMALIZING IN THE USED MARKET

Used vehicle prices have shown some abatement in North America as inventories continue to build up. According to the Black Book Retention index, wholesale prices in Canada and the US have begun to depreciate to -2.8% and -6.6% below their respective peaks earlier this year (chart 10). According to Cox Automotive, used vehicle inventory was 10% above year-ago levels at the end of August. Meanwhile, demand for used cars should start to normalize from last year’s record level, as reflected in sales volume, which was down 16% from 2021 in the US reported by Cox Automotive. Rebounding inventory and improved availability of new vehicles are likely signs of peaking in used vehicle prices, yet we expect the used market to remain relatively tight as the economic cycle matures, especially in the low-price segment.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.