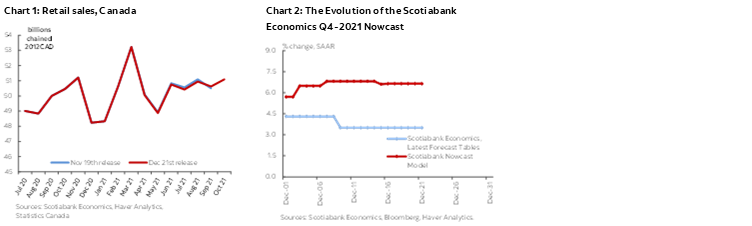

- This note is part of a series that will be published after important data releases, documenting mechanical updates of the nowcast for Canadian GDP coming from the Scotiabank nowcasting model. The evolution of this nowcast will inform Scotiabank Economics’ official macroeconomic outlook.

The model is described in a related note here.

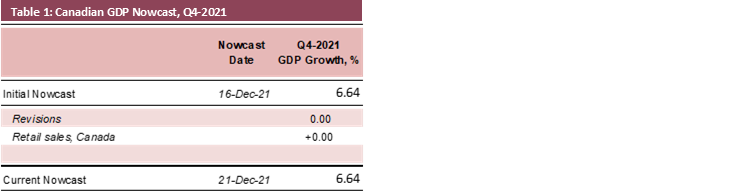

- Canadian consumers were able to spend significant time shopping in October, boosting the fortunes of various retailers according to the Statistics Canada report. Retail sales expanded by +1.6% m/m, with 7 of 11 subsectors registering higher receipts for the month of October. In volume terms the rise was +0.9% m/m, adding to strength in other indicators and leaving Q4-2021 at +6.64% Q/Q SAAR.

- Retail sales were boosted by a rebound in spending on motor vehicles and parts (+2.2% m/m), which made up some of the lost ground after parts shortage-induced declines in the previous two months. In October the chip shortage was less severe, according to StatCan. However, the issue of lack of supplies is expected to persist until mid-2022.

- Purveyors of sporting goods, books and hobby-related items were able to enjoy the return of customers in a big way in October, with sales jumping by +17.5% m/m. Sales were also up at building materials (+3.2% m/m), general merchandise (+2.8% m/m) and clothing and accessories stores (+1.7% m/m). In contrast, receipts at food and beverage stores were down (-0.6% m/m).

- While all the major indicators point to significant strength in October, with manufacturing (+4.3% m/m), wholesale (+1.4% m/m) and retail sales up significantly, in addition to labour market data that showed strong gains in hours worked (+0.7% m/m), the picture later in the quarter becomes murkier.

- First, the spread of the Omicron variant has likely led to a slowdown in economic activity in December, in addition to a reintroduction of capacity restrictions in some provinces. These are likely to continue to impact activity in early 2022.

- Second, the impact of BC floods in November is invisible in the data so far: employment jumped by +154k in November, and early estimates of retail (+1.2% m/m) and wholesale (+2.7% m/m) sales suggest a strong expansion in activity. However, given that the sales estimates are based on low response rates, and that the labour force survey was done just before the floods hit BC in November, we will wait for hard data to make any firm conclusions. Supply chain issues are also expected to be an enduring source of volatility in the data for the next few quarters. One thing is certain: the level of uncertainty around Q4-2021 is extremely high.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.