- Inflation rises more than anticipated…

- ...and with the highest (and rising) breadth in about 31 years

- Inflation will soar again next month when Statcan adds used vehicle prices

- April wasn’t the last 50+ move from the BoC in what may be a series

- The BoC should already be at the middle of the neutral range…

- ...but getting there in 2–3 meetings would be the second best option

Canadian CPI, m/m / y/y %, March:

Actual: 1.4 / 6.7

Scotia: 1.2 / 6.4

Consensus: 0.9 / 6.1

Prior: 1.0 / 5.7

Canadian core CPI, y/y % change, March:

Average: 3.8 (prior 3.5)

Weighted median: 3.8 (prior 3.5)

Common component: 2.8 (2.7 revised up from prior 2.6%)

Trimmed mean: 4.7 (4.4 revised up from prior 4.3)

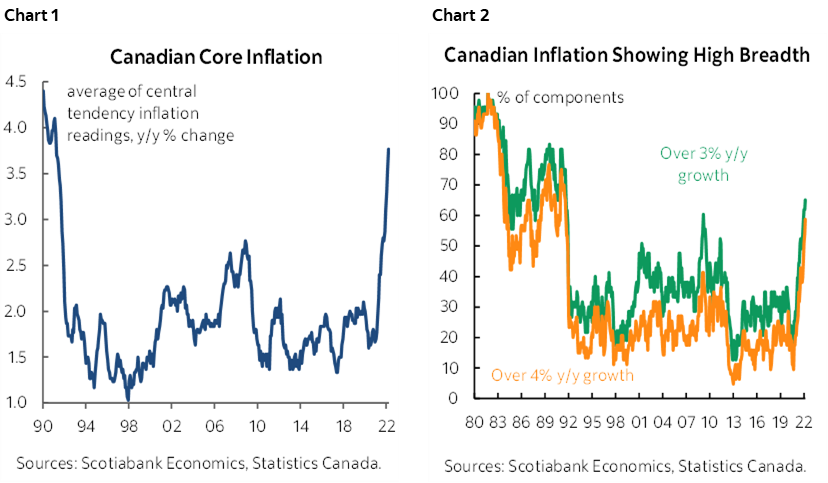

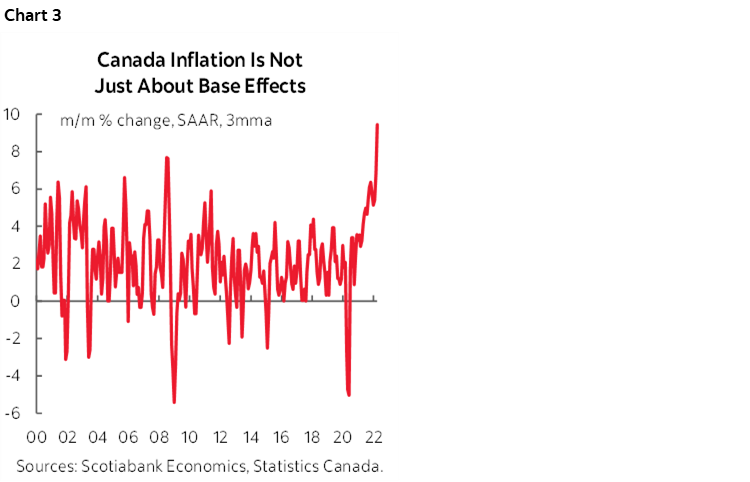

Canadian inflation overshot even my above-consensus estimate of where it would land during March and with eye-popping breadth (charts 1, 2). The fact that inflation is running amok should drive a minimum 50bps hike that we forecast at the next meeting in June. I had previously argued they should deliver a series of three 50bps moves (here). There is even a solid case for the BoC to hike by 75–100bps in one shot.

The obstacle is that the BoC has been dragging it every step of the way which is a big part of the reason behind how we got inflation numbers like these. Monetary policy tailored to current conditions should already be at neutral—if not above— given where inflation is and with a full employment recovery as the economy has moved into excess aggregate demand. Having failed to deliver that outcome, the second best option would be to get to the mid-point of the 2–3% neutral rate range this summer and preferably by July in my view.

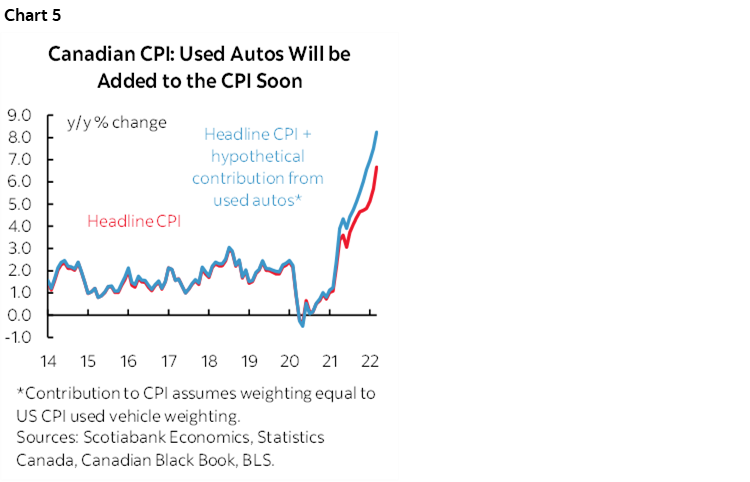

Headline inflation at 6.7% y/y is at its hottest since January 1991 but just wait until next month. StatCan noted that it will finally get around to adding used vehicle prices to the CPI index in next month’s report. That will likely pop inflation over 8% y/y when they do so and return inflation to highs last seen in the early 1980s. When they add used vehicles it will be the final blow to the long false argument that Canada has been managing inflation better than the US and other countries because of a lower official inflation rate. That was only ever due to mismeasurement.

The following month (June) will then bring annual basket weight updates given Statcan’s adoption of annually revising the weights now. I don’t think they’ll materially change things, but the two changes combined mean that judging inflation will be clouded by the need to make some adjustments along the way.

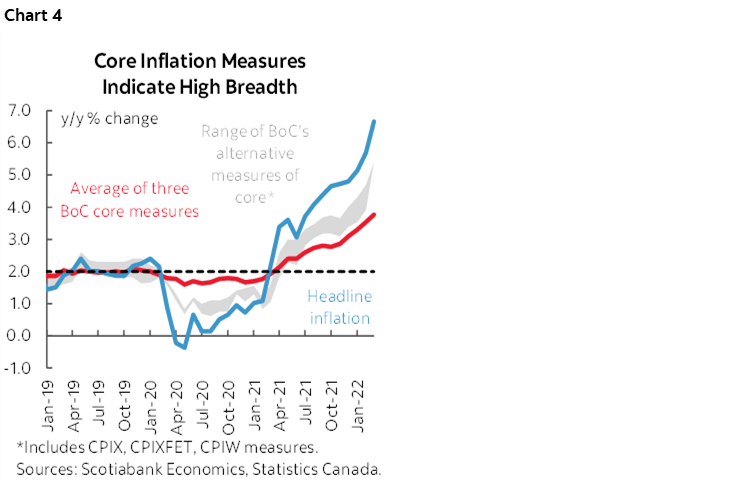

Will that be the peak? Maybe, but it’s not clear. Not only are the year-over-year rates accelerating, but so are the month-over-month seasonally adjusted and annualized rates (SAAR). That measure hit 7.7% m/m SAAR in January, then 9.4% in February, then 11.2% in March. The same is true of simple core (ex f&e) that climbed by 4.5% m/m SAAR in January, 5.4% in February, and 7.2% in March. As chart 3 shows, price pressures at the margin defined in m/m annualized terms are continuing to accelerate. The focus upon year-over-year rates remains misguided in my view and for the same reasons as when CPI inflation was on the way up in the early days.

DETAILS

Core inflation soared again to 3.8% y/y using the average of the BoC’s central tendency measures (chart 1 again). Other measures of core inflation also picked up with CPI ex-food&energy at 4.4% y/y while CPI excluding the eight most volatile items hit 5.6% y/y.

The wow factor is the breadth of the price increases we are now seeing in the Canadian economy. 65% of the CPI basket is now up by 3% or more and a whopping 59% of the basket is up by 4% or more (chart 2 again). The last time we saw such highs was in September 1991. The BoC’s 1–3% inflation target bands are being seriously blown in high breadth fashion.

Inflation is somewhat above the BoC’s revised forecasts that were published just a week ago. At the time they forecast Q1 inflation of 5.6% and the quarter landed at 5.8%.

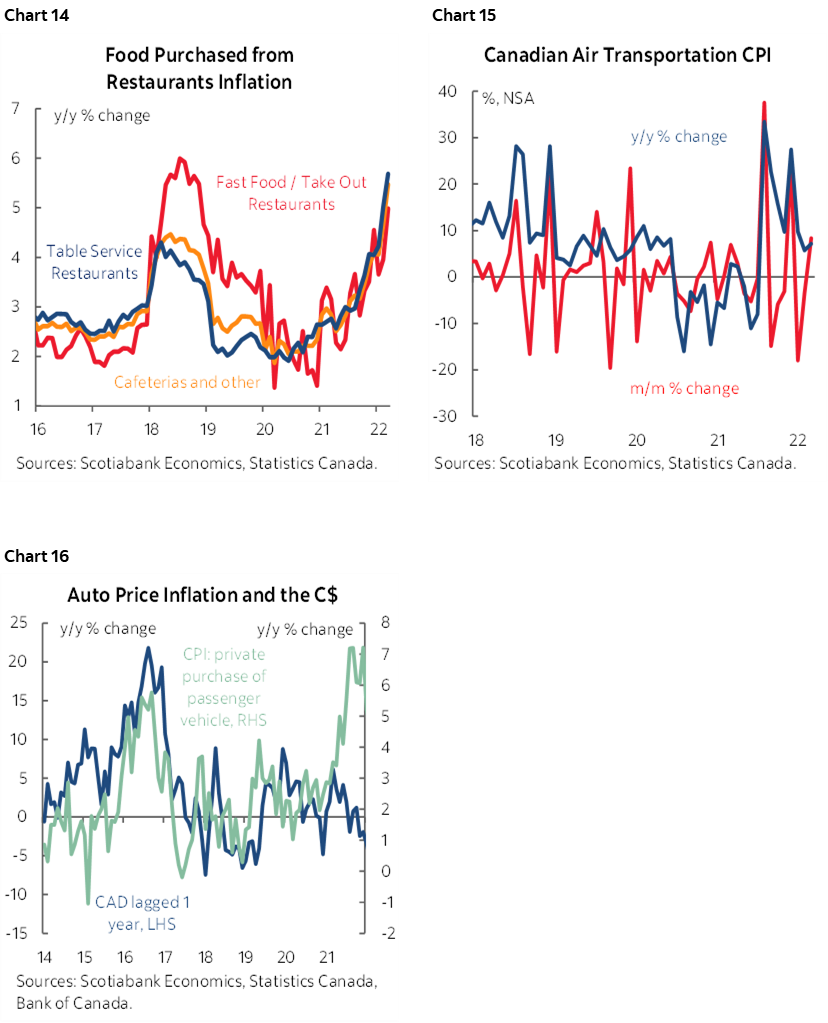

One can't really say that the components indicate much by way of surprise in terms of direction. High contact service prices contributed to the increase in overall inflation. Restaurant prices jumped, so did traveller accommodation (hotels, etc), and with airfare up 8.3% m/m. This reflects the reopening effect away from omicron-related restrictions that existed from December until February to varying degrees across the country. If we continue to see pent-up services demand being unleashed then further gains may be in store.

Chart 4 shows the breadth of inflation across multiple core measures.

Chart 5 shows the effects of adding used vehicles to the CPI basket when they do so according to our estimations.

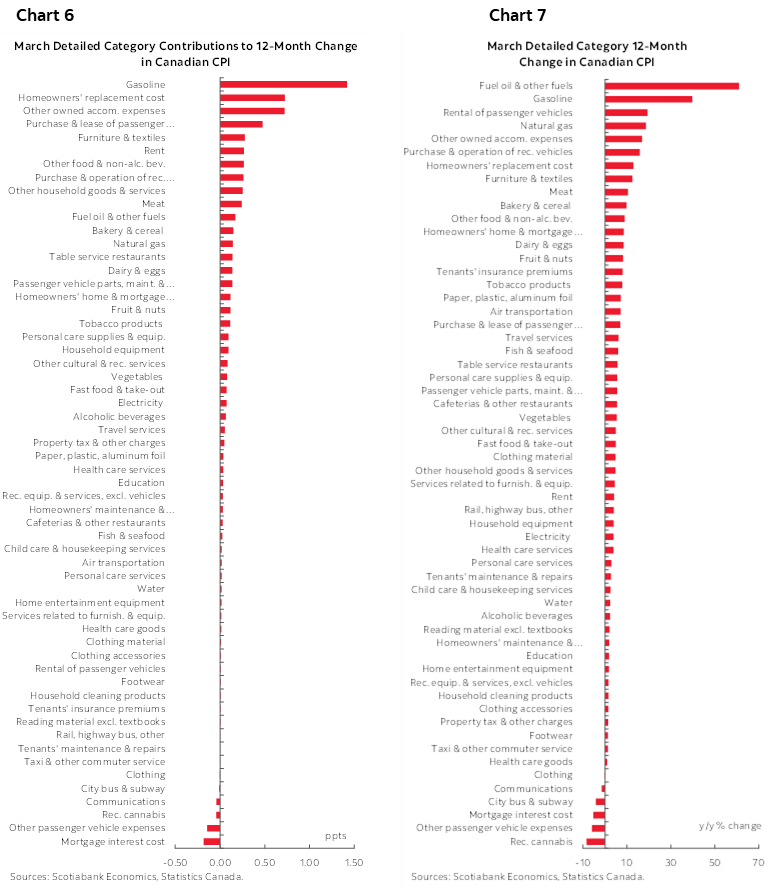

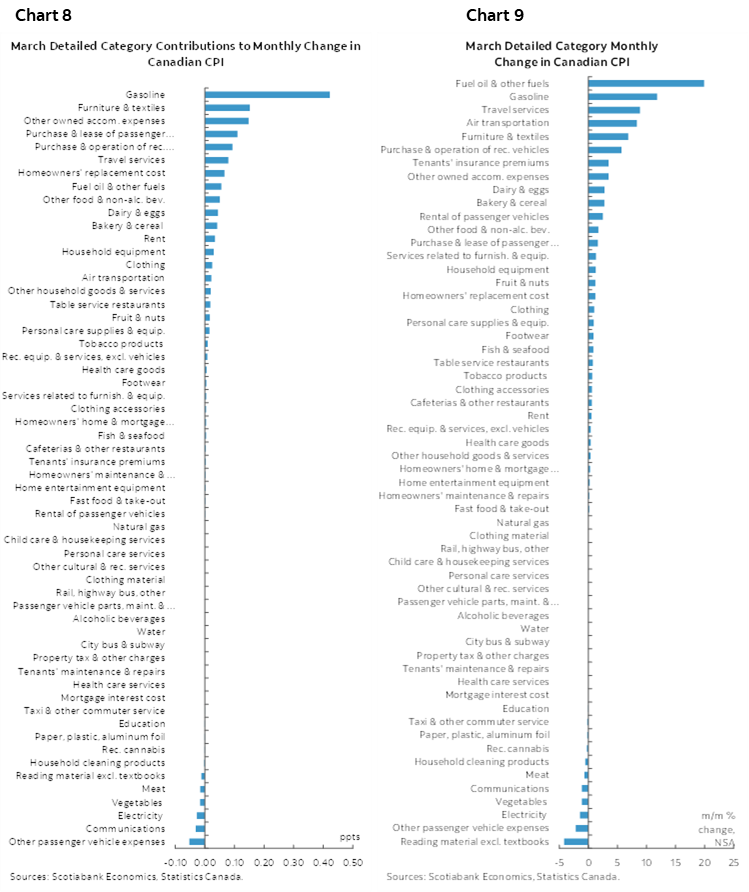

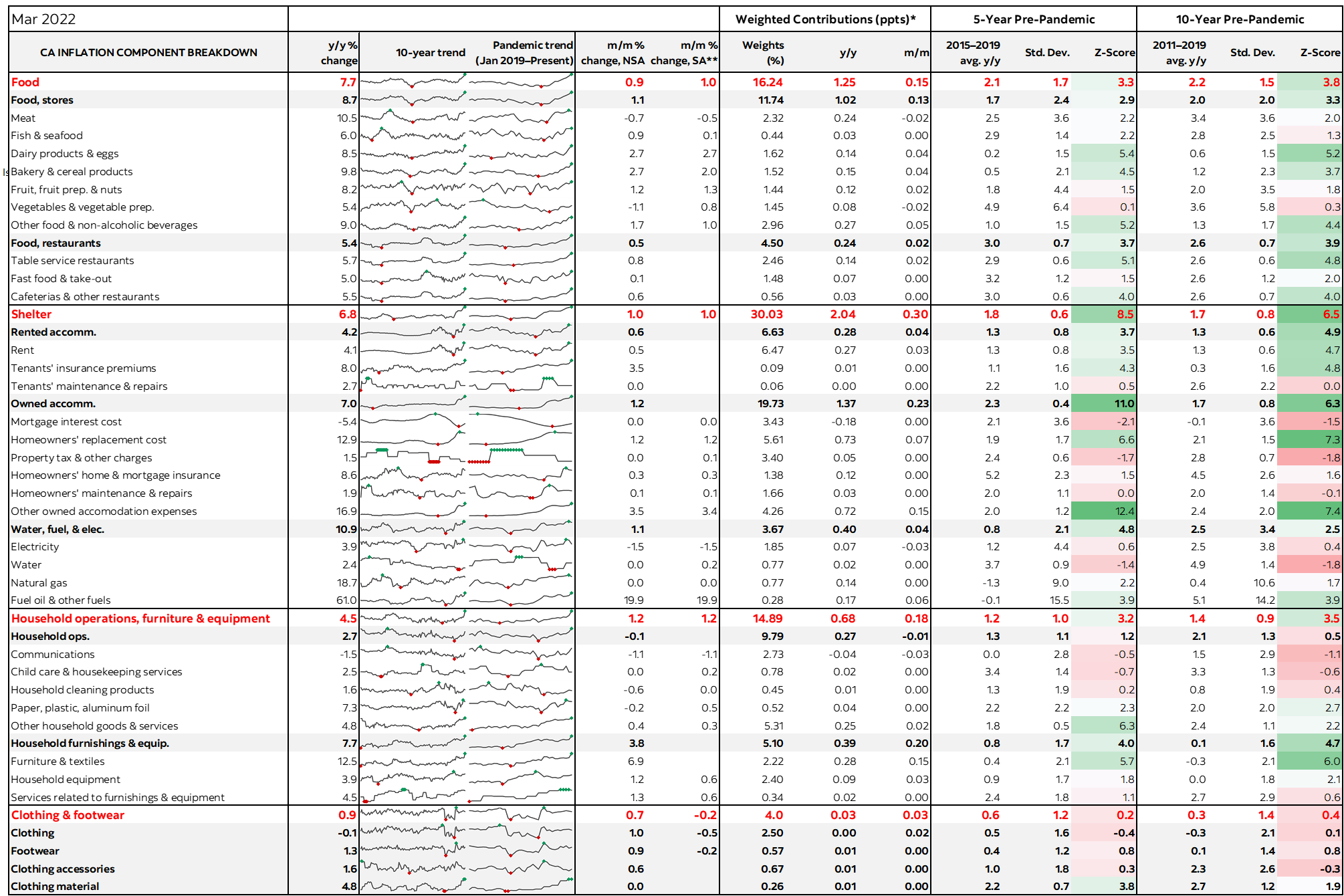

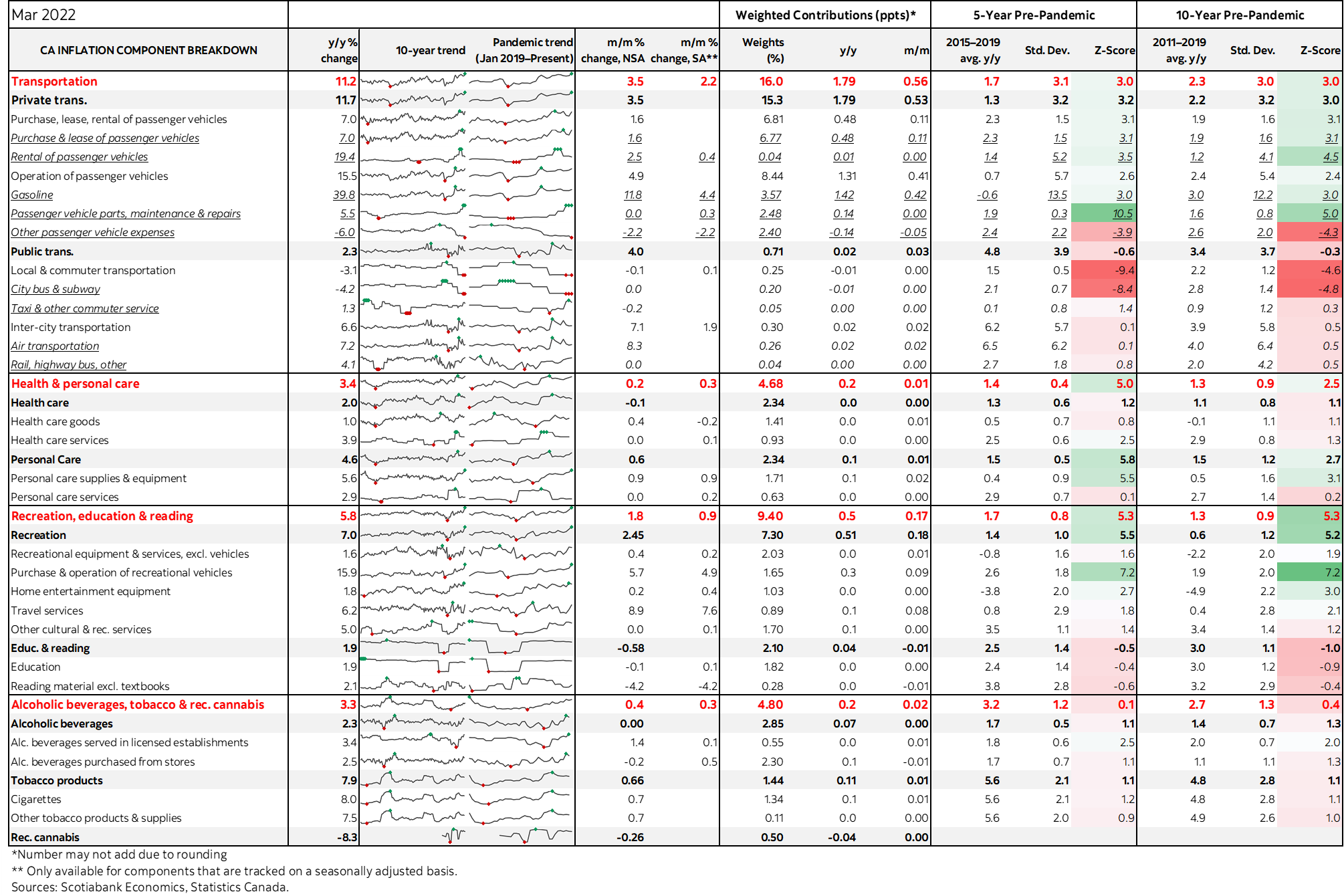

Chart 6 shows the weighted contributions to year-over-year headline CPI inflation by category and chart 7 shows the unweighted y/y price changes by category. Charts 8 and 9 do likewise for the month-over-month price changes. Note the very high breadth in both readings.

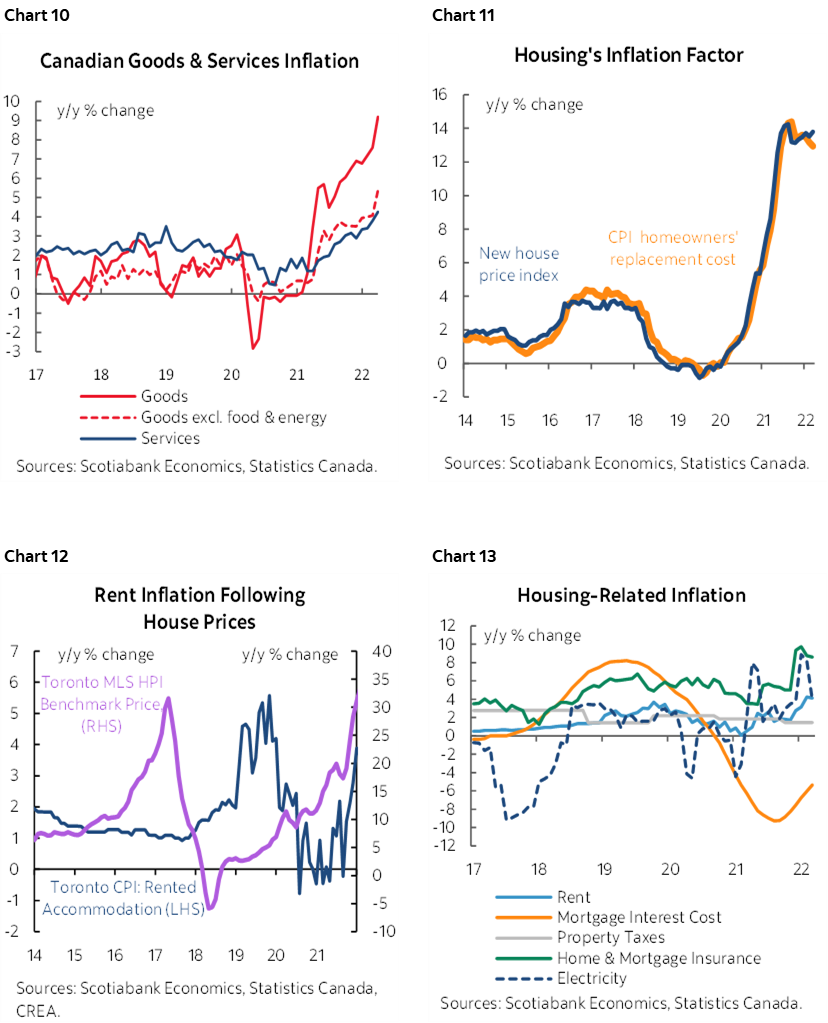

Also see individual charts 10–16 on the following pages.

As a concluding point, it’s important to argue that we’re still at an inflection point in terms of the drivers of inflation. Serial supply shocks plus hot demand plus a net move into excess aggregate demand plus idiosyncratic factors plus an upward shift in secular forces plus rising inflation expectations are all driving inflation in the same higher direction. To dismiss this full list by saying it’s just supply-side factors and that policy shouldn’t be tightening is an absurdly stale, outdated assessment that hasn’t shifted with the times.

Also see the table on the last page that breaks out the basket across multiple measures including measures of dispersion compared to recent norms using Z-scores.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.