- BoC says the front-end is too rich...

- ...either because they have in mind a longer pause, or renewed hikes...

- ...but markets barely listened...

- ...suggesting that more decisive action may be required

- The BoC is itself feeding cut bets with its own inflation forecast

The Bank of Canada’s communications were somewhat muddled around key points but overall I take them to be a signal to markets that the front-end is too dear while sounding ambiguous toward whether that is because cuts won’t be delivered as soon as markets expect and/or whether further tightening lies in store.

Did markets listen? Well, sort of. Minimally. Ok not really. The Canada two-year yield is slightly underperforming US 2s on the day and the C$ appreciated by about a quarter of a cent on a USDCAD basis following the communications. Markets are still pricing a BoC cut by Fall. At least some of the effects on relative rates and CAD have more to do with the market’s particular interpretation of US CPI than whether it listened to the BoC.

In my opinion, if the BoC really wants to counter market pricing for policy rate cuts then actions need to be substituted for warnings that nobody is listening to. Jawbone all you wish, but if the BoC is saying they are uncomfortable toward the easier conditions being priced in the front-end of the Canadian rates curve because it complicates its inflation fight well then the most effective way of addressing this would be to stop the talk and hike or else be dragged along for the ride. Merely wagging a finger puts its credibility at risk.

Alternatively, the soundest argument for leaning against cut pricing would be that 2% inflation won’t be achieved and time will tell. It is Governor Macklem’s perhaps misplaced conviction that it will be achieved that is driving cut pricing. You can’t have it both ways by forecasting a perfect landing on 2% while beseeching markets not to price cuts.

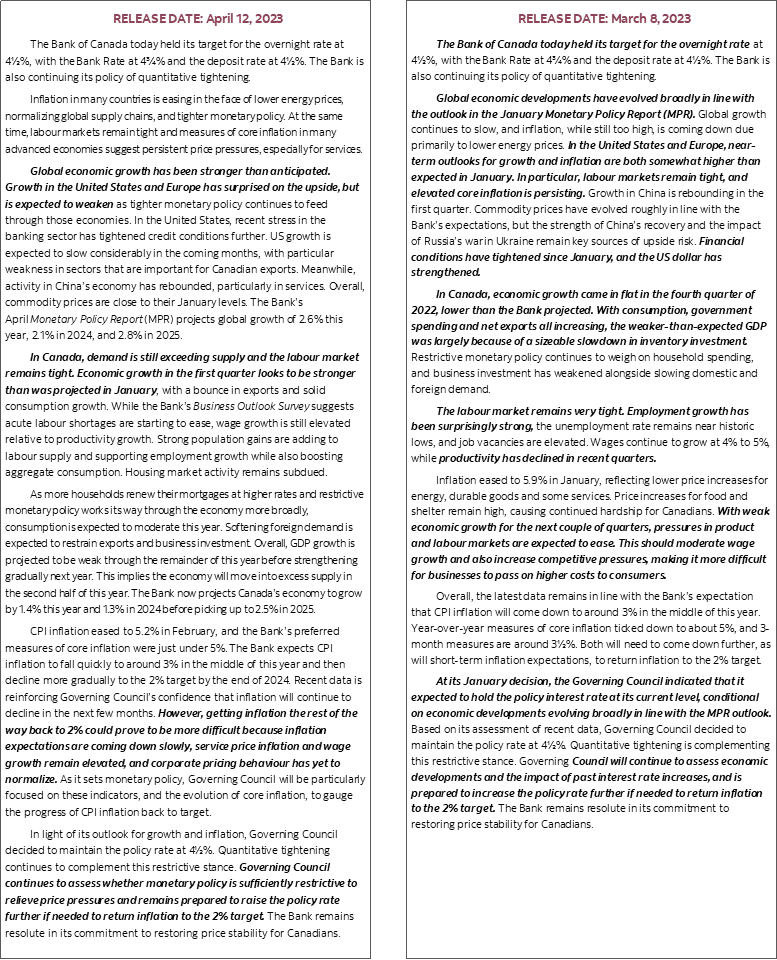

The policy statement is here, Governor Macklem’s opening comments for the press conference are here, and the full Monetary Policy Report is here. Also see the comparison of this statement to the prior statement in March in the appendix to this note.

KEY STATEMENT TAKEAWAYS

Key in the statement are the changes to the guidance in the final paragraph and the language around inflation. There are several examples worth citing.

First, the new statement struck out reference to a conditional hold. Gone is the prior reference in the March statement to how Governing Council “expected to hold the policy interest rate at its current level, conditional on economic developments evolving broadly in line with the MPR outlook.” Note that this is a reference to the prior MPR in January. This omission may have been because they are no longer referencing the adoption of the hold language in January in the present context while taking it for granted that they are holding, or it could have been an accidental oversight. Macklem was asked about it in the press conference and seemed surprised while re-reading what they said which suggests there isn’t much to take away from this in isolation of the build-up of points to follow. Whatever the case, there was zero benefit and significant risk to removing the explicit statement-codified hold language. If they still have an explicit hold bias, then they should have repeated it especially in light of other changes that were made.

Second, the more explicit part of forward guidance now states the following:

"Governing Council continues to assess whether monetary policy is sufficiently restrictive to relieve price pressures and remains prepared to raise the policy rate further if needed to return inflation to the 2% target."

The prior statement had said:

"Governing Council will continue to assess economic developments and the impact of past interest rate increases, and is prepared to increase the policy rate further if needed to return inflation to the 2% target."

The changes therefore include more explicit acknowledgement that they are unsure whether policy is “sufficiently restrictive” while striking out reference to lagging effects but nevertheless keeping this reference elsewhere.

Third, Governing Council sounded more uncertain toward getting inflation all the way back down to 2%. Key is the following paragraph:

"Recent data is reinforcing Governing Council’s confidence that inflation will continue to decline in the next few months. However, getting inflation the rest of the way back to 2% could prove to be more difficult because inflation expectations are coming down slowly, service price inflation and wage growth remain elevated, and corporate pricing behaviour has yet to normalize. As it sets monetary policy, Governing Council will be particularly focused on these indicators, and the evolution of core inflation, to gauge the progress of CPI inflation back to target."

So they are reinforcing prior points about making progress, but saying they are worried that such progress risks stalling out or isn't fast enough for their liking within a reasonable 12–18 month policy horizon. They are not yet convinced that the risk is great enough to merit moving away from a balanced assessment of inflation risks while nevertheless still slanting their bias asymmetrically toward upside rather than downside risks.

Fourth, the BoC emphasized how there remains little to no progress toward opening up disinflationary slack in its output gap framework of thinking. They did this by noting that “demand is still exceeding supply.” Sustained progress toward 2% inflation requires a sustained period marked by a return to balanced conditions if not slack in the economy and that happens with fairly long lagging effects on inflation. This process has not really started in Canada.

Fifth, the BoC acknowledged that “wage growth is still elevated relative to productivity growth.” During the presser, Macklem almost beseeched businesses, governments and labour alike to hold the line on targeted wage growth by having faith in the 2% inflation target but clearly organized labour has other plans.

Sixth, I found the BoC’s guidance on the impact of higher immigration to be somewhat misleading and time will tell what happens. The statement references the impact on both labour supply and job growth while also adding to demand pressures on consumption. My beef is that the Canadian economy usually gets demand infusions from higher immigration through housing first and then supply reacts with a lag such that house price pressures and spillover effects on broader inflation can be material in a persistent cycle. Inflation can be under persistent upward pressure in the intervening period as opposed to the BoC’s intimation that supply and demand adjust together in contemporaneous fashion. When has that ever happened??

MACKLEM LEANS AGAINST MARKETS PRICING CUTS

Macklem spent time during his press conference to emphasize that “We indicated that we are continuing to assess whether policy is sufficiently restrictive. We also discussed the likelihood that monetary policy needs to remain restrictive for longer.”

When Macklem was asked about the outcome of the discussion on whether rates are high enough and the discussion around higher for longer he replied by stating that “Our decision today was about what we wanted to do with the policy rate today. We will take into account future information in deciding on future moves. The implied market pricing for rate cuts does not look like the most likely scenario to us.”

Macklem was pressed further on the matter when asked why a rate cut is unlikely and replied “Inflation will come down to 3% by summer but the destination is 2% and there are a number of things that still need to happen to get back to 2%.”

Macklem was then asked whether he felt they had enough evidence to justify another rate increase which clearly they do not yet (or they would’ve raised today).

“We did not raise interest rates. We stayed at 4.5%. We are conveying we are using this time in this pause to assess whether we have done enough and whether interest rates might need to stay restrictive for longer. Inflation is coming down. Recent data has reinforced our view that inflation will be at 3% by summer. We have revised up our growth projection and the labour market has remained tight. The adjustments toward 2% inflation could take longer. What we are highlighting is that these are things we are watching. They are still above our forecast and we have to see more progress to get inflation back to target. Core inflation provides a good summary of the underlying trend in inflation and is something we will be looking at. These are the things we will be looking at to see if interest rates are high enough.

FORECASTS—GREATER NEAR-TERM CAPACITY PRESSURES DRIVING MORE CONCERN ABOUT LANDING AT 2%

The ranges for potential GDP growth estimates were left largely intact but actual GDP growth was revised up for this year and taken away from next year. That implies a little more by way of front-loaded capacity pressures than previously estimated but it’s a wash next year. This reinforces the above points on how the BoC is somewhat more concerned about getting back to 2% inflation as quickly as it expects by the end of next year given lag effects that follow delayed progress toward removing excess demand compared to prior expectations.

The BoC now sees the noninflationary speed limit to growth as set at 2.3% in 2023, 2.1% in 2024 and 2.1% in 2025. These estimates are down from what was estimated a year ago but broadly intact with more recent estimates.

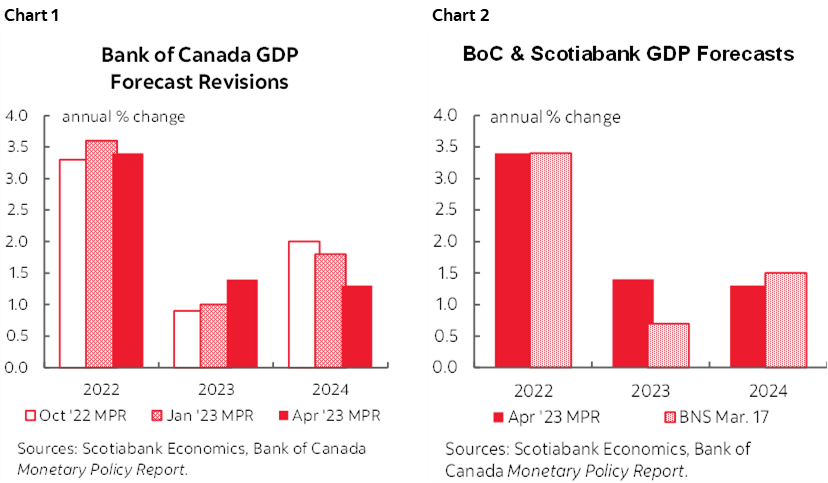

The BoC now expects actual GDP to grow by 1.4% this year (1.0% prior) but assumes this comes at the expense of growth next year (1.3%, down from 1.8% previously). The forecast horizon was extended to show 2.5% growth in 2025. See chart 1 and also chart 2 that shows the BoC is more upbeat toward 2023 growth than Scotiabank Economics. Revising up for this year but down for next year might prove to be correct but feels like arbitrary math to avoid showing more persistence to capacity pressures.

The main drivers of the upgraded 2023 GDP growth projection included private consumption (1.1% weighted contribution from 0.7%), net exports (+1.6 ppts from 1.4 ppts) and government spending (see separate section below). A slightly greater inventory drag effect is a partial offset at -1.2 ppts this year (-1.0% previously).

Where they took away from the 2024 GDP projection was mainly through consumption that now adds 0.5 ppts (0.9% previously).

On nearer-term growth, they've gone conservatively toward revising up Q1 GDP growth to 2.3% q/q SAAR from their prior 0.5% forecast. My tracking and our nowcast estimates indicate Q1 growth is tracking over 3%. Still, the last two quarters have surpassed their expectations on net.

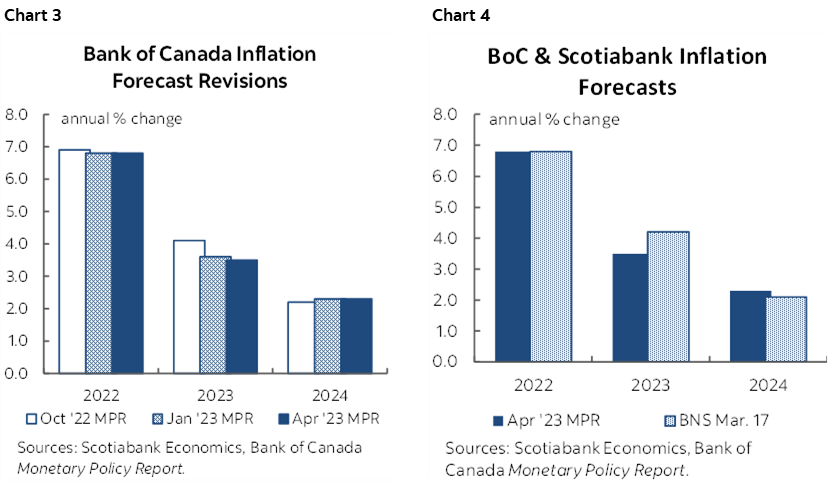

The BoC left projected inflation largely unchanged for this year and next year compared to its January MPR (chart 3). Our own house forecast expects somewhat firmer inflation this year (chart 4). It does not publish projections for any core inflation measures despite the fact that the BoC uses core gauges as the way of operationalizing achievement of its 2% headline inflation target.

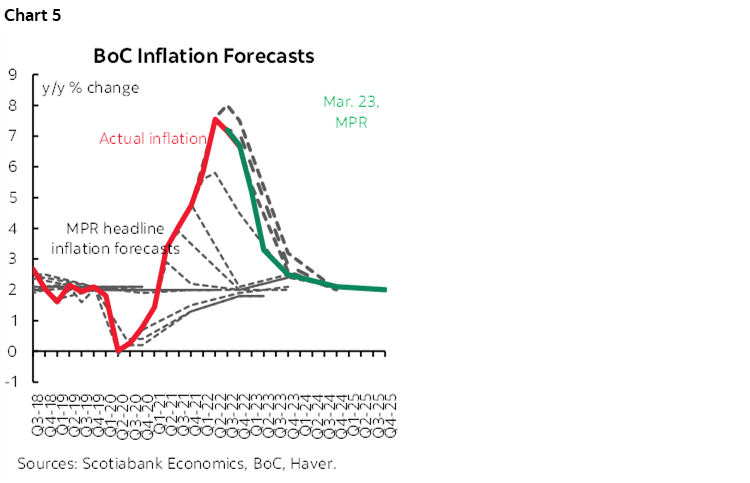

Always, always remember that the BoC’s track record at forecasting inflation is poor. Chart 5 is one that I’ve used many times to illustrate this point and only shows the track record in recent years; dashed and solid green lines show inflation forecasts for each MPR and the solid red line shows actual inflation. Therefore, we should take its forecasts with a high dose of skepticism. The BoC almost always shows itself to be fully under control of inflation—even when it obviously isn’t—by showing a return to 2% inflation as if magically within a medium-term horizon. Maybe if you stopped showing that wishful thinking you wouldn’t have markets pricing rate cuts from restrictive levels above neutral. The BoC doesn’t get the fundamental inconsistency between warning against pricing rate cuts while forecasting 2% inflation and either markets are right or the BoC won’t durably achieve 2% and especially on a core m/m SAAR basis.

NEUTRAL RATE UNCHANGED

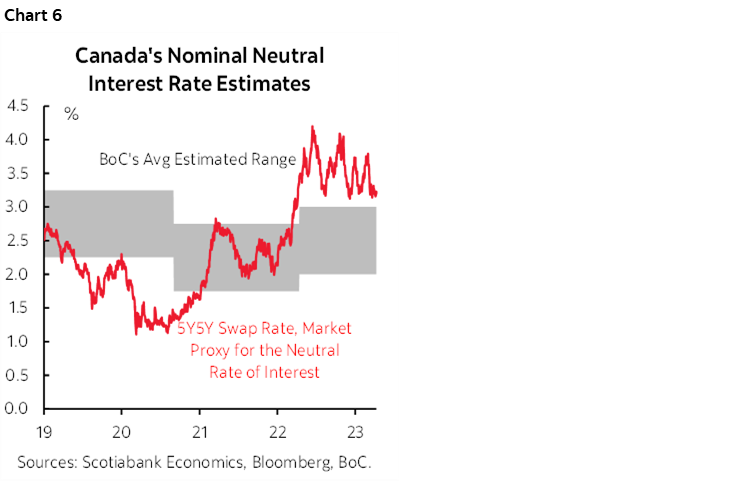

The BoC left the estimated neutral rate range unchanged at 2–3% which matches last April’s estimate. Market proxies continue to lie above this range (chart 6).

BoC ADDRESSES FISCAL STIMULUS

The BoC is being quite direct in pointing to fiscal pressures and concludes that the round of federal and provincial measures amounts to the following comment on page 17 of the MPR:

"Roughly $25 billion per year in additional fiscal measures is added to the projection compared with the January Report."

$25B per year in additional fiscal measures with NGDP at about C$2.8T is not inconsequential. In terms of weighted contributions to real GDP growth, higher government spending accounted for a two-tenths upward revision to 2023 real GDP growth and a one-tenth upward revision in 2024. Remember this is on top of prior estimates before the round of Spring budgets and so the overall weighted contribution to GDP growth from government spending is estimated by the BoC to be 0.6 ppts this year and 0.5 ppts next year.

The problem is that Macklem then waffled on the implications for monetary policy during his press conference and perhaps for political reasons to avoid direct conflict with the governments in question. When asked whether elevated government spending will hamper the BoC’s ability to get inflation to target, Macklem said:

“Fiscal plans are the responsibility of governments and ultimately parliaments. It's not our job to comment on those choices. But it is our job to comment on the implications for inflation. As we usually do when governments put out budgets this projection takes into account the budgets. All together they add $25B/year to NGDP with a higher contribution to growth from government spending. One way to look at it is to evaluate government spending relative to potential growth. Over 2022H2 government spending was well above potential growth. Government spending plans are not contributing to the slowing of growth in our projections but at the same time they are not standing in the way of getting inflation back to target.”

It’s a stretch to believe that government spending plans motivated the BoC to upgrade growth but this has no effect on inflation risk. If the sum total of all government spending is accounting for 0.6 ppts of growth this year and 0.5 ppts next year then isn’t that material enough in a slowing forecast for an economy with capacity pressures to merit a hawkish counter-bias from monetary policy? One that is a little more intense at the margin? My take is that the BoC does believe fiscal policy is making their job more complicated but they are letting the numbers do their talking for them.

NO MAJOR RECESSION EXPECTED

When asked whether the BoC expects a recession, Macklem responded by saying:

“We do expect growth to be weak throughout the rest of the year and pick up gradually into next year. We need a period of weak growth. The outlook for growth has not changed very much. We are not forecasting a major contraction. We are not forecasting a large increase in unemployment. It's therefore not what most people think of about a recession.

One might not expect a central bank governor to say anything else, so treat this for what it’s worth to you.

When asked about the extent to which banking turmoil impacted the BoC’s decision, SDG Rogers said that “the focus is upon financial stability which seems to be contained. The holdover effect has continued in spreads, bank stocks etc and that usually flows through softened lending and feed through to growth. It factors into our monetary policy thinking but for now the immediate stress has been contained.”

FURTHER COMMUNICATIONS

Governor Macklem will return for rounds 2 and 3 tomorrow when he will be on a panel at 9:30amET at the IMF's annual Spring Meetings in Washington and also typically holds a side table discussion with select journalists.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.