- Q4 has 3½% growth tentatively baked in

- Q3 GDP grew by 46% annualized

- August GDP slightly beat expectations…

- …and September maintained momentum as expected

- Over three-quarters of lost output has been recovered...

- ...but the results vary widely by sector

Canadian GDP, m/m % change, SA, August:

Actual: 1.2

Scotia: 1.0

Consensus: 0.9

Prior: 3.1 (revised up from 3.0%)

September guidance: 0.7

Canada’s economy ripped higher in Q3 and very early indications point to sustained growth into Q4.

Statistics Canada guided that Q3 GDP growth is tracking at about +10% q/q at a seasonally adjusted non-annualized pace which is about 46% annualized. That matches expectations (Scotia 46%, consensus 45%).

August GDP landed at 1.2% m/m and September’s guidance was for a further rise of 0.7% while July growth was revised up a tick to 3.1%. They were in the ballpark of expectations after StatsCan had previously indicated August would climb by about 1% and based upon limited tracking information that we had for September.

The Canadian economy is well positioned into q4 risks with 3½% growth ‘baked in’. This estimate is derived from taking September GDP over the Q3 average and annualizing that in order to see what kind of growth would occur if monthly GDP was flat throughout the October to December period. The reason for this approach is to have an estimate that is independent of imposed judgement on the possible evolution of Q4 data.

The way the quarter ended therefore provides a solid starting point to Q4 growth tracking that at least temporarily downplays fear over what would happen in the wake of a 46% Q3 expansion. It’s a solid start compared to the BoC’s forecast for 1% annualized Q4 growth. The BoC’s estimate includes a forecast for how Q4 data will evolve and is also an estimate of expenditure-based GDP growth which can differ from using monthly production-based GDP due to things like inventory and import swings. During Q3, there was no material difference between the two approaches to estimating GDP growth.

Canada’s economy has recovered about 78% of the pandemic hit from February to the bottom in April and now sits just 3.9% smaller than where it was in February (chart 1). The supply side has continued to grow such that a combination of greater potential to produce and a shortfall in recovered actual production continues to result in material slack in the overall economy.

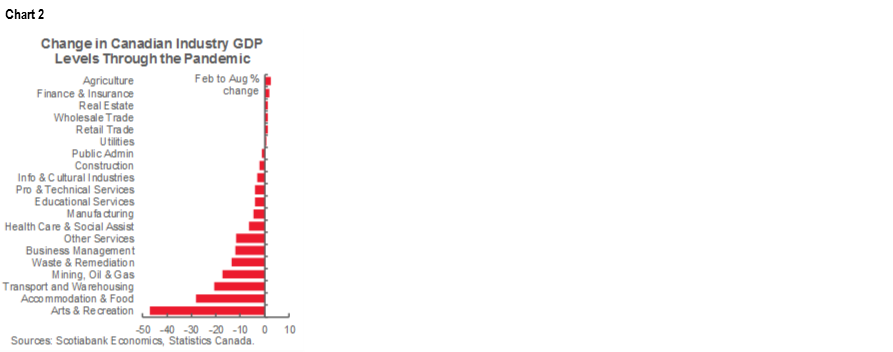

Having said that, the degree of recovery sharply varies across individual sectors as shown in chart 2. A caution is that this only goes to August because the preliminary GDP estimate for September is not broken down by sector. Another caution is that some sectors like restaurants, bars, gyms etc face renewed downside risk into Q4 on tightened restrictions.

Nevertheless, some sectors like agriculture, finance and insurance, real estate, wholesale trade, retailers and utilities have fully recovered in aggregate and then some. Some other sectors like public administration, construction, info/culture, professional/scientific services, education and manufacturing are not far behind. The health sector is still down on net, but not by much. Mining/energy remains almost one-fifth smaller than in February and so does transportation and warehousing.

But deserving separate recognition is that two sectors in particular remain very hard hit. Arts and recreation is about half of what it was in February and the accommodation and food services sector including restaurants and bars is still almost 30% smaller. Those two sectors will remain challenged into 2021.

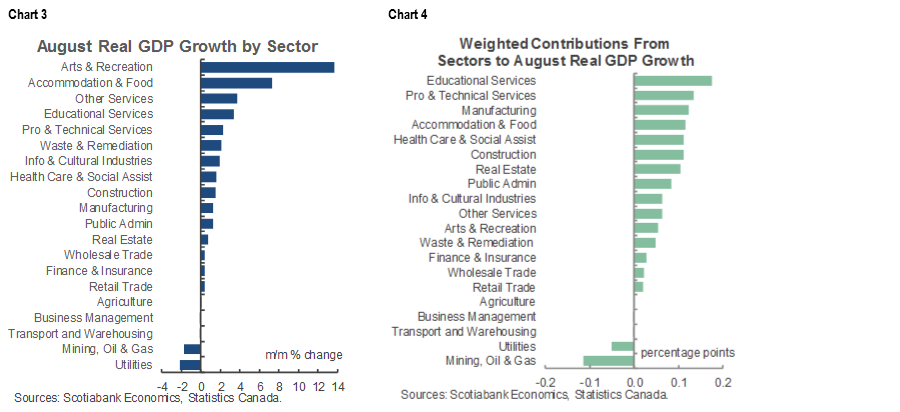

Chart 3 provides a breakdown of August GDP growth by sector. Chart 4 does the same thing on a weighted basis.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.