- This note is part of a series that will be published after important data releases, documenting mechanical updates of the nowcast for Canadian GDP coming from the Scotiabank nowcasting model. The evolution of this nowcast will inform Scotiabank Economics’ official macroeconomic outlook.

The model is described in a related note here.

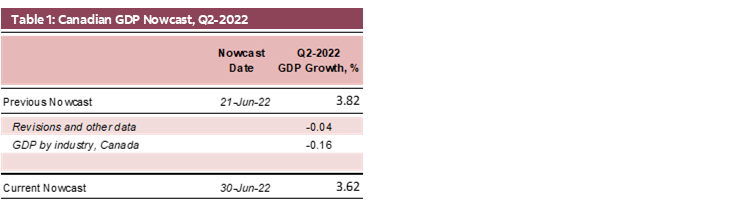

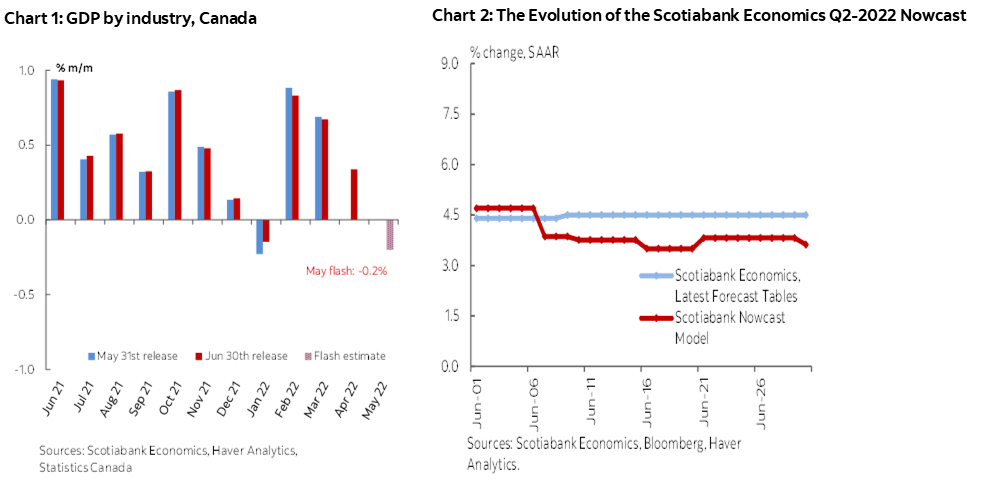

- This morning Statistics Canada published its take on Canada’s economic growth over the past few months. What emerged was a portrait of the Canadian economy that started Q2-2022 at a brisk pace, with GDP growing +0.3% m/m in April, but then reversed abruptly in May (-0.2% m/m). On balance, the new information drove the Canadian GDP nowcast for Q2-2022 weaker to 3.62% Q/Q SAAR, although the uncertainty around this figure is extremely high, due in no small part to the significant risk of revisions to industry-level GDP.

- In April, growth in economy-wide output was based on the expansion in 13 out of 20 industrial sectors, with the largest contribution coming from mining, quarrying and oil and gas extraction (+3.3% m/m), as the sector continued to benefit from elevated energy prices and supply concerns in other regions. In particular, the oil and gas extraction and the associated support activities expanded at a record pace in April.

- Client-facing activities, such as accommodation and food services (+4.6% m/m) and arts and entertainment (+7.0% m/m) continued to recover as pent-up demand from consumers has provided a powerful tailwind for the industry over the past several months. The main offset in April came from housing-related sectors, with construction remaining unchanged, real estate and rental and leasing contracting by -0.8% m/m and financial sector down -0.7% m/m.

- The unexpected weakness in May, with an early estimate pointing to a contraction in GDP of -0.2% m/m, was mainly attributed to weaker activity in construction, mining quarrying and oil and gas, and manufacturing.

- Overall, while growth in April surprised slightly to the upside, the weakness in May and uncertain prospects for June put a question mark over the trend of Canadian growth in the coming months. With high inflation taking a bite out of Canadian household finances, it is becoming increasingly unlikely that consumers can prop up growth going forward, while higher borrowing rates have led to a rapid cooling in the Canadian housing market. Thus, while Q2-2022 should show a relatively healthy expansion in the Canadian GDP, partly due to the strong momentum from the previous quarter, it is becoming difficult to identify drivers for growth in Q3-2022, especially if the current geopolitical crisis continues unabated.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.